Stock Screens: USA

US stocks and indexes are being added to the stock screen module

and should be available by next week.

US stocks and indexes are being added to the stock screen module

and should be available by next week.

Trading Diary

December 10, 2003

These extracts from my daily trading diary are

for educational purposes and should not be interpreted as

investment advice. Full terms and conditions can be found at

Terms

of Use .

USA

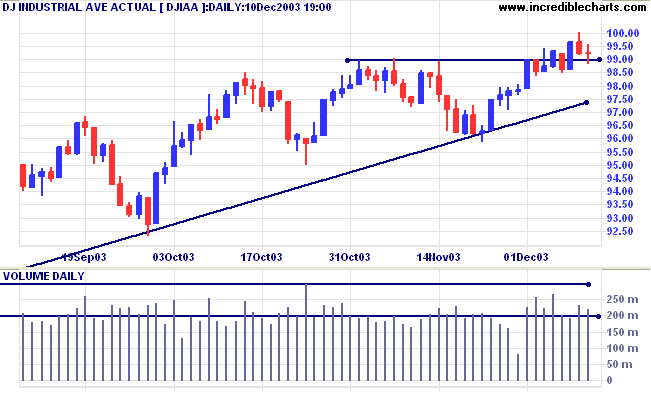

The Dow Industrial Average closed almost

unchanged at 9921, consolidating above the initial support band

of 9900/9850 on lower volume.

The intermediate trend is uncertain. Expect support at 9500 and 9600, resistance at 10000.

The primary trend is up. A fall below support at 9000 will signal reversal.

The intermediate trend is uncertain. Expect support at 9500 and 9600, resistance at 10000.

The primary trend is up. A fall below support at 9000 will signal reversal.

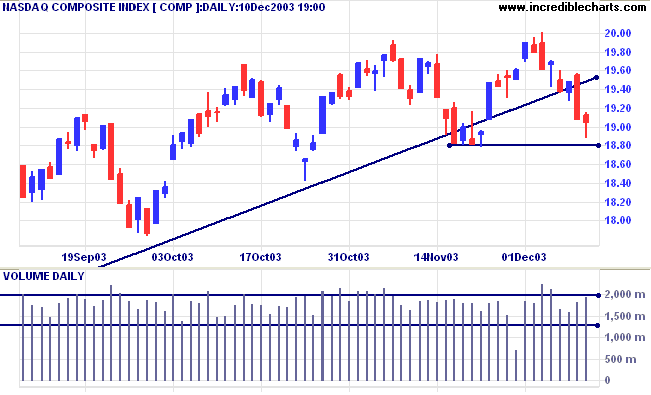

The Nasdaq Composite encountered some buying

support above 1880, closing at 1904 on higher volume.

The intermediate trend is uncertain. A fall below 1880 would complete a double top reversal, with a target of 1760: 1880-(2000-1880).

The primary trend is up. A fall below support at 1640 will signal reversal.

The intermediate trend is uncertain. A fall below 1880 would complete a double top reversal, with a target of 1760: 1880-(2000-1880).

The primary trend is up. A fall below support at 1640 will signal reversal.

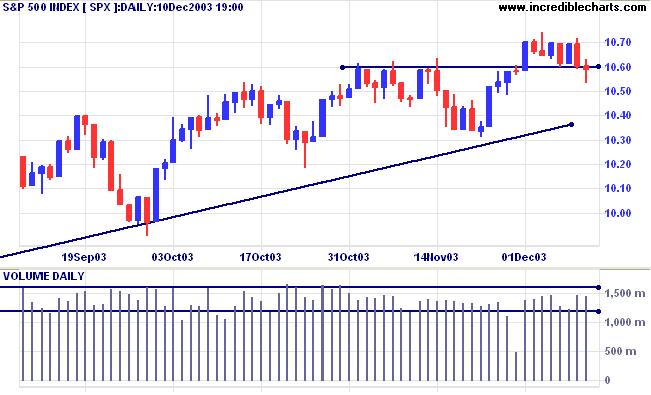

The S&P 500 closed 1 point lower at 1059 on

average volume. The weak close signals buying support at

1059/1060.

The intermediate trend is uncertain.

Short-term: Bullish if the S&P500 is above 1070. Bearish below 1053 (Today's low).

The intermediate trend is uncertain.

Short-term: Bullish if the S&P500 is above 1070. Bearish below 1053 (Today's low).

The primary trend is up. A fall below 960 will

signal reversal.

Intermediate: Bullish above 1070.

Long-term: Bullish above 960.

Intermediate: Bullish above 1070.

Long-term: Bullish above 960.

The Chartcraft NYSE Bullish % Indicator fell

sharply to 81.30% (December 10).

