Trading Diary

December 17, 2005

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use.

USA

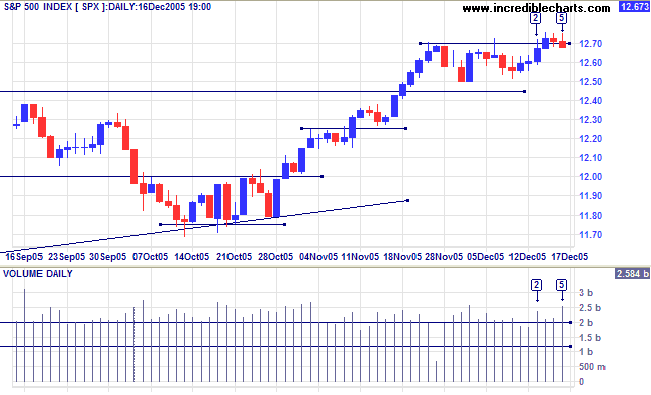

The S&P 500 is testing intermediate resistance at 1270. Strong volume and a weak close at [2] signal selling pressure, while big volume at [5] is attributable to triple-witching hour. This consolidation pattern is likely to resolve in an upward breakout; unless there is a close below support at 1250, which would signal a test of primary support at 1170.

The S&P 500 is testing intermediate resistance at 1270. Strong volume and a weak close at [2] signal selling pressure, while big volume at [5] is attributable to triple-witching hour. This consolidation pattern is likely to resolve in an upward breakout; unless there is a close below support at 1250, which would signal a test of primary support at 1170.

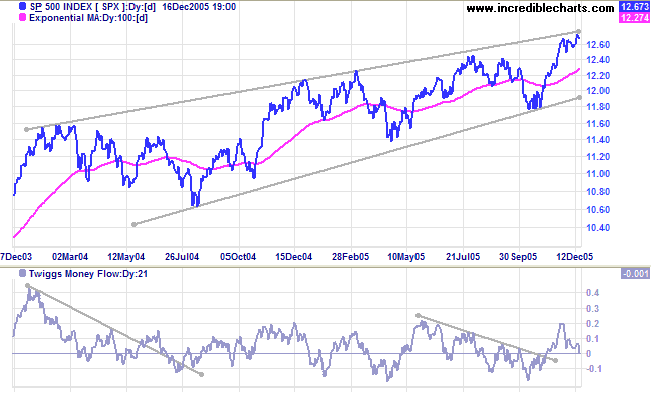

The index is consolidating below the upper border of a long-term

bearish

rising wedge pattern. A breakout would signal a stronger

primary up-trend.

Twiggs Money Flow (21-day) is close to the zero line. An

upward reversal at this point would be a bullish sign.

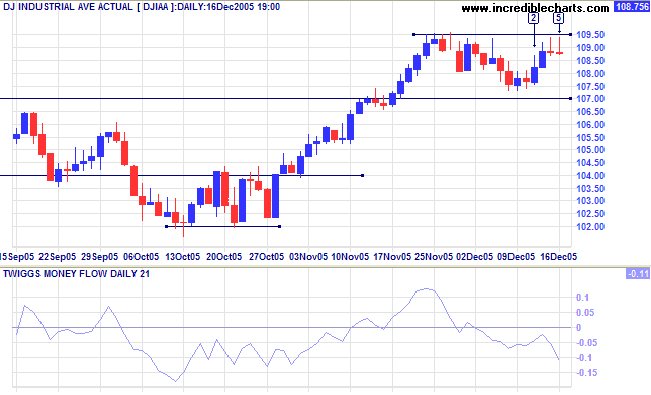

The Dow Industrial Average successfully tested support at

10700 and is now testing intermediate resistance at 10950.

Twiggs Money Flow (21-day) is negative and we can expect

another test of support at 10700 after weak closes on days [4]

and [5]. In the long-term, primary support at 10000 and

resistance at 11000 appear formidable and the index may continue

to range for some time.

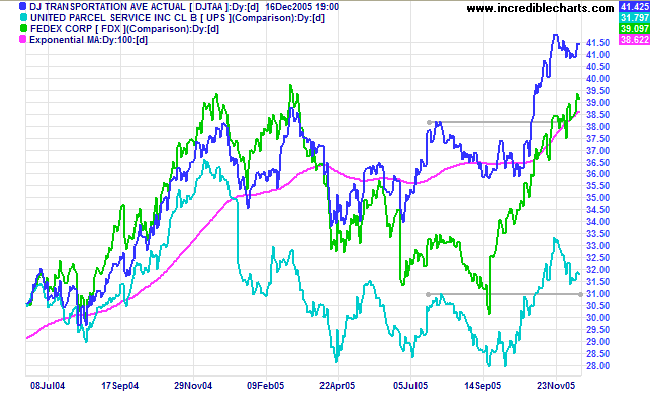

The Dow Jones Transportation Average, Fedex and UPS all

show strong primary up-trends: a positive sign for equity

markets.

