|

ETOs and

Warrants We are making progress. ETOs and warrants will be available shortly. US stocks to follow. |

Trading Diary

October 2, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

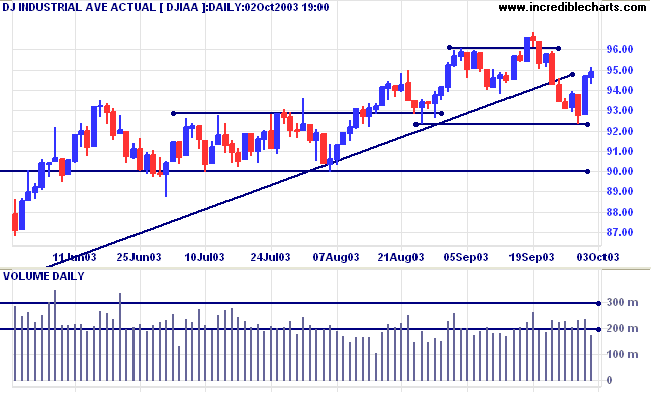

After Wednesday's sharp rally, the Dow Industrial Average

consolidated, closing slightly up at 9488 on low volume.

The intermediate trend is still down.

The index is below the upward trendline, signaling primary trend weakness. A fall below 9000 will signal reversal.

The intermediate trend is still down.

The index is below the upward trendline, signaling primary trend weakness. A fall below 9000 will signal reversal.

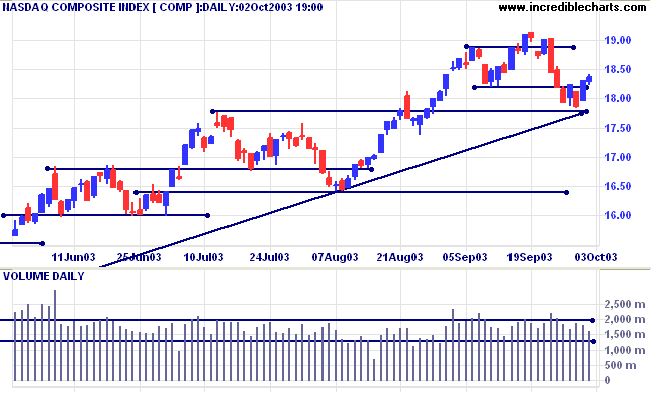

The Nasdaq Composite made a similar consolidation, closing up 4

points at 1836 on average volume.

The intermediate trend is down.

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

The intermediate trend is down.

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

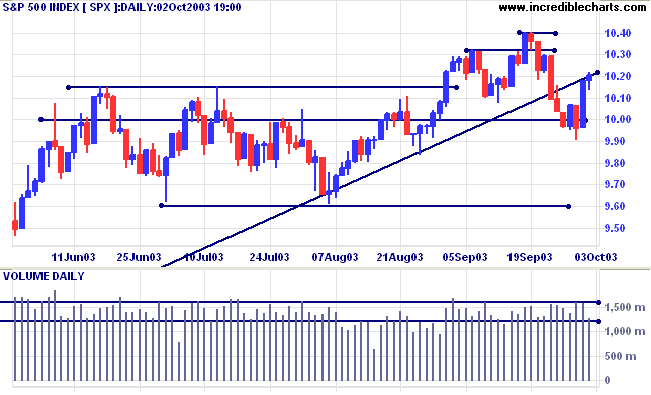

The S&P 500 rallied 22 points to close at 1018 on lower

volume.

The intermediate down-trend is weak.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

The intermediate down-trend is weak.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

The Chartcraft NYSE Bullish % Indicator rallied

to 78.95% (October 2).

Market Strategy

Short-term: Bearish below 1013. Bullish above 1040.

Intermediate: Bearish below 960. Bullish above 1040.

Long-term: Bullish above 960.

Short-term: Bearish below 1013. Bullish above 1040.

Intermediate: Bearish below 960. Bullish above 1040.

Long-term: Bullish above 960.

Jobless claims rise

New unemployment claims increased to 399,000 from a revised 386,000 in the previous week. (more)

New unemployment claims increased to 399,000 from a revised 386,000 in the previous week. (more)

Treasury yields

The yield on 10-year treasury notes rose slightly to 4.01%, after 2 days below support at 4.00%.

The intermediate trend is down.

The primary trend is up.

