|

Searching for ETOs and

Warrants You will need to upload the menu before doing a search: (1) select Securities >> ASX ETOS & WARRANTS >> Upload ASX ETOS & WARRANTS Menu; and (2) click Yes if you want the menu to update at the start of each session. US stocks will follow shortly. |

Trading Diary

October 16, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

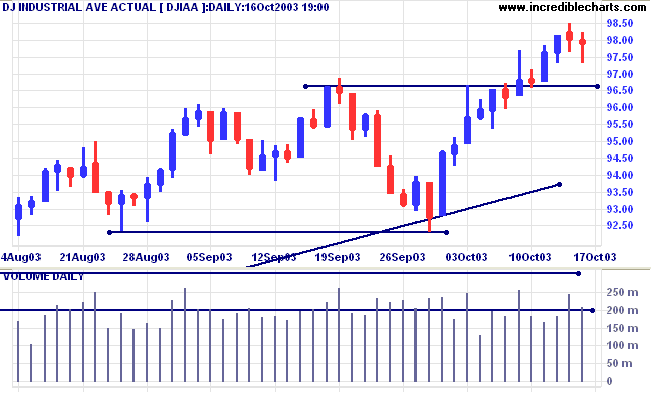

The Dow Industrial Average continued to decline, closing slightly

lower at 9792. Lower volume signals trend strength. Expect

support at 9660.

The intermediate trend is up.

The primary trend is up. A fall below 9230 would signal reversal.

The intermediate trend is up.

The primary trend is up. A fall below 9230 would signal reversal.

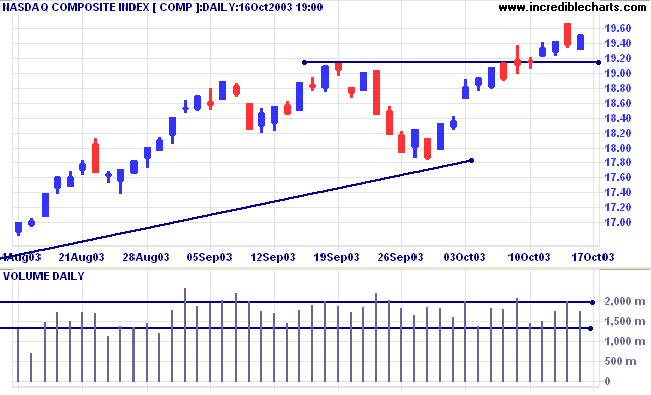

The Nasdaq Composite reversed direction with a weaker

closing price reversal, closing 11 points higher at 1950 on

lower volume.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

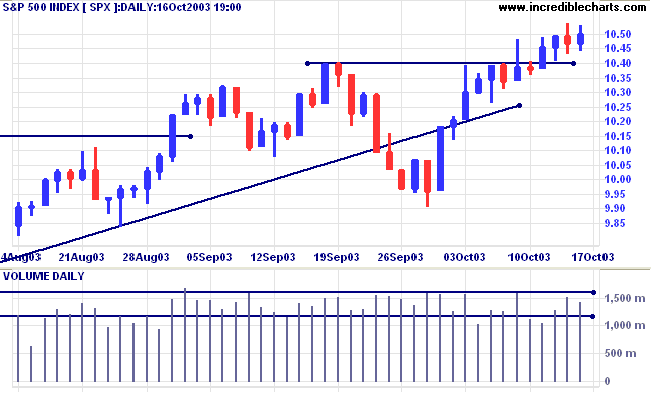

The S&P 500 formed an inside day, gaining 3 points to close

at 1050 on lower volume; a continuation signal.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator increased

to 81.75% (October 16).

Market Strategy

Short-term: Bullish if the S&P500 is above 1043.

Intermediate: Bullish above 1043.

Long-term: Bullish above 990.

Short-term: Bullish if the S&P500 is above 1043.

Intermediate: Bullish above 1043.

Long-term: Bullish above 990.

Production rises

The Fed reports that industrial production rose 0.4% in September, against 0.1% in August. (more)

The Fed reports that industrial production rose 0.4% in September, against 0.1% in August. (more)

Jobless claims lower

New unemployment claims fell to 384,000 last week, compared to a revised 388,000 the week before. (more)

New unemployment claims fell to 384,000 last week, compared to a revised 388,000 the week before. (more)

Treasury yields

The yield on 10-year treasury notes climbed to 4.46%.

The intermediate trend is up.

