Incredible

Posts: Best of the Forum

A collection of the most highly-rated posts since the start of the Forum.

Thanks to Mosaic for coming up with the idea and providing the initial list

and to all the contributors.

A collection of the most highly-rated posts since the start of the Forum.

Thanks to Mosaic for coming up with the idea and providing the initial list

and to all the contributors.

Trading Diary

December 3, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

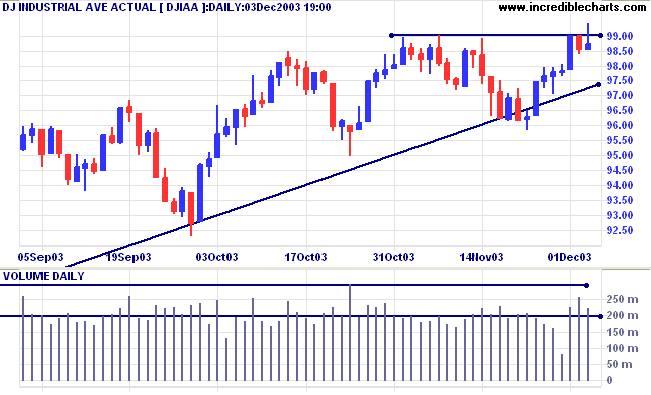

The Dow Industrial Average made a false break

above resistance at 9900 before closing back at 9873 on lower

volume.

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 9000 will signal reversal.

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 9000 will signal reversal.

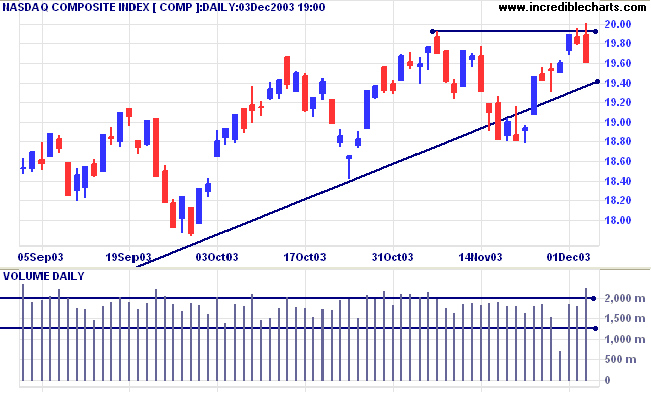

The Nasdaq Composite also made a false break

above resistance before retreating to close 20 points lower at

1960. Strong volume signals selling pressure.

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 1640 will signal reversal.

The intermediate trend is uncertain.

The primary trend is up. A fall below support at 1640 will signal reversal.

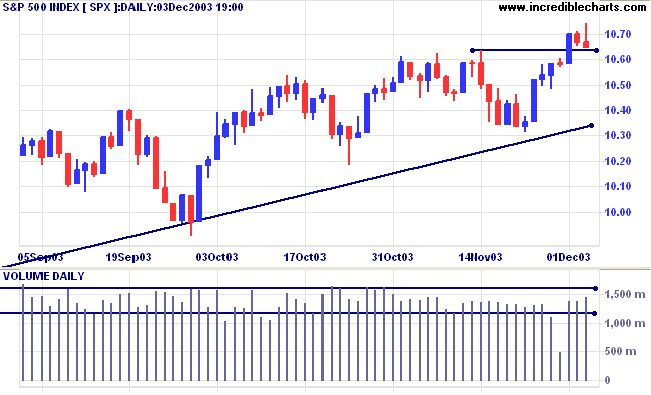

The S&P 500 held above support but the weak

close, at 1064, and higher volume signal selling pressure.

The intermediate trend is uncertain.

Short-term: Bullish if the S&P500 is above support at 1064. Bearish below 1031 (the November 21 low).

The intermediate trend is uncertain.

Short-term: Bullish if the S&P500 is above support at 1064. Bearish below 1031 (the November 21 low).

The primary trend is up. A fall below 960 will

signal reversal.

Intermediate: Bullish above 1064.

Long-term: Bullish above 960.

Intermediate: Bullish above 1064.

Long-term: Bullish above 960.

The Chartcraft NYSE Bullish % Indicator made a

new 10-year high at 82.14% (December 3).

