|

US stocks Our target is to have NYSE, Nasdaq and Amex charts available by Friday. |

Trading Diary

November 3, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

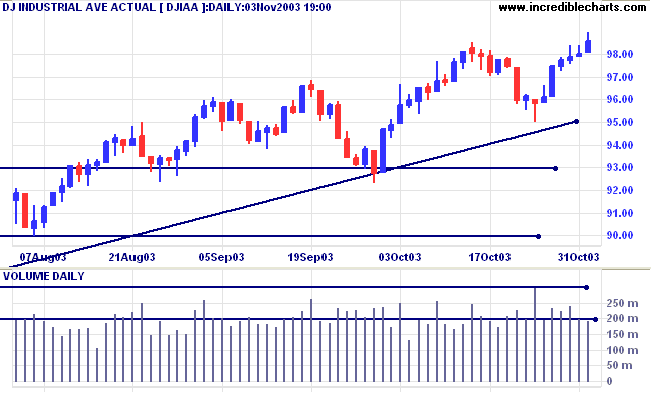

The Dow Industrial Average broke through resistance to close up

0.6% at 9858. Low volume signals potential weakness.

The intermediate trend has turned up.

The primary trend is up. A fall below 9000 will signal reversal.

The intermediate trend has turned up.

The primary trend is up. A fall below 9000 will signal reversal.

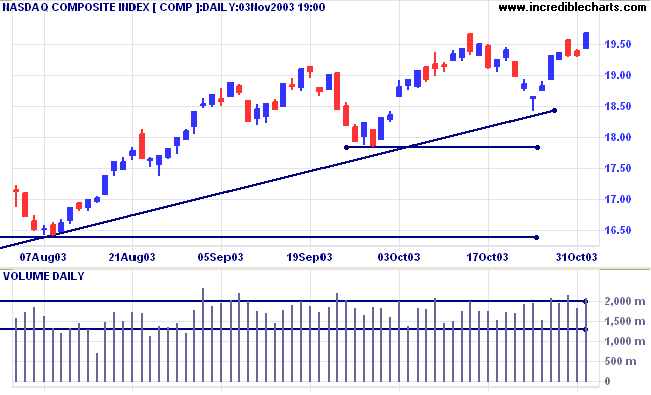

The Nasdaq Composite jumped 35 points to close at 1968 on strong

volume.

The intermediate trend has turned up.

The primary trend is up. A fall below 1640 will signal reversal.

The intermediate trend has turned up.

The primary trend is up. A fall below 1640 will signal reversal.

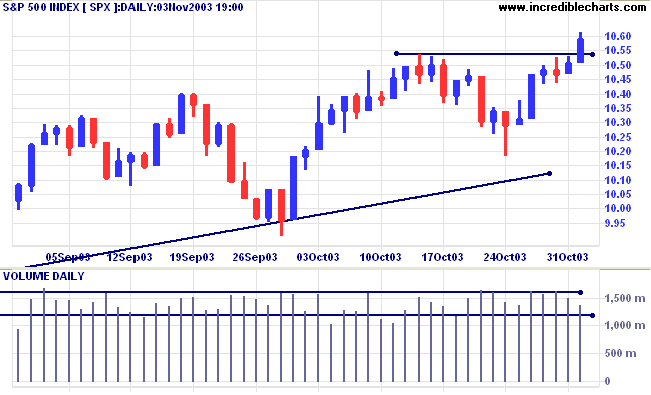

The S&P 500 closed 8 points higher at 1059 on lower

volume.

The intermediate trend has turned up.

The primary trend is up. A fall below 960 will signal reversal.

The intermediate trend has turned up.

The primary trend is up. A fall below 960 will signal reversal.

The Chartcraft NYSE Bullish % Indicator rallied

to 81.36% (November 3).

Market Strategy

Short-term: Bullish if the S&P500 is above 1054.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

Short-term: Bullish if the S&P500 is above 1054.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

Manufacturing surge

The ISM manufacturing index jumped to 57 in October, from 53.7 in September. (more)

The ISM manufacturing index jumped to 57 in October, from 53.7 in September. (more)

Treasury yields

The yield on 10-year treasury notes increased to 4.37%.

