Trading Diary

January 28, 2006

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use.

USA

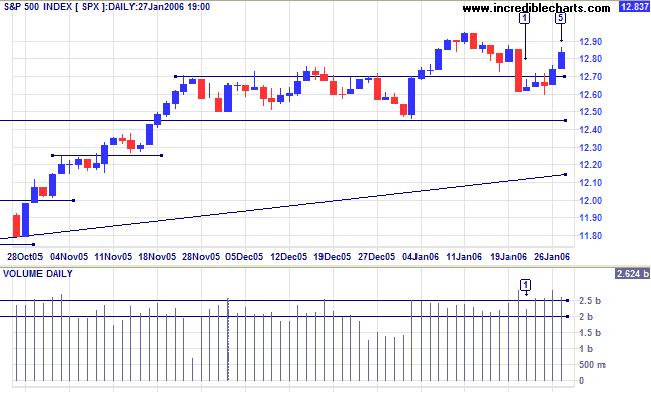

The close below support at 1270 on the S&P 500 triggered strong buying, evidenced by narrow ranges and substantial volume. The index is headed for a test of short-term resistance at 1295, the recent high.

The close below support at 1270 on the S&P 500 triggered strong buying, evidenced by narrow ranges and substantial volume. The index is headed for a test of short-term resistance at 1295, the recent high.

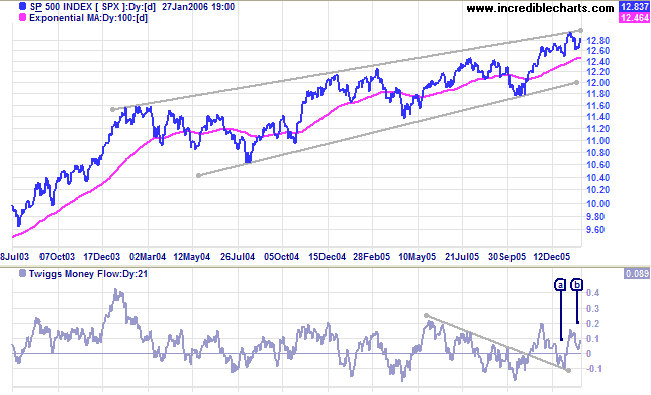

In the longer term, the index appears headed for another test of

the upper border of the long-term bearish

rising wedge pattern. An upward breakout from the pattern

would signal acceleration of the primary up-trend. A downward

breakout would signal a trend reversal.

Twiggs Money Flow (21-day) shows uncertainty, with a higher

low [b] following the recent lower high.

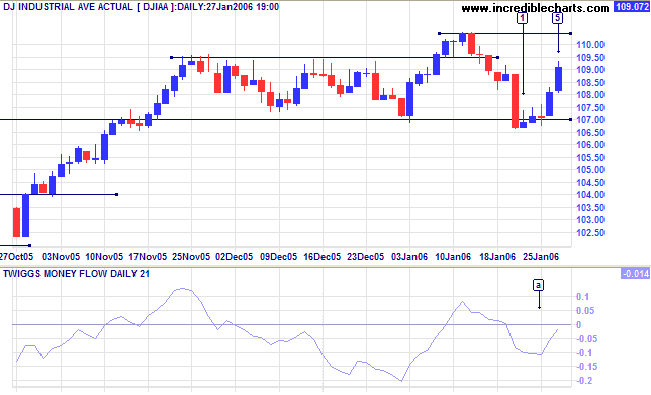

Buying support was also evident on the Dow Industrial

Average notwithstanding last weeks

close below intermediate support at 10700. The first three days

of the week showed that buyers were capable of absorbing selling

pressure: the index closed up on Monday and Tuesday despite the

tall shadows.

Twiggs Money Flow (21-day) formed a higher low, signaling

early accumulation. Expect a test of resistance at 11000/11050.

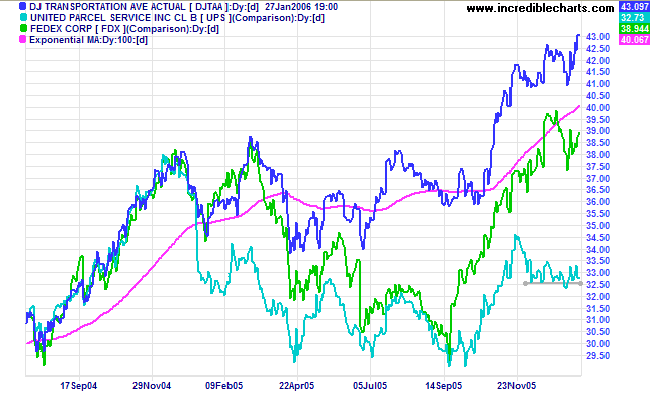

The Dow Jones Transportation Average has resumed a primary

up-trend, while Fedex and UPS have lost momentum.

