|

US stocks The existing hard disks on our server cannot cope with the enlarged database. Upgrade of the server may delay us by a day or two. |

Trading Diary

November 5, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

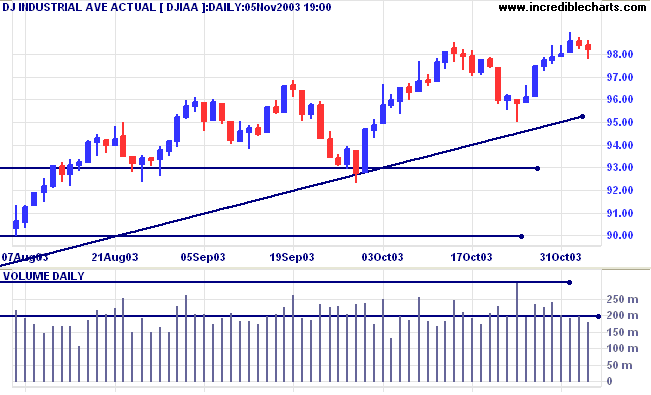

The Dow Industrial Average closed down slightly at 9821 on

encouragingly low volume.

The intermediate trend is up.

The primary trend is up. A fall below 9000 will signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below 9000 will signal reversal.

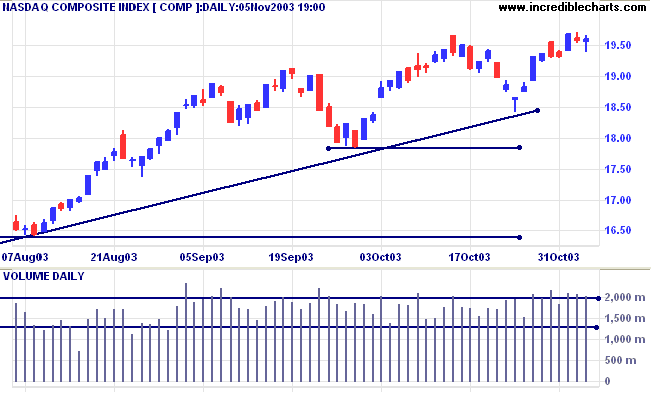

The Nasdaq Composite shows a tussle between buyers and sellers,

with a 1 point rise to 1959 on strong volume.

The intermediate trend is up.

The primary trend is up. A fall below 1640 will signal reversal. Expect resistance at 2000.

The intermediate trend is up.

The primary trend is up. A fall below 1640 will signal reversal. Expect resistance at 2000.

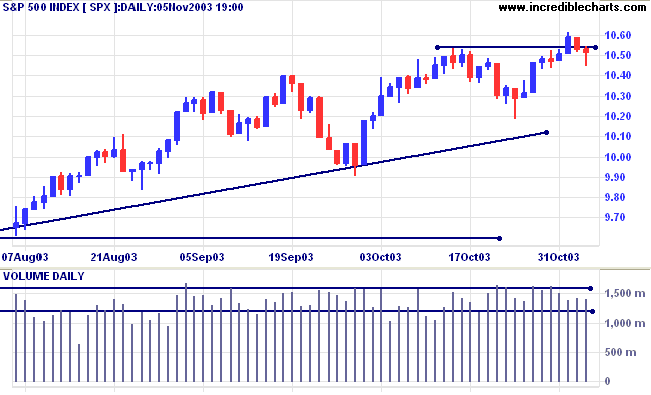

The S&P 500 closed 1 point lower at 1052 on average volume.

The weak close reflects buying support at 1050.

The intermediate trend is up.

The primary trend is up. A fall below 960 will signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below 960 will signal reversal.

The Chartcraft NYSE Bullish % Indicator recovered

to 81.54% (November 5).

Market Strategy

Short-term: Bullish if the S&P500 is above 1055.

Intermediate: Bullish above 1055.

Long-term: Bullish above 960.

Short-term: Bullish if the S&P500 is above 1055.

Intermediate: Bullish above 1055.

Long-term: Bullish above 960.

