Our Latest Plans

|

We will appreciate feedback and suggestions on the Chart

Forum.

Trading Diary

January 7, 2004

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use .

USA

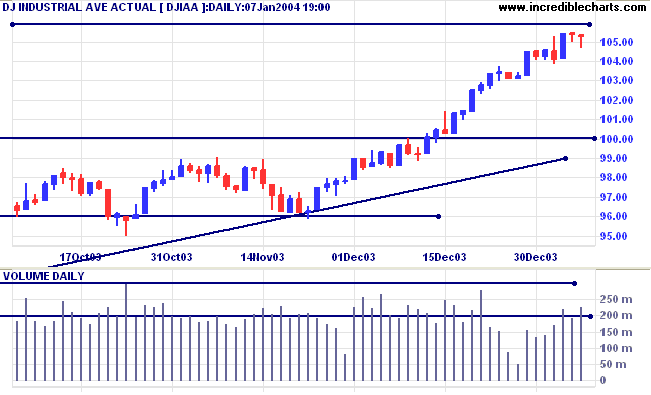

The Dow Industrial Average eased slightly,

closing at 10529. Buying support is still evident with a long

tail and higher volume.

The intermediate trend is up.

The primary trend is up. A fall below support at 9600 will signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below support at 9600 will signal reversal.

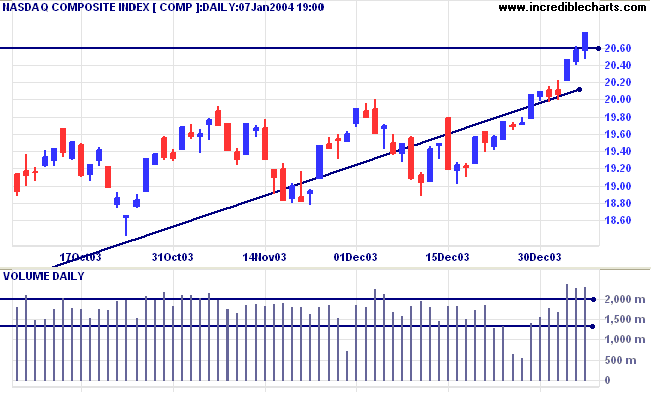

The Nasdaq Composite rallied 20 points to close

at 2077 on strong volume.

The intermediate trend is up. Resistance is at 2060 to 2100.

The primary trend is up. A fall below support at 1640 will signal reversal.

The intermediate trend is up. Resistance is at 2060 to 2100.

The primary trend is up. A fall below support at 1640 will signal reversal.

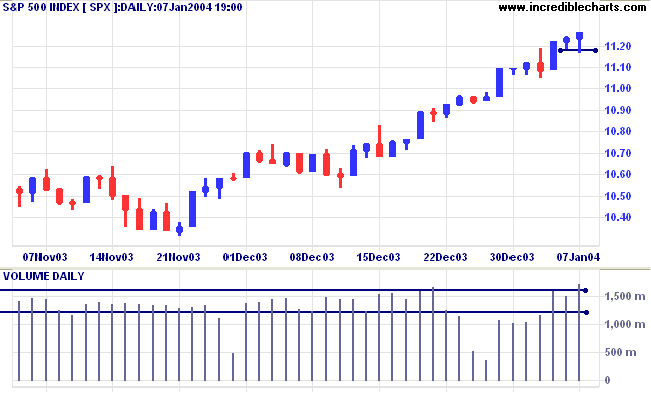

The S&P 500 made a false break below

yesterday's low before rallying to close strongly at 1126.

The intermediate trend is up. The next resistance level is at 1175.

Short-term: Bullish if the S&P500 is above 1124 (Tuesday's high). Bearish below 1118 (Tuesday's low).

The intermediate trend is up. The next resistance level is at 1175.

Short-term: Bullish if the S&P500 is above 1124 (Tuesday's high). Bearish below 1118 (Tuesday's low).

The primary trend is up. A fall below 960 will

signal reversal.

Intermediate: Bullish above 1124.

Long-term: Bullish above 960.

Intermediate: Bullish above 1124.

