Trading Diary

October 15, 2005

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use.

USA

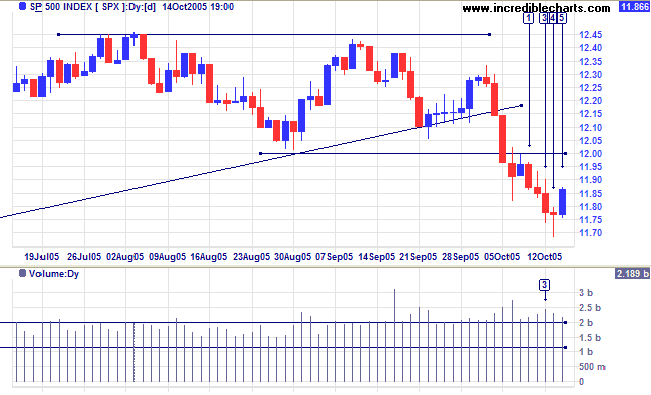

The S&P 500 has commenced a pull-back at [5], to test the new 1200 resistance level, after weak closes and strong volume at [3] and [4] signaled buying support around 1175.

The S&P 500 has commenced a pull-back at [5], to test the new 1200 resistance level, after weak closes and strong volume at [3] and [4] signaled buying support around 1175.

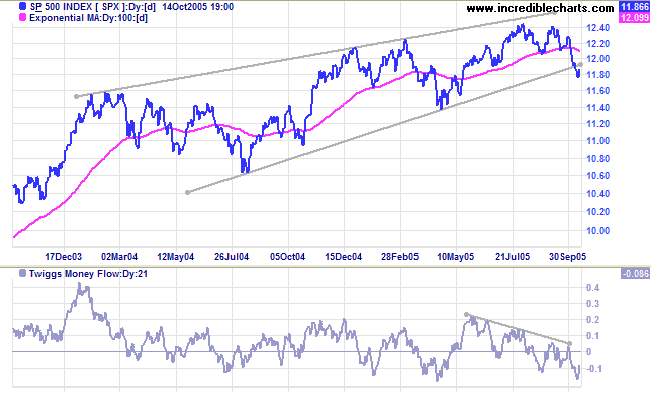

The secondary correction has broken through the lower border of

the bearish

rising wedge pattern, warning of a primary trend reversal. If

the short-term pull-back respects resistance at 1200, that would

add further weight to the signal; while a close below primary

support at 1140 would confirm the signal.

Twiggs Money Flow (21-day) is well below zero, signaling

medium-term distribution.

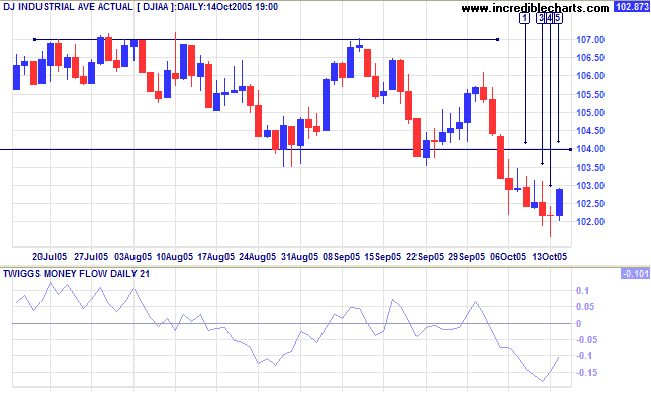

The Dow Industrial Average started a short-term

retracement on Friday [5] after two days of weak closes and

increased volume at [3] and [4], signaling buying support at

10200. The reaction appears headed for a test of resistance at

10400. Failure to breach that level would indicate a test of

primary support at 10000.

Twiggs Money Flow (21-day) is below zero, signaling

medium-term

distribution.

In the long-term expect consolidation between 10000 and 11000.

In the long-term expect consolidation between 10000 and 11000.

