|

Incredible Charts version

4.0.2.600 See What's New for details. Check Help >> About to ensure that you have received the automatic update. |

Trading Diary

October 23, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

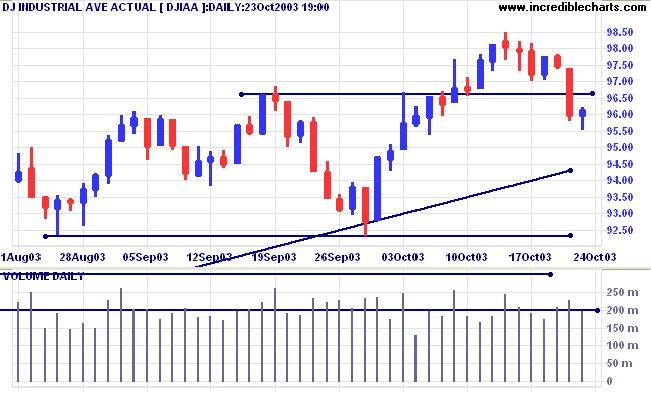

The Dow Industrial Average recovered slightly to 9613 on low

volume.

The intermediate trend is down. Support is at 9230.

The primary trend is up. A fall below 9000 will signal reversal.

The intermediate trend is down. Support is at 9230.

The primary trend is up. A fall below 9000 will signal reversal.

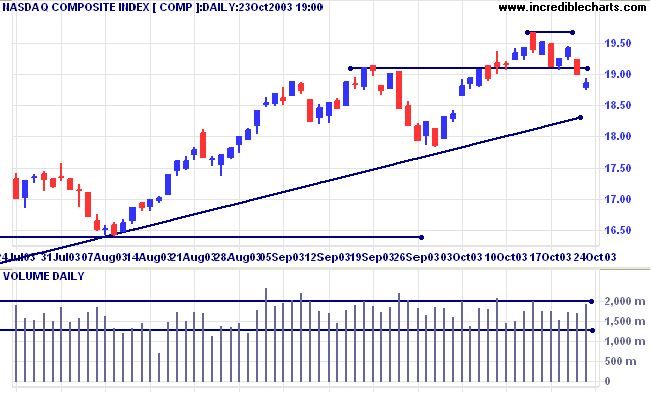

The Nasdaq Composite recovered slightly in a late rally to close

12 points down at 1886 on higher volume.

The intermediate trend is down. Support is at 1783.

The primary trend is up. A fall below 1640 will signal reversal.

The intermediate trend is down. Support is at 1783.

The primary trend is up. A fall below 1640 will signal reversal.

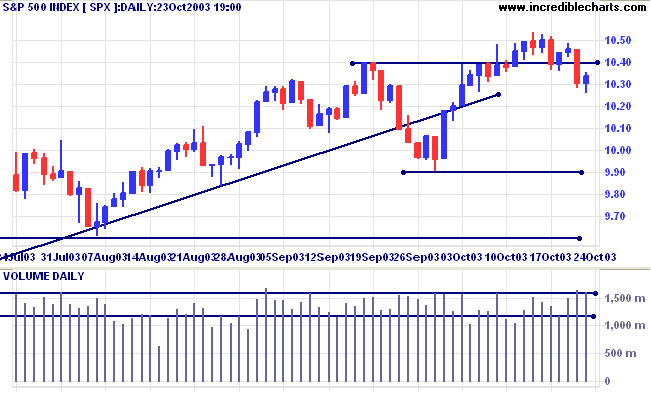

The S&P 500 recovered 4 points to close at 1034 on strong

volume.

The intermediate trend is down. Support is at 990.

The primary trend is up. A fall below 960 will signal reversal.

The intermediate trend is down. Support is at 990.

The primary trend is up. A fall below 960 will signal reversal.

The Chartcraft NYSE Bullish % Indicator fell to

80.57% (October 23).

Market Strategy

Short-term: Bearish if the S&P500 is below 1036.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

Short-term: Bearish if the S&P500 is below 1036.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

Jobless claims lower

New unemployment claims were lower at 386,000 last week. (more)

New unemployment claims were lower at 386,000 last week. (more)

Treasury yields

The yield on 10-year treasury notes rallied to 4.32%.

The intermediate trend is up. Expect resistance at 4.60%, support at 4.25%.

The primary trend is up.

The yield on 10-year treasury notes rallied to 4.32%.

The intermediate trend is up. Expect resistance at 4.60%, support at 4.25%.

The primary trend is up.

Gold

New York (19:12) Spot gold eased slightly to $384.70.

