|

S&P 500 [SPX] data history |

|

The S&P 500 data history has been extended to 24

years |

Trading Diary

June 12, 2004

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use.

USA

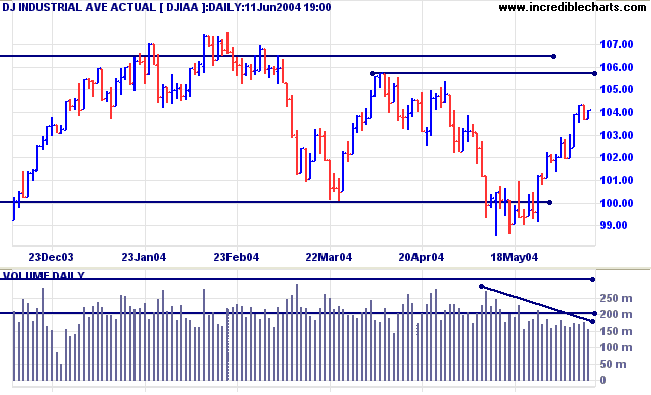

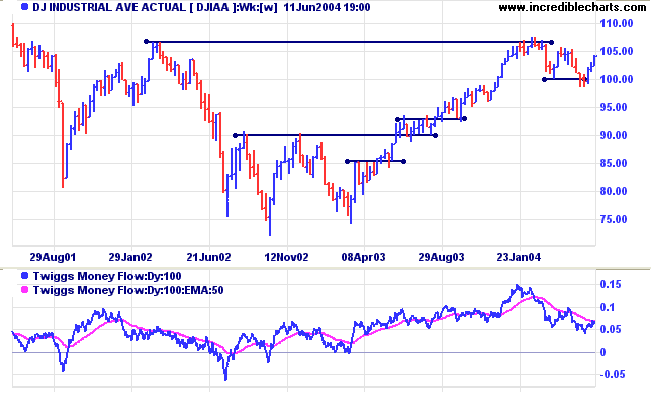

The Dow Industrial Average rally appears healthy, with

short retracements on low volume. However, declining overall

volume raises doubt about buyers ability to break through

resistance at 10570. Failure to do so would signal a re-test of

support at 10000/9900.

A rise above 10570 would signal resumption of the primary

up-trend.

But Twiggs Money Flow continues to signal distribution.

But Twiggs Money Flow continues to signal distribution.

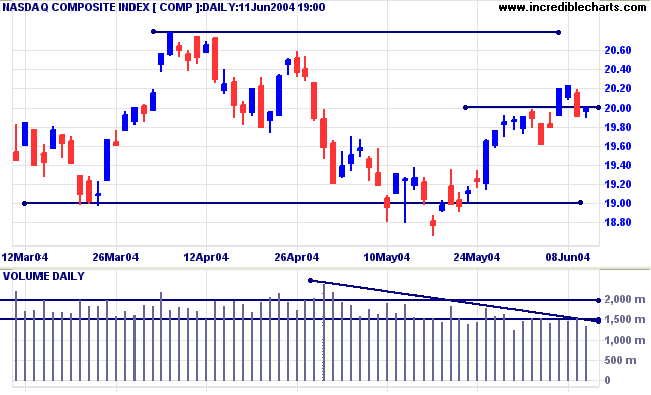

The Nasdaq Composite broke through resistance at 2000 but

has since retreated below this level.

Declining volume signals a lack of commitment from buyers.

Twiggs Money Flow continues to show distribution.

Declining volume signals a lack of commitment from buyers.

Twiggs Money Flow continues to show distribution.