The yield on 10-year treasury notes rose slightly to 4.01%, after 2 days below support at 4.00%.

The intermediate trend is down.

The primary trend is up.

Gold

New York (17:30): Spot gold eased to $382.30.

The primary trend is up. Expect heavy resistance between 400 and 415 (the 10-year high).

New York (17:30): Spot gold eased to $382.30.

The primary trend is up. Expect heavy resistance between 400 and 415 (the 10-year high).

ASX Australia

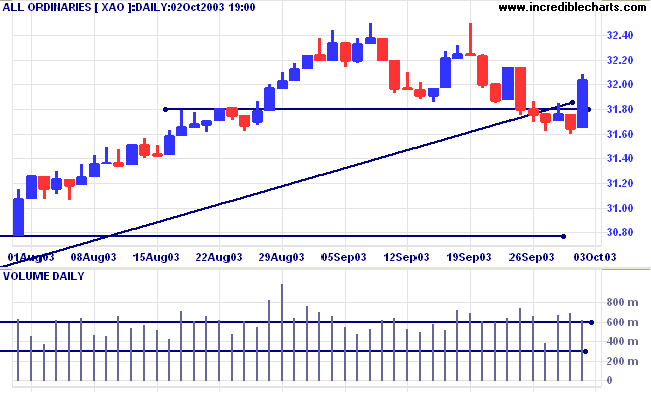

Confirming the influence of the US markets over the All

Ordinaries, the local index rallied 38 points to close at 3203 on

strong volume. Expect resistance at 3214 and 3250.

The intermediate trend is down.

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above;

Twiggs Money Flow (21) signals distribution.

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above;

Twiggs Money Flow (21) signals distribution.

Market Strategy

Short-term: Bullish if the All Ords is above 3250. Bearish below 3160.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

Short-term: Bullish if the All Ords is above 3250. Bearish below 3160.

Intermediate: Bullish above 3250.

Long-term: Bullish above 3000.

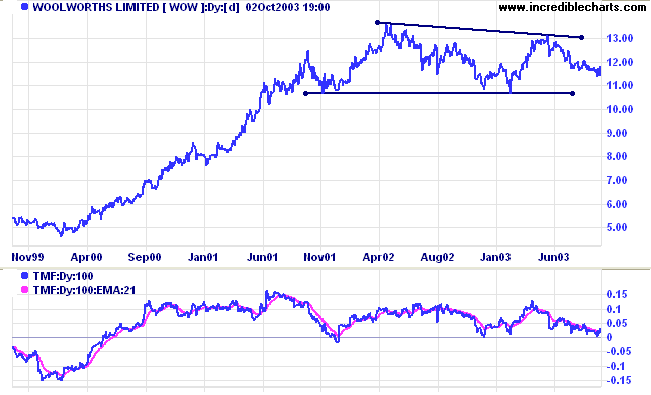

Woolworths [WOW]

Last covered on July 24, 2003.

Woolworths has formed a broad stage 3 top. Twiggs Money Flow (100) threatens to cross below zero. MACD is bearish.

Last covered on July 24, 2003.

Woolworths has formed a broad stage 3 top. Twiggs Money Flow (100) threatens to cross below zero. MACD is bearish.

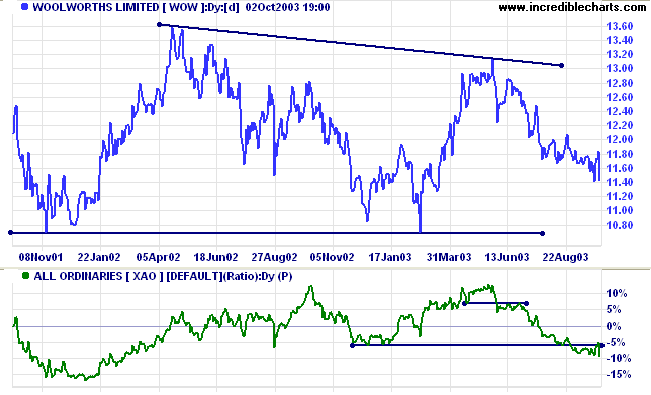

Relative Strength (price ratio: xao) has fallen to a new 6-month

low, signaling primary weakness.