The intermediate down-trend is weak.

The primary trend is up.

The yield on 10-year treasury notes increased to 4.37%.

The intermediate down-trend is weak.

The primary trend is up.

Gold

New York (16:21): Spot gold plunged to $377.00.

The intermediate trend is up. Price has formed equal highs in the past 6 weeks; a fall below 370.00 will be a bear signal.

The primary trend is up. Expect resistance at 400 to 415.

New York (16:21): Spot gold plunged to $377.00.

The intermediate trend is up. Price has formed equal highs in the past 6 weeks; a fall below 370.00 will be a bear signal.

The primary trend is up. Expect resistance at 400 to 415.

ASX Australia

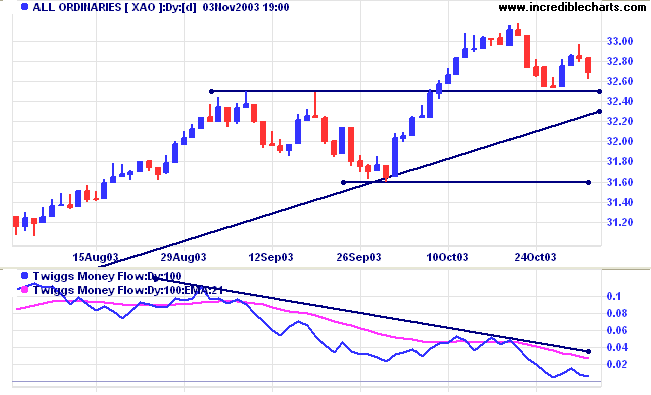

Selling continued, with the All Ordinaries falling 13 points to

close at 3269. Lower volume indicates that the 3238 to 3250

support band may hold, especially after the strong performance in

the US.

The intermediate up-trend is weak. A fall below 3250 will signal

reversal.

The primary trend is up. The rally is extended and probability of a reversal increases with each successive primary trend movement. A fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

The primary trend is up. The rally is extended and probability of a reversal increases with each successive primary trend movement. A fall below 3160 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed below; Twiggs Money Flow (100) is below its signal line and displays a bearish "triple" divergence.

Market Strategy

Short-term: Bullish if the All Ords is above 3317. Bearish below 3250.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

Short-term: Bullish if the All Ords is above 3317. Bearish below 3250.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

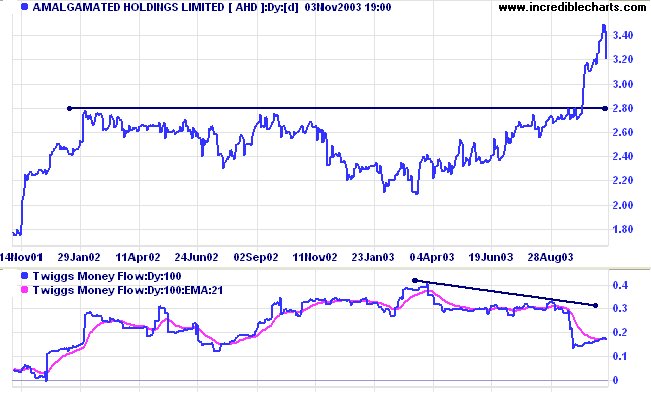

Amalgamated Holdings [AHD]

AMH, after a lengthy consolidation, broke above resistance at 2.80 but has corrected sharply in the last 2 days. Twiggs Money Flow (100) signals a bearish divergence.

AMH, after a lengthy consolidation, broke above resistance at 2.80 but has corrected sharply in the last 2 days. Twiggs Money Flow (100) signals a bearish divergence.

