Trading Diary

November 26, 2005

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use.

USA

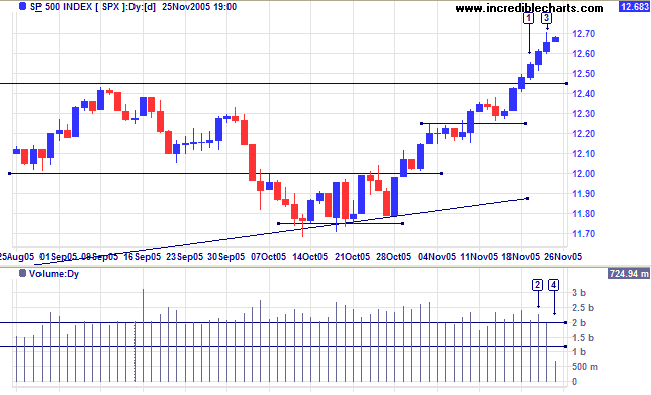

After a strong surge to a new 3-year high the S&P 500 ended the week quietly with the Thanksgiving holiday on the 24th and reduced trading hours on Friday [4]. Look for confirmation from a retracement that respects the new support level at 1245.

After a strong surge to a new 3-year high the S&P 500 ended the week quietly with the Thanksgiving holiday on the 24th and reduced trading hours on Friday [4]. Look for confirmation from a retracement that respects the new support level at 1245.

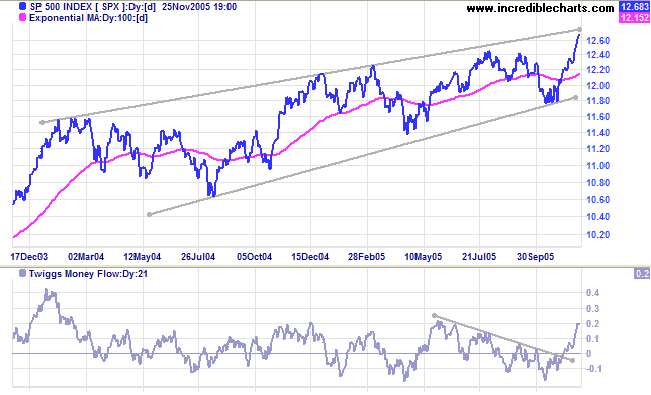

In the long-term the index is testing the upper border of the

bearish

rising wedge pattern. A breakout above the wedge pattern

would signal a stronger up-trend with a target of 1500: 1260 +

(1160 - 800) = 1620. A reversal at the upper border, however,

would mean a further test of the lower edge of the pattern.

Twiggs Money Flow (21-day) signals accumulation with a sharp

climb above the zero line.

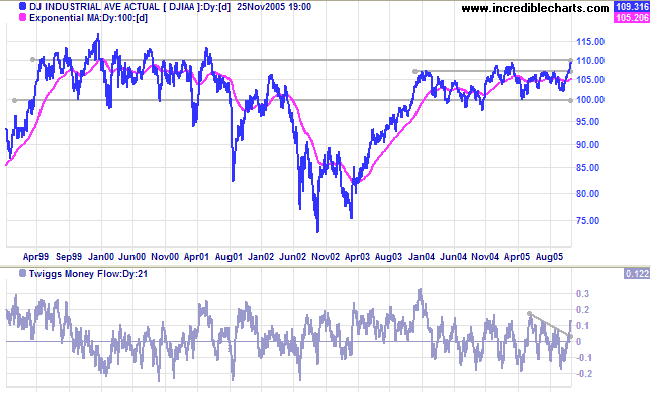

The Dow Industrial Average is headed for another test of

resistance at 11000.

Twiggs Money Flow (21-day) is rising steeply above zero,

signaling accumulation. In the long-term the Dow faces heavy

resistance at 11000/11500 and strong support at 10000.

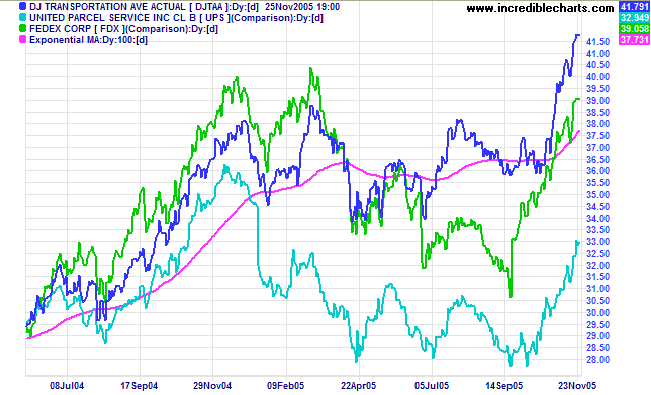

The Dow Jones Transportation Average and its two

stalwarts, Fedex and UPS, have all commenced strong primary

up-trends: a bullish sign for the equity market.