Long-term: Bullish above 960.

The Chartcraft NYSE Bullish % Indicator continues

to make new highs, reaching 85.26% (January 7).

Credit crunch?

Credit card delinquencies are at a record high of 4.09%. (more)

Credit card delinquencies are at a record high of 4.09%. (more)

Treasury yields

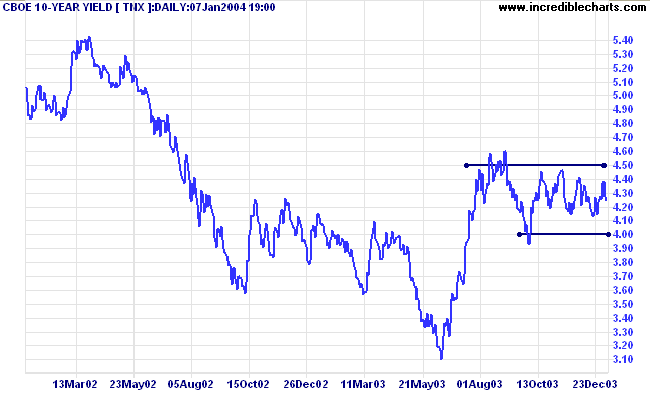

The yield on 10-year treasury notes slipped to 4.24%.

The intermediate trend is uncertain. Support is at 4.00% and resistance at 4.50%.

The primary trend is up.

The yield on 10-year treasury notes slipped to 4.24%.

The intermediate trend is uncertain. Support is at 4.00% and resistance at 4.50%.

The primary trend is up.

Gold

New York (23.37): Spot gold is almost unchanged at $420.20.

The intermediate trend is up.

The primary trend is up. Expect support at 415.

New York (23.37): Spot gold is almost unchanged at $420.20.

The intermediate trend is up.

The primary trend is up. Expect support at 415.

ASX Australia

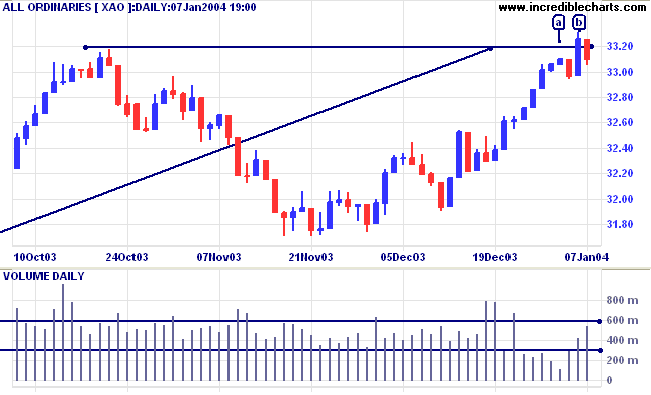

The All Ordinaries retreated to close at 3310 after yesterday's

marginal break above resistance [b]. The close half-way down

yesterday's strong up candle signals that the market is

uncomfortable with higher prices, confirmed by higher volume.

Short-term support is at 3310, the high of [a]. A fall below this

level will indicate a loss of momentum, but if price respects the

new support level, we may see a strong surge as institutional

buyers return from their holidays.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3)

is below.

Short-term: Bullish above today's high of 3325.

Short-term: Bullish above today's high of 3325.

The All Ords is below its long-term trendline, signaling

weakness. The primary trend is up but will reverse if there is a

fall below 3160 (the October 1 low). Twiggs Money Flow (100) has

leveled out but is still bearish after a large divergence.

Intermediate term: Bullish above 3325. Bearish below 3160.

Long-term: Bearish below 3160.

Intermediate term: Bullish above 3325. Bearish below 3160.

Long-term: Bearish below 3160.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search the

archives.

Colin Twiggs

Humility leads to strength and not to

weakness.

It is the highest form of self-respect

to admit mistakes and to make amends for them.

~ John (Jay) McCloy.

It is the highest form of self-respect

to admit mistakes and to make amends for them.

~ John (Jay) McCloy.

Individual Stocks

Back Issues

| Analysis of individual stocks will resume on Monday, January 12th. |

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.