The primary trend is up.

The yield on 10-year treasury notes climbed to 4.46%.

The intermediate trend is up.

The primary trend is up.

Gold

New York (20:56): Spot gold eased to $371.00.

The intermediate trend is down.

The primary trend is up, with support at 343 to 350.

New York (20:56): Spot gold eased to $371.00.

The intermediate trend is down.

The primary trend is up, with support at 343 to 350.

ASX Australia

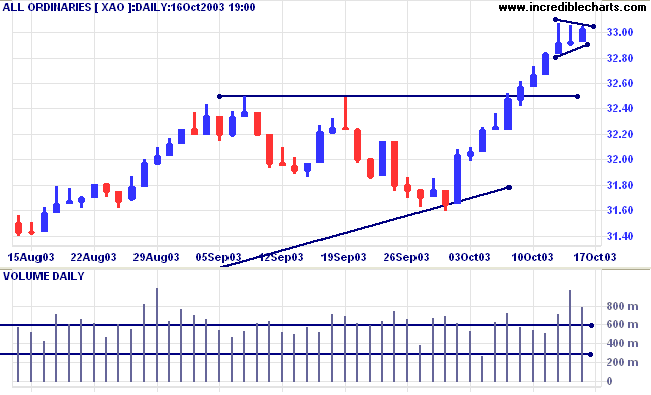

The All Ordinaries formed a small

pennant, closing up 10 points at 3302. The pennant normally

signals continuation but unusually high volumes and narrow ranges

warn of strong selling pressure.

The intermediate trend is up.

The primary trend is up. The rally is extended after 3 secondary corrections back to the trendline; the probability of a reversal increases with each consecutive rally.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line having completed another bearish divergence.

The primary trend is up. The rally is extended after 3 secondary corrections back to the trendline; the probability of a reversal increases with each consecutive rally.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (100) is below its signal line having completed another bearish divergence.

Market Strategy

Short-term: Bullish if the All Ords is above 3307.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3160. Tighten stops (to intermediate level) when the secondary rally ends.

Short-term: Bullish if the All Ords is above 3307.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3160. Tighten stops (to intermediate level) when the secondary rally ends.

Banks

Last covered July 22, 2003.

The major banks have lost momentum since their upward drive in the first half of the year and now appear headed for a re-test of support levels.

Last covered July 22, 2003.

The major banks have lost momentum since their upward drive in the first half of the year and now appear headed for a re-test of support levels.

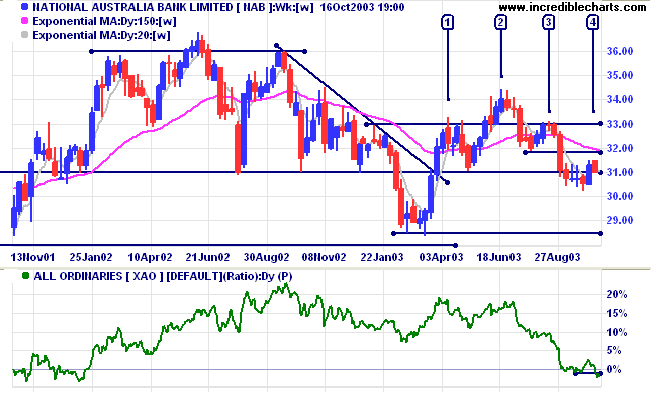

National Australia Bank [NAB] formed an unstable V-bottom at the

start of the year before rallying to 34.00. Price has formed a

weak head and shoulders pattern at [1], [2] and [3]; weak because

the neckline has an upward slope. The primary trend has reversed

downward after [3], with a fall below the previous low. Twiggs

Money Flow (100) signals distribution. Relative Strength (price

ratio: xao) continues to fall and a reversal of the secondary

retracement, while below the previous low (32.00), will be

a strong bear signal.

