|

ETOs and

Warrants ETOs and warrants are ready and will be introduced this week. US stocks will follow. |

Trading Diary

October 6, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

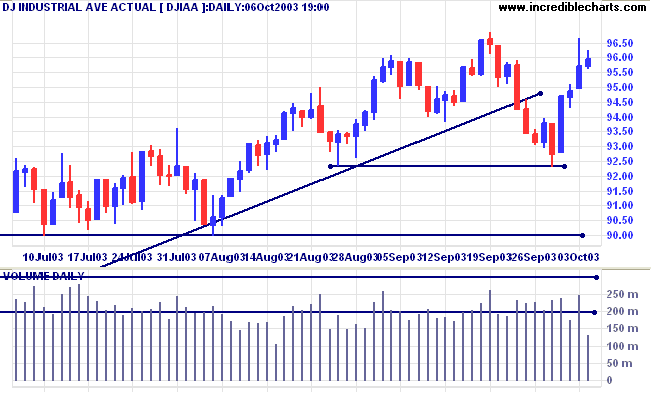

The Dow Industrial Average formed an inside day on low volume,

signaling continuation. The index closed slightly up at

9595.

The intermediate trend is down. A rise above 9686 will signal reversal.

The primary trend is up. A fall below 9000 will signal reversal.

The intermediate trend is down. A rise above 9686 will signal reversal.

The primary trend is up. A fall below 9000 will signal reversal.

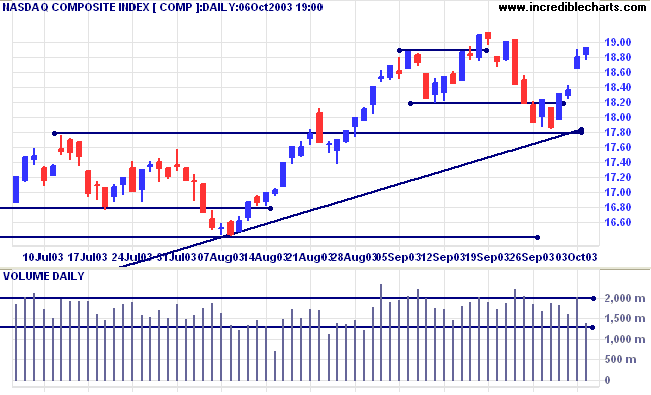

The Nasdaq Composite closed 12 points higher at 1893 on lower

volume.

The intermediate trend is down. A rise above 1914 will signal reversal.

The primary trend is up. A fall below 1640 will signal reversal.

The intermediate trend is down. A rise above 1914 will signal reversal.

The primary trend is up. A fall below 1640 will signal reversal.

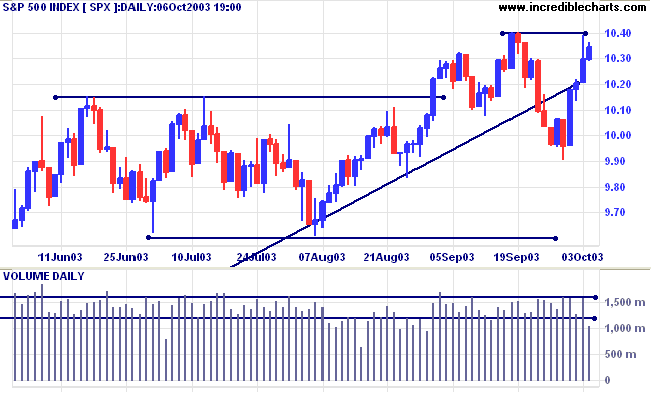

The S&P 500 formed an inside day on low volume, signaling

continuation. The index closed up 4 points at 1034.

The intermediate trend is weak. A rise above 1040 will signal resumption of the up-trend.

The primary trend is up. A fall below 960 will signal reversal.

The intermediate trend is weak. A rise above 1040 will signal resumption of the up-trend.

The primary trend is up. A fall below 960 will signal reversal.

The Chartcraft NYSE Bullish % Indicator rose to

79.74% (October 6).

Market Strategy

Short-term: Bullish if the S&P500 is above 1040. Bearish below 1029.

Intermediate: Bullish above 1040.

Long-term: Bullish above 960.

Short-term: Bullish if the S&P500 is above 1040. Bearish below 1029.

Intermediate: Bullish above 1040.

Long-term: Bullish above 960.

The Fed's next step: will they raise interest rates?

Most Fed-watchers say that it is too soon, and that the Fed will wait for further evidence of recovery before acting. (more)

Most Fed-watchers say that it is too soon, and that the Fed will wait for further evidence of recovery before acting. (more)

Treasury yields

The yield on 10-year treasury notes consolidated at 4.15%, after a sharp jump to 4.20%.

The intermediate down-trend appears weak.

The primary trend is up.

The yield on 10-year treasury notes consolidated at 4.15%, after a sharp jump to 4.20%.

The intermediate down-trend appears weak.

The primary trend is up.

Gold

New York (17:32): Spot gold has leveled out at $372.50.

The intermediate trend has turned down.

The primary trend is up. A fall below 350 will signal reversal.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321), but expect heavy resistance between 400 and 415 (the 10-year high).

