Except for the 30-day free trial, free end-of-day data will be

delayed by 18 hours in future. This means that the updates will

occur at 10.00 a.m. - suitable for training purposes but not

active trading.

Premium subscribers are unaffected by these

changes.

To find out more about premium subscriptions - see Incredible Offer.

Also, early US subscribers enjoy an extended free trial until

June 30 and will not be affected by the changes.

If your free trial expiry date is not correctly reflected (see

Help >> About), please contact members

support.

|

Free Data |

Trading Diary

April 10, 2004

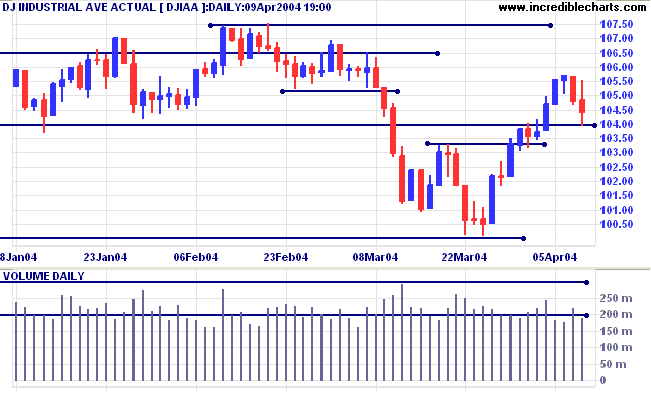

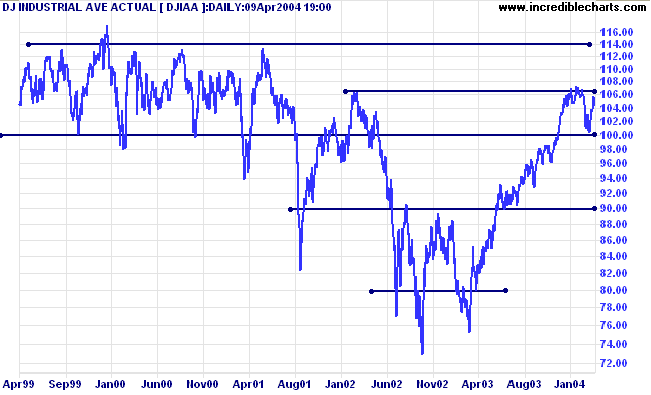

An up-turn, without penetrating below the support level, would be a bullish sign. Failure to rise above the recent high of 10570 within the next, say, 10 days would be bearish.

Twiggs Money Flow (not shown) is still bearish, below it's signal line.

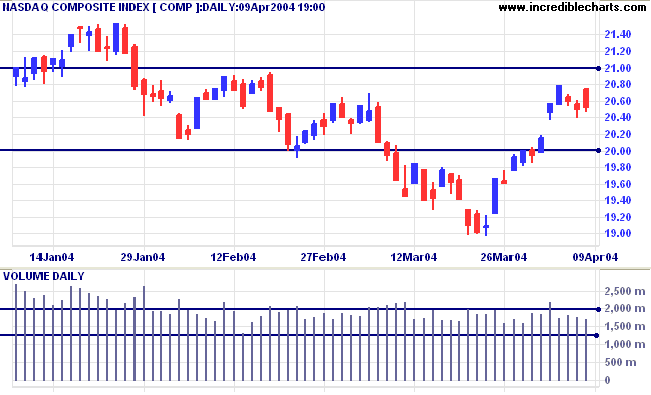

A rise above 2150 would signal resumption of the primary up-trend. Expect support at 2000 and 1900 (major).

Twiggs Money Flow (not shown) is bearish.

