Trading Diary

February 11, 2006

These extracts from my daily trading diary are for educational

purposes and should not be interpreted as investment advice. Full

terms and conditions can be found at Terms

of Use.

USA

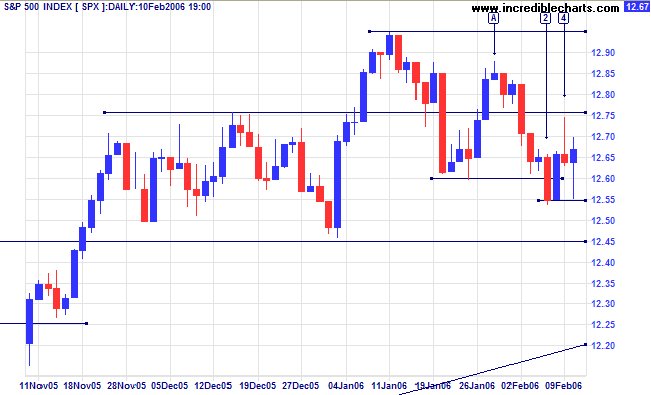

The S&P 500 has started a secondary correction and is headed for a test of support at 1245, after forming a lower high at [A] and lower low at [2]. One could argue that 1245 represents primary support and a close below this level would signal a primary trend reversal -- based on the 5-week consolidation in November/December -- but it is best to be cautious and treat primary support as 1170 (the October 2005 low).

The S&P 500 has started a secondary correction and is headed for a test of support at 1245, after forming a lower high at [A] and lower low at [2]. One could argue that 1245 represents primary support and a close below this level would signal a primary trend reversal -- based on the 5-week consolidation in November/December -- but it is best to be cautious and treat primary support as 1170 (the October 2005 low).

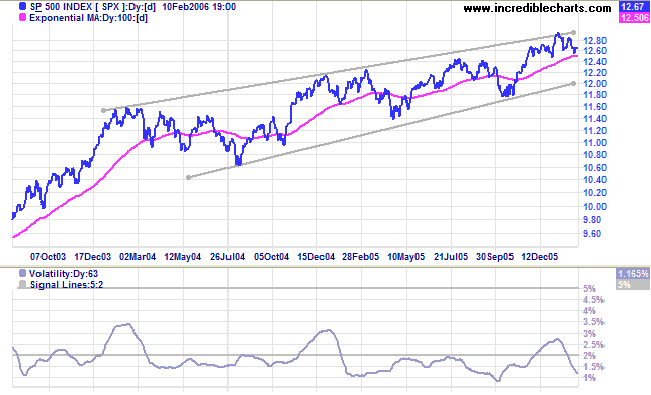

The index is consolidating in a narrow range below the upper

border of the long-term bearish

rising wedge pattern. An upward breakout from the pattern

would signal acceleration of the primary up-trend, while a

downward breakout would warn of a primary trend reversal.

Volatility remains at historically low levels (last witnessed in

1993/94 -- during the previous

short-term rate trough), while

Twiggs Money Flow (21-day) signals uncertainty.

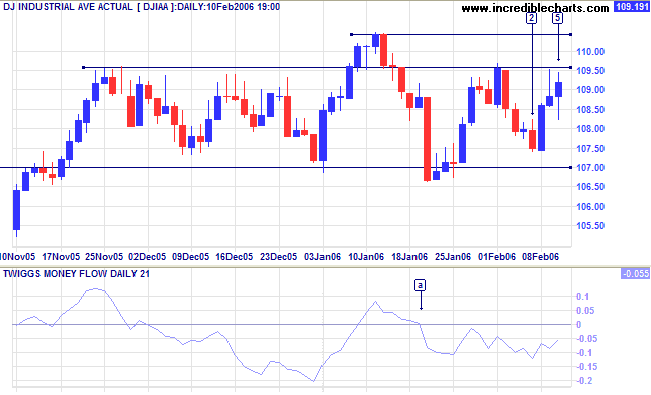

The Dow Industrial Average is testing resistance at 10950,

having been in a narrow consolidation between 10950 and 10700 for

several months. The higher low [2] is encouraging, but

Twiggs Money Flow (21-day) remains bearish -- holding below

the zero line.