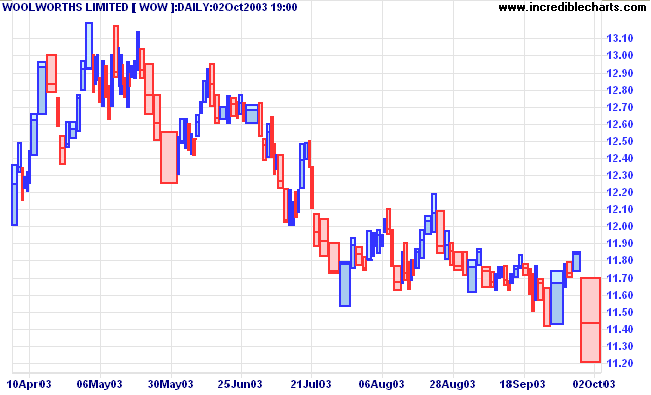

The latest bar on the equivolume chart signals buying support,

with strong volume and a weak close. A fall below 11.40 will

signal further weakness.

A close below 10.70 will be a strong bear signal. The

target is 7.80 (10.70 - (13.60 - 10.70)).

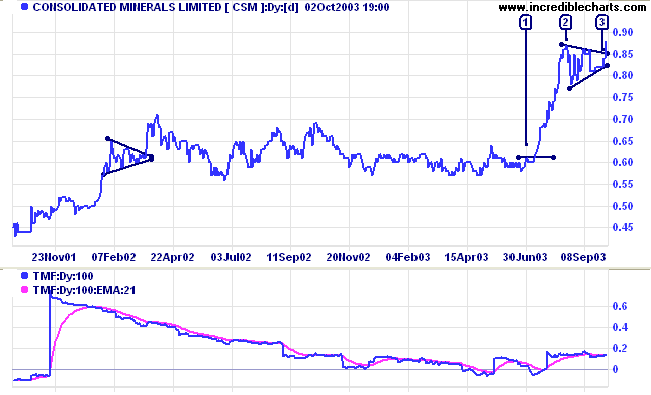

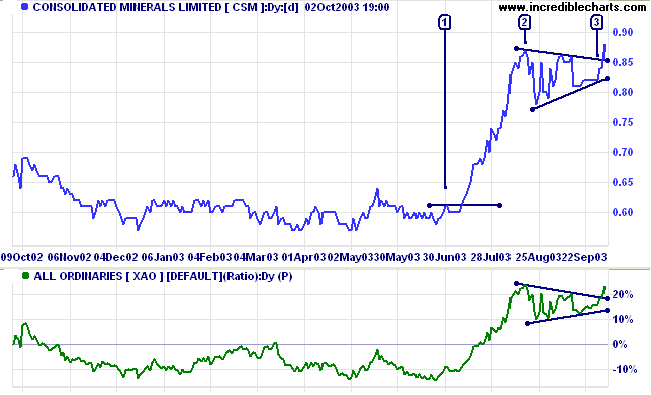

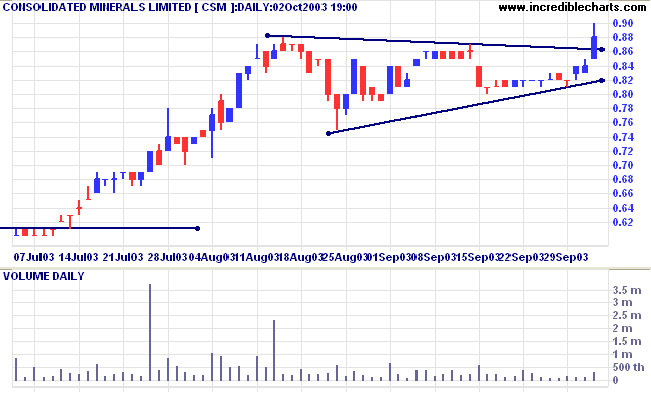

Consolidated Minerals [CSM]

An ASX 300 stock, CSM broke out of a broad consolidation, rallying strongly before forming a triangle pattern. Twiggs Money Flow (100) signals accumulation. MACD has formed a bullish trough above zero.

An ASX 300 stock, CSM broke out of a broad consolidation, rallying strongly before forming a triangle pattern. Twiggs Money Flow (100) signals accumulation. MACD has formed a bullish trough above zero.

