|

ETOs and

Warrants ETOs and warrants will be available shortly. US stocks will follow. |

Trading Diary

September 23, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

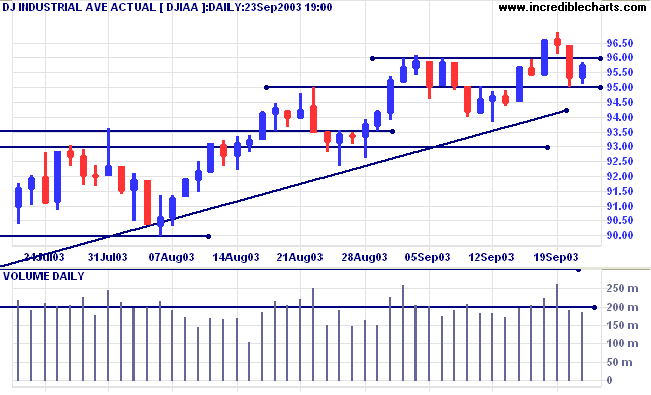

The Dow Industrial Average formed an inside day above support at

9500, closing at 9576 on low volume.

The intermediate trend is up. Continued low volume signals weakness. A fall below 9381 will be a bear signal.

The primary trend is up.

The intermediate trend is up. Continued low volume signals weakness. A fall below 9381 will be a bear signal.

The primary trend is up.

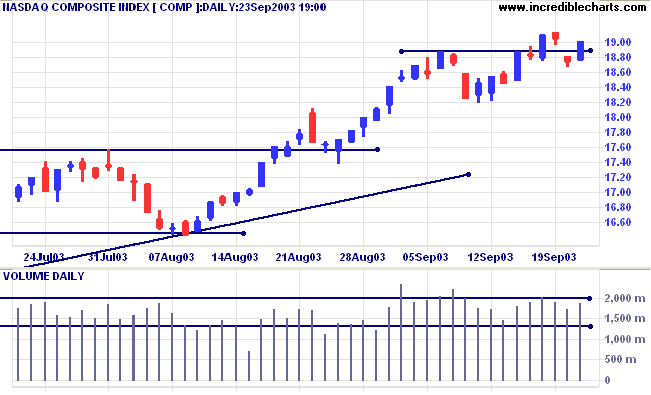

The Nasdaq Composite recovered 27 points to close at 1902 on

higher volume.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

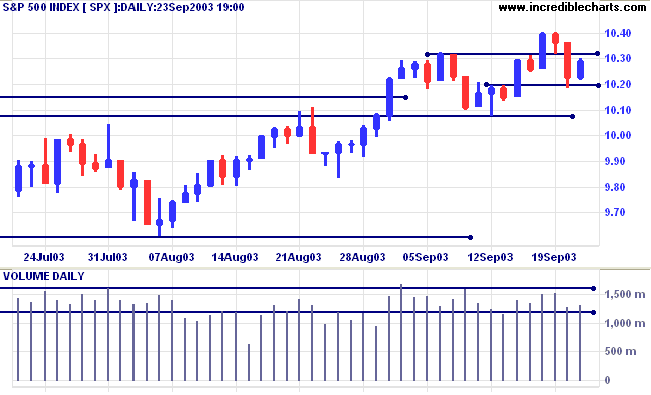

The S&P 500 consolidated with an inside day, closing 6 points

higher at 1029 on average volume.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator eased

slightly to 80.64% (September 23).

Market Strategy

Short-term: Long if the S&P500 is above 1030. Short if below 1008.

Intermediate: Long if S&P 500 is above 1030.

Long-term: Long is the index is above 1008.

Short-term: Long if the S&P500 is above 1030. Short if below 1008.

Intermediate: Long if S&P 500 is above 1030.

Long-term: Long is the index is above 1008.

Small business optimistic

A survey of small-business owners reflects a large jump in optimism. (more)

A survey of small-business owners reflects a large jump in optimism. (more)

Treasury yields

The yield on 10-year treasury notes eased to 4.21%, above the band of support at 4.10% to 4.00%.

The intermediate and primary trends are both up.

The yield on 10-year treasury notes eased to 4.21%, above the band of support at 4.10% to 4.00%.

The intermediate and primary trends are both up.

Gold

The first chart I check every morning is gold. The New York (19.17) spot gold price has eased to $384.60.

The primary trend is up.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321). But expect heavy resistance at 400 to 415 (the 10-year high).

The first chart I check every morning is gold. The New York (19.17) spot gold price has eased to $384.60.

The primary trend is up.

The target for the symmetrical triangle is calculated as 426 (365 + 382 - 321). But expect heavy resistance at 400 to 415 (the 10-year high).