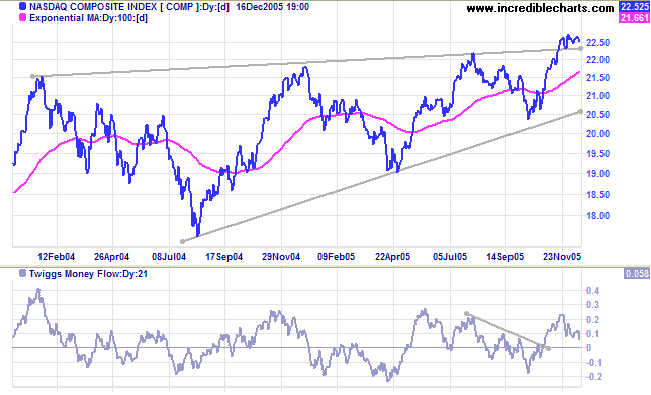

The Nasdaq Composite is consolidating above the upper

border of the bearish

rising wedge pattern: a bullish sign for equity markets.

Twiggs Money Flow (21-day) is above zero, signaling

accumulation.

Treasury yields

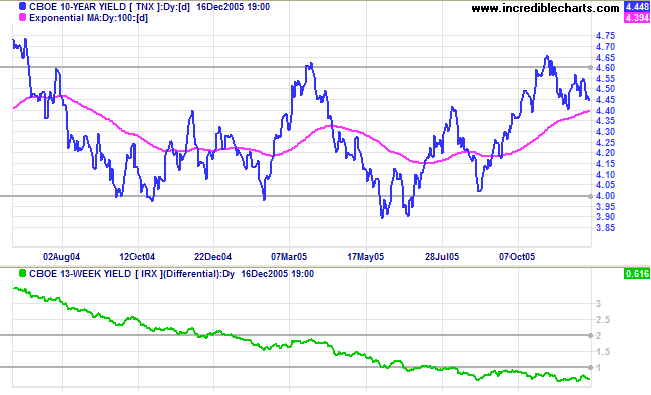

The Fed delivered an early Christmas present, hinting at a slow-down in future rate hikes, while ten-year yields signal weakness, consolidating below the recent high. An improving economy is likely to place upward pressure on inflation and long-bond yields. The yield differential (10-year T-notes minus 13-week T-bills) remains low -- not a good position for the Fed if inflation starts to rise.

The Fed delivered an early Christmas present, hinting at a slow-down in future rate hikes, while ten-year yields signal weakness, consolidating below the recent high. An improving economy is likely to place upward pressure on inflation and long-bond yields. The yield differential (10-year T-notes minus 13-week T-bills) remains low -- not a good position for the Fed if inflation starts to rise.

Gold

New York: Spot gold pulled back to close $502.90 on Friday, briefly dipping below the support level on Thursday/Friday. If support at 500 holds we are likely to see a rally to around $560: 500 + (530 - 500)*2. Otherwise, look out for a test of primary support at $420.

New York: Spot gold pulled back to close $502.90 on Friday, briefly dipping below the support level on Thursday/Friday. If support at 500 holds we are likely to see a rally to around $560: 500 + (530 - 500)*2. Otherwise, look out for a test of primary support at $420.

United Kingdom

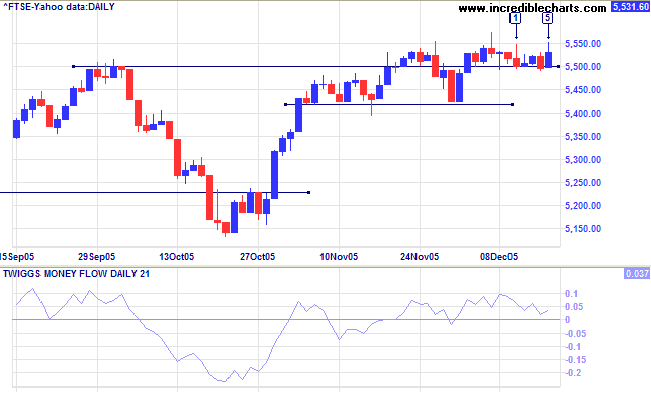

The FTSE 100 is looking positive: holding above support at 5500, while Twiggs Money Flow (21-day) is holding above zero. The target for a breakout would be close to the 6000 level: 5500 + (5500 - 5140) = 5860.

The FTSE 100 is looking positive: holding above support at 5500, while Twiggs Money Flow (21-day) is holding above zero. The target for a breakout would be close to the 6000 level: 5500 + (5500 - 5140) = 5860.