New York (17:32): Spot gold has leveled out at $372.50.

The intermediate trend has turned down.

The primary trend is up. A fall below 350 will signal reversal.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321), but expect heavy resistance between 400 and 415 (the 10-year high).

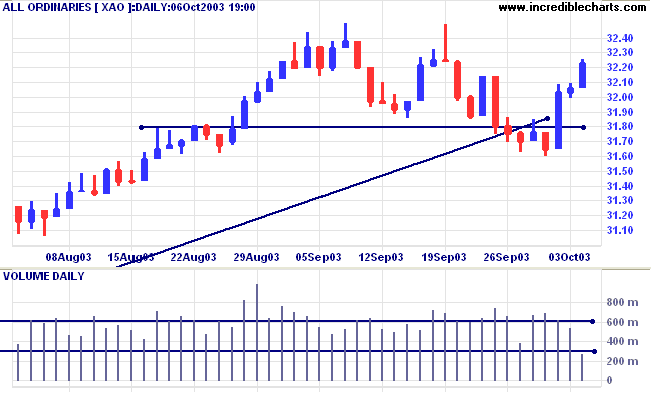

ASX Australia

The All Ordinaries rallied, closing up 17 points at 3223 on low

volume.

The intermediate down-trend is weak. The next resistance level is

at 3250; support is at 3160.

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow signals distribution.

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is above; Twiggs Money Flow signals distribution.

Market Strategy

Short-term: Bullish if the All Ords is above 3209. Bearish below 3200.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

Short-term: Bullish if the All Ords is above 3209. Bearish below 3200.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

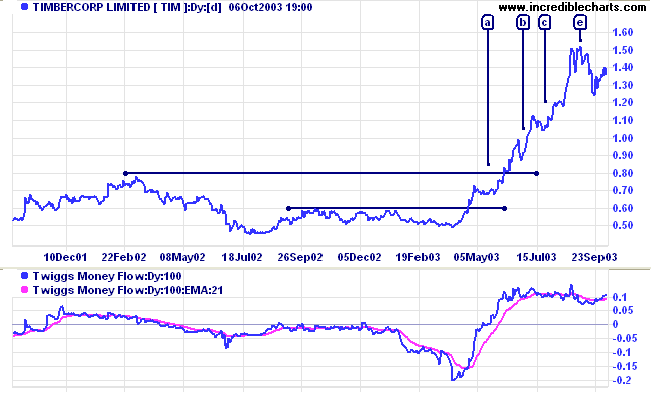

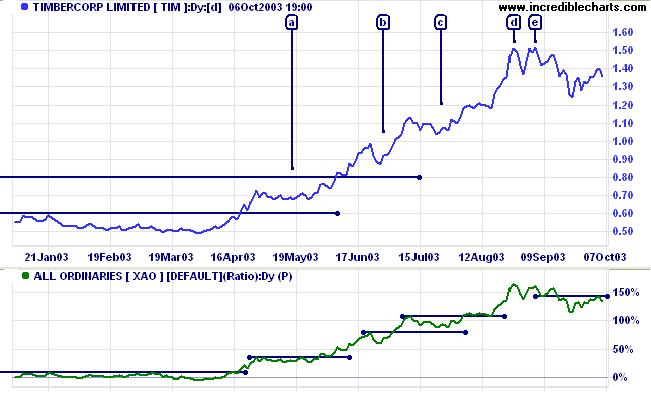

Timbercorp [TIM]

Last covered July 14, 2003.

TIM enjoyed a strong rally, with 3 fairly weak corrections at [a], [b] and [c], before a top formed at [e].

Twiggs Money Flow has crossed back above its signal line.

Last covered July 14, 2003.

TIM enjoyed a strong rally, with 3 fairly weak corrections at [a], [b] and [c], before a top formed at [e].

Twiggs Money Flow has crossed back above its signal line.

Relative Strength (price ratio: xao) is declining.

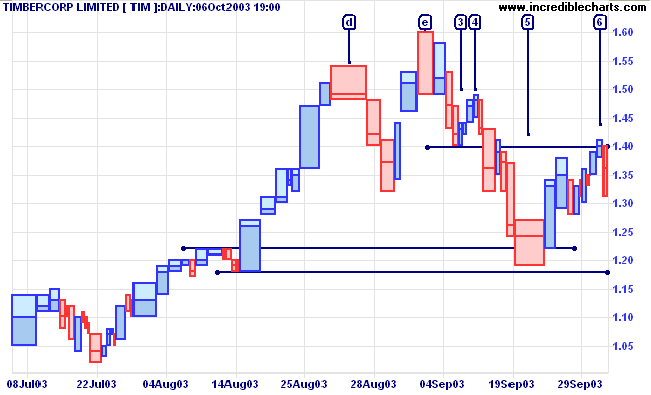

The double top at [d] and [e] is an intermediate bear signal.

The double top at [d] and [e] is an intermediate bear signal.