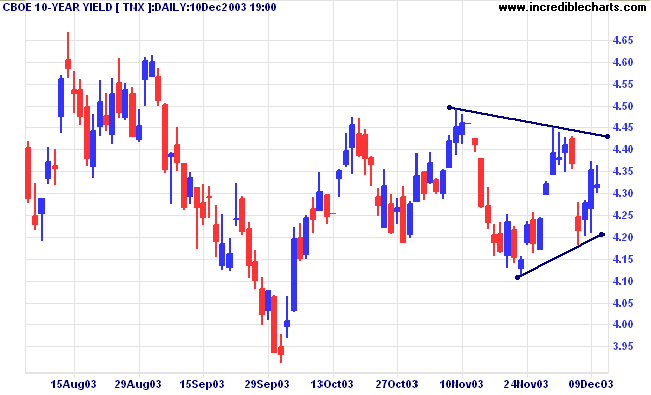

Treasury yields

The yield on 10-year treasury notes is consolidating, with an inside day closing at 4.31%.

The intermediate trend is down.

The primary trend is up.

The yield on 10-year treasury notes is consolidating, with an inside day closing at 4.31%.

The intermediate trend is down.

The primary trend is up.

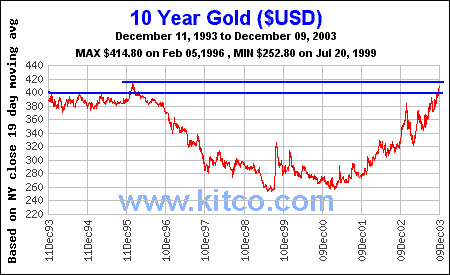

Gold

New York (22.03): Spot gold retreated to $404.70.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415.

New York (22.03): Spot gold retreated to $404.70.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415.

ASX Australia

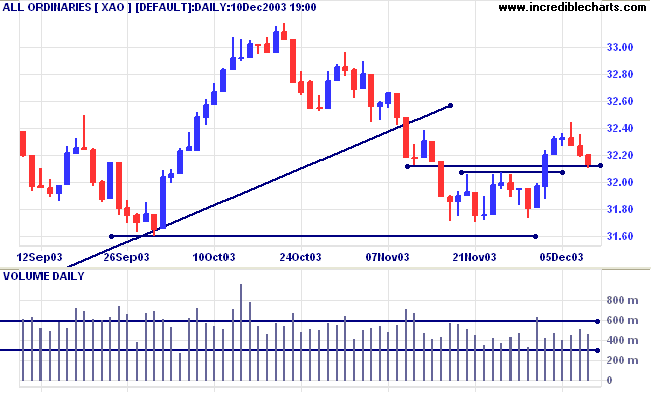

The All Ordinaries closed at the initial 3212

support level on lower volume.

The intermediate up-trend continues.

The intermediate up-trend continues.

MACD (26,12,9) is above its signal line; Slow

Stochastic (20,3,3) has crossed to below.

Short-term: Bullish above 3221, today's high. Bearish below 3173 (December 1st low).

Short-term: Bullish above 3221, today's high. Bearish below 3173 (December 1st low).

XAO is below the long-term trendline, signaling

weakness. The primary trend is up but will reverse if there is a

fall below 3160 (the October 1 low). Twiggs Money Flow (100) has

crossed below its signal line, signaling distribution, following

a large bearish triple

divergence.

Intermediate term: Bullish above 3221. Bearish below 3160.

Long-term: Bearish below 3160.

Intermediate term: Bullish above 3221. Bearish below 3160.

Long-term: Bearish below 3160.

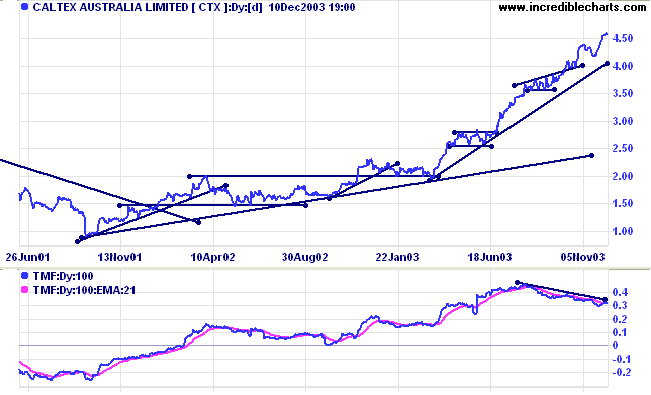

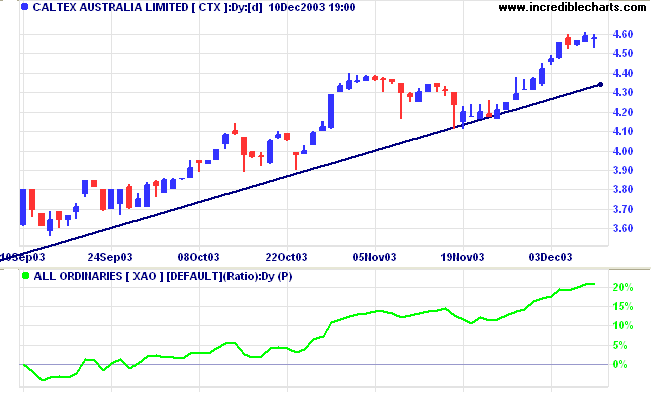

Caltex [CTX]

Last covered on September 11, 2003.

Caltex accelerated into a fast intermediate up-trend in April 2003, after an earlier creeping trend. Twiggs Money Flow (100) now displays a strong bearish divergence.