Cisco ahead

The internet equipment maker reported sales up 5.3% for the first quarter and earnings (excluding one-off charges) of 17 cents a share, 2 cents above analysts forecasts. (more)

The internet equipment maker reported sales up 5.3% for the first quarter and earnings (excluding one-off charges) of 17 cents a share, 2 cents above analysts forecasts. (more)

Treasury yields

The yield on 10-year treasury notes rallied to 4.35%.

The intermediate down-trend is weak.

The primary trend is up.

The yield on 10-year treasury notes rallied to 4.35%.

The intermediate down-trend is weak.

The primary trend is up.

Gold

New York (17.32): Spot gold recovered to $381.80.

The intermediate trend is up. Price has formed equal highs in the past 6 weeks; a fall below 370.00 will be a bear signal.

The primary trend is up. Expect resistance at 400 to 415.

New York (17.32): Spot gold recovered to $381.80.

The intermediate trend is up. Price has formed equal highs in the past 6 weeks; a fall below 370.00 will be a bear signal.

The primary trend is up. Expect resistance at 400 to 415.

ASX Australia

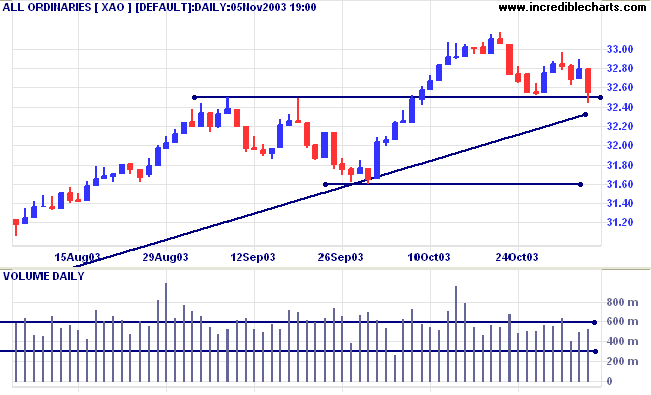

The All Ordinaries made a false break below 3250, before closing

24 points lower at 3256. Higher volume and a weak close signal

buying support at 3250.

The intermediate trend has turned down. There is a band of

support between 3238 and 3250.

The primary trend is up. The rally is extended and probability of a reversal increases with each successive primary trend movement. A fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

The primary trend is up. The rally is extended and probability of a reversal increases with each successive primary trend movement. A fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Market Strategy

Short-term: Bullish if the All Ords is above 3296. Bearish below 3238.

Intermediate: Bullish above 3296.

Long-term: Bullish above 3160.

Short-term: Bullish if the All Ords is above 3296. Bearish below 3238.

Intermediate: Bullish above 3296.

Long-term: Bullish above 3160.

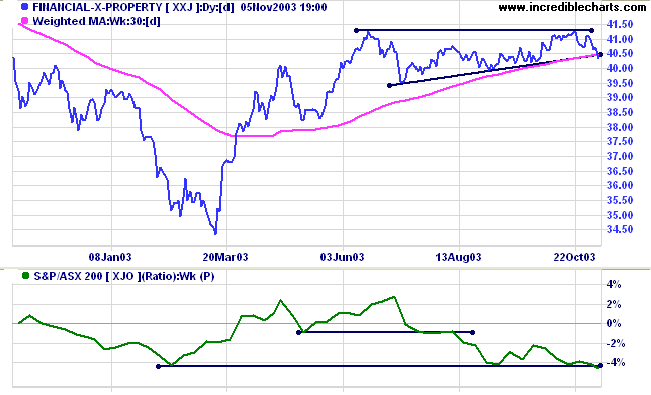

Banks

After the Reserve Bank raised interest rates by 0.25 per cent, which they have left rather late in my opinion, the banks are once again in the spotlight. The Financial-x-Property index [XXJ] is weakening and Relative Strength (xjo) has fallen to a new 12-month low.

After the Reserve Bank raised interest rates by 0.25 per cent, which they have left rather late in my opinion, the banks are once again in the spotlight. The Financial-x-Property index [XXJ] is weakening and Relative Strength (xjo) has fallen to a new 12-month low.

