Trading Diary

January 7, 2006

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use.

USA

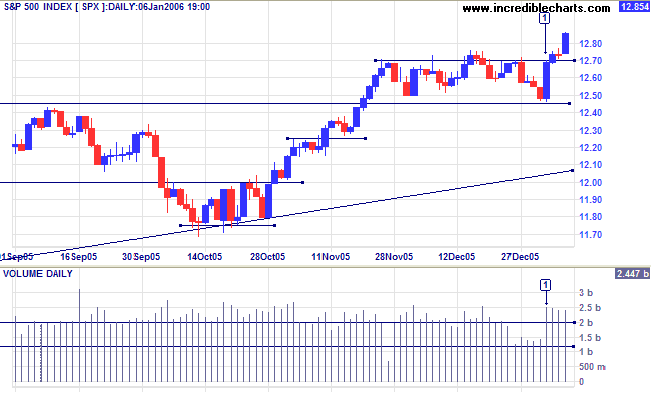

After consolidating for several weeks, the S&P 500 has broken through resistance at 1270, signaling resumption of the primary up-trend. The index initially tested support at [1] before rallying on strong volume to a new 4-year high.

After consolidating for several weeks, the S&P 500 has broken through resistance at 1270, signaling resumption of the primary up-trend. The index initially tested support at [1] before rallying on strong volume to a new 4-year high.

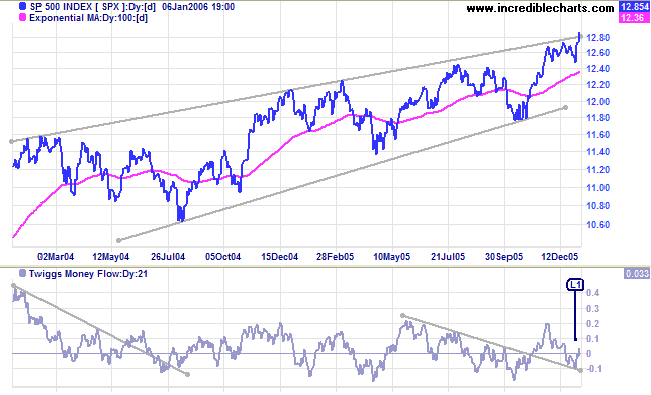

The index broke out above the upper border of the long-term

bearish

rising wedge pattern, signaling a stronger primary up-trend.

The signal would be confirmed if a retracement respects the new

support level (of 1270) in the next few weeks (in a similar

fashion to the Nasdaq Composite).

Twiggs Money Flow (21-day) completed a higher trough at [L1],

often the first sign of longer-term accumulation.

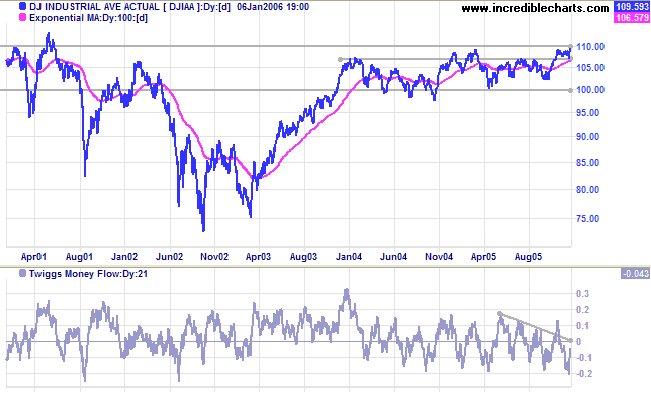

The Dow Industrial Average appears decidedly bullish,

having consolidated for several weeks in a narrow band below

primary resistance at 11000. A breakout above 11000 would be a

huge boost for the market.

Twiggs Money Flow (21-day), however, continues to trend

downwards. Watch for positive signs from a new high/ higher low.

Expect resistance at 11000 to be formidable and it may be some

time before there is a clear breakout.

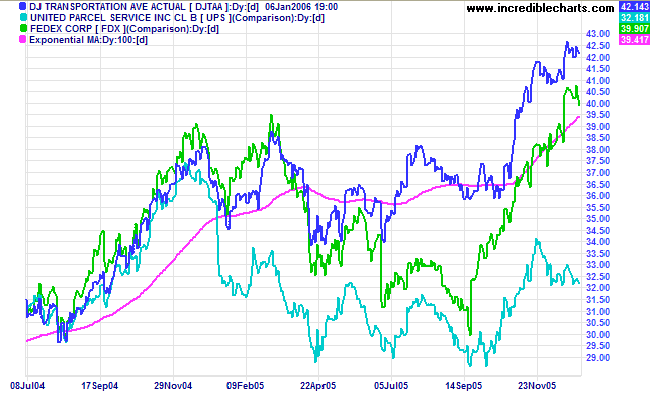

The Dow Jones Transportation Average, Fedex and UPS

continue to show strong primary up-trends: a positive sign for

the economy and equity markets.