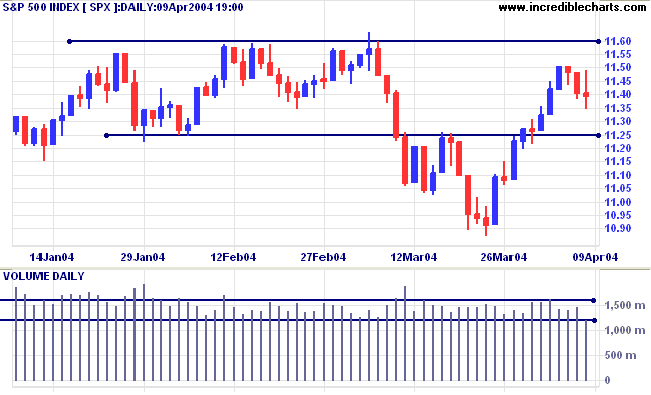

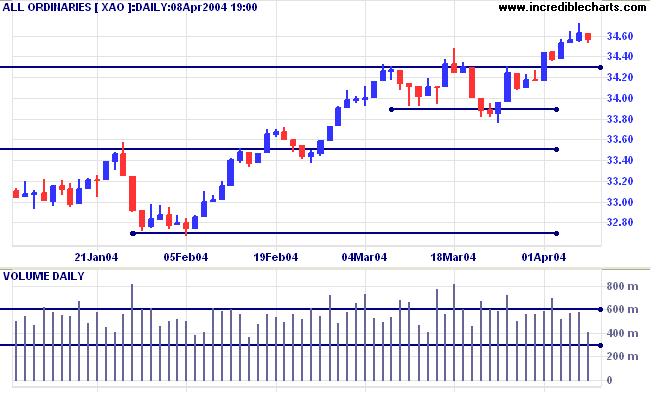

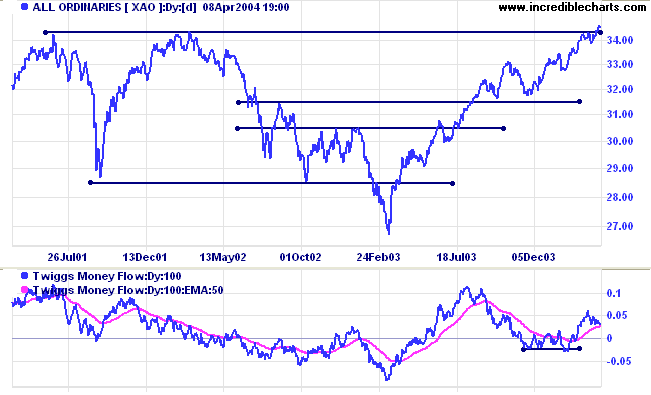

Twiggs Money Flow is bearish, below its signal line.

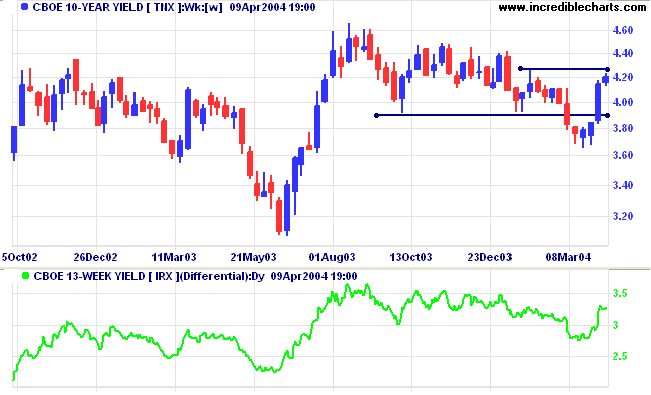

The yield on 10-year treasury notes closed at 4.197%.

The narrow range indicates a consolidation below resistance, increasing the likelihood of a continuation (above 4.25%).

The primary trend is uncertain.

New York: Spot gold closed at $420.80 with the metal consolidating between $415 and $430 over the last 2 weeks.

The intermediate trend is up. A fall below $415 would indicate a reversal.

The primary trend is up. A fall below $390 would signal reversal.

