Monday Morning Update

By Colin Twiggs

July 24, 2006

July 24, 2006

In response to a number of requests, we will trial a detailed

weekly newsletter on Thursdays and a quick update at the start

of the week. Your feedback

will be appreciated.

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

These extracts from my daily trading diary are for educational purposes and should not be interpreted as investment advice. Full terms and conditions can be found at Terms of Use.

USA

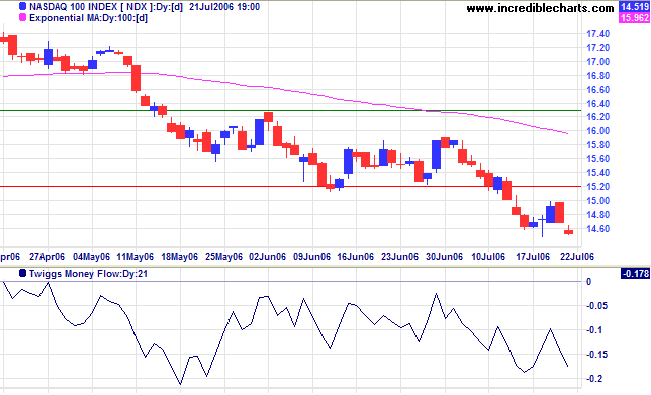

The Nasdaq 100 retracement respected the new resistance

level at 1520, confirming the primary down-trend.

Twiggs Money Flow (21-day) has remained below zero for 3

months, signaling strong long-term

distribution.

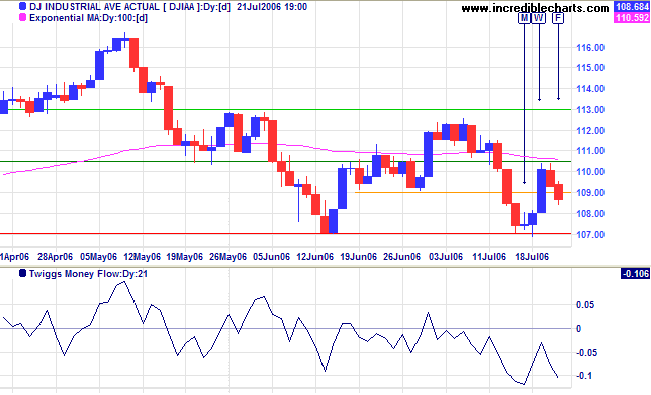

The Dow Industrial Average respected resistance at 11050

and the 100-day

exponential moving average, a bearish sign.

Twiggs Money Flow (21-day) holding below the zero line

signals

distribution. The index is headed for another test of

primary support at 10700. A fall below this level would signal

reversal to a primary down-trend.

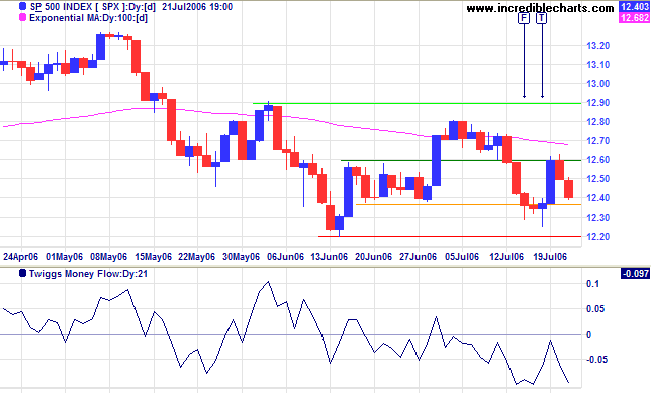

In a similar fashion, the S&P 500 respected

resistance at 1260 and appears headed for a test of primary

support at 1220. A close below this level would signal reversal

of the primary trend.

Twiggs Money Flow (21-day) holding below the zero line

signals

distribution.