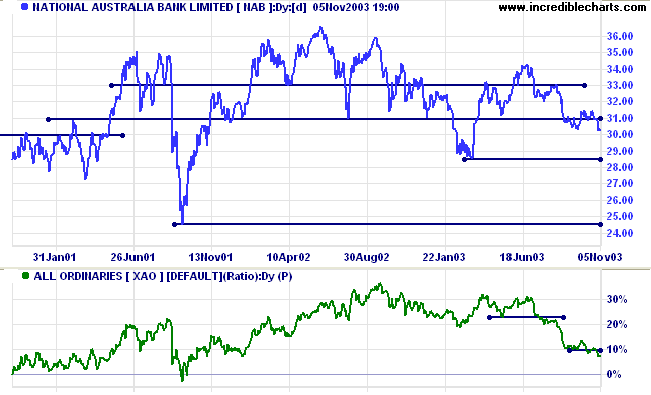

National Australia Bank [NAB]

Last covered on October 16, 2003.

NAB is in a primary down-trend, with falling Relative Strength (xao).

Last covered on October 16, 2003.

NAB is in a primary down-trend, with falling Relative Strength (xao).

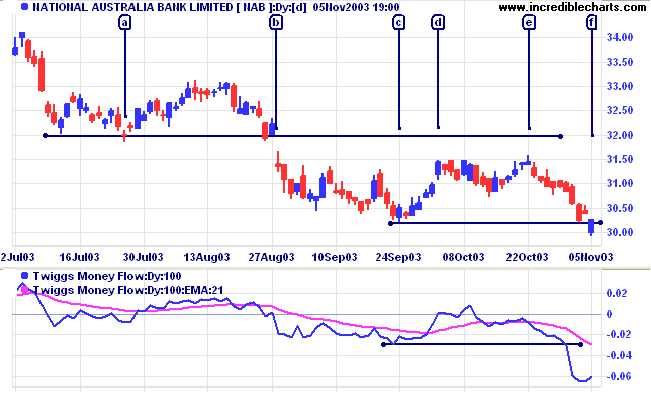

Price was unable to rally above initial resistance, formed at the

previous support level of 32.00. The large gap between the highs

of [d] and [e] and resistance at the low of [a] signals a strong

bear trend. Twiggs Money Flow (100) gave early warning of the

breakout at [f], with a sharp fall a few days before.

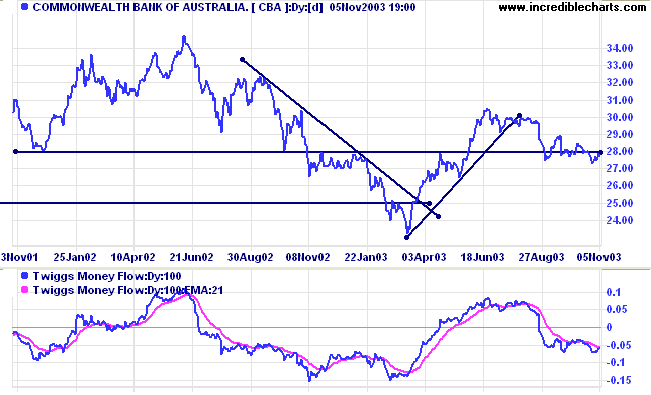

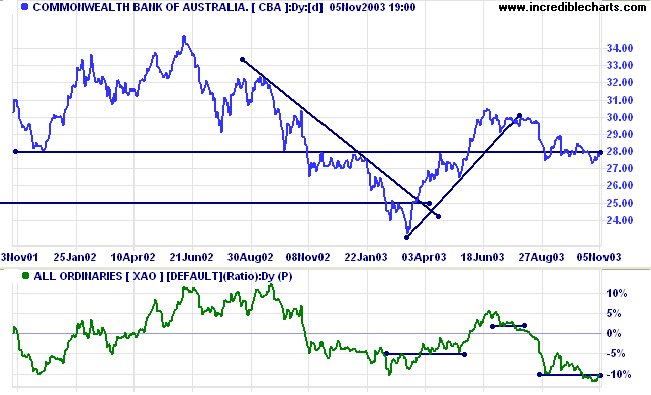

Commonwealth Bank [CBA]

Last covered on October 16, 2003.

