A Quick Survey

|

We have received about 300 responses so

far. I will evaluate the survey results over the

weekend. If you have not yet completed the survey, please assist us by replying to this email and answering the questions below. Highlight answers in red or with an asterisk*.

Thanks for all your comments and suggestions. Colin Twiggs |

Trading Diary

February 12, 2004

These extracts from my daily trading diary are for educational

purposes and should not be interpreted as investment advice. Full

terms and conditions can be found at Terms

of Use .

USA

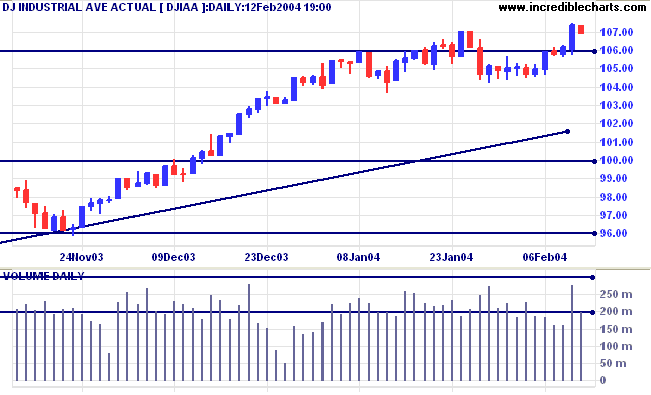

The Dow Industrial Average consolidated, with a narrow range and

low volume, after the strong gains of the previous day.

The intermediate trend is up.

The primary trend is up. A fall below support at 9600 will signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below support at 9600 will signal reversal.

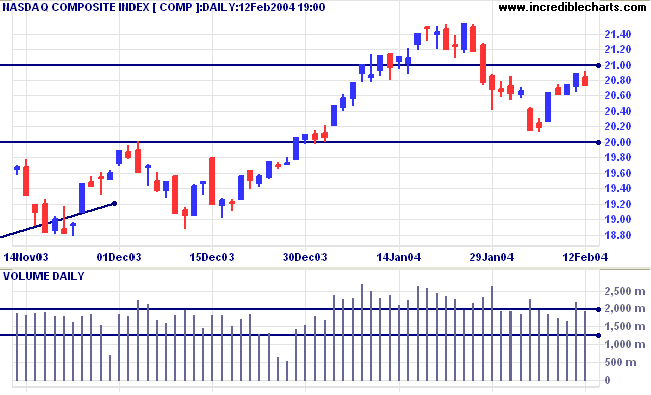

The Nasdaq Composite showed more hesitancy, retracing most of the

previous day's gains on reasonable volume.

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 1640 will signal reversal.

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 1640 will signal reversal.

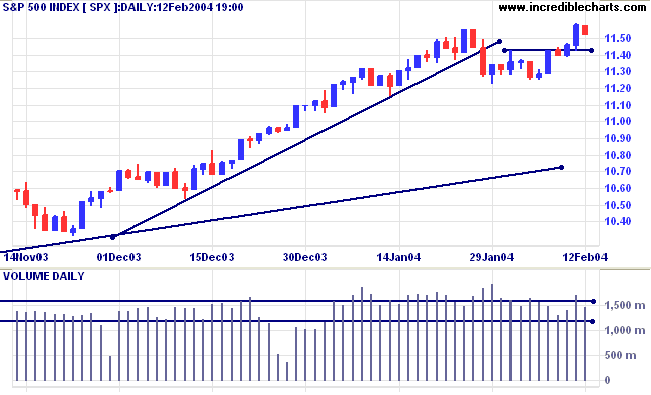

The S&P 500 formed an inside day, retracing about half of the

previous day's strong gains.

The intermediate trend is up. The next resistance level is at 1175. A fall below the recent low of 1122 would be bearish.

The intermediate trend is up. The next resistance level is at 1175. A fall below the recent low of 1122 would be bearish.

The primary trend is up. A fall below 960 will signal

reversal.

Intermediate: Bullish above 1122.

Long-term: Bullish above 1000.

Intermediate: Bullish above 1122.

Long-term: Bullish above 1000.

The Chartcraft NYSE Bullish % Indicator is up at

85.20%.

Jobless claims rise

New unemployment claims rose to 363,000 from 357,000 the previous week. (more)

New unemployment claims rose to 363,000 from 357,000 the previous week. (more)

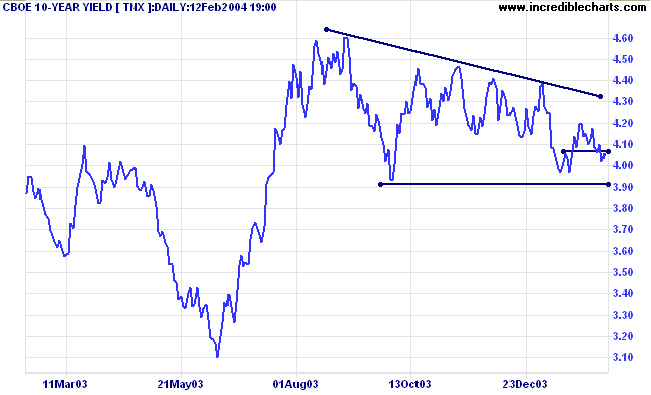

Treasury yields

The yield on 10-year treasury notes retraced about half the previous day's fall, closing at 4.058%.

