Live Update: Incredible Charts version 4.0.2.900

|

The latest version of Incredible Charts is now available.

Your version should automatically update when you login to

the server. Check under Help >> About to

confirm that you have received the update. If you experience a timeout error, download the latest version and install over your present version. This will not affect your watchlists and indicator settings. See What's New for further details. |

Trading Diary

January 21, 2004

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use .

USA

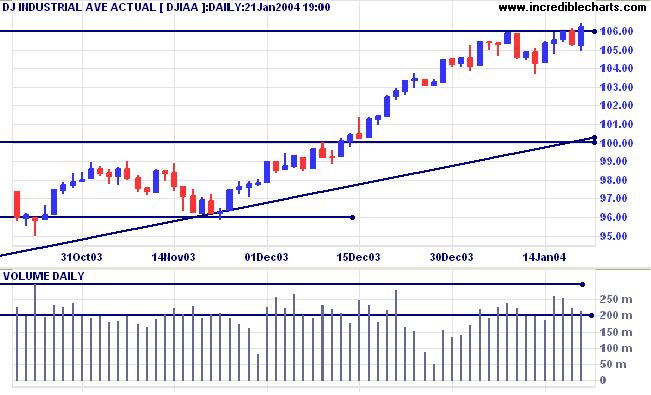

The Dow Industrial Average rallied to form a

key

reversal, closing above resistance at 10623. Lower volume

signals a lack of enthusiasm from buyers.

The intermediate trend is up.

The primary trend is up. A fall below support at 9600 will signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below support at 9600 will signal reversal.

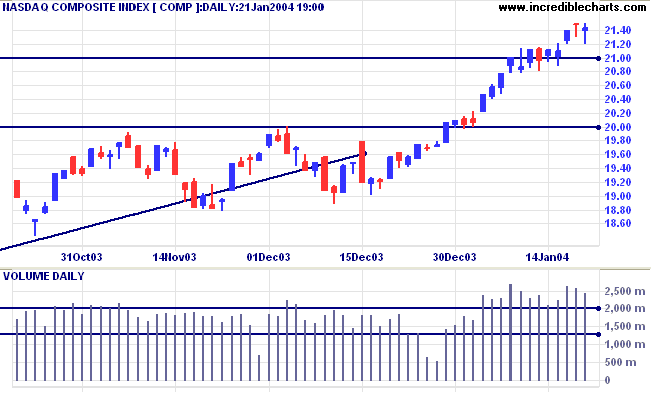

The Nasdaq Composite closed down at 2142. Buying

support is evident from the long tail and strong

volume.

The intermediate trend is up.

The primary trend is up. A fall below support at 1640 will signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below support at 1640 will signal reversal.

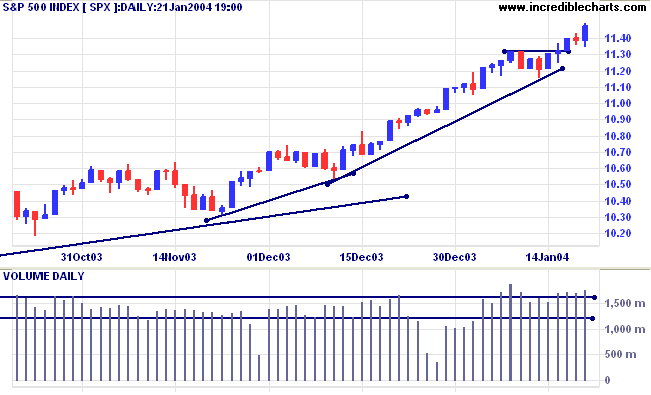

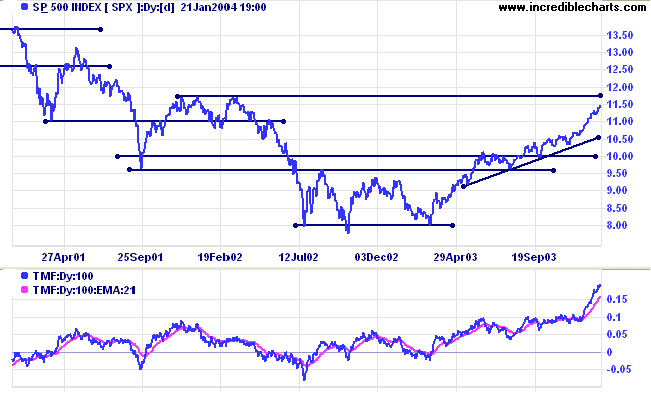

The S&P 500 followed through after

yesterday's doji, closing up 9 points at 1147 on strong

volume.