Last covered on September 11, 2003.

Caltex accelerated into a fast intermediate up-trend in April 2003, after an earlier creeping trend. Twiggs Money Flow (100) now displays a strong bearish divergence.

Price and Relative Strength (xao) continue to

rise.

Keep stops below the latest short-term trough, but switch to a tighter trailing % stop if the trend accelerates into a blow-off.

Keep stops below the latest short-term trough, but switch to a tighter trailing % stop if the trend accelerates into a blow-off.

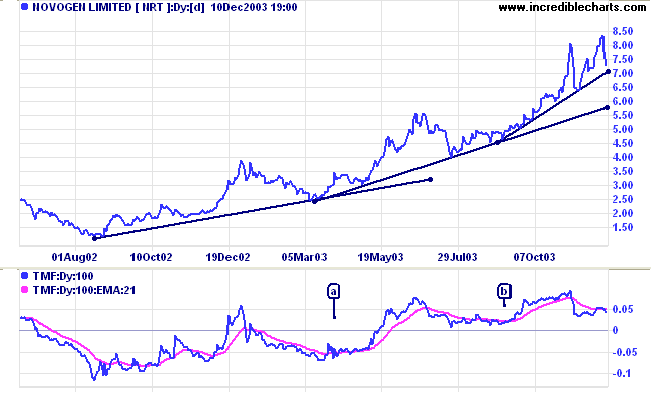

Novogen [NRT]

Last covered October 14, 2003.

Novogen provides a good example of a blow-off following an accelerating trend. The trend accelerates at each higher trough on Twiggs Money Flow (100), ending in a blow-off spike.

Last covered October 14, 2003.

Novogen provides a good example of a blow-off following an accelerating trend. The trend accelerates at each higher trough on Twiggs Money Flow (100), ending in a blow-off spike.

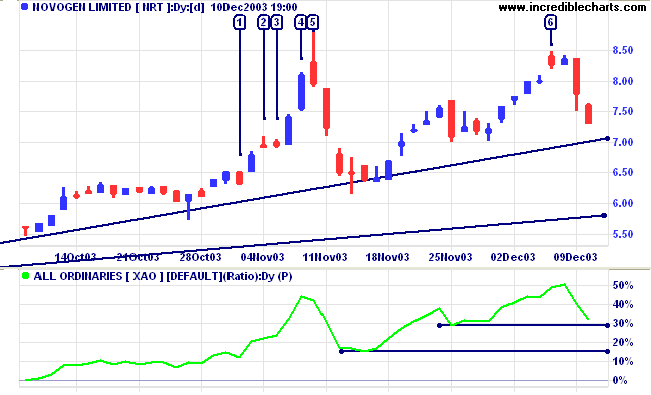

The up-trend moves into a blow-off, with

increased volatility; very short corrections/ consolidations, as

at [1] and [3]; and frequent gaps, as at [2] and [4]. There is a

strong reversal signal at [5]: a wide-ranging day with a very

weak close, below the previous day, and strong volume. This

is followed by a sharp correction back to the longer-term

trendline.

The subsequent attempt at [6] failed to make a new high; a bearish sign. A fall below support at 7.00, accompanied by a similar break of the RS support level, will strengthen the signal, while a fall below the November 13 low will complete a double top reversal.

The subsequent attempt at [6] failed to make a new high; a bearish sign. A fall below support at 7.00, accompanied by a similar break of the RS support level, will strengthen the signal, while a fall below the November 13 low will complete a double top reversal.

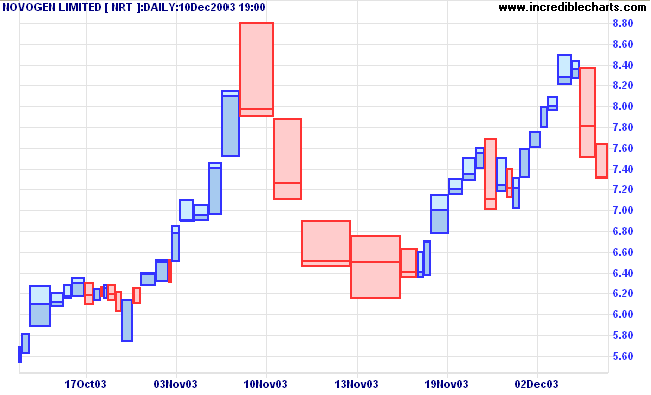

Equivolume highlights the heavy volume on the

correction.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including directions on how to search the

archives.

Colin Twiggs

Take kindly the counsel of the years,

gracefully surrendering the things of youth.

Nurture strength of spirit to shield you in sudden misfortune.

But do not distress yourself with dark imaginings.

Many fears are born of fatigue and loneliness.

~ Max Ehrmann: Desiderata (1927)

gracefully surrendering the things of youth.

Nurture strength of spirit to shield you in sudden misfortune.

But do not distress yourself with dark imaginings.

Many fears are born of fatigue and loneliness.

~ Max Ehrmann: Desiderata (1927)

Dilution

Adjustments

Where price history is adjusted for the effect of corporate actions.

Where price history is adjusted for the effect of corporate actions.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.