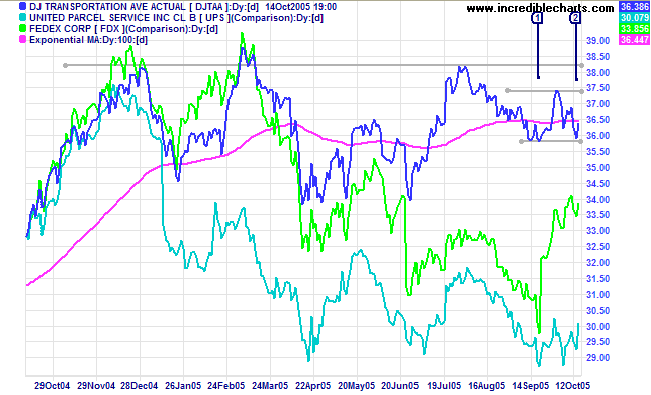

The Dow Jones Transportation Average has pulled back to

form two equal lows at [1] and [2]. The most likely outcome, in a

down-trend, is a downside continuation. However, bullish signs on

Fedex and UPS suggest that there is a good chance of a rally. A

rise above the intervening peak would complete a

double bottom reversal.

The primary trend is in a top pattern, with a flat 100-day MA.

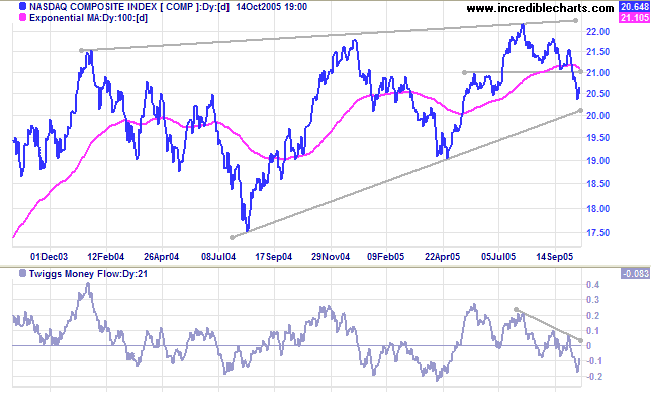

The Nasdaq Composite is also undergoing a secondary

correction, while

Twiggs Money Flow (21-day) signals medium-term

distribution. The latest short-term pull-back may test the

new resistance level at 2100, but in the medium-term the index

appears headed for a test of the lower border of the bearish

rising wedge pattern.

A breach of primary support at 1900 would signal the start of a primary down-trend.

A breach of primary support at 1900 would signal the start of a primary down-trend.

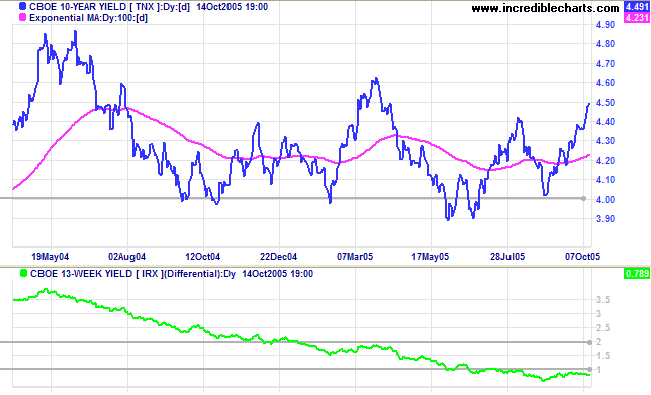

Treasury yields

Both long and short-term yields climbed sharply, after the recent Fed policy meeting indicated further rate hikes are necessary to contain inflation. The yield differential (10-year T-notes minus 13-week T-bills) remains below 1%, squeezing bank margins. A flat yield curve is detrimental to the profitability of banks (who pay mostly short-term rates to depositors while charging long-term rates to borrowers) and a long-term bear signal for the entire equity market.