Service slow

The Institute of Supply Management index of non-manufacturing activity fell to 60.1, from 64.7 in October. (more)

The Institute of Supply Management index of non-manufacturing activity fell to 60.1, from 64.7 in October. (more)

Treasury yields

The yield on 10-year treasury notes increased slightly to 4.41%.

The intermediate trend is down.

The primary trend is up.

The yield on 10-year treasury notes increased slightly to 4.41%.

The intermediate trend is down.

The primary trend is up.

Gold

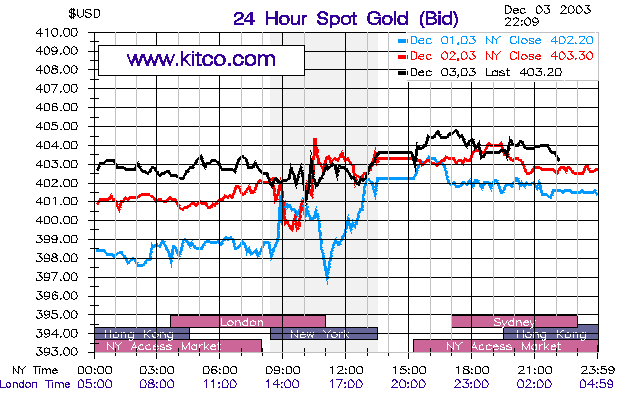

New York (22.09): Spot gold is at $403.20 after testing 405.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415.

New York (22.09): Spot gold is at $403.20 after testing 405.

The intermediate trend is up.

The primary trend is up. Expect support at 400, resistance at 415.

ASX Australia

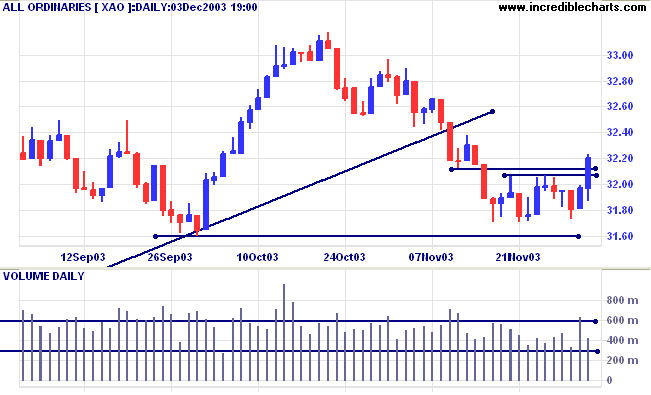

The All Ordinaries broke through resistance at 3207 to 3212,

closing at 3220. Lower volume signals possible weakness.

The intermediate trend has reversed up.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below.

Short-term: Bullish if the All Ords is above 3212, the November 12 low. Bearish below 3173 (Monday's low).

XAO is below its long-term trendline, signaling weakness. The primary trend is up but will reverse if there is a fall below 3160 (the October 1 low). Declining weekly volume increases the likelihood that support at 3160 will hold. Twiggs Money Flow (100) has crossed above its signal line.

Intermediate term: Bullish above 3212. Bearish below 3160.

Long-term: Bearish below 3160.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below.

Short-term: Bullish if the All Ords is above 3212, the November 12 low. Bearish below 3173 (Monday's low).

XAO is below its long-term trendline, signaling weakness. The primary trend is up but will reverse if there is a fall below 3160 (the October 1 low). Declining weekly volume increases the likelihood that support at 3160 will hold. Twiggs Money Flow (100) has crossed above its signal line.

Intermediate term: Bullish above 3212. Bearish below 3160.

Long-term: Bearish below 3160.

Challenger [CFG]

Last covered on September 10, 2003.

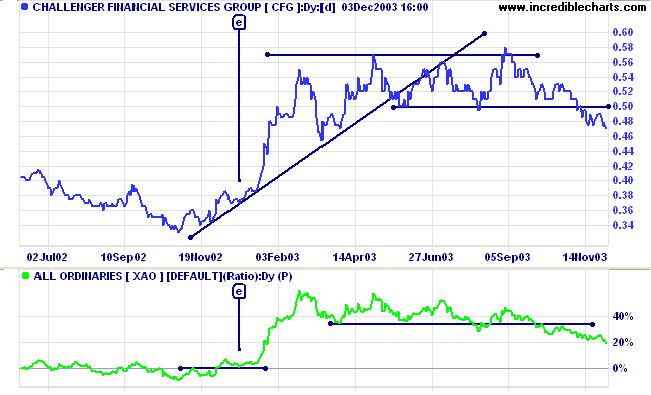

CFG formed a broad stage 3 top after a strong rally. Price then broke below support at 0.50, followed by a small consolidation pattern, a bearish sign. Relative Strength (xao) is falling, with a bearish peak below the previous RS support level.