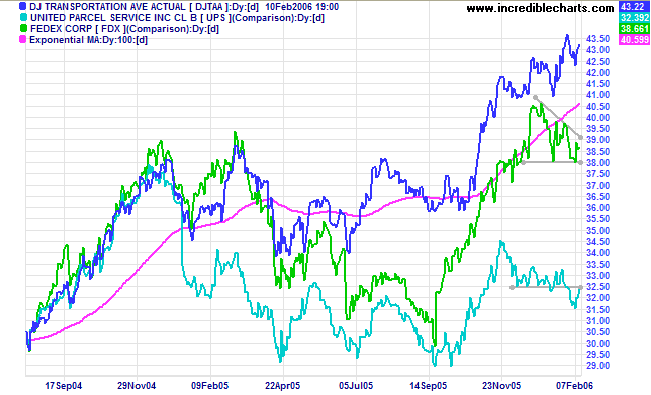

The Dow Jones Transportation Average continues in a strong

primary up-trend, but lead indicators, Fedex (descending

triangle) and UPS (reversal to a down-trend) are both bearish.

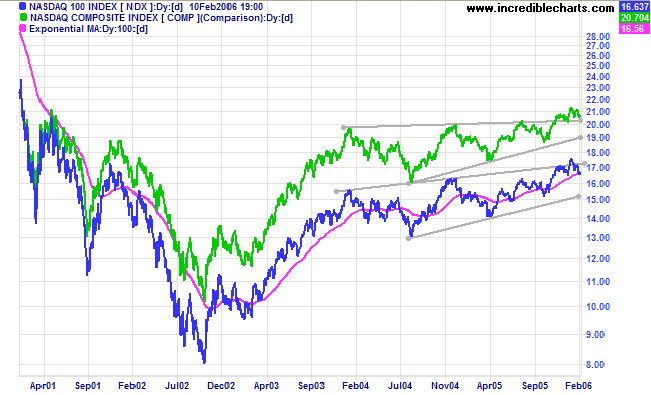

The Nasdaq 100 and Nasdaq Composite display

conflicting signals from long-term bearish

rising wedge patterns. A clear break above the upper border

would signal a stronger primary up-trend and a positive for other

US equity markets.

Treasury yields

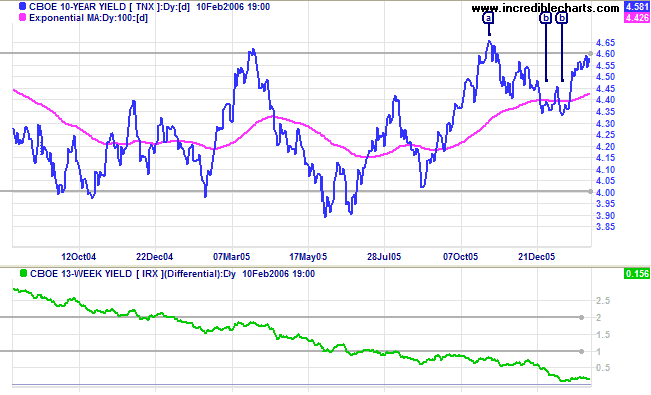

The 10-Year treasury yield is testing resistance at 4.60/4.65% after a bullish short retracement (with a double bottom at [b]). A breakout above the high of [a] would be a bullish sign for long-bond yields and a long-term positive for the economy: strengthening the weak yield differential (10-year T-notes minus 13-week T-bills).

The 10-Year treasury yield is testing resistance at 4.60/4.65% after a bullish short retracement (with a double bottom at [b]). A breakout above the high of [a] would be a bullish sign for long-bond yields and a long-term positive for the economy: strengthening the weak yield differential (10-year T-notes minus 13-week T-bills).

The Big Picture: Major equity indexes have been

consolidating for the past 2 years while interest rates were low.

The Dow Transport index displays a strong primary up-trend, but

the Fedex and UPS lead indicators are weak. Short-term rates are

rising while long-term rates may follow, easing pressure on the

flat yield curve. There are not enough positive signs yet to lift

the market out of the present doldrums.

Gold

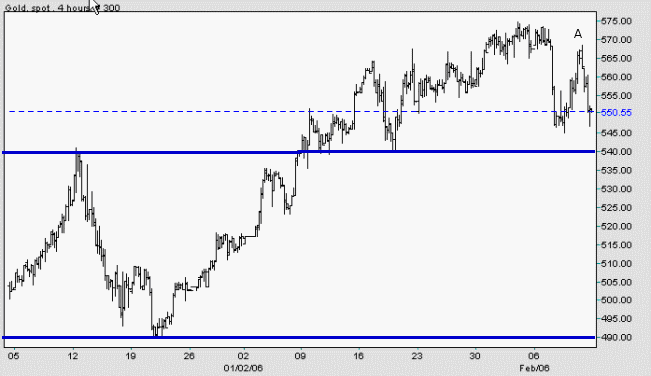

Spot gold is currently at $550.55 and headed for a test of initial support at $540 (from the December peak) after a lower high at [A]. If the metal respects this level, the strong primary up-trend will continue. However, if price falls below $540, we can expect a test of primary support at $490. The strengthening US dollar may cause a fall in demand for gold.