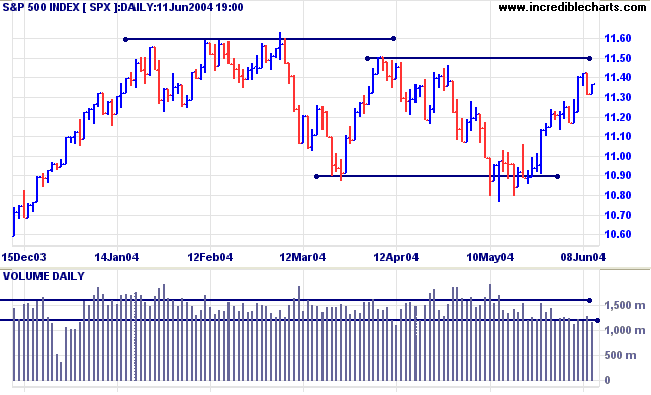

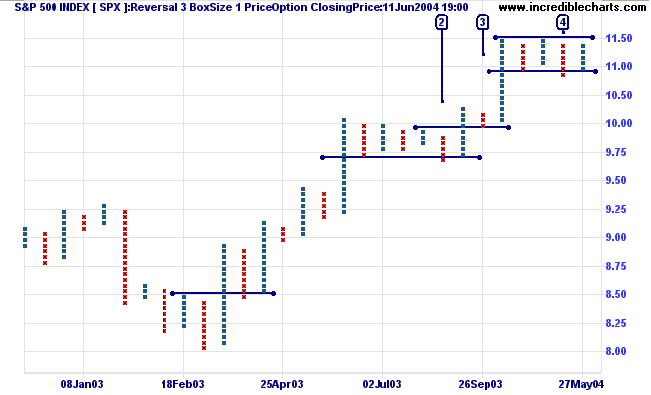

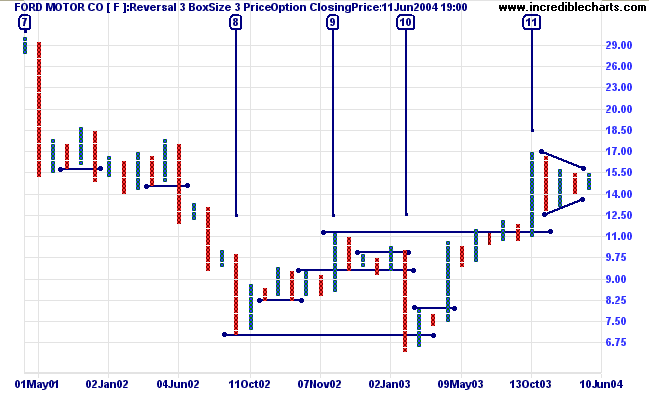

The S&P 500 has also experienced low volumes on the

latest rally. Failure to break above resistance at 1150 will

signal another test of support at 1090/1080.

A bear trap pattern is evident at [4] on the P&F chart

below.

A clear break above resistance at 1150 would signal resumption of the primary up-trend; though it may be advisable to wait for confirmation, as at [3] on the last breakout.

Twiggs Money Flow continues to signal distribution.

A clear break above resistance at 1150 would signal resumption of the primary up-trend; though it may be advisable to wait for confirmation, as at [3] on the last breakout.

Twiggs Money Flow continues to signal distribution.

Treasury yields

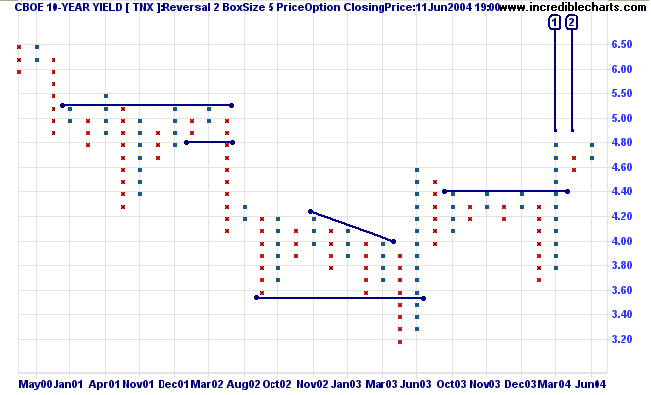

The yield on 10-year treasury notes is at 4.791%. The short retracement [2] after the breakout [1] above resistance indicates a healthy primary up-trend.

The yield differential (10-year T-notes minus 13-week T-bills) at 3.5% reflects imminent rates increases.

The yield on 10-year treasury notes is at 4.791%. The short retracement [2] after the breakout [1] above resistance indicates a healthy primary up-trend.