The intermediate trend has turned up.

The primary trend is up.

New York (19:12) Spot gold eased slightly to $384.70.

The intermediate trend has turned up.

The primary trend is up.

ASX Australia

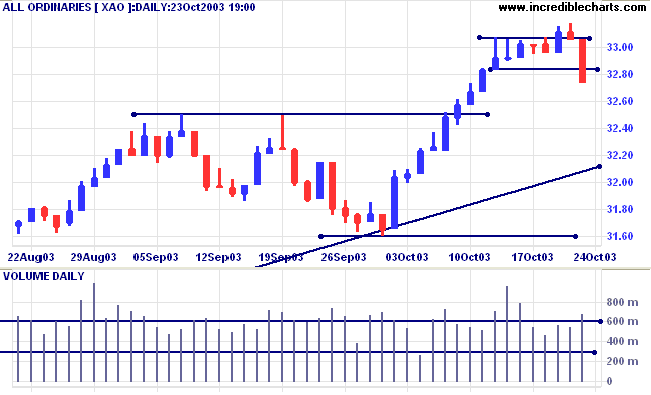

The All Ordinaries fell sharply after the reversal on US markets,

closing 31 points down at 3274 on strong volume.

Initial support is at 3250.

Initial support is at 3250.

The intermediate trend is weak.

The primary trend is up. A fall below 3160 will signal reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line, displaying a bearish "triple" divergence.

The primary trend is up. A fall below 3160 will signal reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line, displaying a bearish "triple" divergence.

Market Strategy

Short-term: Bullish if the All Ords is above 3317. Bearish below 3283.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

Short-term: Bullish if the All Ords is above 3317. Bearish below 3283.

Intermediate: Bullish above 3317.

Long-term: Bullish above 3160.

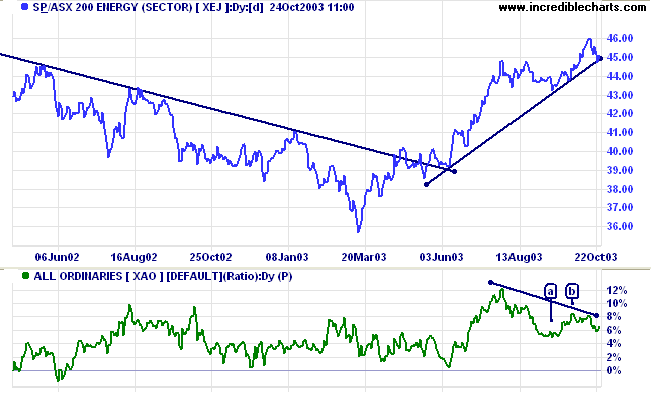

Energy [XEJ]

The sector index formed a V-bottom in March followed by a strong rally. The up-trend has now broken below its trendline, signaling weakness.

Relative Strength (price ratio: xao) displays a bearish divergence; a fall below the low of [a] will be a strong bear signal. A rise above the high of [b] will be bullish.

The sector index formed a V-bottom in March followed by a strong rally. The up-trend has now broken below its trendline, signaling weakness.

Relative Strength (price ratio: xao) displays a bearish divergence; a fall below the low of [a] will be a strong bear signal. A rise above the high of [b] will be bullish.

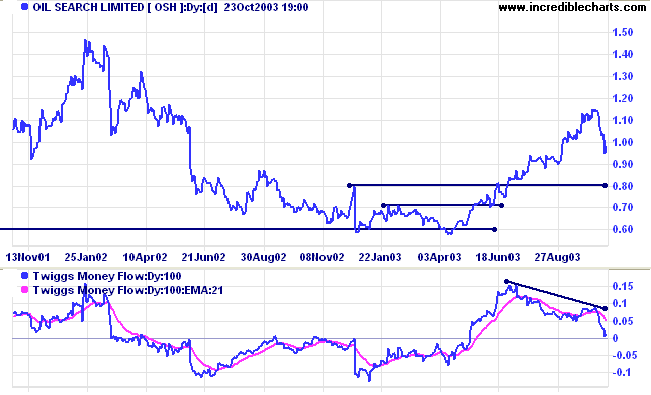

Oil Search [OSH] was last covered on August 7, 2003.

Price has corrected strongly towards support at 0.80. Twiggs Money Flow (100) displays a strong bearish divergence.

Price has corrected strongly towards support at 0.80. Twiggs Money Flow (100) displays a strong bearish divergence.