The intermediate trend is up.

Short-term: Bullish if the S&P500 is above 1140 (Friday's high). Bearish below 1115 (last Tuesday's low).

The intermediate trend is up.

Short-term: Bullish if the S&P500 is above 1140 (Friday's high). Bearish below 1115 (last Tuesday's low).

The next resistance level is at 1175, the highs

of late 2001 to early 2002.

The primary trend is up. A fall below 960 will signal reversal (on reflection, 1000 is significant, but not a primary support level).

Intermediate: Bullish above 1115 (last Tuesday's low).

Long-term: Bullish above 1000.

The primary trend is up. A fall below 960 will signal reversal (on reflection, 1000 is significant, but not a primary support level).

Intermediate: Bullish above 1115 (last Tuesday's low).

Long-term: Bullish above 1000.

The Chartcraft NYSE Bullish % Indicator climbed

to 85.81% (January 21).

Treasury yields

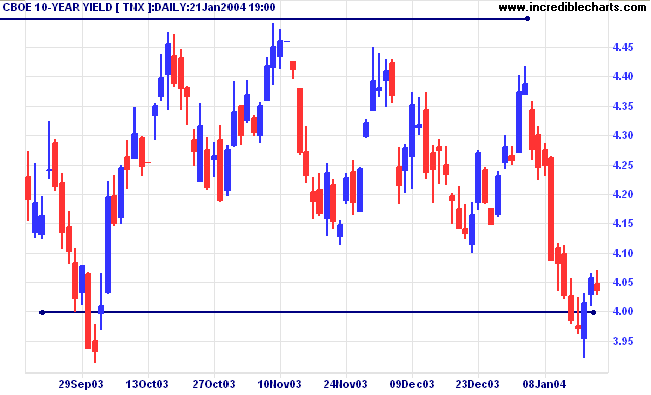

The yield on 10-year treasury notes stalled, forming an inside day with a close at 4.03%. This is a bearish sign: a 2-day correction would signal a fast down-trend.

The intermediate trend is down.

The primary trend is up. A close below 3.93% will signal reversal.

The yield on 10-year treasury notes stalled, forming an inside day with a close at 4.03%. This is a bearish sign: a 2-day correction would signal a fast down-trend.

The intermediate trend is down.

The primary trend is up. A close below 3.93% will signal reversal.

Gold

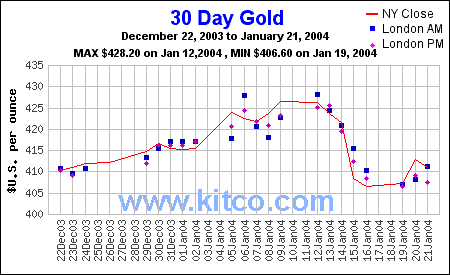

New York (22.56): Spot gold eased to $410.20.

The intermediate trend is up, but a fall to 405 would signal reversal.

The primary trend is up.

New York (22.56): Spot gold eased to $410.20.

The intermediate trend is up, but a fall to 405 would signal reversal.

The primary trend is up.

ASX Australia

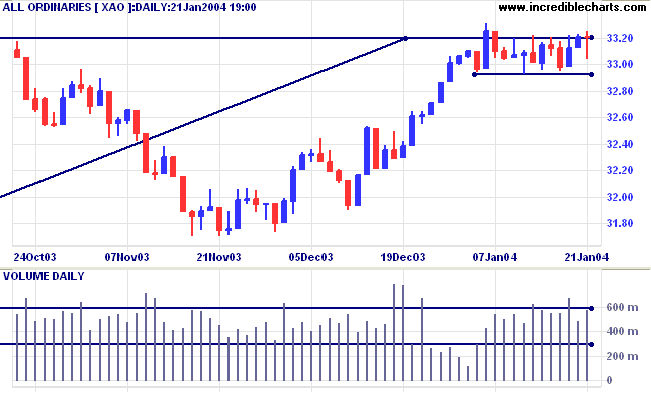

The All Ordinaries continues to consolidate between 3320 and

3293. Sellers drove the index back into the consolidation range

before buying support lifted the close to 3320.7, almost

unchanged from yesterday. A follow-through above 3320, will be a

bull signal. A break below support at 3293 would be bearish,

signaling a likely re-test of support at 3160.

