|

ETOs and

Warrants ETOs and warrants will be available shortly. US stocks to follow. |

Trading Diary

September 26, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

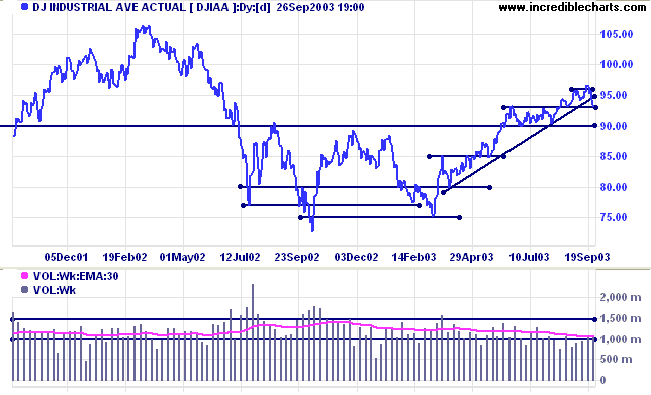

The Dow Industrial Average declined to 9313, testing support at

9300.

The intermediate trend is weak, with continued low volume.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 9000 will signal reversal.

The intermediate trend is weak, with continued low volume.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 9000 will signal reversal.

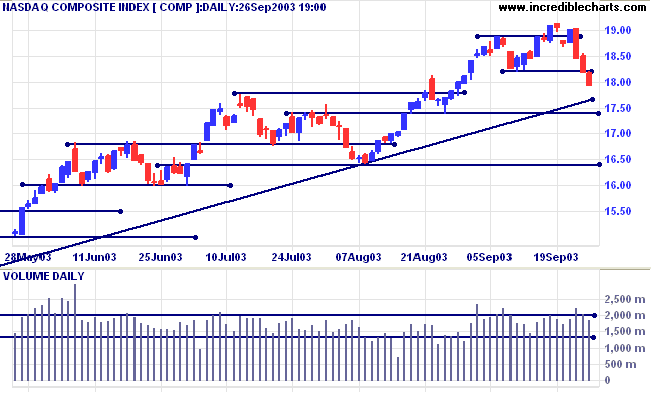

The Nasdaq Composite closed down 26 points at 1792 on lower

volume.

The intermediate trend has turned down.

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

The intermediate trend has turned down.

The primary trend is up. Price appears headed for a re-test of the supporting trendline. A fall below 1640 will signal reversal.

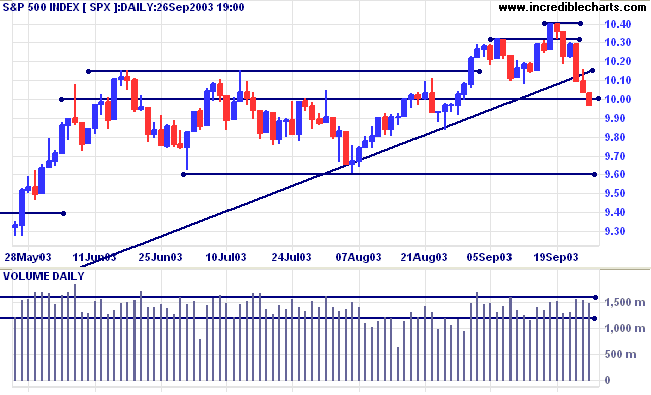

The S&P 500 broke through support at 1000 to close at 997 on

lower volume.

The intermediate trend is weak.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

The intermediate trend is weak.

The primary trend is up. The trendline has been broken, signaling weakness. A fall below 960 will signal reversal.

The Chartcraft NYSE Bullish % Indicator fell

sharply to 78.81% (September 26).

Market Strategy

Short-term: Bullish if the S&P500 is above 1008. Bearish below 1000.

Intermediate: Bullish above 1008.

Long-term: Bullish above 1008.

Short-term: Bullish if the S&P500 is above 1008. Bearish below 1000.

Intermediate: Bullish above 1008.

Long-term: Bullish above 1008.