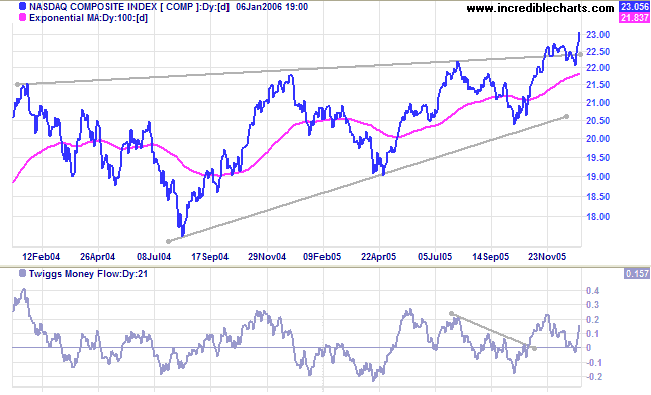

The Nasdaq Composite successfully tested the upper border

of the bearish

rising wedge pattern: a bullish sign for equity markets.

Twiggs Money Flow (21-day) signals accumulation after holding

above the zero line.

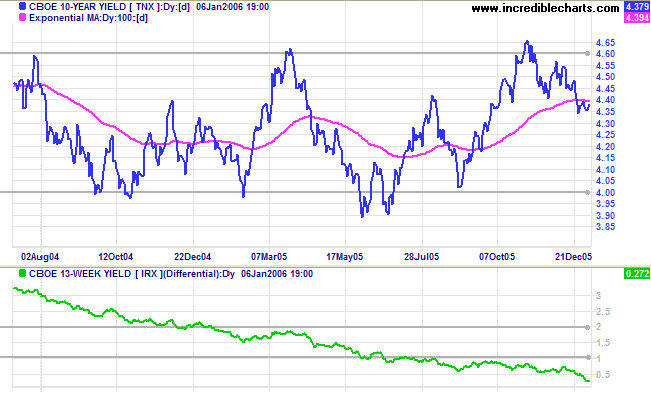

Treasury yields

On the fundamental side, the yield differential (10-year T-notes minus 13-week T-bills) fell sharply over the past few weeks. A negative yield differential (signaling a negative yield curve) is an excellent predictor of economic down-turns and the Fed may be forced to slow short-term interest rate hikes in an attempt to prevent this. Not a good position to be in if inflation starts to rise.

On the fundamental side, the yield differential (10-year T-notes minus 13-week T-bills) fell sharply over the past few weeks. A negative yield differential (signaling a negative yield curve) is an excellent predictor of economic down-turns and the Fed may be forced to slow short-term interest rate hikes in an attempt to prevent this. Not a good position to be in if inflation starts to rise.

Gold

New York: Spot gold rallied strongly since dipping briefly below the $500 support level in mid-December, closing at $538.80 on Friday. A breakout above $540 would confirm the strong primary up-trend and give a target of $580: 540 + (540 - 500).

New York: Spot gold rallied strongly since dipping briefly below the $500 support level in mid-December, closing at $538.80 on Friday. A breakout above $540 would confirm the strong primary up-trend and give a target of $580: 540 + (540 - 500).

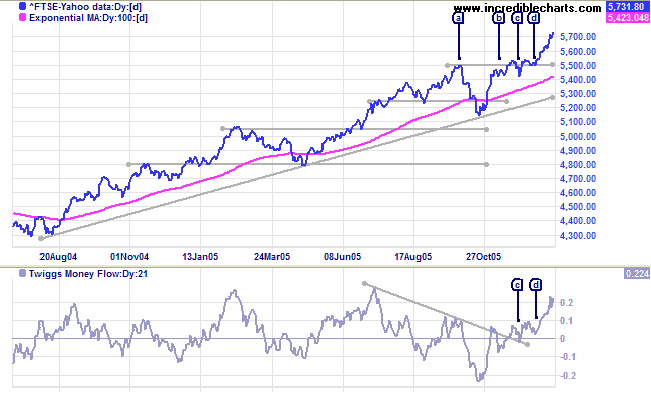

United Kingdom

The FTSE 100 has rallied strongly since the bull signal at [d]: holding above support at 5500. Twiggs Money Flow (21-day) signals accumulation after initially respecting the former downward trendline at [c] followed by a higher low respecting zero at [d]. The target for the breakout is close to 6000: 5500 + (5500 - 5140) = 5860.

The FTSE 100 has rallied strongly since the bull signal at [d]: holding above support at 5500. Twiggs Money Flow (21-day) signals accumulation after initially respecting the former downward trendline at [c] followed by a higher low respecting zero at [d]. The target for the breakout is close to 6000: 5500 + (5500 - 5140) = 5860.