The intermediate trend is down.

The primary trend is up. A close below 3.93% will signal reversal.

The yield on 10-year treasury notes retraced about half the previous day's fall, closing at 4.058%.

The intermediate trend is down.

The primary trend is up. A close below 3.93% will signal reversal.

Gold

New York (16.43): Spot gold rallied to $412.60.

The intermediate trend is uncertain. We may still see another test of support at 400.

The primary trend is up.

New York (16.43): Spot gold rallied to $412.60.

The intermediate trend is uncertain. We may still see another test of support at 400.

The primary trend is up.

ASX Australia

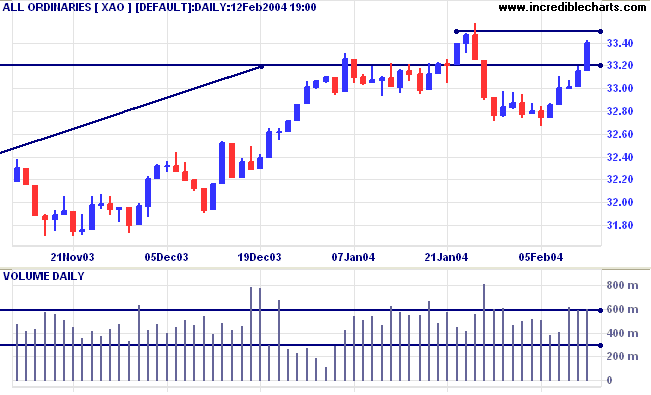

The All Ordinaries broke through resistance at 3320, with a

strong close at 3340. Large volume signals commitment from

buyers.

The intermediate trend is uncertain. A rise above resistance at 3350 would be bullish; as would a retracement that respects the 3320 support level. A fall below 3266 would signal the start of a down-trend.

The intermediate trend is uncertain. A rise above resistance at 3350 would be bullish; as would a retracement that respects the 3320 support level. A fall below 3266 would signal the start of a down-trend.

Twiggs Money Flow (100) has risen above its 3-month support

level.

The primary trend is up. A fall below 3160 (the October 1 low) would signal reversal.

Intermediate term: Bullish above 3350. Bearish below 3160.

Long-term: Bearish below 3160.

The primary trend is up. A fall below 3160 (the October 1 low) would signal reversal.

Intermediate term: Bullish above 3350. Bearish below 3160.

Long-term: Bearish below 3160.

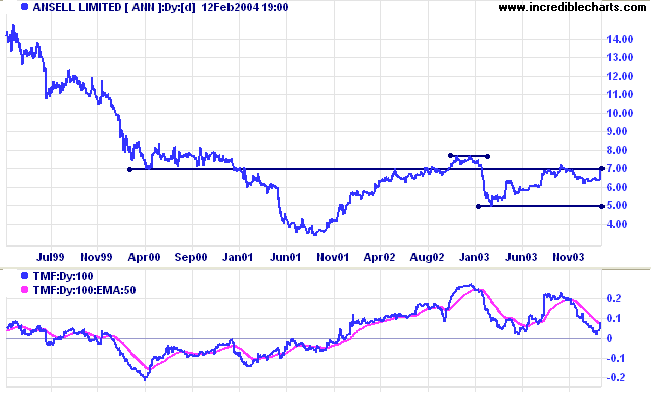

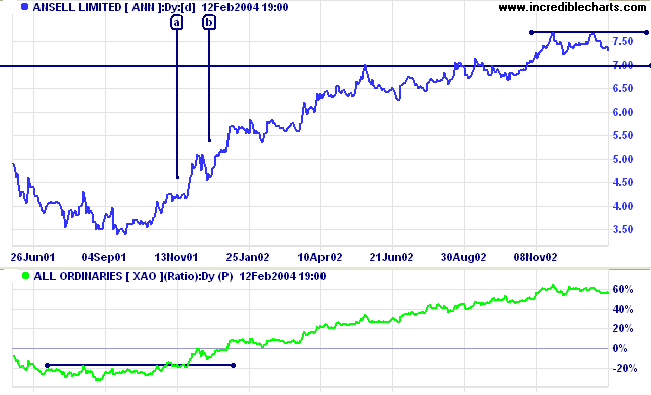

Ansell [ANN]

ANN has been trending upwards since testing support at 5.00 in early 2003. Twiggs Money Flow has again turned up above zero, signaling accumulation, while price is now approaching resistance at 7.00.