The yield differential (10-year T-notes minus 13-week T-bills) at 3.5% reflects imminent rates increases.

Gold

New York: Spot gold closed down at $384.90, below resistance at 390. Expect a bearish consolidation or slow down-trend.

The next (intermediate) support level is at the May low of 375.

New York: Spot gold closed down at $384.90, below resistance at 390. Expect a bearish consolidation or slow down-trend.

The next (intermediate) support level is at the May low of 375.

Incredible Charts - now with US

Data

|

FREE trial - Click Here

ASX Australia

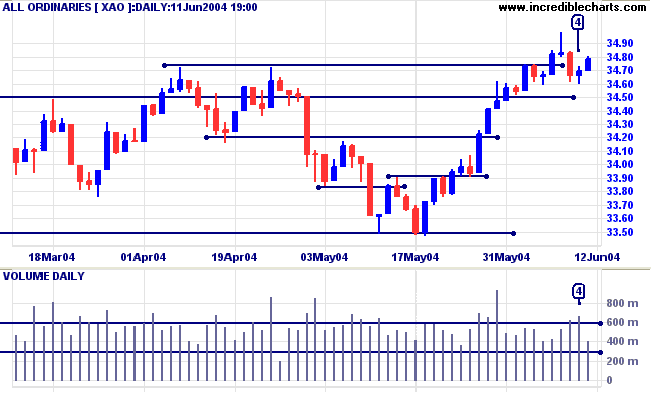

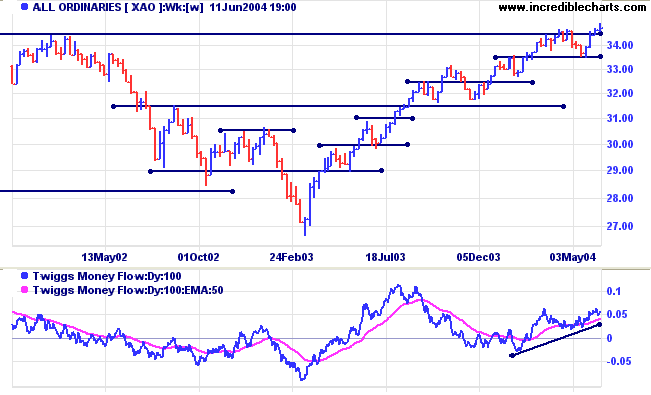

The All Ordinaries rallied to a new high

but quickly reversed on increased volume. Buyers then

intervened, overcoming sellers on strong volume at [4], but the

action seems to have exhausted demand: volume dropped

significantly on Friday.

While Twiggs Money Flow shows signs of

increasing accumulation, we have not yet seen confirmation of the

breakout, in the form of a pull-back that respects the new

support level.

Point & Figure - Bull and Bear

Traps

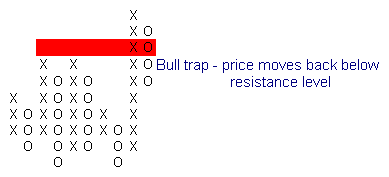

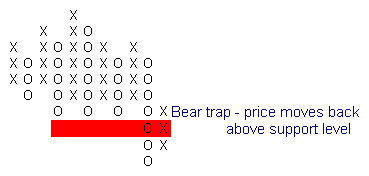

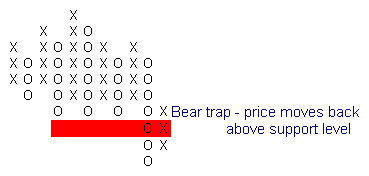

One of the most reliable patterns. Bull traps occur when an upward breakout retreats back below a resistance level. Bear traps occur when a downward breakout retreats back above a support level.

Bull Traps

One of the most reliable patterns. Bull traps occur when an upward breakout retreats back below a resistance level. Bear traps occur when a downward breakout retreats back above a support level.

Bull Traps

- Bull traps should be traded in a down-trend.

- They may also signal reversal after an extended up-trend.

- Go short when price falls back below the resistance level.

Bear Traps

More on triangle patterns next week....

