|

Searching for ETOs and Warrants

(Premium Members) Important: Ensure that you have Time Periods >> Chart Complete Data selected. You will need to upload the menu before doing a search: (1) select Securities >> ASX ETOS & WARRANTS >> Upload ASX ETOS & WARRANTS Menu; and (2) click Yes if you want the menu to update at the start of each session. |

Trading Diary

October 17, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

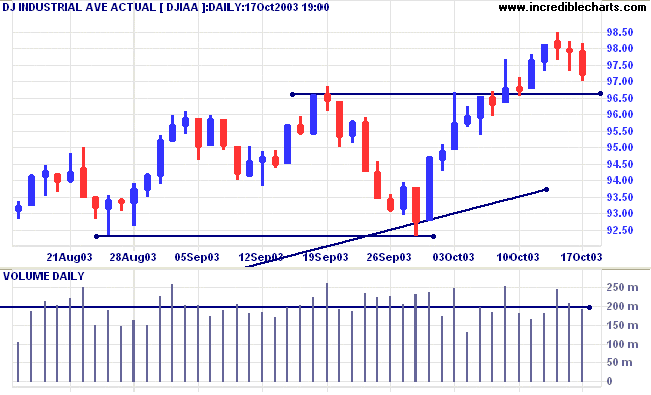

The Dow Industrial Average retreated 0.7% on lower volume. Expect

support at 9660.

The intermediate trend is up.

The primary trend is up. A fall below 9000 will signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below 9000 will signal reversal.

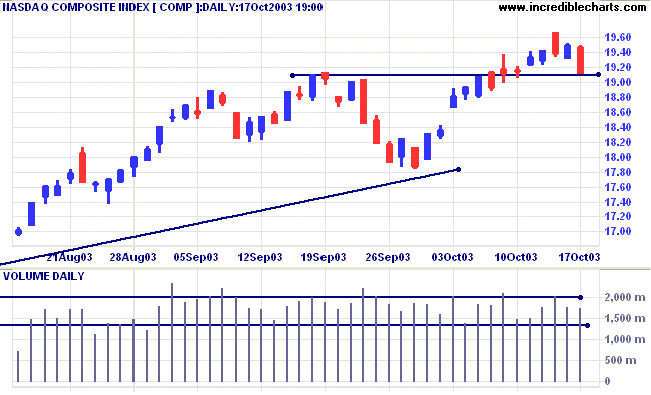

The Nasdaq Composite lost 38 points, closing at 1912 on lower

volume, testing support at 1910.

The intermediate trend is up.

The primary trend is up. A fall below 1640 will signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below 1640 will signal reversal.

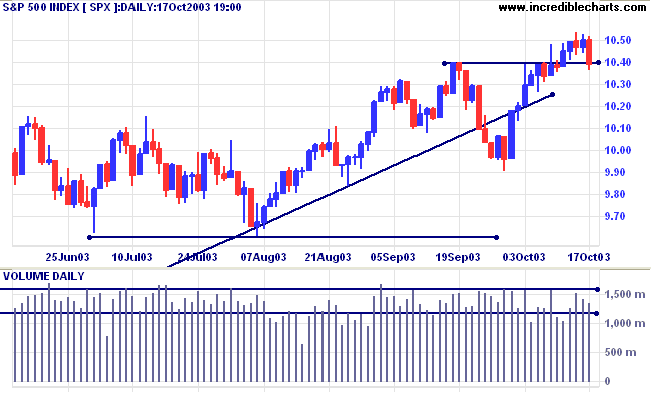

The S&P 500 closed 11 points down at 1039 on lower volume.

The break below initial support at 1040 signals a loss of

momentum.

The intermediate trend is up.

The primary trend is up. A fall below 960 will signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below 960 will signal reversal.

The Chartcraft NYSE Bullish % Indicator eased

slightly to 81.71% ( October 17).

Market Strategy

Short-term: Bullish if the S&P500 is above 1054.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

Short-term: Bullish if the S&P500 is above 1054.

Intermediate: Bullish above 1054.

Long-term: Bullish above 960.