Last covered on September 10, 2003.

CFG formed a broad stage 3 top after a strong rally. Price then broke below support at 0.50, followed by a small consolidation pattern, a bearish sign. Relative Strength (xao) is falling, with a bearish peak below the previous RS support level.

In recent months, I have changed the way that I use Relative

Strength. I used to look for new 3-month highs or lows, but now

look for setups where an RS trough respects an earlier peak (ie.

where resistance becomes support). The time frame may be as short

as 2 to 3 weeks. Compare [e] above to the RS chart on July 17. The new signals are earlier and far

more advantageous.

The hardest part is still the exit. You have to have a strong nerve to endure secondary corrections like the one in March 2003, back to the primary supporting trendline. I prefer to move stops up below successive troughs, switching to trailing stops if there is a price spike (blow-off) or a breach of the secondary trendline. This is where entry and exit are inter-related: an effective exit strategy has to (on average) get you out sufficiently above the next entry point (above the primary trendline) to cover your costs and justify the effort.

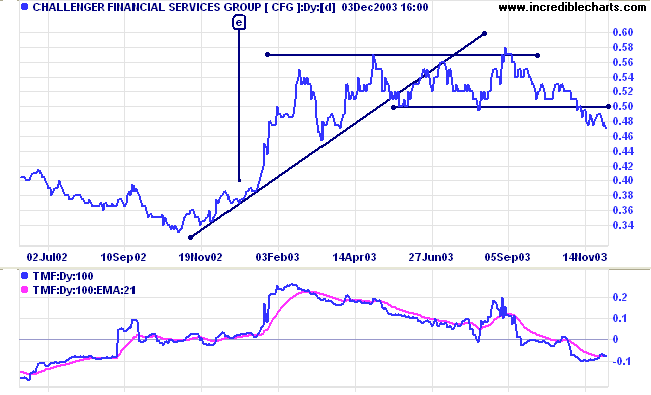

On the chart below, Twiggs Money Flow (100) is declining, signaling distribution.

The hardest part is still the exit. You have to have a strong nerve to endure secondary corrections like the one in March 2003, back to the primary supporting trendline. I prefer to move stops up below successive troughs, switching to trailing stops if there is a price spike (blow-off) or a breach of the secondary trendline. This is where entry and exit are inter-related: an effective exit strategy has to (on average) get you out sufficiently above the next entry point (above the primary trendline) to cover your costs and justify the effort.

On the chart below, Twiggs Money Flow (100) is declining, signaling distribution.

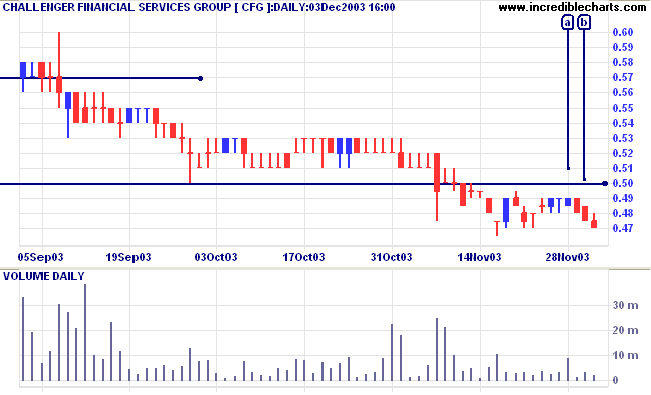

On the daily volume chart, the latest pull-back to the new 0.50

resistance level displays low volatility. Higher volume and a

narrow range show strong selling snuffed out the rally at [a].

The ideal short entry point is just below 0.48 at [b].

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

Of all the skills one needs to learn to be a

consistently successful trader,

learning to take profits is probably the most difficult to master.

~ Mark Douglas: Trading in the Zone.

learning to take profits is probably the most difficult to master.

~ Mark Douglas: Trading in the Zone.

US stocks

The complete NYSE, Nasdaq and Amex exchanges are on the new server.

We are adding some finishing touches before releasing the new version in the next day or two.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.