Japan

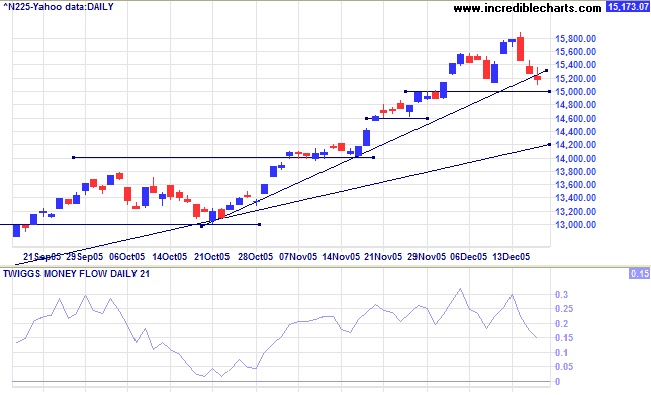

The Nikkei 225 has broken the latest trendline, signaling a loss of momentum. Expect a test of support at 15000. Consolidation above 15000 would be a positive sign for the longer term, establishing a base for further gains. Twiggs Money Flow (21-day) continues to signal strong accumulation, holding well above the zero line. The index is in a strong primary up-trend, with a long-term target of 16400: 12000 + ( 12000 - 7600 [April 2003]).

The Nikkei 225 has broken the latest trendline, signaling a loss of momentum. Expect a test of support at 15000. Consolidation above 15000 would be a positive sign for the longer term, establishing a base for further gains. Twiggs Money Flow (21-day) continues to signal strong accumulation, holding well above the zero line. The index is in a strong primary up-trend, with a long-term target of 16400: 12000 + ( 12000 - 7600 [April 2003]).

ASX Australia

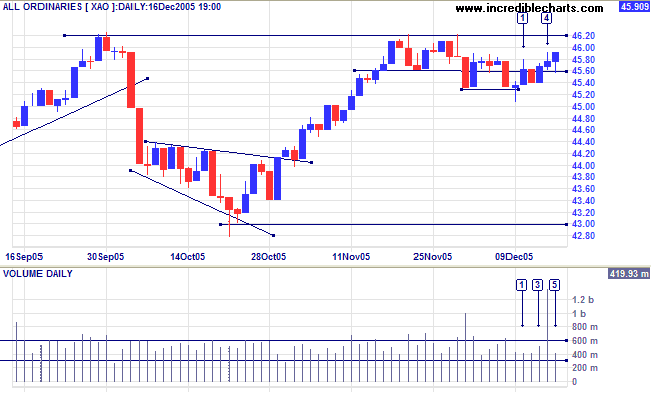

After a hesitant start to the week, the All Ordinaries has shown some resilience. A weak close at [1] followed by an inside day at [2] signal uncertainty, but the index has since rallied despite exceptional volume from the option close-out at [4] (see triple-witching hour). Expect a test of 4620. Watch for a weak pull-back, possibly respecting 4560: a bullish sign. A close below 4530, on the other hand, would be a bear signal.

After a hesitant start to the week, the All Ordinaries has shown some resilience. A weak close at [1] followed by an inside day at [2] signal uncertainty, but the index has since rallied despite exceptional volume from the option close-out at [4] (see triple-witching hour). Expect a test of 4620. Watch for a weak pull-back, possibly respecting 4560: a bullish sign. A close below 4530, on the other hand, would be a bear signal.

Twiggs Money Flow (21-day) is close to the zero line; not yet

displaying any significant signal.

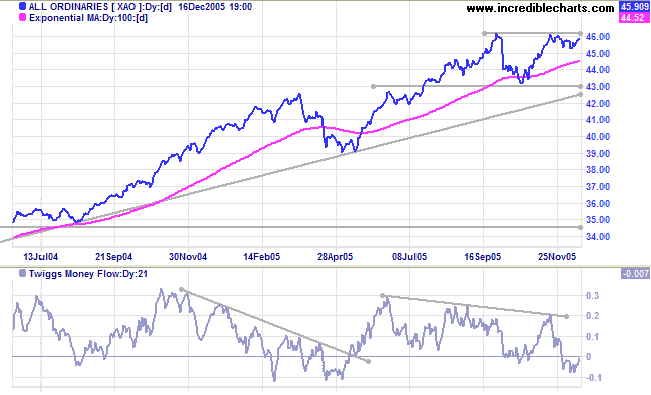

The index is in a strong primary up-trend, with initial resistance at 4620. A breakout would present a target close to 5000: 4620 + (4620 - 4300) = 4940.

The index is in a strong primary up-trend, with initial resistance at 4620. A breakout would present a target close to 5000: 4620 + (4620 - 4300) = 4940.

This is the last trading diary for the year. The newsletter will

resume on 7th January.

Colin Twiggs

We wish all our readers peace and goodwill over

the Christmas season

and prosperity in the year ahead.

and prosperity in the year ahead.