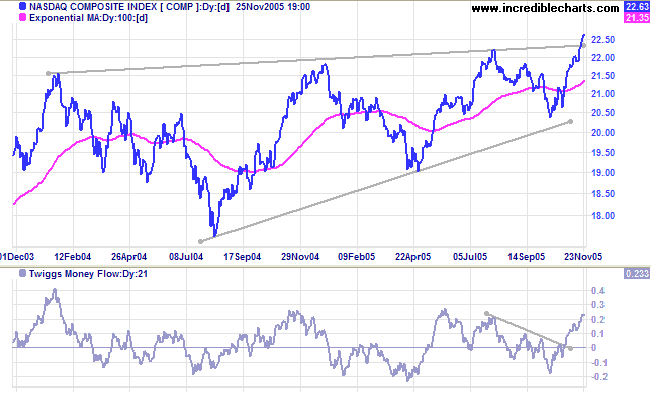

The Nasdaq Composite has broken above the upper border of

the bearish

rising wedge pattern.

Twiggs Money Flow (21-day) signals accumulation, climbing

steeply above zero. This is a positive sign for the general

equity market. Look for confirmation from a retracement that

respects support above, say, 2200.

Treasury yields

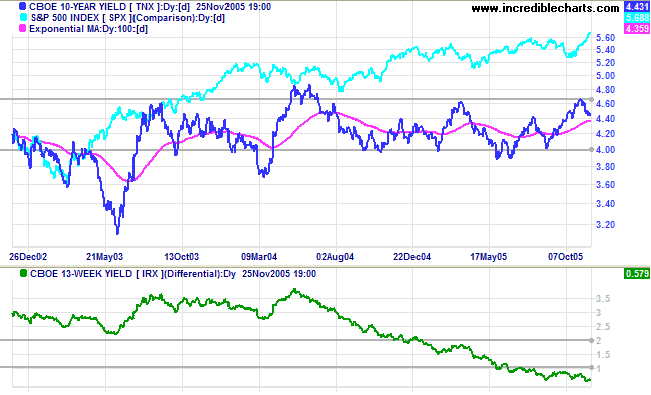

Short-term yields are rising while long-term yields continue to retreat from resistance at 4.60%. The yield differential (10-year T-notes minus 13-week T-bills) is low and the Fed faces a tough choice: continue to hike short-term rates, and end up with a negative yield curve, or ease off the rate hikes and risk having inflation take root. Either result could have negative consequences.

Short-term yields are rising while long-term yields continue to retreat from resistance at 4.60%. The yield differential (10-year T-notes minus 13-week T-bills) is low and the Fed faces a tough choice: continue to hike short-term rates, and end up with a negative yield curve, or ease off the rate hikes and risk having inflation take root. Either result could have negative consequences.

Gold

New York: Spot gold is close to $500, closing at $495.70 on Friday. Expect profit-taking at the resistance level before an attempted breakout.

New York: Spot gold is close to $500, closing at $495.70 on Friday. Expect profit-taking at the resistance level before an attempted breakout.

United Kingdom

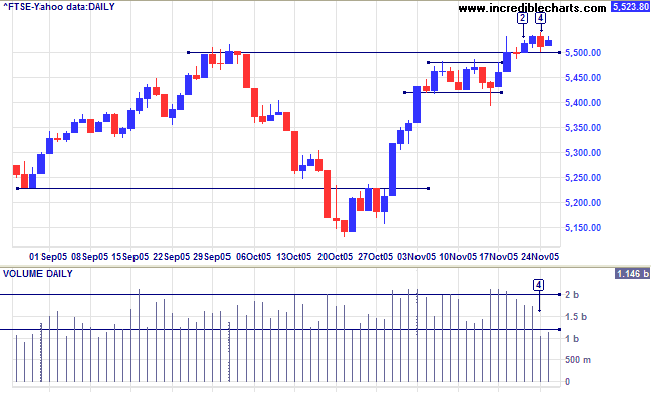

After a brief hesitation the FTSE 100 broke through resistance at 5500 on Tuesday at [2]. The index is consolidating, with a quick test of the new support level at [4]. Volume dropped off sharply at the end of the week, repeating the pattern from last year's Thanksgiving holidays in the US. Twiggs Money Flow (21-day) shows short-term accumulation. The target for the breakout is close to 6000: 5500 + (5500 - 5140) = 5860.

After a brief hesitation the FTSE 100 broke through resistance at 5500 on Tuesday at [2]. The index is consolidating, with a quick test of the new support level at [4]. Volume dropped off sharply at the end of the week, repeating the pattern from last year's Thanksgiving holidays in the US. Twiggs Money Flow (21-day) shows short-term accumulation. The target for the breakout is close to 6000: 5500 + (5500 - 5140) = 5860.