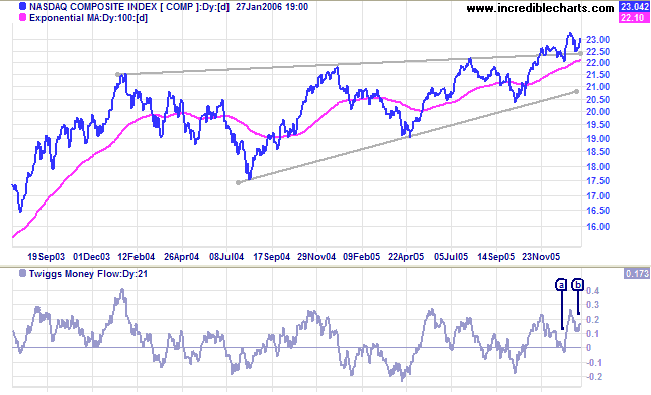

The Nasdaq Composite respected the upper border of the

long-term bearish

rising wedge pattern and appears ready to commence a stronger

primary up-trend.

Twiggs Money Flow (21-day) recorded a higher low at [b], well

above the zero line, signaling medium-term accumulation.

Treasury yields

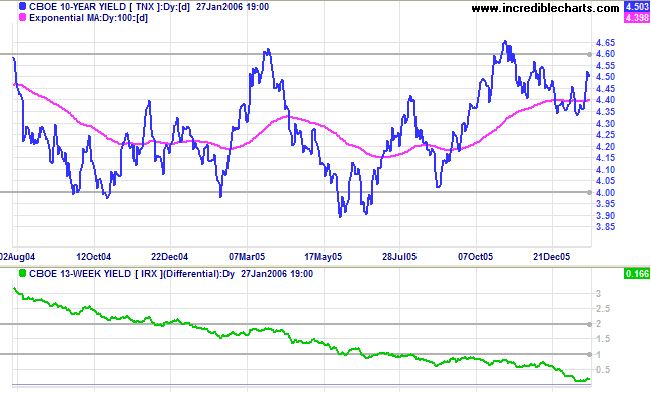

The 10-Year treasury yield is preparing for another test of resistance at 4.60%. While a breakout would result in short-term pain, it would strengthen the weak yield differential (10-year T-notes minus 13-week T-bills), a long-term positive for the economy. Otherwise, the Fed may be forced to slow short-term interest rate hikes in order to shore up the flat yield curve -- while hoping that inflation does not take root.

The 10-Year treasury yield is preparing for another test of resistance at 4.60%. While a breakout would result in short-term pain, it would strengthen the weak yield differential (10-year T-notes minus 13-week T-bills), a long-term positive for the economy. Otherwise, the Fed may be forced to slow short-term interest rate hikes in order to shore up the flat yield curve -- while hoping that inflation does not take root.

The Big Picture: The S&P500 is in a long-term rising

wedge pattern while the Dow remains range-bound between 10000 and

11000. The Nasdaq Composite index, on the other hand, is

strengthening. The Dow Transport index resumed its' primary

up-trend while the Fedex and UPS lead indicators display

medium-term weakness. The flat yield curve is a

long-term predictor of economic down-turns and is likely to weigh

heavily on the market in the next few months. The market

is making tentative advances but remains vulnerable to bad news.

Gold

New York: Spot gold continues to consolidate above support at $540, closing at $558.50 on Friday. The narrow consolidation, during a primary up-trend, is likely to resolve in a continuation of the trend.

The Big Picture: Gold is in a primary up-trend with a target of $580: 540 + (540 - 500). Increased demand signals weakness for the US dollar.

New York: Spot gold continues to consolidate above support at $540, closing at $558.50 on Friday. The narrow consolidation, during a primary up-trend, is likely to resolve in a continuation of the trend.

The Big Picture: Gold is in a primary up-trend with a target of $580: 540 + (540 - 500). Increased demand signals weakness for the US dollar.

United Kingdom

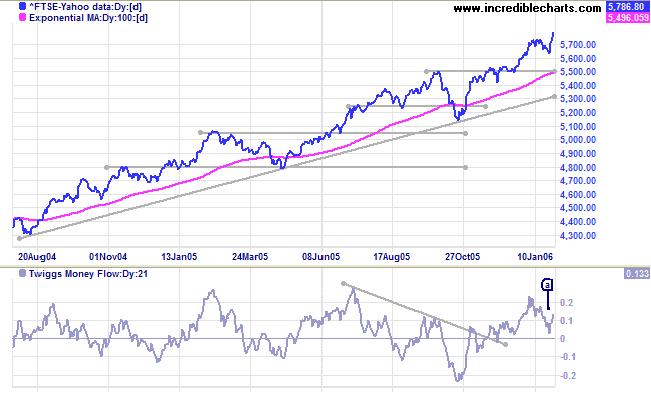

After a false break below support the FTSE 100 resumed a strong up-trend. Twiggs Money Flow (21-day) formed a low above the zero line at [a], signaling accumulation.

The Big Picture: The primary trend is up, with a target close to 6000: 5500 + (5500 - 5140) = 5860.

After a false break below support the FTSE 100 resumed a strong up-trend. Twiggs Money Flow (21-day) formed a low above the zero line at [a], signaling accumulation.