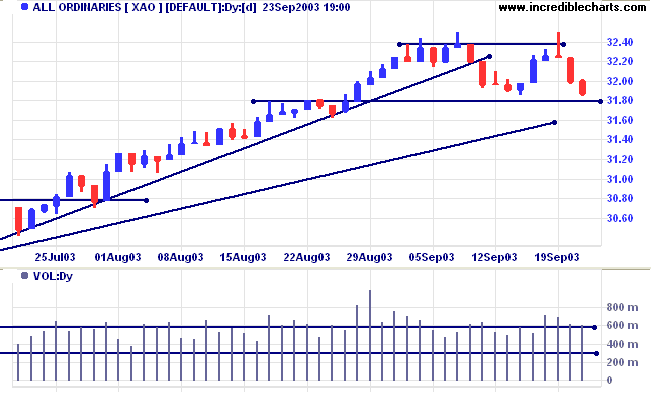

ASX Australia

The All Ordinaries lost a further 13 points to close at 3187 on

strong volume.

The intermediate up-trend is weak, with the index having broken

its intermediate trendline and formed two equal highs. A break

below 3180 will signal a reversal.

The primary trend is up.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to below;

Twiggs Money Flow signals distribution, after a bearish divergence.

The primary trend is up.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to below;

Twiggs Money Flow signals distribution, after a bearish divergence.

Market Strategy

Short-term: Long above 3201. Short if below 3180.

Intermediate: Long if the index is above 3201.

Long-term: Long if the index is above 3180.

Short-term: Long above 3201. Short if below 3180.

Intermediate: Long if the index is above 3201.

Long-term: Long if the index is above 3180.

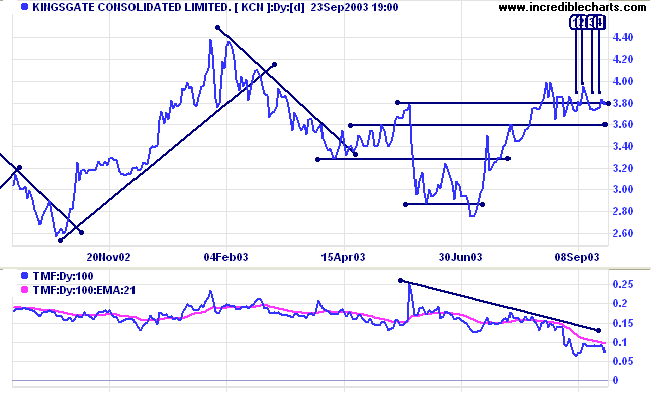

Kingsgate [KCN]

Last covered September 9, 2003.

Several gold stocks are, understandably, in fast up-trends. There are one or two laggards, however, that warrant closer inspection.

KCN has consolidated below resistance at 4.00 with Twiggs Money Flow (100) showing a bearish divergence.

Last covered September 9, 2003.

Several gold stocks are, understandably, in fast up-trends. There are one or two laggards, however, that warrant closer inspection.

KCN has consolidated below resistance at 4.00 with Twiggs Money Flow (100) showing a bearish divergence.

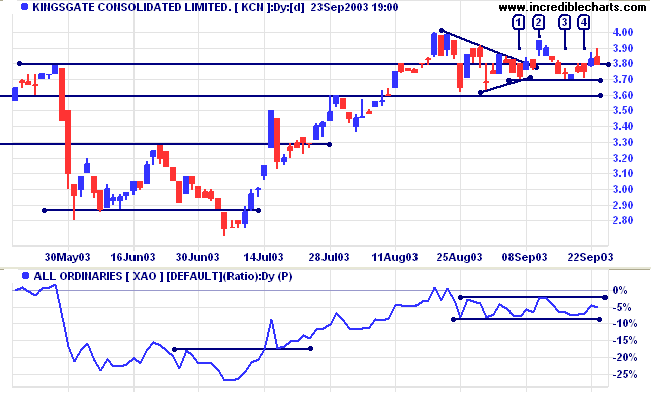

Relative Strength (Price Ratio: XAO) is oscillating in a narrow

range after a healthy rise. MACD is neutral.

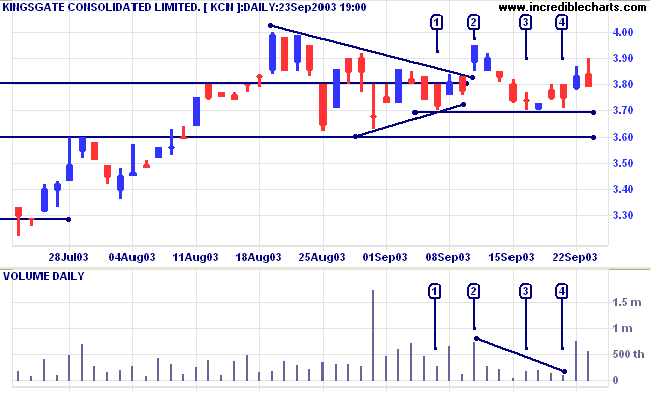

Price broke out of a pennant at [2] but has failed to rally,

pulling back to re-test support at 3.70. Volume has dried up at

[3] and [4], at the support level; a bullish sign.