Short-term: Bullish above 3320. Bearish below 3293.

Short-term: Bullish above 3320. Bearish below 3293.

With the long-term cycle, a break above 3320 will signal a likely

re-test of the previous highs at 3425 and 3440.

The primary trend is up but will reverse if there is a fall below 3160.

Twiggs Money Flow (100) has leveled out but is still bearish after a large divergence.

Intermediate term: Bullish above 3320. Bearish below 3160.

Long-term: Bearish below 3160.

The primary trend is up but will reverse if there is a fall below 3160.

Twiggs Money Flow (100) has leveled out but is still bearish after a large divergence.

Intermediate term: Bullish above 3320. Bearish below 3160.

Long-term: Bearish below 3160.

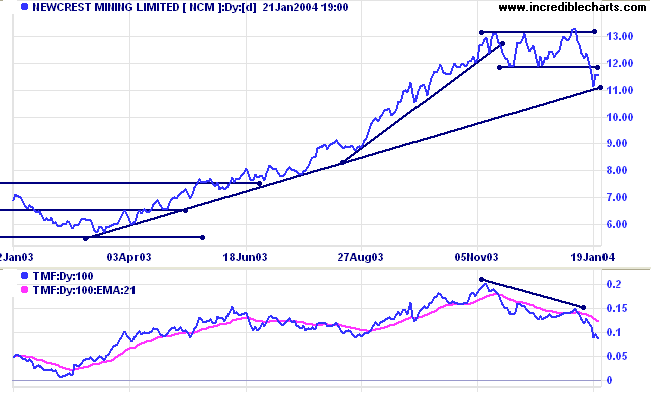

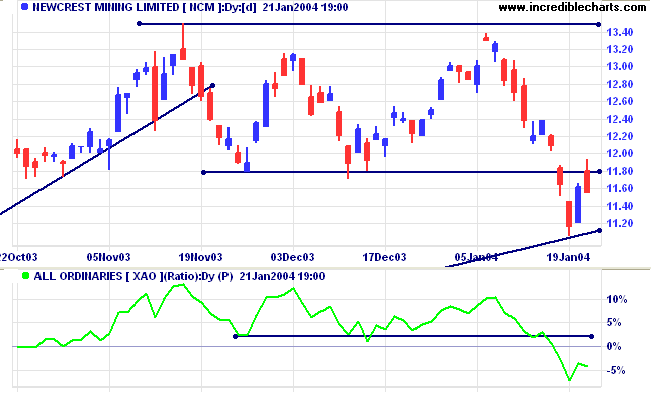

Newcrest Mining [NCM]

Last covered September 24, 2003.

NCM broke below support from the recent consolidation, testing the primary supporting trendline.

Twiggs Money Flow (100) displays a bearish divergence.

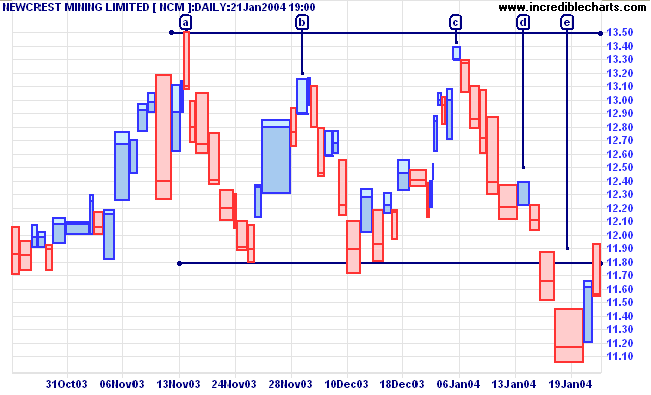

Last covered September 24, 2003.