Consumer sentiment falls

The University of Michigan index of consumer sentiment fell to 87.7 for September, from 89.3 in August. (more)

The University of Michigan index of consumer sentiment fell to 87.7 for September, from 89.3 in August. (more)

Treasury yields

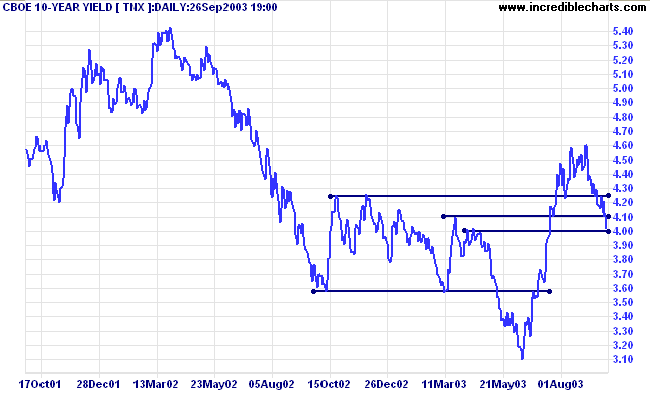

The yield on 10-year treasury closed down at 4.02%, testing support between 4.10% to 4.00%.

The intermediate trend has turned down.

The primary trend is up. A close below 4.00% will signal weakness.

The yield on 10-year treasury closed down at 4.02%, testing support between 4.10% to 4.00%.

The intermediate trend has turned down.

The primary trend is up. A close below 4.00% will signal weakness.

Gold

New York (13.30): Spot gold broke through resistance at 382, rising as high as 393 before retreating back to 380.20.

The primary trend is up.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321), but expect heavy resistance between 400 and 415 (the 10-year high).

New York (13.30): Spot gold broke through resistance at 382, rising as high as 393 before retreating back to 380.20.

The primary trend is up.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321), but expect heavy resistance between 400 and 415 (the 10-year high).

ASX Australia

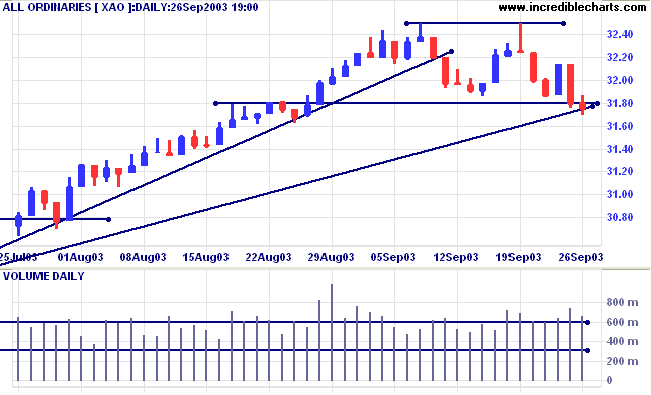

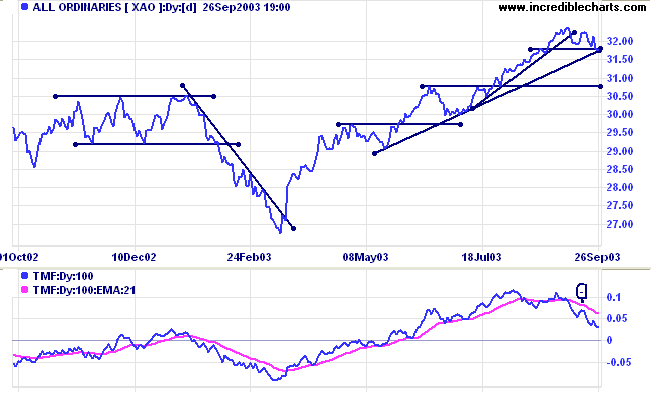

The All Ordinaries broke below support at 3180, closing 4 points

lower at 3176. Strong volume and a narrow range signal buying

support above the long-term trendline.

The intermediate trend has turned down. The next support level is

at 3080.

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below;

Twiggs Money Flow (100) displays a bearish peak [-] below the signal line.

The primary trend is up. A fall below 3000 will signal reversal.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) is below;

Twiggs Money Flow (100) displays a bearish peak [-] below the signal line.

Market Strategy

Short-term: Bullish if the All Ords is above 3214. Bearish below 3170.

Intermediate: Bullish above 3214.

Long-term: Bullish above 3180.

Short-term: Bullish if the All Ords is above 3214. Bearish below 3170.

Intermediate: Bullish above 3214.

Long-term: Bullish above 3180.

Sector Analysis

Changes are highlighted in bold.

Changes are highlighted in bold.

- Energy [XEJ] - stage 2 (RS is rising).