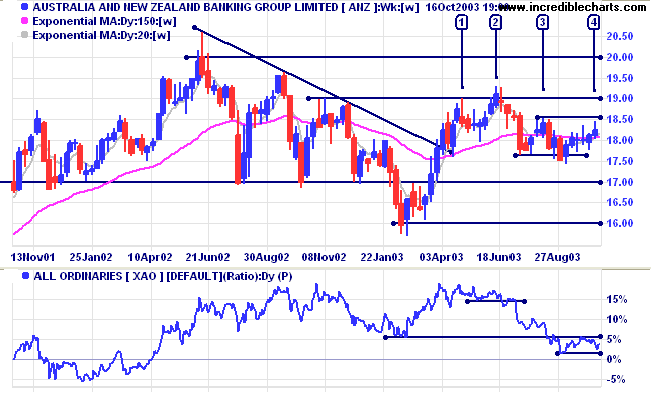

ANZ Bank [ANZ] has also completed a primary trend reversal, with

a break below the previous low after a lower high at [3]. A

reversal of the upward retracement at/below the high of [3] will

be a strong bear signal: equal highs below a higher high. Twiggs

Money Flow (100) signals distribution. Relative Strength (xao): a

fall below the August low will be a strong bear signal.

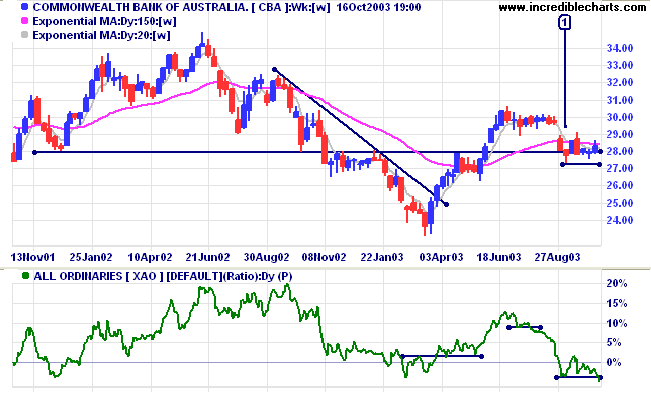

Commonwealth Bank [CBA] has yet to make a primary trend reversal,

consolidating around the 28.00 level after a low at [1]. Twiggs

Money Flow (100) signals distribution and Relative Strength

(price ratio: xao) is falling. A fall below 27.28, the low of

[1], will be a strong bear signal.

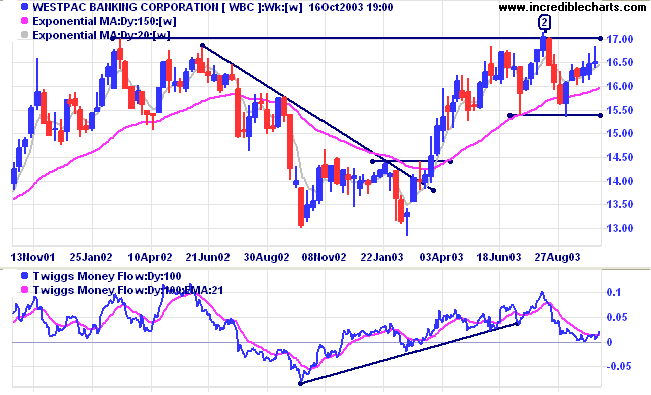

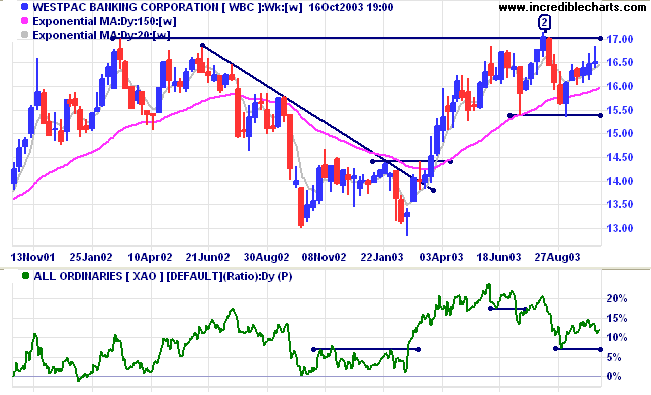

Westpac [WBC] encountered resistance at 17.00, the earlier high

from February 2002. Price then tested support at the previous low

before again rallying. The primary up-trend is still intact.

Twiggs Money Flow (100) is still above zero signaling

accumulation, but it may be difficult to overcome resistance at

17.00, considering the weak performance of the other 3

banks.

Relative Strength (price ratio: xao) is declining and a fall

below the August low will be a strong bear signal.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

Live your life so that whenever you lose, you're

ahead.

~ Will Rogers, cowboy humorist (1879 - 1935).

~ Will Rogers, cowboy humorist (1879 - 1935).

ETOs & Warrants

|

ETOs and warrants are only updated after the market

close. We will add hourly updates when the data feed is available from our data supplier. |

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.