CBA is creeping lower but Twiggs Money Flow (100) has fallen sharply, signaling distribution.

Last covered on October 16, 2003.

CBA is creeping lower but Twiggs Money Flow (100) has fallen sharply, signaling distribution.

Relative Strength (price ratio: xao) has fallen to a 2-year low,

signaling a possible re-test of the major support level at 23.00.

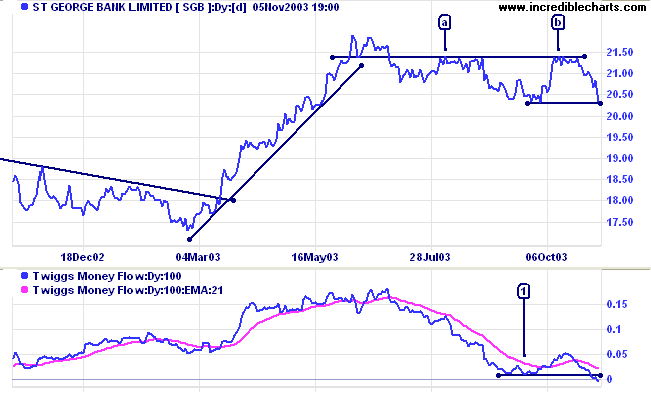

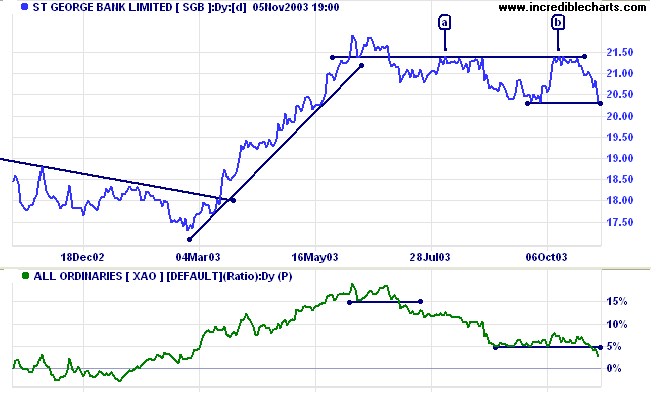

St George Bank [SGB]

Last covered October 27, 2003.

Despite producing record results, SGB is testing support, after two equal highs at [a] and [b] below the earlier high, a strong bear signal.

Twiggs Money Flow has broken below the previous low at [1], another bear signal.

Last covered October 27, 2003.

Despite producing record results, SGB is testing support, after two equal highs at [a] and [b] below the earlier high, a strong bear signal.

Twiggs Money Flow has broken below the previous low at [1], another bear signal.

Relative Strength (price ratio: xao) has fallen to a 12-month

low, another strong bear signal.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

I constantly have three treasures;

Hold on to them and treasure them.

The first is compassion;

The second is frugality;

And the third is not presuming to be at the forefront in the world.

Now it's because I'm compassionate that I therefore can be courageous;

And it's because I'm frugal that I therefore can be magnanimous;

And it's because I don't presume to be at the forefront in the world

that I therefore can lead those with complete talent.

~ Lao Tse (c. 300 B.C.)

Hold on to them and treasure them.

The first is compassion;

The second is frugality;

And the third is not presuming to be at the forefront in the world.

Now it's because I'm compassionate that I therefore can be courageous;

And it's because I'm frugal that I therefore can be magnanimous;

And it's because I don't presume to be at the forefront in the world

that I therefore can lead those with complete talent.

~ Lao Tse (c. 300 B.C.)

Undo

If you have deleted a trendline or

indicator and you want to restore it, try clicking the Undo

button  on the toolbar.

on the toolbar. The Redo  button reverses the Undo.

button reverses the Undo.

|

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.