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 1 (RS is level)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is rising)

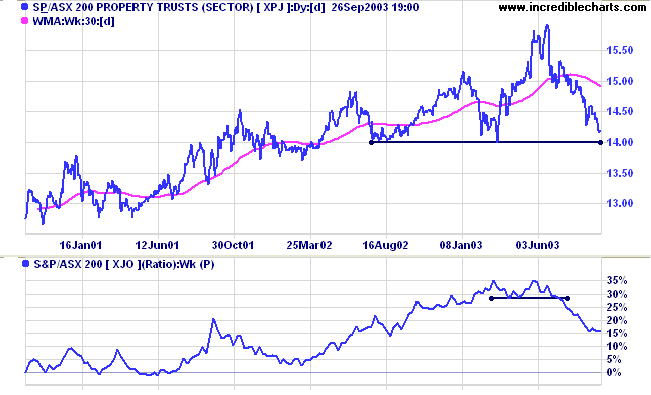

- Property Trusts [XPJ] - stage 3 (RS is falling)

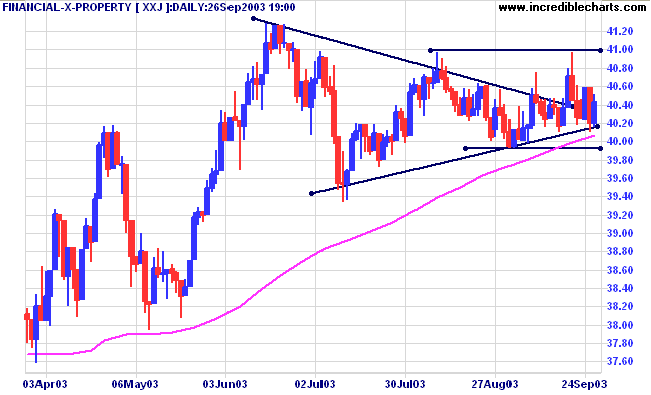

- Financial excl. Property Trusts [XXJ] - stage 2 (RS is level)

- Information Technology [XIJ] - stage 2 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is level).

- Utilities [XUJ] - stage 3 (RS is falling)

Financial index [ XXJ] completed a symmetrical triangle with an

upward breakout on September 18. The index, however, failed to

make further gains, pulling back to re-test support. Further

consolidation lies ahead, with resistance at 4100 and support at

3992.

Property Trusts [XPJ] has formed a large stage 3 top pattern.

Support at 1400 has, so far, held firm. A break below this level

will signal the start of a stage 4 down-trend.

Sectors: Relative Strength

A stock screen of the ASX 200 using % Price Move (1 month: +5%) has fallen to 54 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

A stock screen of the ASX 200 using % Price Move (1 month: +5%) has fallen to 54 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Gold (6)

- Diversified Metals & Mining (4)

- Diversified Commercial (3)

- Diversified Financial (3)

- Oil & Gas Exploration & Production (3)

Daily Trading Diary

Stocks analyzed during the week were:

Stocks analyzed during the week were:

- Billabong - BBG

- Globe International - GLB

- Kingsgate - KCN

- Sons Of Gwalia - SGW

- Newcrest - NCM

- Computershare - CPU

- Higlands Pacific - HIG

Understanding

the Trading Diary has been expanded to offer further

assistance to readers, including

directions on how to search the archives.

Colin Twiggs

I began to feel more and more that much of the

success literature of the past 50 years was

superficial.......

In stark contrast, almost all the literature in the first 150 years or so focused on what could be called the Character Ethic as the foundation of success - things like integrity, humility, fidelity, temperance, courage, justice, patience, industry, simplicity, modesty and the Golden Rule. Benjamin Franklin's autobiography is representative of that literature. It is, basically, the story of one man's efforts to integrate certain principles and habits deep within his nature.

The Character Ethic taught that there are basic principles of effective living, and that people can only experience true success and enduring happiness as they learn and integrate these principles into their basic character.

~ Steven Covey: The Seven Habits of Highly Effective People.

In stark contrast, almost all the literature in the first 150 years or so focused on what could be called the Character Ethic as the foundation of success - things like integrity, humility, fidelity, temperance, courage, justice, patience, industry, simplicity, modesty and the Golden Rule. Benjamin Franklin's autobiography is representative of that literature. It is, basically, the story of one man's efforts to integrate certain principles and habits deep within his nature.

The Character Ethic taught that there are basic principles of effective living, and that people can only experience true success and enduring happiness as they learn and integrate these principles into their basic character.

~ Steven Covey: The Seven Habits of Highly Effective People.

Become a Premium Member

for only

$270

for only

$270

Includes

Incredible Charts Premium version with hourly

updates

and the Daily Trading Diary (click here for a free sample).

and the Daily Trading Diary (click here for a free sample).

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.