Triangles are generally continuation patterns in an up-trend,

commonly occurring at the mid-point in an up-trend. So the target

is measured from the previous breakout point [1] to the highest

point of the triangle [2] and then projected upwards from the

breakout [3]. In this example, the target would be 1.11 (0.85 +

0.87 - 0.61). I prefer to measure from the closing price, rather

than the high or low.

Relative Strength has formed a similar pattern.

Relative Strength has formed a similar pattern.

There is no significant increase in daily volume at the breakout,

a sign of weakness. We may well see a pull-back to re-test

support before the stock makes further gains.

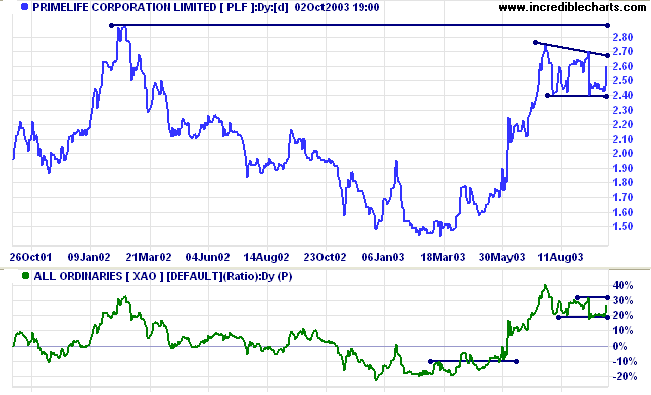

Primelife [PLF]

Another ASX 300 stock shows a similar mid-point consolidation after a strong rally. But there is one major difference: overhead resistance at 2.90. The target should be adjusted accordingly.

Another ASX 300 stock shows a similar mid-point consolidation after a strong rally. But there is one major difference: overhead resistance at 2.90. The target should be adjusted accordingly.

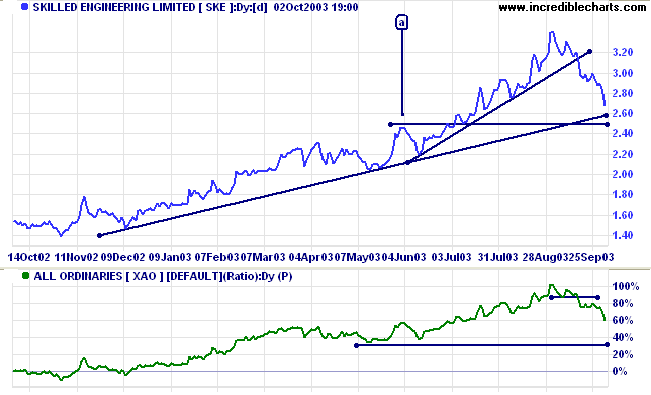

Skilled Engineering [SKE]

SKE has corrected sharply after a healthy rally off the long-term trendline. We are likely to see a re-test of the supporting trendline. Short-term and intermediate traders may find long opportunities if volume and volatility dry up, or there is a strong reversal signal, at the trendline.

SKE has corrected sharply after a healthy rally off the long-term trendline. We are likely to see a re-test of the supporting trendline. Short-term and intermediate traders may find long opportunities if volume and volatility dry up, or there is a strong reversal signal, at the trendline.

The test of the trendline and the high of the previous peak [a]

often coincide, reinforcing the support level. Where they do not,

as in the above chart, there may well be a break of the

trendline. But long opportunities may well present themselves at

the 2.50 support level.

A close below 2.50 will be bearish, while a close below 2.00 would signal reversal of the primary trend.

A close below 2.50 will be bearish, while a close below 2.00 would signal reversal of the primary trend.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

Sincere words are not showy;

Showy words are not sincere.

Those who know are not "widely learned";

Those "widely learned" do not know.

The good do not have a lot;

Those with a lot are not good.

~ Lao Tse.

Showy words are not sincere.

Those who know are not "widely learned";

Those "widely learned" do not know.

The good do not have a lot;

Those with a lot are not good.

~ Lao Tse.

Format Charts: Bar sizes

|

To alter the width of the price bars,

separately from other indicators: (1) select Format Charts >> Indicator Width >> Set Candle/OHLC/Parabolic SAR Width; (2) enter a value between 1 and 5 in the pop-up box; (3) click OK. I have set the All Ordinaries chart above as an example: Indicator Width is 2, but Candle Width is set at 3. Note the difference between the price and volume bars on the chart. |

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.