|

Incredible Charts version 4.0.2.300 is now available Check Help >> About to ensure that your version has automatically updated. To scroll through a watchlist: (1) Open the Watchlist menu; (2) Set the Active Watchlist; (3) Scroll through the watchlist using the up/down arrows on the toolbar. To select a stock from the Active Watchlist: (1) Open the Watchlist menu; (2) Place your mouse over the Active Watchlist at the bottom of the menu; (3) Select a security from the pop-up list. See Watchlists for further details. |

Trading Diary

August 25, 2003

These extracts from my daily trading diary

are for educational purposes

and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

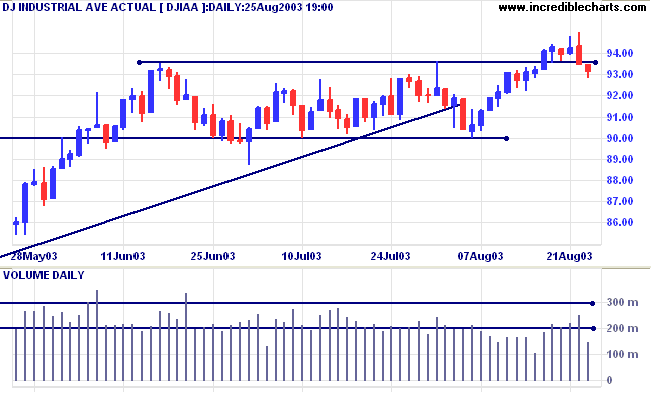

The Dow closed below the new 9350 support level, down 0.3% at

9318. Volume is reassuringly low.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

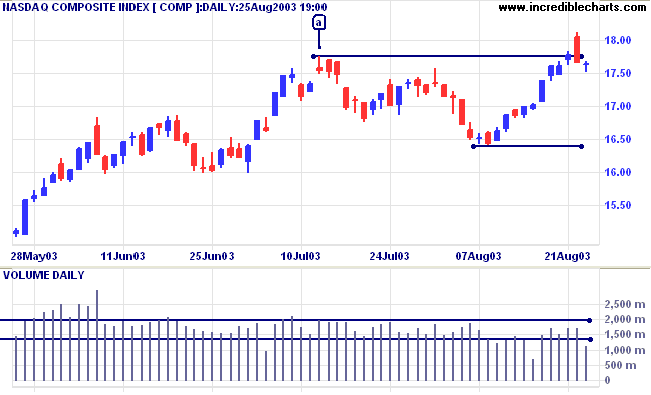

The Nasdaq Composite lost 1 point to close at 1764, after a false

break above the previous high [a]. Volume is, again, reassuringly

low.

Equal highs in an up-trend are not particularly bearish - unless the index falls below the intervening low of 1640.

The intermediate trend is up.

The primary trend is up.

Equal highs in an up-trend are not particularly bearish - unless the index falls below the intervening low of 1640.

The intermediate trend is up.

The primary trend is up.

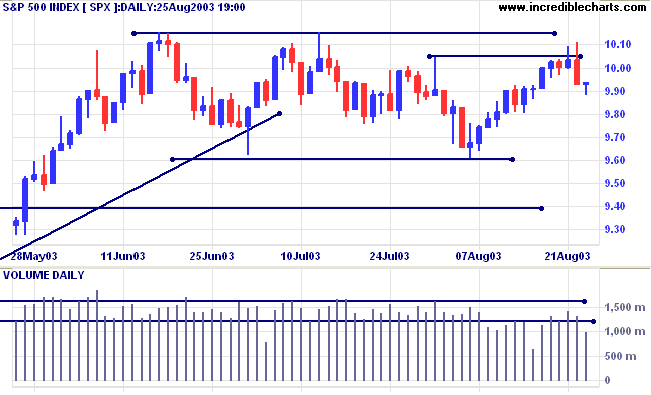

The S&P 500 closed up 1 point at 994 on lower volume.

The intermediate trend is down.

The primary trend is up.

The intermediate trend is down.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator closed

last week at 76.71% (August 22).

Market Strategy

Short-term: Long if the S&P500 is above 1011. Short if below 988.

Intermediate: Long if S&P 500 is above 1015. Short if below 960.

Long-term: Long is the index is above 960.

Short-term: Long if the S&P500 is above 1011. Short if below 988.

Intermediate: Long if S&P 500 is above 1015. Short if below 960.

Long-term: Long is the index is above 960.

Dollar weakens against yen

The Nikkei's rise to a one year high is fuelling a switch from dollars to yen. (more)

The Nikkei's rise to a one year high is fuelling a switch from dollars to yen. (more)

Treasury yields

The yield on 10-year treasury notes closed up at 4.53%, ranging in a narrow band.

The intermediate and primary trends are both up.

The yield on 10-year treasury notes closed up at 4.53%, ranging in a narrow band.

The intermediate and primary trends are both up.