Both long and short-term yields climbed sharply, after the recent Fed policy meeting indicated further rate hikes are necessary to contain inflation. The yield differential (10-year T-notes minus 13-week T-bills) remains below 1%, squeezing bank margins. A flat yield curve is detrimental to the profitability of banks (who pay mostly short-term rates to depositors while charging long-term rates to borrowers) and a long-term bear signal for the entire equity market.

Gold

New York: Spot gold is wedging slowly upwards, having closed at $469.20 on Friday. The pattern is a form of consolidation; likely to end with resumption of the primary up-trend. A fall below support at 460, on the other hand, would indicate the start of a secondary correction.

New York: Spot gold is wedging slowly upwards, having closed at $469.20 on Friday. The pattern is a form of consolidation; likely to end with resumption of the primary up-trend. A fall below support at 460, on the other hand, would indicate the start of a secondary correction.

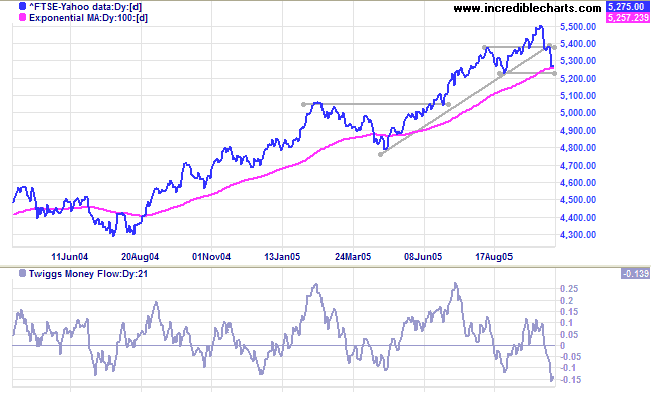

United Kingdom

Having broken the ascending trendline, the FTSE 100 is headed for a test of primary support at 5225. Failure of this level would signal reversal to a down-trend. Twiggs Money Flow (21-day) supports this, with a sharp fall below zero signaling strong distribution.

However, the outcome of most equal lows in an up-trend is in the direction of the prevailing trend. If the index respects support at 5225, the result is likely to test resistance at 5500.

Having broken the ascending trendline, the FTSE 100 is headed for a test of primary support at 5225. Failure of this level would signal reversal to a down-trend. Twiggs Money Flow (21-day) supports this, with a sharp fall below zero signaling strong distribution.

However, the outcome of most equal lows in an up-trend is in the direction of the prevailing trend. If the index respects support at 5225, the result is likely to test resistance at 5500.

Japan

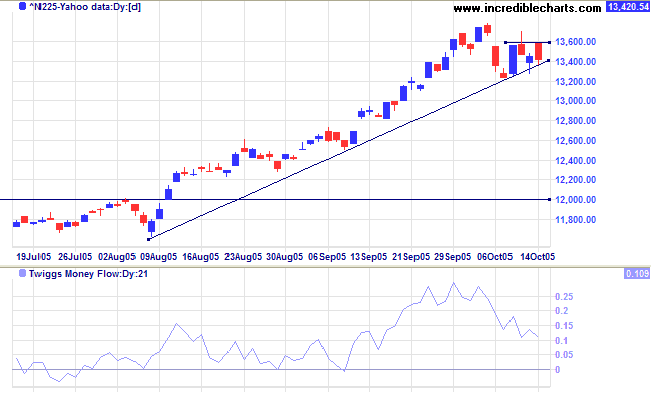

The Nikkei 225 remains in an up-trend, but declining Twiggs Money Flow (21-day) signals short-term distribution. Resistance at 13600, below the previous peak, is also a bearish sign. A fall below last Friday's low of 13200 would signal the start of a secondary correction; possibly testing support at 12000.

The primary up-trend appears strong and support at 12000 is likely to hold. The long-term target for the breakout is: 12000 + ( 12000 - 7600 [the April 2003 low]) = 16400.