In the short-term, a rise above 3.95 will be bullish, while a

fall below 3.70 would be bearish.

In the intermediate term, a fall below 3.60 would be a bear signal, while a rise above 4.00 will be bullish.

In the intermediate term, a fall below 3.60 would be a bear signal, while a rise above 4.00 will be bullish.

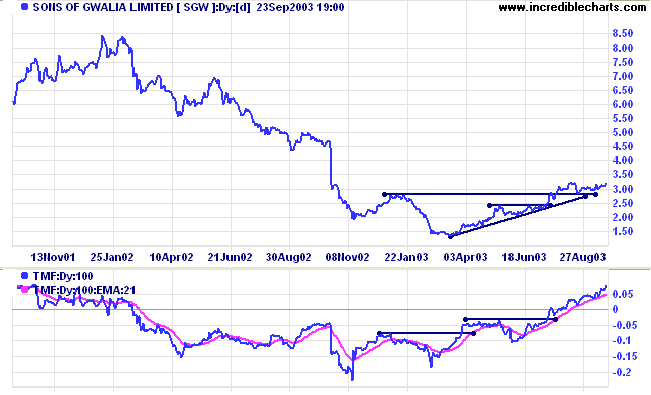

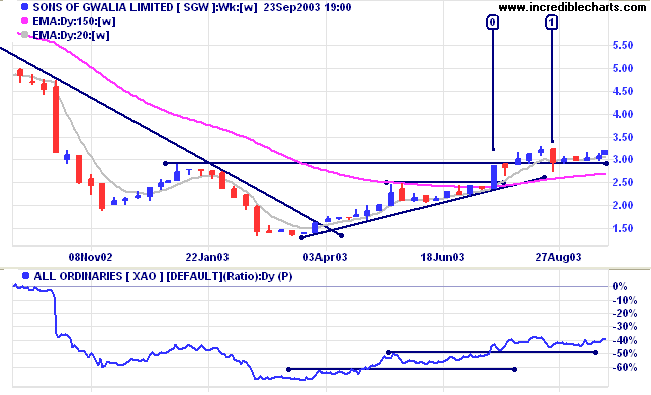

Sons of Gwalia [SGW]

Last covered September 9, 2003.

SGW has also been a bit slow out of the blocks, consolidating around 3.00 after a bullish ascending triangle at 2.50.

Twiggs Money Flow (100) signals accumulation after a bullish divergence, while MACD has formed two bullish troughs above zero.

Last covered September 9, 2003.

SGW has also been a bit slow out of the blocks, consolidating around 3.00 after a bullish ascending triangle at 2.50.

Twiggs Money Flow (100) signals accumulation after a bullish divergence, while MACD has formed two bullish troughs above zero.

Relative Strength (price ratio: xao) is rising steadily.

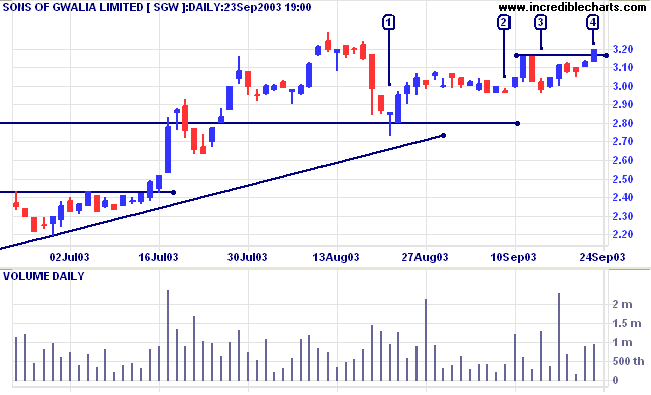

After the false break of the 2.80 support level at [1], price has

formed higher equal lows at [2] and [3]. The first low is

accompanied by low volume but the low at [3] shows higher volume.

I believe this to be due to buying support, because price

respects the support level, although the close is not

sufficiently weak to confirm this.

A rise above 3.29 will be an intermediate bull signal, while a

fall below 2.80 would be bearish.

Colin Twiggs

One of the most helpful things that anybody can

learn is to give up trying to catch the last eighth - or the

first.

These two are the most expensive eighths in the world.

~ Edwin Lefevre: Reminiscences of a Stock Operator (1923).

These two are the most expensive eighths in the world.

~ Edwin Lefevre: Reminiscences of a Stock Operator (1923).

|

Relative Strength/ Price

Ratio Thank you for the posts regarding Price Ratio and Price Comparison. There appear to be some members who prefer the existing method of calculation and it may be necessary to offer both options, at least for Relative Strength/Price Ratio. If you would like to express your opinion, please post at Chart Forum: Indicators. |

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.