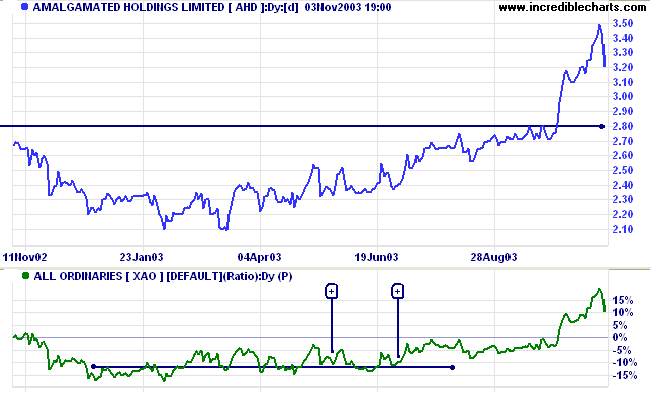

Relative Strength (xao) is rising. Bull signals at [+] are when

RS respects the support line from earlier highs.

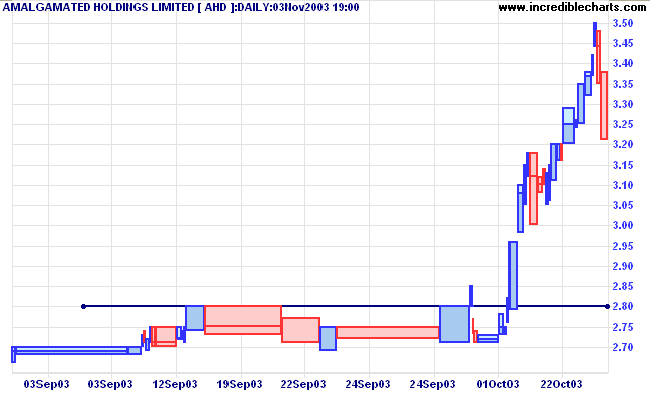

Broad equivolume bars in September indicate that price is likely

to encounter strong support at 2.80. Entry opportunities may

present themselves if RS and TMF turn upwards while price

respects the support level.

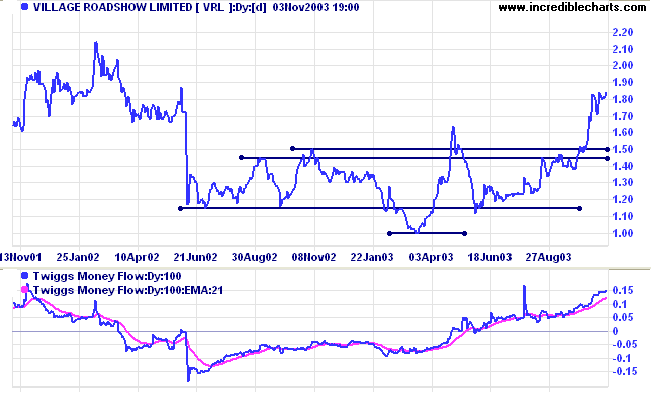

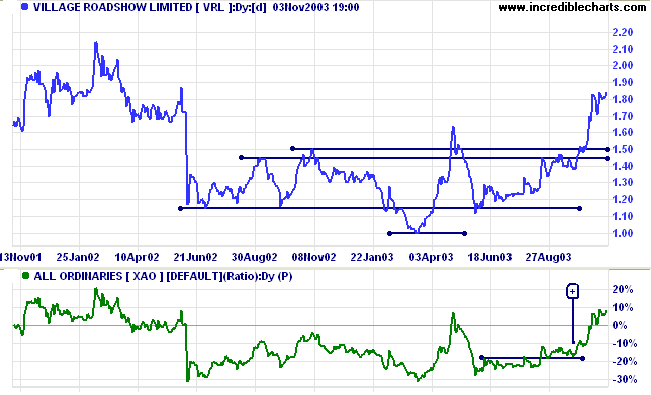

Village Roadshow [VRL]

Last covered on June 7, 2002, VRL has recovered, breaking through resistance at 1.45 to 1.50, with Twiggs Money Flow (100) rising steadily.

Last covered on June 7, 2002, VRL has recovered, breaking through resistance at 1.45 to 1.50, with Twiggs Money Flow (100) rising steadily.

Relative Strength (price ratio: xao) presented entry

opportunities while price was consolidating just below the

resistance level, with RS respecting support [+] from previous

highs.

Price is likely to encounter resistance at 2.00, presenting opportunities to enter if there is a pull-back to re-test support levels.