Gold

New York (20.27): Spot gold eased a dollar to $361.60.

The primary trend is up.

New York (20.27): Spot gold eased a dollar to $361.60.

The primary trend is up.

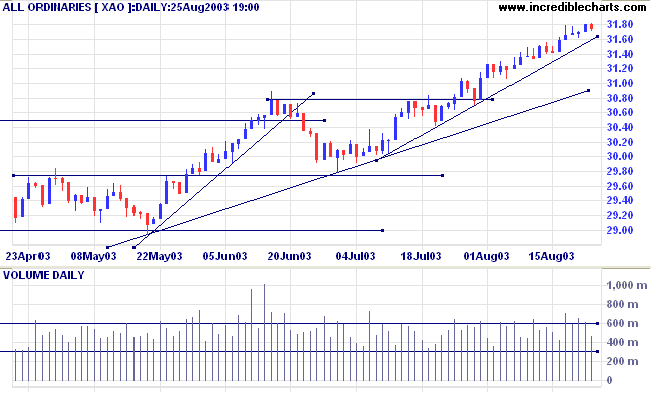

ASX Australia

The All Ordinaries retreated 5 points to close at 3175 on lower

volume.

The intermediate and primary trends are up.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is above;

Twiggs Money Flow signals accumulation.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is above;

Twiggs Money Flow signals accumulation.

Market Strategy

Short-term: Long if the All Ords is above 3182. Short if the intermediate trend reverses.

Intermediate: Long if the index is above 3182.

Long-term: Long positions if the index is above 2978 .

Short-term: Long if the All Ords is above 3182. Short if the intermediate trend reverses.

Intermediate: Long if the index is above 3182.

Long-term: Long positions if the index is above 2978 .

Diversified Metals & Mining

Stocks in this sector have recently featured strongly in the weekly stock screen that I do on % Price Move (1 month).

Stocks in this sector have recently featured strongly in the weekly stock screen that I do on % Price Move (1 month).

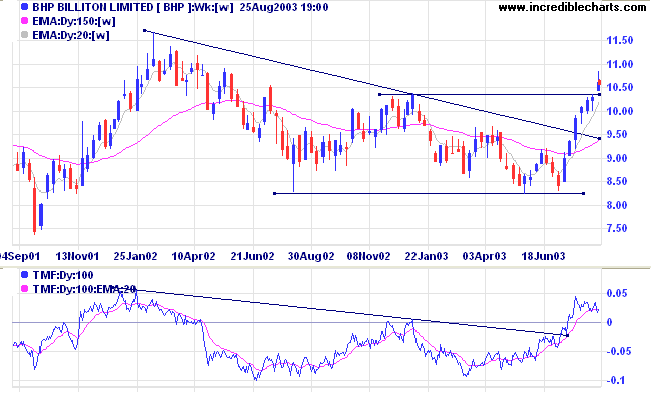

BHP Billiton [BHP] has formed a broad double bottom, recently

completed with a break out above the neckline.

Twiggs Money Flow (100) has risen above zero, to signal accumulation, after breaking its downward trendline.

Relative Strength threatens to make a new 2-year high, while MACD is bullish.

Twiggs Money Flow (100) has risen above zero, to signal accumulation, after breaking its downward trendline.

Relative Strength threatens to make a new 2-year high, while MACD is bullish.

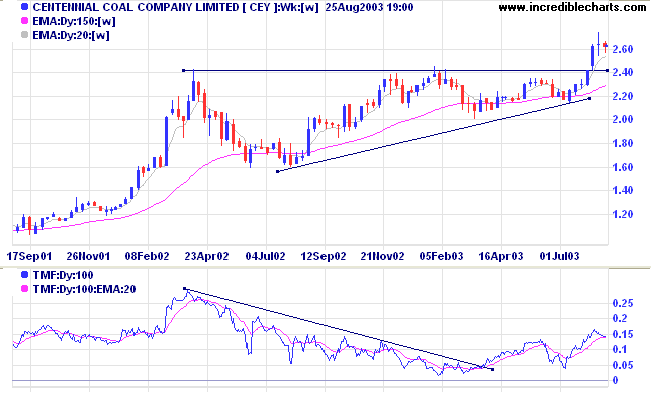

Centennial Coal [CEY] broke out of a bullish ascending

triangle.

Relative Strength has made a new 2-year high.

Traders should be alert for a pull-back to the new support level at 2.40 which may present entry opportunities.

Relative Strength has made a new 2-year high.

Traders should be alert for a pull-back to the new support level at 2.40 which may present entry opportunities.