Back Issues

- Bear traps should be traded in an up-trend.

- They may also signal reversal after an extended down-trend.

- Go long when price rises above the support level.

Wide Bull and Bear traps

Bull and bear traps (and false breaks) often occur in longer time frames as well.

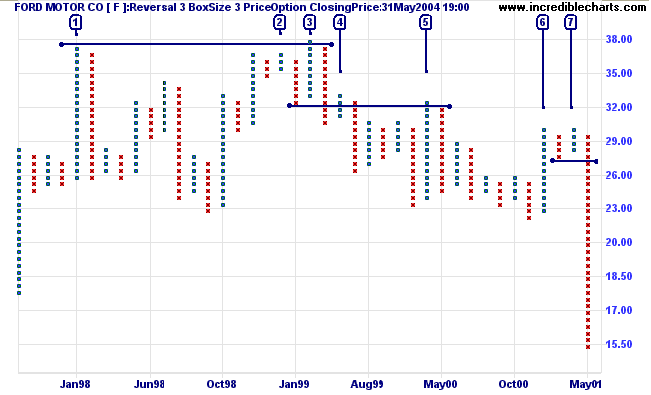

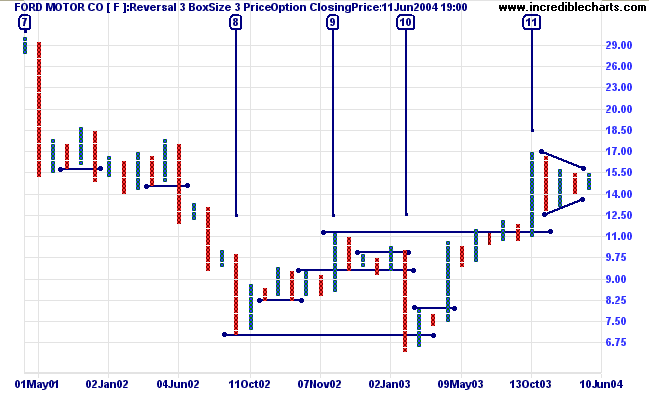

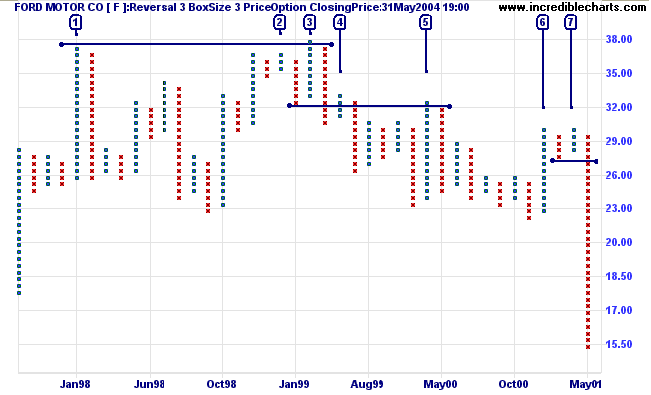

Ford Motor Co. displays a bull trap that took more than a year to complete.

Bull and bear traps (and false breaks) often occur in longer time frames as well.

Ford Motor Co. displays a bull trap that took more than a year to complete.

- Price spikes up to a new high, in early 1998, but quickly retraces.

- Resistance forms just below the previous high. The strong following correction is a bearish sign.

- The Bull trap: Price rallies to a marginal new high but then retreats below the resistance level.

- A short retracement confirms the trend change.

- An equal lower high confirms resistance has formed at 32.00: the low before [3]. A strong bear signal.

- Another attempted rally peters out.

- Equal highs in a down-trend are a strong bear signal; and are followed by a long downward spike.

More on triangle patterns next week....

Basic point and figure chart patterns are explained at the

Trading Guide: P&F Chart Patterns.

About

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search

the archives.

Colin Twiggs

The usual bull market successfully weathers

a number of testsuntil it is

considered invulnerable,

whereupon it is ripe for a bust.

~ George Soros

whereupon it is ripe for a bust.

~ George Soros

Back Issues

Click here to access the Trading Diary Archives.

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.