The Nikkei 225 remains in an up-trend, but declining Twiggs Money Flow (21-day) signals short-term distribution. Resistance at 13600, below the previous peak, is also a bearish sign. A fall below last Friday's low of 13200 would signal the start of a secondary correction; possibly testing support at 12000.

The primary up-trend appears strong and support at 12000 is likely to hold. The long-term target for the breakout is: 12000 + ( 12000 - 7600 [the April 2003 low]) = 16400.

ASX Australia

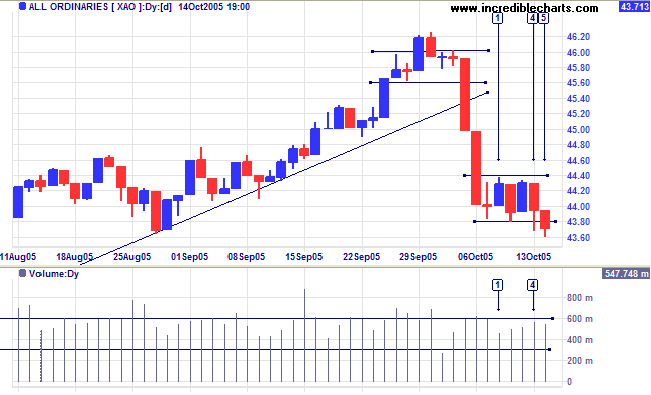

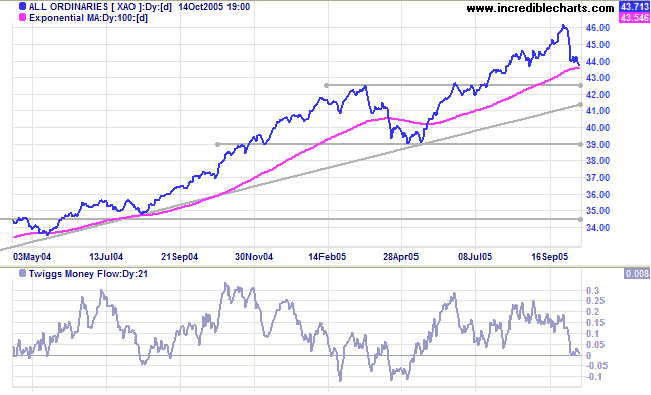

The All Ordinaries consolidated in a narrow range for most of the week before a false break at [4]; the long tail and increased volume indicating buying support. The Friday breakout appears tentative, with reasonable volume but a fairly weak close [5]. The target for the breakout is: 4380 - (4580 - 4380) = 4180. However, beware of a close back above 4380 which would indicate a bear trap.

The All Ordinaries consolidated in a narrow range for most of the week before a false break at [4]; the long tail and increased volume indicating buying support. The Friday breakout appears tentative, with reasonable volume but a fairly weak close [5]. The target for the breakout is: 4380 - (4580 - 4380) = 4180. However, beware of a close back above 4380 which would indicate a bear trap.

Twiggs Money Flow (21-day) is just above zero, signaling

consolidation. The secondary correction is likely to test initial

support at 4250. A successful test would signal that the primary

up-trend remains strong; and 5000 may still be within reach. The

aggressive target is calculated by projecting the previous

up-swing from its' peak: 4250 [B] + (4250 - 3450 [A]) =

5050.

Failure of initial support, however, would indicate that the primary trend is weakening and a test of primary support at 3900 likely. Continued weakness on the Dow and S&P 500 would have a bearish influence on the All Ords.

Failure of initial support, however, would indicate that the primary trend is weakening and a test of primary support at 3900 likely. Continued weakness on the Dow and S&P 500 would have a bearish influence on the All Ords.

For further assistance, read About

the Trading Diary.

Colin Twiggs

A failure is a man who has blundered,

but is not able to cash in on the experience.

~ Elbert Hubbard

but is not able to cash in on the experience.

~ Elbert Hubbard

Back Issues

Access the Trading Diary Archives.