Source: Netdania

Currencies

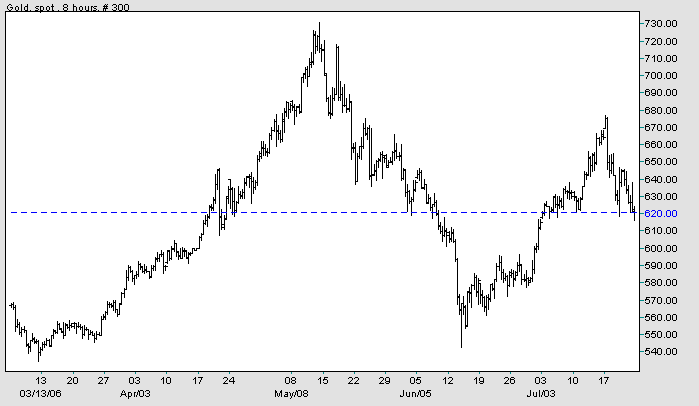

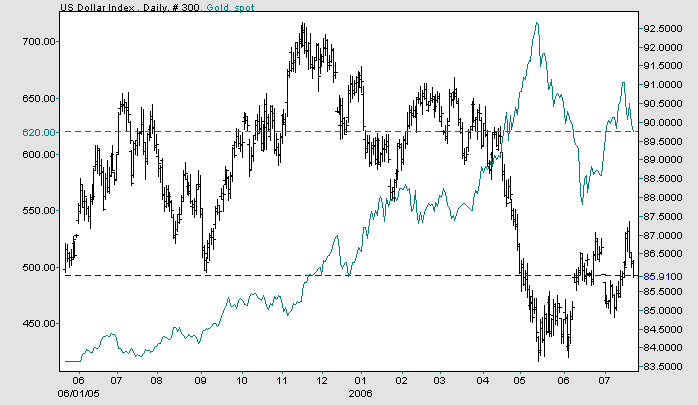

The US Dollar Index weakened over the last few days while gold was also falling. The two never continue in the same direction for long. Expect either gold to rally or the dollar to strengthen.

The US Dollar Index weakened over the last few days while gold was also falling. The two never continue in the same direction for long. Expect either gold to rally or the dollar to strengthen.

Source: Netdania

United Kingdom

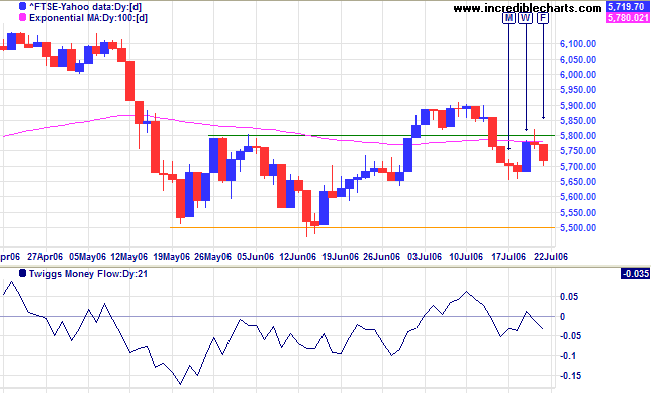

The FTSE 100 shows a similar pattern to the Dow and S&P 500, and is headed for a test of primary support at 5500.

The FTSE 100 shows a similar pattern to the Dow and S&P 500, and is headed for a test of primary support at 5500.

Japan

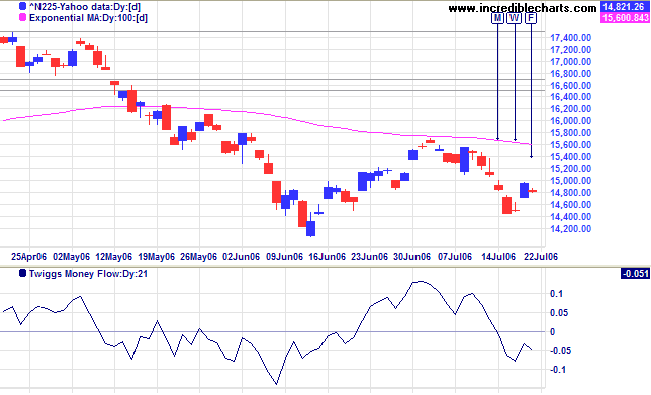

The Nikkei 225 is in a primary down-trend, having respected the 100-day exponential moving average from below. The index bounced at support at 14400, but the overall pattern is negative. A close below 14000 would confirm the down-trend.

The Nikkei 225 is in a primary down-trend, having respected the 100-day exponential moving average from below. The index bounced at support at 14400, but the overall pattern is negative. A close below 14000 would confirm the down-trend.

ASX Australia

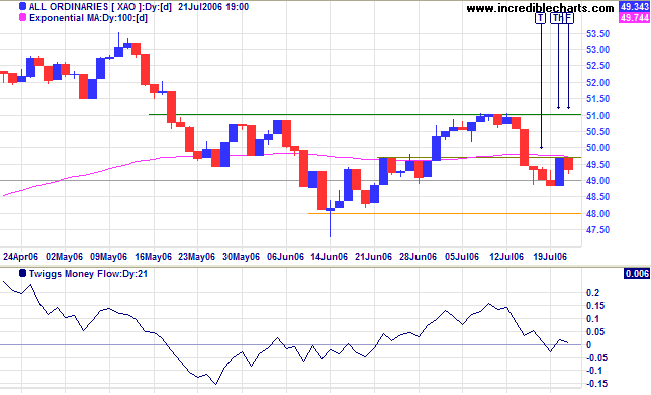

The All Ordinaries is following other markets down, having respected resistance at 4960. Expect a test of primary support at 4800.

The All Ordinaries is following other markets down, having respected resistance at 4960. Expect a test of primary support at 4800.

For more background information, read About

the Trading Diary.