Live Update: Internet Explorer 6

| Some members have reported that earlier versions of Internet Explorer interfere with the Live Update. If you experience a timeout error during the Live Update, update to Internet Explorer 6 at Microsoft Download. |

Trading Diary

January 26, 2004

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use .

USA

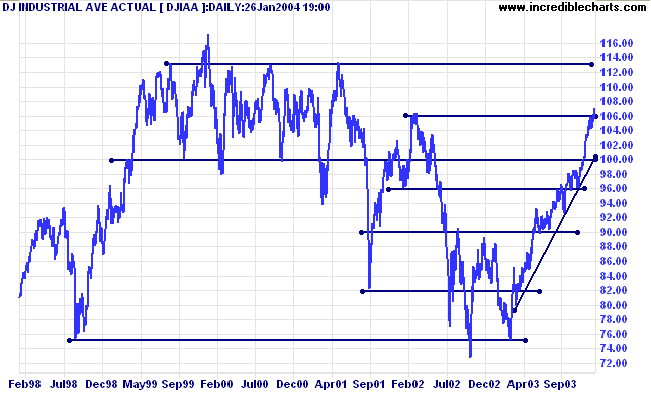

The Dow Industrial Average rallied strongly to close at 10702,

breaking through resistance. Lower volume signals buyer wariness

and there may be a pull-back within the next few days, to test

the new 10600 support level. If successful, we are likely to see

a rally to resistance at 11350.

Twiggs Money Flow (100) continues to signal strong accumulation.

The primary trend is up. A fall below support at 9600 would signal reversal.

Twiggs Money Flow (100) continues to signal strong accumulation.

The primary trend is up. A fall below support at 9600 would signal reversal.

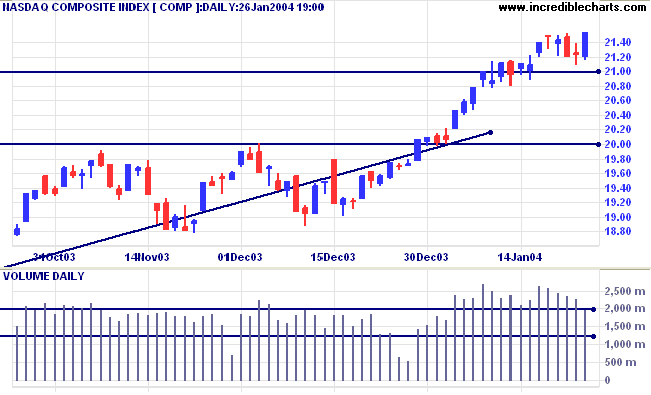

The Nasdaq Composite rallied above support at 2100, closing at

2153. Lower volume signals buyer wariness.

The intermediate trend is up. Momentum is increasing, with little or no overlap between troughs and previous peaks.

Twiggs Money Flow (100) continues to signal strong accumulation.

The primary trend is up. A fall below support at 1640 would signal reversal.

The intermediate trend is up. Momentum is increasing, with little or no overlap between troughs and previous peaks.

Twiggs Money Flow (100) continues to signal strong accumulation.

The primary trend is up. A fall below support at 1640 would signal reversal.

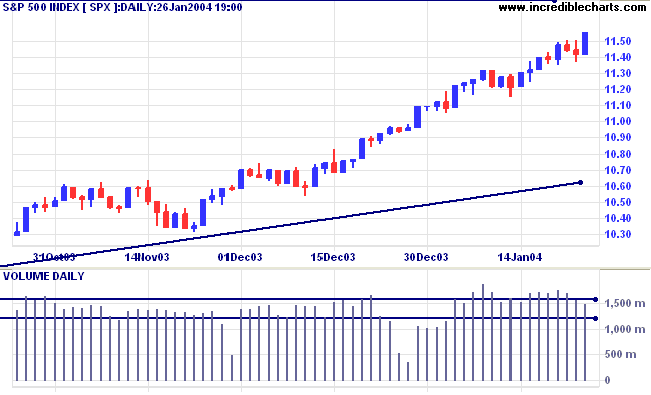

The S&P 500 rallied to close up 14 points at 1155. Lower

volume signals buyer wariness.