The equivolume chart shows that the two highs are not exactly

equal: [d] signals strong selling pressure with a square bar; [e]

displays less volume but still closes weakly. The lower high [4]

and subsequent lower low signals that the intermediate trend has

turned down. Price ended a two-thrust counter-trend at [5], with

strong buying support signaled by heavy volume and a weak close.

A weak rally followed, encountering resistance at [6].

A break above 1.40 on strong volume will signal a re-test of

resistance at 1.60. Watch out for a primary double top pattern,

if TIM forms another equal high.

A fall below 1.18 will be a strong bear signal.

A fall below 1.18 will be a strong bear signal.

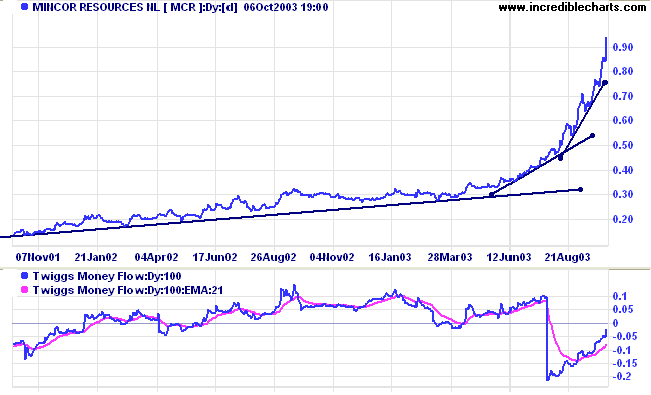

Mincor [MCR]

Mincor appears to be headed for a sharp blow-off reversal.

Twiggs Money Flow (100) is rising rapidly after an earlier fall.

Mincor appears to be headed for a sharp blow-off reversal.

Twiggs Money Flow (100) is rising rapidly after an earlier fall.

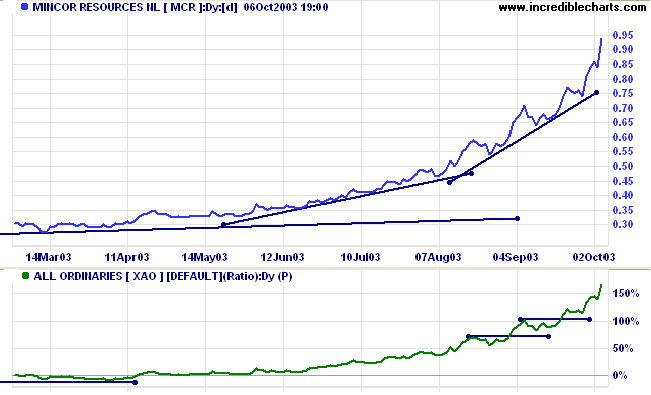

Relative Strength (price ratio: xao) reflects the same

accelerating up-trend.

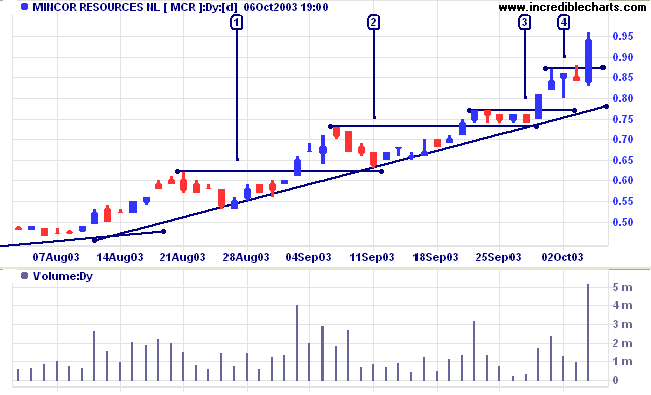

The daily volume chart shows clear signs of acceleration:

- Counter-trends are shorter, with a one day reversal at [4], after 4-day counter-trends at [1], [2] and [3];

- The gap between the low of each reversal and the previous high is increasing - one of Bill McLaren's strongest signals;

- Volume and volatility are increasing on each breakout above the previous high.

Continued volatility, gaps and high volumes may signal a good

time to lock in profits with a

trailing % stop.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

We are group animals still, and there is nothing

wrong with that.

But what is dangerous is not the belonging to a group, or groups,

but not understanding the social laws that govern groups and govern us.

When we're in a group, we tend to think as that group does:

we may even have joined the group to find 'like-minded' people.

But we also find our thinking changing because we belong to a group.

It is the hardest thing in the world to maintain an individual dissident opinion,

as a member of a group.

~ Doris Lessing: Prisons We Choose To Live Inside (1994).

But what is dangerous is not the belonging to a group, or groups,

but not understanding the social laws that govern groups and govern us.

When we're in a group, we tend to think as that group does:

we may even have joined the group to find 'like-minded' people.

But we also find our thinking changing because we belong to a group.

It is the hardest thing in the world to maintain an individual dissident opinion,

as a member of a group.

~ Doris Lessing: Prisons We Choose To Live Inside (1994).

Recently Charted Stocks

To re-open a recently charted stock, select

Securities >> Re-Open

to display a list of the 20 most recently charted stocks.

Only stocks from the current session are displayed.

to display a list of the 20 most recently charted stocks.

Only stocks from the current session are displayed.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.