Consumer sentiment up

Preliminary readings for the University of Michigan index of consumer sentiment indicate a rise to 89.4; up from September but only marginally above the August reading. (more)

Preliminary readings for the University of Michigan index of consumer sentiment indicate a rise to 89.4; up from September but only marginally above the August reading. (more)

Treasury yields

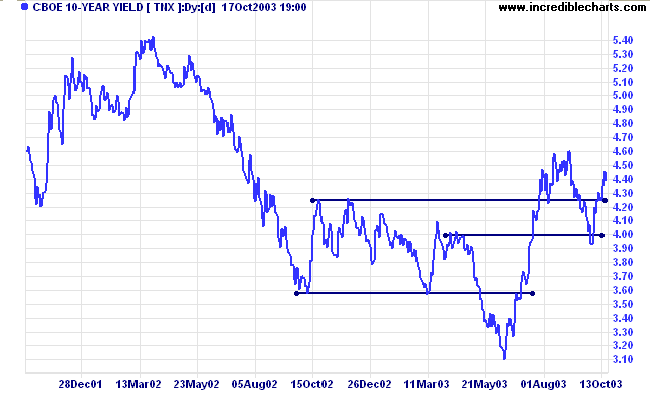

The yield on 10-year treasury notes closed the week at 4.39%.

The intermediate trend is up. Expect resistance at 4.60%.

The primary trend is up.

The yield on 10-year treasury notes closed the week at 4.39%.

The intermediate trend is up. Expect resistance at 4.60%.

The primary trend is up.

Gold

New York (13.30): Spot gold has weakened to $371.30.

The intermediate trend is down.

The primary trend is up, with support at 343 to 350.

New York (13.30): Spot gold has weakened to $371.30.

The intermediate trend is down.

The primary trend is up, with support at 343 to 350.

ASX Australia

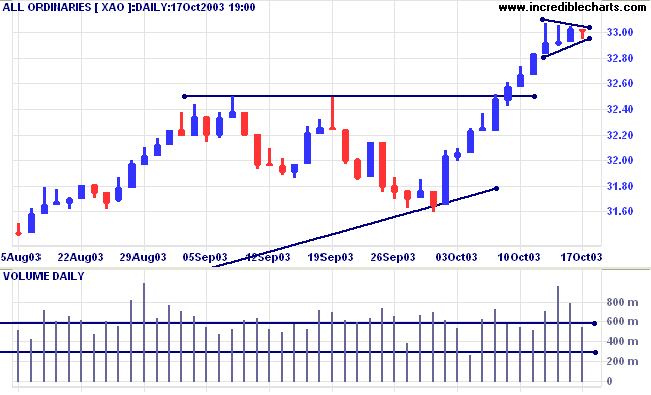

The All Ordinaries formed a small pennant over the last four

days, closing 1 point down on Friday at 3301. Lower volume is an

encouraging sign: high volume over the previous 2 days signaled

strong selling pressure.

The intermediate trend is up.

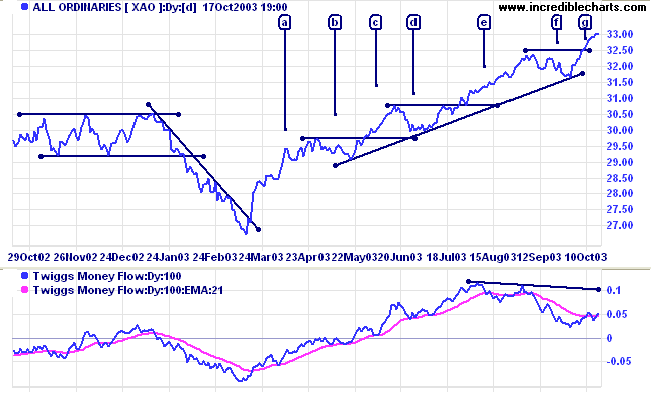

The primary trend is up. The rally is extended, with 4 primary trend movements at [a], [c], [e] and [g]; and 3 secondary corrections at [b], [d] and [f]. The probability of a reversal increases with each primary trend movement. Elliot wave theory maintains that the natural cycle is 5 waves, [a] to [e], while Gann holds that a bull campaign will normally have 3 or 4 advances, [a] to [e] or [g].