Price is likely to encounter resistance at 2.00, presenting opportunities to enter if there is a pull-back to re-test support levels.

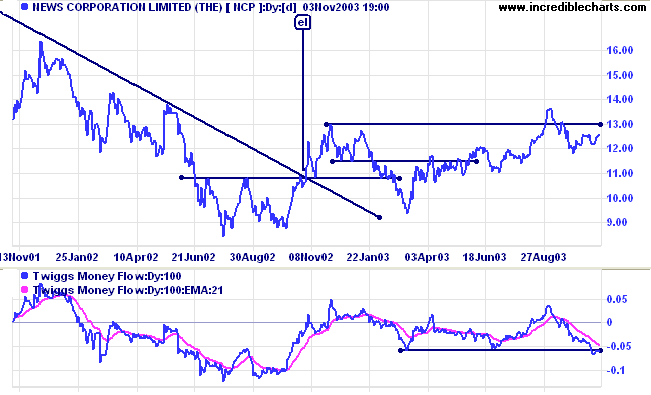

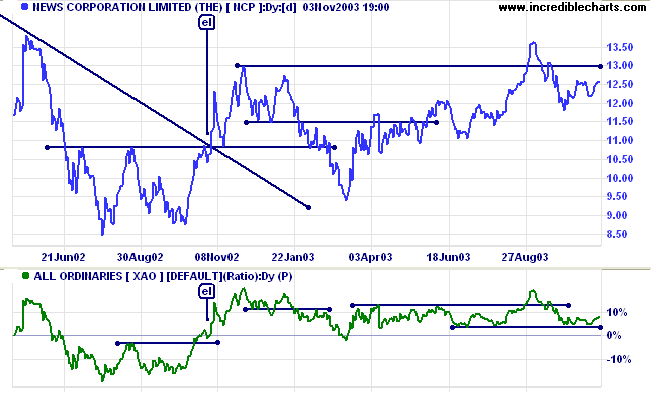

News Corporation [NCP]

NCP is in a creeping up-trend while Twiggs Money Flow (100) is falling, a bearish sign.

NCP is in a creeping up-trend while Twiggs Money Flow (100) is falling, a bearish sign.

Relative Strength (xao) presented an early entry opportunity at

[el] but price reversed sharply after reaching its target

(10.80+(10.80-10.50)).

RS subsequently leveled out, providing neither bull or bear signals in the last 6 months.

RS subsequently leveled out, providing neither bull or bear signals in the last 6 months.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

The wavelike movement affecting the economic

system,

the recurrence of periods of boom which are followed by periods of depression [recession],

is the unavoidable outcome of the attempts, repeated again and again,

to lower the gross market rate of interest by means of credit expansion.

There is no means of avoiding the final collapse of a boom expansion brought about by credit expansion.

The alternative is only whether the crisis should come sooner

as the result of the voluntary abandonment of further credit expansion,

or later as a final and total catastrophe of the currency system involved.

~ Ludwig von Mises (1881 - 1973)

The Federal Reserve is injecting cash into the US economy to stimulate "the best recovery that money can buy",

in the words of one commentator. This is unsustainable - as reflected by the falling dollar.

the recurrence of periods of boom which are followed by periods of depression [recession],

is the unavoidable outcome of the attempts, repeated again and again,

to lower the gross market rate of interest by means of credit expansion.

There is no means of avoiding the final collapse of a boom expansion brought about by credit expansion.

The alternative is only whether the crisis should come sooner

as the result of the voluntary abandonment of further credit expansion,

or later as a final and total catastrophe of the currency system involved.

~ Ludwig von Mises (1881 - 1973)

The Federal Reserve is injecting cash into the US economy to stimulate "the best recovery that money can buy",

in the words of one commentator. This is unsustainable - as reflected by the falling dollar.

Indicator Colors

|

The easiest way to change indicator

colors is to: (1) display the legend; (2) click the color button next to the indicator; (3) select a new color from the palette and lick OK. You can also use the menu: (1) select Format Charts >> Colors; (2) select the indicator (on the bottom half of the pop-up menu); (3) click the color button and select a new color. |

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.