ANN has been trending upwards since testing support at 5.00 in early 2003. Twiggs Money Flow has again turned up above zero, signaling accumulation, while price is now approaching resistance at 7.00.

Relative Strength (price ratio: xao) has penetrated the first

resistance level at -15%.

It is still too early for the RS signal to be reliable. If we

look at the earlier trough in 2001, we can see two RS entry

signals at [a] and [b]. The first signal occurred when RS rose

above the resistance level at [a] before consolidating at this

level, without significant penetration below the line. The second

signal is far clearer, with RS retracement well above the new

support level. Watch for a dry up of volume and volatility on the

pull-back; these signal that selling pressure is easing.

Both of the above signals occurred with Twiggs Money Flow above its signal line, a further bullish sign.

Both of the above signals occurred with Twiggs Money Flow above its signal line, a further bullish sign.

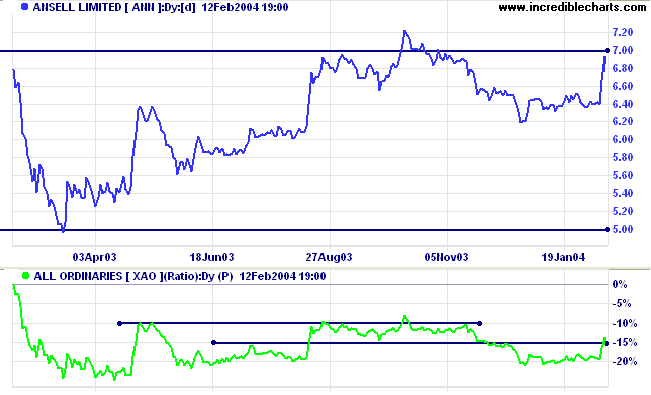

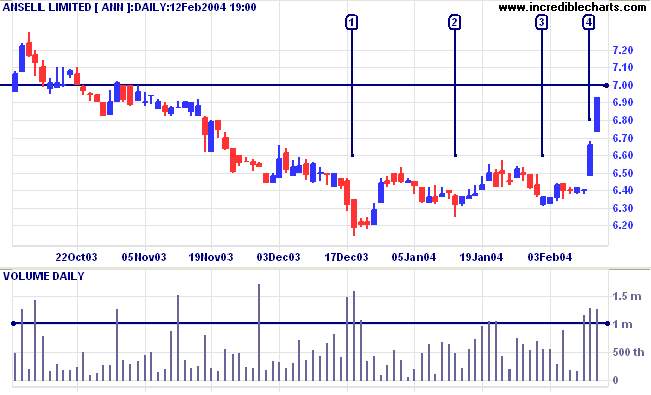

Back to the present with the daily volume chart.

We can see a healthy shake-out at [1] with strong downward bars and big volume. A trick I learned from Bill McLaren is to draw an arbitrary line on the volume chart to separate large volume from regular volume - it helps one focus on unusual activity. Note the lower volume on the lows at [2] and [3], signaling fading selling pressure, and the real dry-up in volume and volatility before the gap up at [4]. Strong upward bars, gaps and large volume at [4] signals buyers "climbing over each other to get in". Be careful, this kind of activity can exhaust buyers energy and is often observed in blow-off spikes. Expect a pull-back or consolidation at resistance at 7.00.

We can see a healthy shake-out at [1] with strong downward bars and big volume. A trick I learned from Bill McLaren is to draw an arbitrary line on the volume chart to separate large volume from regular volume - it helps one focus on unusual activity. Note the lower volume on the lows at [2] and [3], signaling fading selling pressure, and the real dry-up in volume and volatility before the gap up at [4]. Strong upward bars, gaps and large volume at [4] signals buyers "climbing over each other to get in". Be careful, this kind of activity can exhaust buyers energy and is often observed in blow-off spikes. Expect a pull-back or consolidation at resistance at 7.00.

About

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search the

archives.

Colin Twiggs

Efficiency is doing a thing right - effective is doing the right

thing.

~ Peter Drucker.

~ Peter Drucker.

Price Ratio: Relative Strength

Some members have difficulty setting up RS for stocks.

(1) Open Price Ratio in the Indicator Panel (after opening any stock chart);

(2) Select either the All Ords or ASX 200 index for comparison;

(3) Select Daily and Project in the center panel;

(4) Save [>] your settings.

Some members have difficulty setting up RS for stocks.

(1) Open Price Ratio in the Indicator Panel (after opening any stock chart);

(2) Select either the All Ords or ASX 200 index for comparison;

(3) Select Daily and Project in the center panel;

(4) Save [>] your settings.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.