A fall below 3160 will signal reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has whipsawed back above; Twiggs Money Flow (100) is above its signal line but displays a "triple" bearish divergence.

The primary trend is up. The rally is extended, with 4 primary trend movements at [a], [c], [e] and [g]; and 3 secondary corrections at [b], [d] and [f]. The probability of a reversal increases with each primary trend movement. Elliot wave theory maintains that the natural cycle is 5 waves, [a] to [e], while Gann holds that a bull campaign will normally have 3 or 4 advances, [a] to [e] or [g].

A fall below 3160 will signal reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has whipsawed back above; Twiggs Money Flow (100) is above its signal line but displays a "triple" bearish divergence.

Market Strategy

Short-term: Bullish if the All Ords is above 3307.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3160.

Short-term: Bullish if the All Ords is above 3307.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3160.

Sector Analysis

Changes are highlighted in bold.

Changes are highlighted in bold.

- Energy [XEJ] - stage 2 (RS is rising).

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 2 (RS is level). An unstable V-bottom.

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is rising)

- Property Trusts [XPJ] - stage 3 (RS is falling)

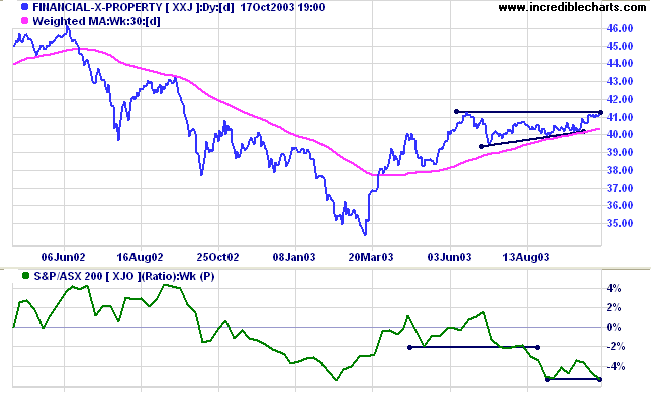

- Financial excl. Property [XXJ] - stage 2 (RS is falling)

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is level).

- Utilities [XUJ] - stage 3 (RS is falling)

Financials-X-Property [XXJ] is consolidating in a triangular

pattern. However, Relative Strength (xjo) is falling; a strong

bear signal.

Sectors: Relative Strength

A stock screen of the ASX 200 using % Price Move (1 month: +5%) rose to 63 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

A stock screen of the ASX 200 using % Price Move (1 month: +5%) rose to 63 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Diversified Metals & Mining (5)

- Broadcasting & Cable TV (5)

- Diversified Financial (4)

- Gold (4)

- Publishing (3)

- Construction Materials (3)

- Steel (3)

Daily Trading Diary

Stocks analyzed during the week were:

Stocks analyzed during the week were:

- Publishing & Broadcasting - PBL

- Seven Network - SEV

- Ten Network - TEN

- Prime Television - PRT

- Austereo - AEO

- Southern Cross Broadcasting - SBC

- Macquarie Communications Infrastructure Group - MCG

- Novogen - NRT

- Novus Petroleum - NVS

- Zimbabwe Platinum - ZIM

- Smorgon Steel - SSX

- Lion Selection Group - LSG

- National Australia Bank - NAB

- ANZ Bank - ANZ

- Commonwealth Bank - CBA

- Westpac - WBC

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

There is, perhaps, no greater pitfall

than being an adamant and continuing bear.

...... it is a real danger to look for disaster so constantly

as to miss opportunities.

~ Richard Arms: Trading Without Fear.

than being an adamant and continuing bear.

...... it is a real danger to look for disaster so constantly

as to miss opportunities.

~ Richard Arms: Trading Without Fear.

Premium members can now chart ETOs and Warrants.

The data feed is still beta at this stage - there may be a few bugs that have to be ironed out.

The data feed is still beta at this stage - there may be a few bugs that have to be ironed out.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.