Japan

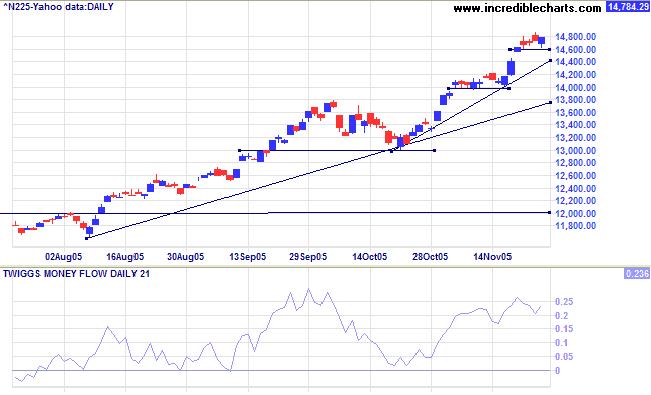

The Nikkei 225 also enjoyed a short week with Labor Thanksgiving Day on Wednesday. The index consolidated for most of the week but is in an accelerating curve; so we need to beware of sharp reversals. Twiggs Money Flow (21-day) is exceptionally strong, forming troughs high above the zero line. The primary up-trend should continue for some time, with a long-term target above 16000: 12000 + ( 12000 - 7600 [April 2003]) = 16400.

The Nikkei 225 also enjoyed a short week with Labor Thanksgiving Day on Wednesday. The index consolidated for most of the week but is in an accelerating curve; so we need to beware of sharp reversals. Twiggs Money Flow (21-day) is exceptionally strong, forming troughs high above the zero line. The primary up-trend should continue for some time, with a long-term target above 16000: 12000 + ( 12000 - 7600 [April 2003]) = 16400.

ASX Australia

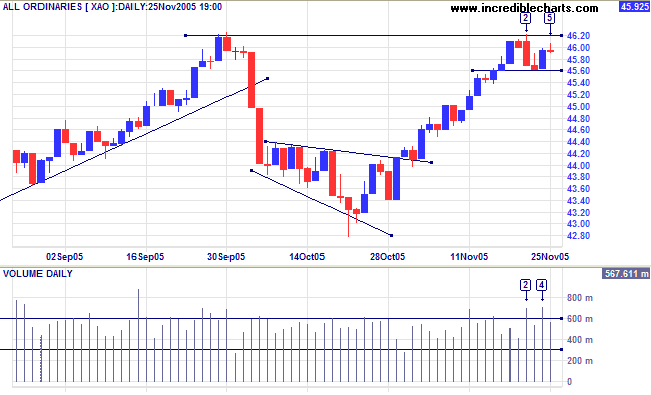

The All Ordinaries is consolidating below resistance at 4620. Strong volume and a red candle at [2] signaled profit-taking at the previous high, while strong volume and a blue candle at [4] indicate buying support. A weaker close at [5] signals diminishing buyer interest, possibly awaiting a further lead from US markets. Consolidation in a narrow band below resistance is likely to resolve in an upward breakout, but a close below 4560 would be a bearish sign.

The All Ordinaries is consolidating below resistance at 4620. Strong volume and a red candle at [2] signaled profit-taking at the previous high, while strong volume and a blue candle at [4] indicate buying support. A weaker close at [5] signals diminishing buyer interest, possibly awaiting a further lead from US markets. Consolidation in a narrow band below resistance is likely to resolve in an upward breakout, but a close below 4560 would be a bearish sign.

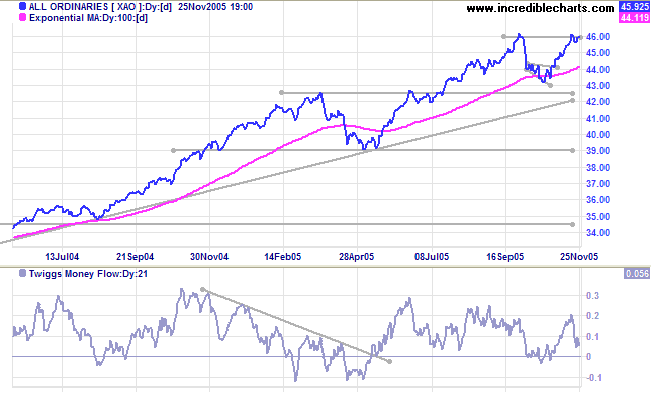

Twiggs Money Flow (21-day) signals accumulation and the index

is in a strong primary up-trend. A breakout above 4620 would

present a target close to 5000: 4620 + (4620 - 4320) = 4920. On

the other hand, though unlikely, failure to break above

resistance would signal a test of primary support at 4320.

For further assistance, read About

the Trading Diary.

Colin Twiggs

I spent a lot of money on booze, birds and fast

cars

-- the rest I just squandered.

~ former Manchester United football star, George Best, who died, aged 59, on Friday.

-- the rest I just squandered.

~ former Manchester United football star, George Best, who died, aged 59, on Friday.