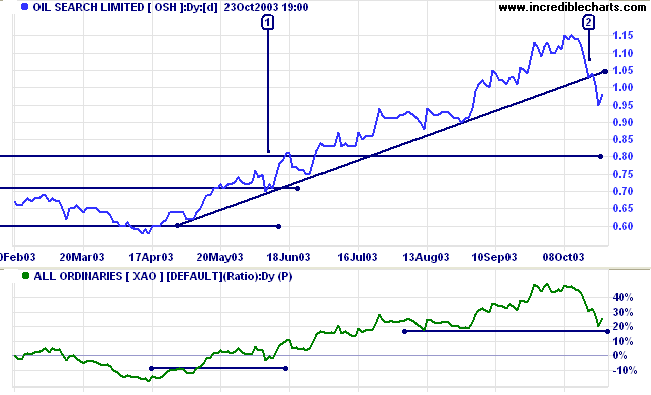

Relative Strength (price ratio: xao) is declining after a strong

rise. The short consolidation at the trendline at [2] gave a bear

signal ahead of the trendline break. This may well be a secondary

correction, but a break of RS below its August low would be a

strong bear signal, as would a close below support at 0.80.

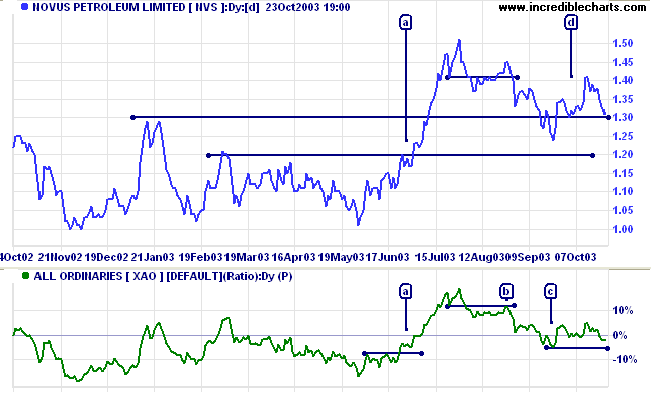

Novus Petroleum [NVS] last covered October 14, 2003.

Novus is testing support after rallying off the recent low. If price respects support at 1.30 and Relative Strength (price ratio: xao) holds above the low of [c] this will be a bull signal. The target would be resistance at 1.50.

Novus is testing support after rallying off the recent low. If price respects support at 1.30 and Relative Strength (price ratio: xao) holds above the low of [c] this will be a bull signal. The target would be resistance at 1.50.

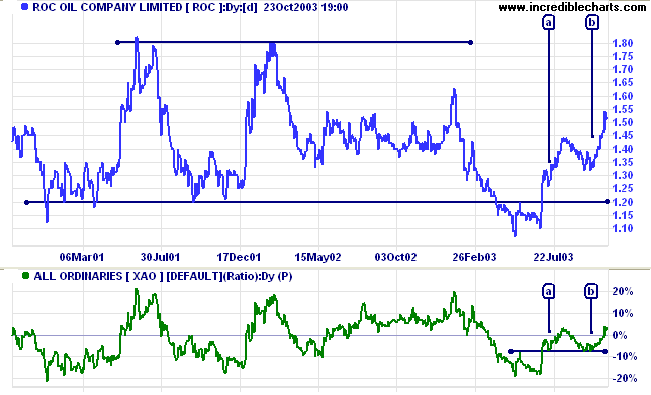

ROC Oil [ROC] last covered July

10, 2003.

Relative Strength (xao) has given two accumulation signals at [a] and [b], respecting support from the previous RS high.

Relative Strength (xao) has given two accumulation signals at [a] and [b], respecting support from the previous RS high.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

If the weather men can't predict the weather for

the next day in Florida,

which they can't seem to do with any accuracy despite all their fancy scientific instruments,

what makes people think they can predict where the market will be a month from now?

I think that the greatest misconception about the markets is that you have to be able to call the direction correctly.

Wrong.

Making money in the markets is all about managing risk.

~ Linda Bradford Raschke interview

(with thanks to bookii)

which they can't seem to do with any accuracy despite all their fancy scientific instruments,

what makes people think they can predict where the market will be a month from now?

I think that the greatest misconception about the markets is that you have to be able to call the direction correctly.

Wrong.

Making money in the markets is all about managing risk.

~ Linda Bradford Raschke interview

(with thanks to bookii)

Brokers:

Negotiating the best rates

We have received an excellent response so far.

I will work out a set of criteria to present to brokers.

Please post your suggestions at the above link.

We have received an excellent response so far.

I will work out a set of criteria to present to brokers.

Please post your suggestions at the above link.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.