Japan

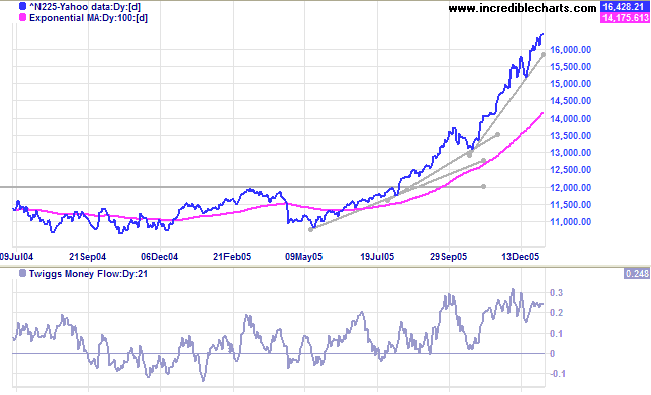

The Nikkei 225 remains in a strong primary up-trend, having reached its long-term target of 16400: 12000 + ( 12000 - 7600 [April 2003]). Cautious investors may commence taking profits, but this bull-trend appears far from spent. Twiggs Money Flow (21-day) signals massive accumulation, having held above the zero line since July 2005.

The Nikkei 225 remains in a strong primary up-trend, having reached its long-term target of 16400: 12000 + ( 12000 - 7600 [April 2003]). Cautious investors may commence taking profits, but this bull-trend appears far from spent. Twiggs Money Flow (21-day) signals massive accumulation, having held above the zero line since July 2005.

ASX Australia

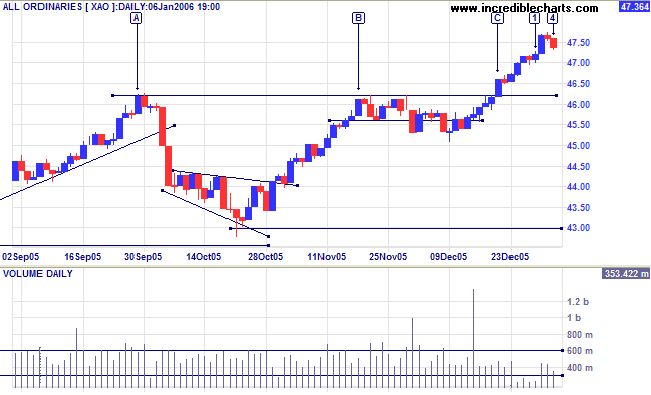

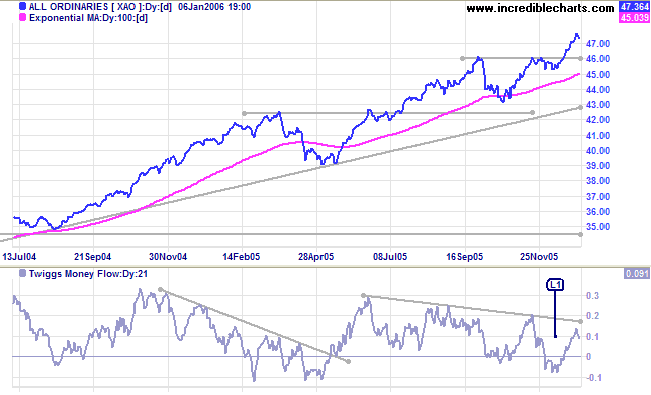

The All Ordinaries rallied strongly since mid-December. This seems to be a regular pattern over the past few years, with the index rising strongly on reduced volume over the last two weeks of the calendar year -- when most institutional buyers/sellers would be expected to be absent. The index completed a cup ([A] to [B]) and handle with a strong breakout at [C]. The retracement at [4] will indicate the strength of the up-trend, but as long as it holds above the new support level of 4620 the market is in positive territory.

The All Ordinaries rallied strongly since mid-December. This seems to be a regular pattern over the past few years, with the index rising strongly on reduced volume over the last two weeks of the calendar year -- when most institutional buyers/sellers would be expected to be absent. The index completed a cup ([A] to [B]) and handle with a strong breakout at [C]. The retracement at [4] will indicate the strength of the up-trend, but as long as it holds above the new support level of 4620 the market is in positive territory.

The index is in a strong primary up-trend with a target close to

5000: 4620 + (4620 - 4300) = 4940. However,

Twiggs Money Flow (21-day) did not confirm the cup and handle

pattern, completing a lower trough at L1. Failure of the next

trough to hold above the zero line, or at least form a higher

low, would be a bearish warning.

Wishing you a healthy and prosperous New Year.

Colin Twiggs

The tragedy of life doesn't lie in not reaching

your goal.

The tragedy lies in having no goal to reach.

~ Benjamin Mays

The tragedy lies in having no goal to reach.

~ Benjamin Mays