The Big Picture: Gold is in a primary up-trend, but stay alert for signs of weakness.

Spot gold is currently at $550.55 and headed for a test of initial support at $540 (from the December peak) after a lower high at [A]. If the metal respects this level, the strong primary up-trend will continue. However, if price falls below $540, we can expect a test of primary support at $490. The strengthening US dollar may cause a fall in demand for gold.

The Big Picture: Gold is in a primary up-trend, but stay alert for signs of weakness.

Source: Netdania

Currencies

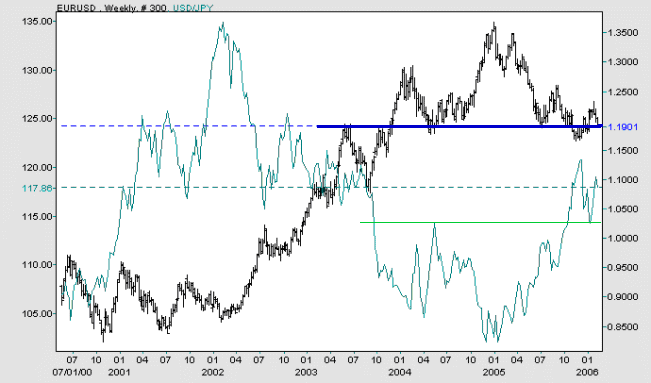

The US dollar is strengthening against both the euro and the Japanese yen. The euro is testing support at $1.20 and a fall below the November 2005 low would signal a strong down-trend. Against the yen, the dollar has successfully tested the new support level of 115 after breaking through resistance towards the end of last year.

The Big Picture: The dollar is strengthening against its major trade partners, a result of improved exports and rising interest rates.

The US dollar is strengthening against both the euro and the Japanese yen. The euro is testing support at $1.20 and a fall below the November 2005 low would signal a strong down-trend. Against the yen, the dollar has successfully tested the new support level of 115 after breaking through resistance towards the end of last year.

The Big Picture: The dollar is strengthening against its major trade partners, a result of improved exports and rising interest rates.

Source: Netdania

United Kingdom

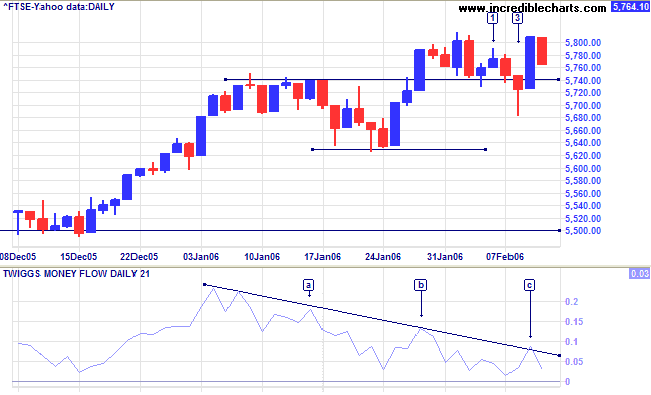

The FTSE 100 successfully tested initial support at 5740, with a long tail and strong volume at [3]. However, the index has again reversed and appears set for another test; and descending highs at [a] to [c] on Twiggs Money Flow (21-day) signal distribution.

The Big Picture: The primary trend is up, with a target of 5860 {5500 + (5500 - 5140)}, but the index is struggling to make further gains and we need to be watchful for a secondary correction.

The FTSE 100 successfully tested initial support at 5740, with a long tail and strong volume at [3]. However, the index has again reversed and appears set for another test; and descending highs at [a] to [c] on Twiggs Money Flow (21-day) signal distribution.

The Big Picture: The primary trend is up, with a target of 5860 {5500 + (5500 - 5140)}, but the index is struggling to make further gains and we need to be watchful for a secondary correction.