The intermediate trend is up, with resistance overhead at 1175.

Short-term: Bullish if the S&P500 is above 1150.

The intermediate trend is up, with resistance overhead at 1175.

Short-term: Bullish if the S&P500 is above 1150.

The primary trend is up. A fall below 960 will signal

reversal.

Intermediate: Bullish above 1136 (from January 23).

Long-term: Bullish above 1000.

Intermediate: Bullish above 1136 (from January 23).

Long-term: Bullish above 1000.

The Chartcraft NYSE Bullish % Indicator is almost

unchanged at 86.24%.

Fed unlikely to move

The Federal Reserve Board is expected to leave rates unchanged at this week's meeting. (more)

The Federal Reserve Board is expected to leave rates unchanged at this week's meeting. (more)

Treasury yields

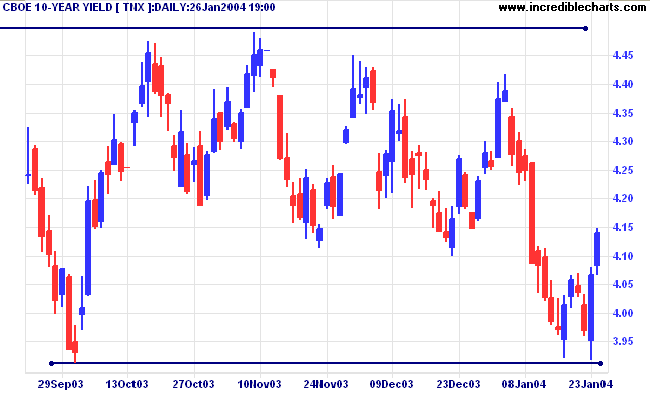

The yield on 10-year treasury notes followed through to close at 4.14%, completing a double bottom reversal. A re-test of resistance at 4.4% to 4.5% is likely.

The primary trend is up. A close below the September low of 3.93% would signal a reversal.

The yield on 10-year treasury notes followed through to close at 4.14%, completing a double bottom reversal. A re-test of resistance at 4.4% to 4.5% is likely.

The primary trend is up. A close below the September low of 3.93% would signal a reversal.

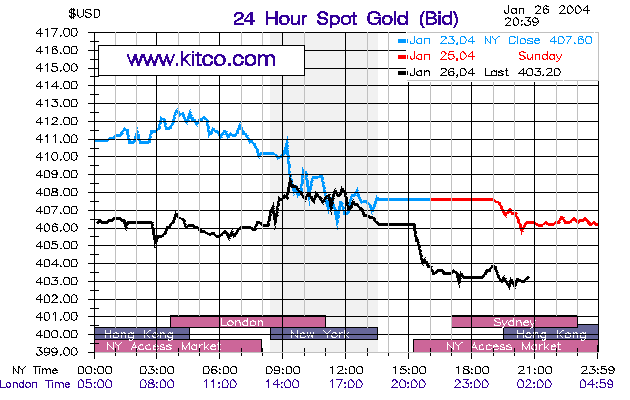

Gold

New York (20.39): Spot gold fell to $403.20.

The intermediate trend has reversed downwards and is likely to test support at 400.

The primary trend is up.

New York (20.39): Spot gold fell to $403.20.

The intermediate trend has reversed downwards and is likely to test support at 400.

The primary trend is up.

About

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search the

archives.

Colin Twiggs

Errors using inadequate data are much less

than those using no data at all.

~ Charles Babbage, English mathematician (1792 - 1871).

than those using no data at all.

~ Charles Babbage, English mathematician (1792 - 1871).

Incredible Posts: Suggestions

We would like to add more 5-star posts to the

Incredible Posts thread.

If you have any suggestions, please post the links

at

the

Suggestion box.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.