Incredible Charts - now with US

Data

|

FREE trial - Click Here

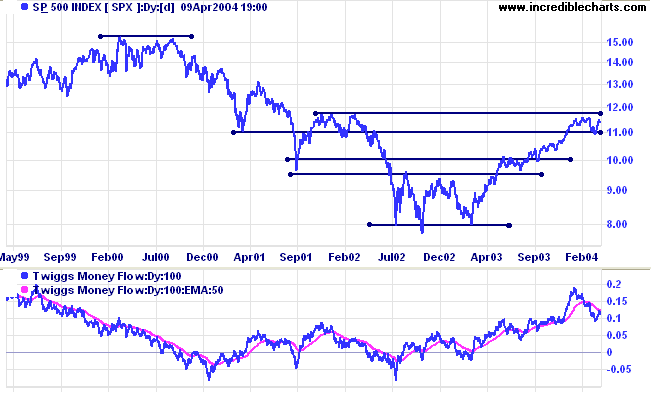

Twiggs Money Flow signals accumulation (intermediate), with the indicator above its signal line. The long-term picture appears more doubtful, with the indicator well below its August 2003 high.

Incredible Charts Premium

version

|

FREE trial - Click Here

Gaps occur when the lowest price traded is above the high of the previous day or, conversely, when the highest price traded is below the previous day’s low.

There are four main types of gaps:

- Common gaps

- Breakaway

- Continuation

- Exhaustion

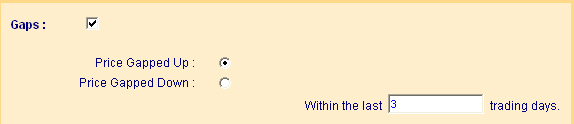

Screening for gaps is relatively easy:

-

Open the Stock Screen module from the

toolbar

- Select Gaps

-

Then select

- Price Gapped Up when looking for long entries

- Price Gapped Down for short entries.

- Finally, add a time frame (e.g. 3 days) and Submit.

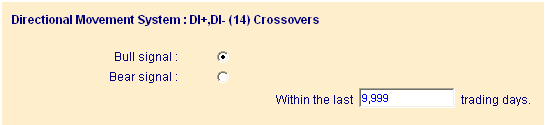

To identify particular types of gaps, combine with Directional Movement (or Moving Average) filters :

- Select Directional Movement System

-

And DI+,DI-(14)

Crossovers:

- Bull signal

- Within the last 9999 days (to capture all stocks where DI+ is greater than DI-)

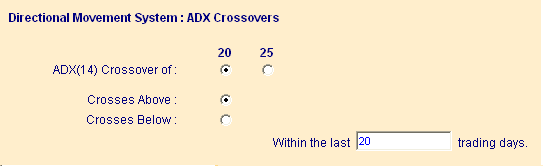

-

Then select ADX

Crossovers:

- Crossover of 20

- Crosses Above

- Within the last 20 days (to capture stocks that recently started trending)

Sort on the ADX Crossovers field (by clicking on the column header) to find the most recent breakaways.

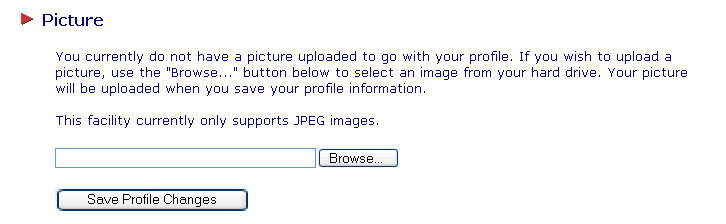

To add an image:

- Login to your Chart Forum Profile

- Select Picture

- Click the Browse button and select a JPEG image from your files

- Save Profile Changes.

because it is dressed in overalls

and looks like work.

~ Thomas Alva Edison.

Click here to access the Trading Diary Archives.

Back Issues