Japan

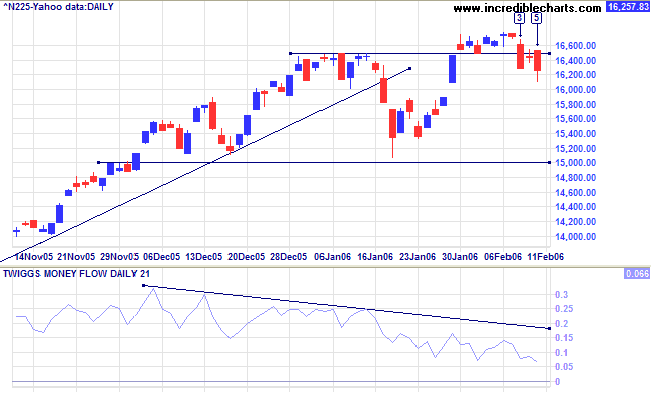

The Nikkei 225 completed a bearish false break with a retreat below initial support at 16400/16500 at [3]. The short-term recovery [4] failed and we are likely to see a test of primary support at 15000. Twiggs Money Flow (21-day) is declining, signaling (intermediate) weakness, but a long-term positive if it holds above the zero line.

The Big Picture: The Nikkei is in a strong primary up-trend with a target of 17500 { 16400 + (16400 - 15300)}.

The Nikkei 225 completed a bearish false break with a retreat below initial support at 16400/16500 at [3]. The short-term recovery [4] failed and we are likely to see a test of primary support at 15000. Twiggs Money Flow (21-day) is declining, signaling (intermediate) weakness, but a long-term positive if it holds above the zero line.

The Big Picture: The Nikkei is in a strong primary up-trend with a target of 17500 { 16400 + (16400 - 15300)}.

ASX Australia

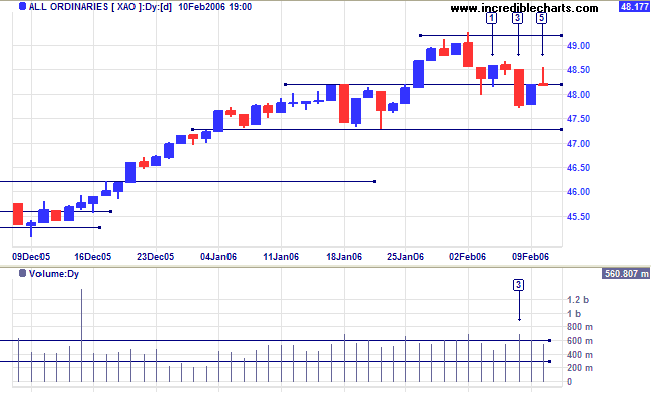

The All Ordinaries broke through the first line of (intermediate) support at 4820, the strong red candle and increased volume at [3] signaling committed sellers. The short-term retracement appears to have failed, with a very weak close at [5]. This would be confirmed if the index falls below 4780, signaling a test of primary support at 4620 and 4300, or negated if the index rises above 4850.

The All Ordinaries broke through the first line of (intermediate) support at 4820, the strong red candle and increased volume at [3] signaling committed sellers. The short-term retracement appears to have failed, with a very weak close at [5]. This would be confirmed if the index falls below 4780, signaling a test of primary support at 4620 and 4300, or negated if the index rises above 4850.

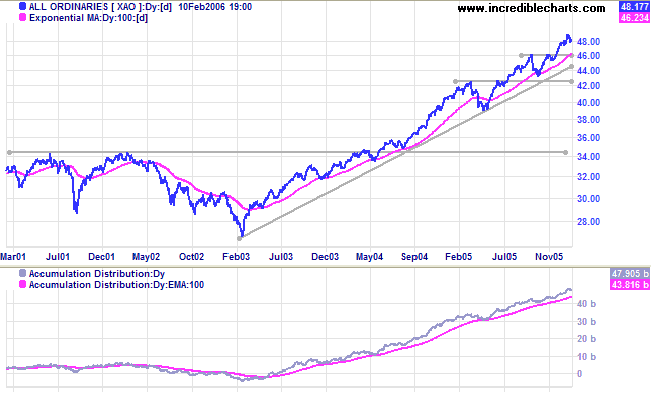

Twiggs Money Flow (21-day) is retreating, but remains above

zero. A trough that respects the zero line would be a bull

signal. Long-term

Accumulation-Distribution continues to be bullish, holding

above its' 100-day moving average.

The Big Picture: The index is in a strong primary up-trend; approaching its target of 4940 {4620 + (4620 - 4300)}.

The Big Picture: The index is in a strong primary up-trend; approaching its target of 4940 {4620 + (4620 - 4300)}.

For further background information, read About

the Trading Diary.

Regards,

Regards,

Colin Twiggs

We should consider every day lost on which we

have not danced at least once.

And we should call every truth false which was not accompanied by at least one laugh.

~ Friedrich Nietzsche

And we should call every truth false which was not accompanied by at least one laugh.

~ Friedrich Nietzsche