The Big Picture: The primary trend is up, with a target close to 6000: 5500 + (5500 - 5140) = 5860.

Japan

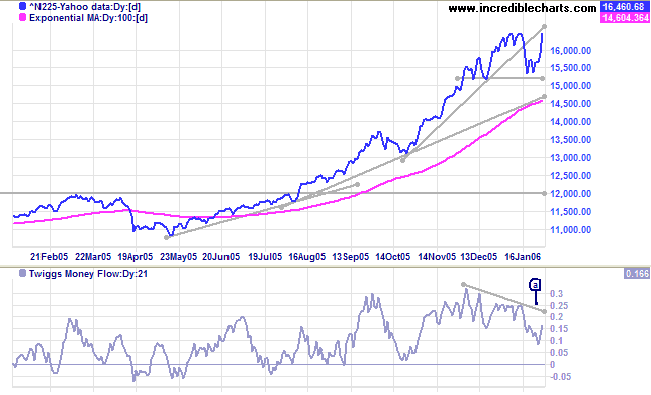

The Nikkei 225 respected support at 15200, followed by a rally to test resistance at 16400. A new high, confirmed by a retracement or consolidation that holds above 16400, would signal that the strong primary up-trend will continue. Twiggs Money Flow (21-day) formed a low above the zero line at [a] -- a possible start of further accumulation.

The Big Picture: The Nikkei is in a strong primary up-trend. The retracement to 15200 may provide a base for further gains. The target for a breakout would be 17500: 16400 + (16400 - 15300).

The Nikkei 225 respected support at 15200, followed by a rally to test resistance at 16400. A new high, confirmed by a retracement or consolidation that holds above 16400, would signal that the strong primary up-trend will continue. Twiggs Money Flow (21-day) formed a low above the zero line at [a] -- a possible start of further accumulation.

The Big Picture: The Nikkei is in a strong primary up-trend. The retracement to 15200 may provide a base for further gains. The target for a breakout would be 17500: 16400 + (16400 - 15300).

ASX Australia

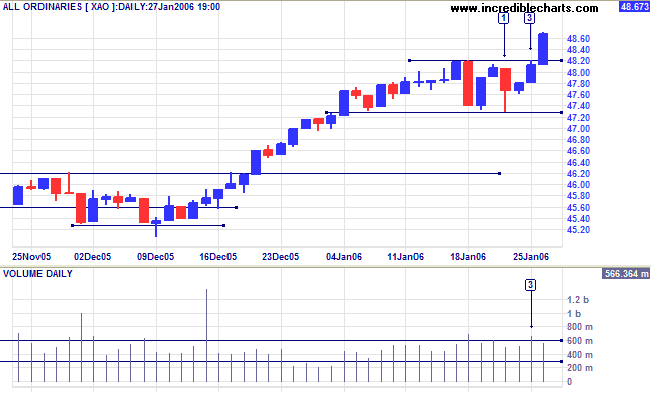

The All Ordinaries confirmed the strength of the up-trend with a strong blue candle on Friday, following a breakout above resistance at 4820. Earlier in the week the index tested support at 4730, with a long tail signaling buying strength. This was followed by increased volume at [3] as buyers encountered selling at the resistance level; the strong close again signaling buyers' commitment.

The All Ordinaries confirmed the strength of the up-trend with a strong blue candle on Friday, following a breakout above resistance at 4820. Earlier in the week the index tested support at 4730, with a long tail signaling buying strength. This was followed by increased volume at [3] as buyers encountered selling at the resistance level; the strong close again signaling buyers' commitment.

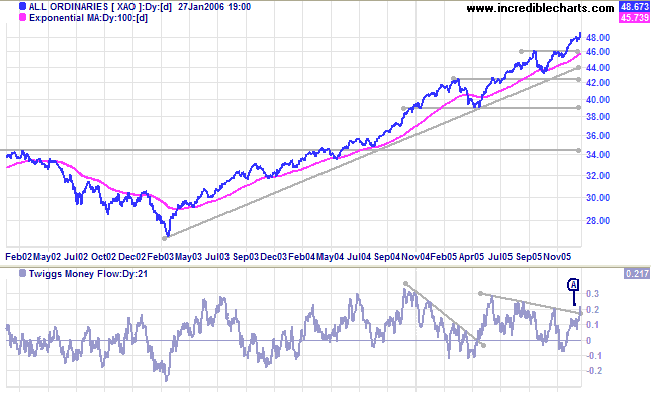

Twiggs Money Flow (21-day) rallied after a period of

consolidation above the zero line at [A]: signaling

accumulation.

The Big Picture: The index is in a strong primary up-trend with a target close to 5000: 4620 + (4620 - 4300) = 4940.

The Big Picture: The index is in a strong primary up-trend with a target close to 5000: 4620 + (4620 - 4300) = 4940.

For further background information, read About

the Trading Diary.

Regards,

Regards,

Colin Twiggs

Every man is a damn fool for at least five

minutes every day;

Wisdom consists in not exceeding that limit.

~ Elbert Hubbard

Wisdom consists in not exceeding that limit.

~ Elbert Hubbard