NCM broke below support from the recent consolidation, testing the primary supporting trendline.

Twiggs Money Flow (100) displays a bearish divergence.

Relative Strength (price ratio: xao) is falling, signaling a

potential trend reversal.

Equivolume displays two failed attempts to make a new high, at

[b] and [c]; a bearish sign. The short correction at [d] signals

a fast downward trend. Heavy volume indicates that price

encountered some support at the long-term trendline, at [e]. The latest bar is a

closing price reversal, signaling continuation of the

down-trend.

A fall below the low of [e] would be a strong bear signal. A close below the long-term trendline would add further confirmation.

A (low probability) rally above 13.50 would be a bull signal.

A fall below the low of [e] would be a strong bear signal. A close below the long-term trendline would add further confirmation.

A (low probability) rally above 13.50 would be a bull signal.

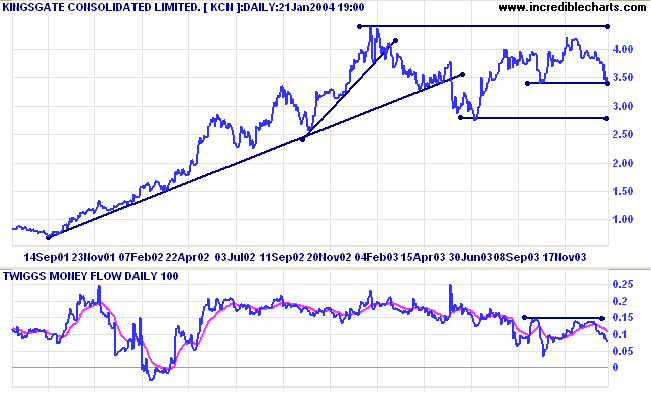

Kingsgate Consolidated [KCN]

Last covered September 23, 2003.

KCN is also testing an important support level at 3.40, with a target of 2.80 if there is a downward breakout.

Last covered September 23, 2003.

KCN is also testing an important support level at 3.40, with a target of 2.80 if there is a downward breakout.

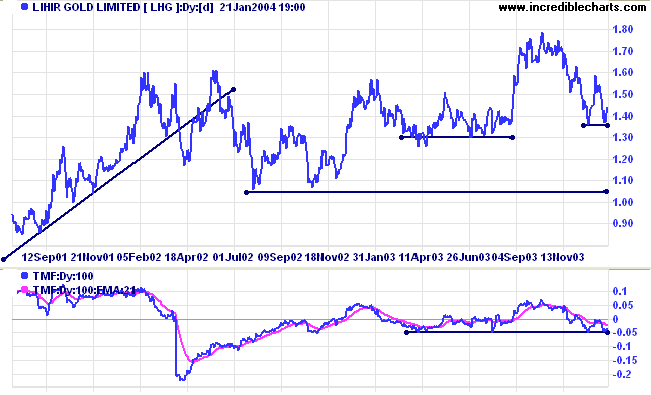

Lihir Gold [LHG]

Last covered November 13, 2003.

LHG faces a likely target of 1.10 if price breaks below 1.35.

Last covered November 13, 2003.

LHG faces a likely target of 1.10 if price breaks below 1.35.

About

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search the

archives.

Colin Twiggs

There is a

time for all things and I didn't know it.

And that is precisely what beats so many men in Wall Street

who are very far from being in the main sucker class.

There is the plain fool, who does the wrong thing at all times everywhere,

but there is the Wall Street fool, who thinks he must trade all the time.

~ Edwin Lefevre: Reminiscences of a Stock Operator (1923).

And that is precisely what beats so many men in Wall Street

who are very far from being in the main sucker class.

There is the plain fool, who does the wrong thing at all times everywhere,

but there is the Wall Street fool, who thinks he must trade all the time.

~ Edwin Lefevre: Reminiscences of a Stock Operator (1923).

Incredible Posts: Suggestions

We would like to add more 5-star posts to the

Incredible Posts thread.

If you have any suggestions, please post the

links at

the

Suggestion box.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.