Daily Trading Diary - Subscriptions

|

We have removed the Daily Trading Diary from the

subscription page until the new format is

resolved.

New subscribers will be afforded the opportunity to

subscribe at the old price when the Diary is

re-introduced.

|

Trading Diary

February 23, 2004

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use .

ASX Australia

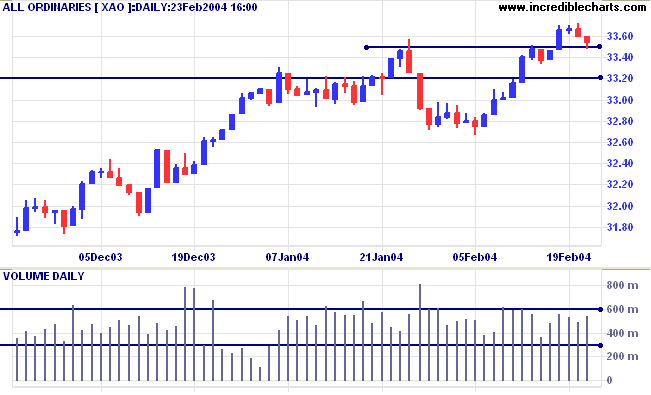

The All Ordinaries tested support at 3350 before

closing at 3354. A fairly weak close and higher volume indicate

buying support. For the fast up-trend to continue, the index

must respect the 3350 support level. A (sustained) rise above

today's high will be a bull signal. A fall below last Monday's

low of 3333 would be bearish.

The intermediate trend is up. A fall below

support at 3320 would be bearish.

The primary trend is up. Resistance is at the 2001/2002 highs of

3425 and 3440. Support is at 3160.

Stock Screening - Stage 1 Breakouts

I have received

several requests for an explanation of how to screen for Stage 1

breakouts.

Just to ensure that everyone knows what a Stage 1 breakout is,

here is an excerpt from

About

the Trading Diary:

|

Market Stages

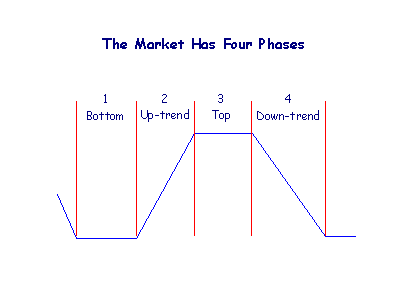

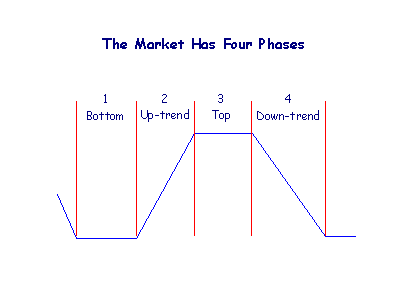

There are four possible stages/phases:

-

Base or bottom

The market

ranges between support and resistance, after a

stage 4 down-trend. The index normally

whipsaws around long-term moving averages and there

may be clear signs of accumulation, including declining

volume on downward movements and increasing volume on

rallies.

-

Primary up-trend

Stage 2 up-trends will follow a breakout from stage 1.

The index

respects long-term moving averages (from above) and

there should be strong volume on rallies and light

volume on corrections.

-

Top

The market levels off into a

trading range after a stage 2 up-trend. The index

normally

whipsaws around long-term moving averages. A stage

3 top normally continues to show high volume as the

market repeatedly attempts to overcome resistance. A

dry-up of volume may signal that the trading range will

breakout on the upside, reverting back to a stage 2

up-trend.

-

Primary down-trend

A stage 4 down-trend will follow a break below a stage

3 top. The index

respects long-term moving averages (from below) and

there should be strong volume on declines and light

volume on upward corrections.

Sometimes the market will form a chart pattern, such as a

descending or ascending triangle, in place of a

rectangular trading range at a top or bottom. And fairly

often the market forms a mid-point consolidation, easily

mistaken for a Stage 3 Top, at roughly half-way through

Stage 2.

|

A Stage 1 bottom is likely to have the following

characteristics:

-

price has moved sideways for an extended

time period;

-

moving averages whipsaw as price is

ranging;

-

volatility and volume decline;

-

Directional Movement is low;

-

Price will make a new 3-month or 6-month

high at the breakout.

If we want to trade pull-backs, where the stock

has broken out of its base and then pulls back to test the new

support level, we will have to follow the stock from its initial

breakout.

-

The most important screen will be the %

Of Price High: insert 100 as the 3-month or

6-month minimum.

Now this will identify all stocks making

new highs, not just those breaking out from a base; so how do we

narrow the search?

-

First we eliminate all dormant or illiquid

stocks by adding a Volume Filter:

20-day Volume MA; minimum value 1000 (or 10000 depending on

what stocks you wish to trade).

-

You could select an index such as the All

Ordinaries or ASX 300 instead of the Volume Filter.

-

Next, eliminate stocks already in strong

trending moves:

enter 20 as the Maximum % Move for 3, 6 and 12

months.

This screen will not be entirely accurate,

returning some stocks in mid-point consolidations and others that

have completed a secondary reaction. But at least you will only

need to scan 10 or so stocks, for signs of a breakout, rather

than the entire market.

An alternative is to screen for Directional Movement - I will

cover that tomorrow.

To screen for stocks that may be approaching a

stage 1 breakout (rather than stocks that have completed a

breakout), repeat the above screen but use 96 or 98

as the % Of Price High.

About

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search the

archives.

Colin Twiggs

There are two classes of people who tell what

is going to happen in the future:

Those who don't know, and those who don't know they don't

know.

~ John Kenneth Galbraith.

Back

Issues

Access the Trading Diary Archives.