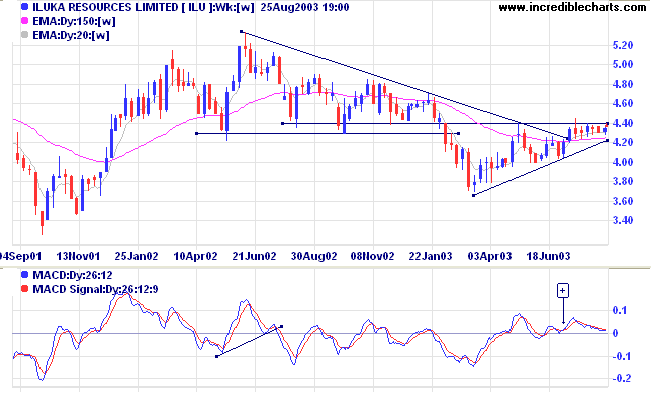

Iluka Resources [ILU] has formed a base in the shape of an

ascending triangle. Consolidation just below the 4.40 resistance

level for the past 7 weeks is a bullish sign.

Relative strength appears to be moving sideways, forming a base, while Twiggs Money Flow (100) has crossed to above zero and then pulled back to the zero line. MACD shows a bullish trough [+] above the zero line.

Relative strength appears to be moving sideways, forming a base, while Twiggs Money Flow (100) has crossed to above zero and then pulled back to the zero line. MACD shows a bullish trough [+] above the zero line.

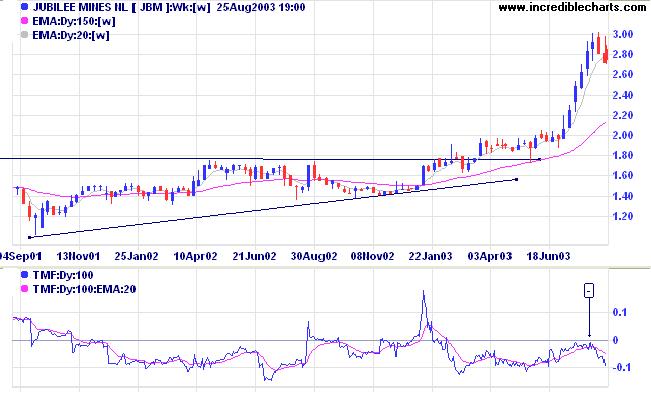

Jubilee Mines [JBM] shows a fast up-trend after breaking out of a

broad ascending triangle base at the beginning of the year.

The up-trend has now rolled over into what promises to be a sharp correction, judging from the strong bearish divergence [-] on Twiggs Money Flow (100).

MACD and Relative Strength have both turned down after a large spike.

The up-trend has now rolled over into what promises to be a sharp correction, judging from the strong bearish divergence [-] on Twiggs Money Flow (100).

MACD and Relative Strength have both turned down after a large spike.

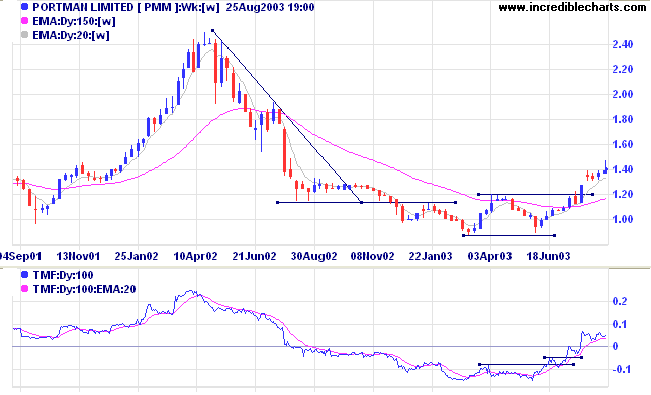

Portman Mining [PMM] has started a stage 2 rally after completing

a double bottom. Many traders will be hoping for a pull-back to

the new 1.20 support level to provide further entry

opportunities.

Relative Strength and Twiggs Money Flow (100) are rising, while MACD is also bullish.

Relative Strength and Twiggs Money Flow (100) are rising, while MACD is also bullish.

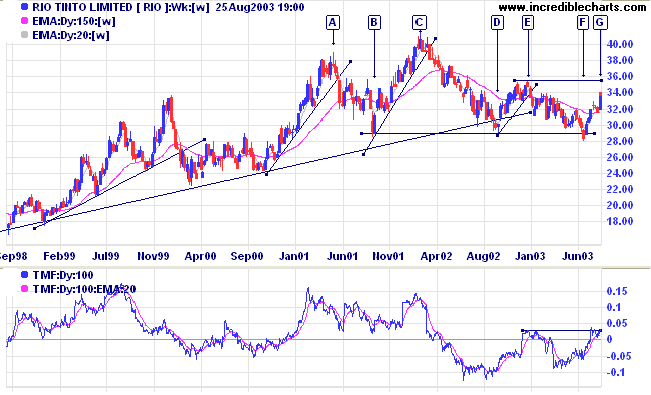

Rio Tinto [RIO] formed a head and shoulders at [A], [C] and [E]

but has respected the supporting neckline at 29.00. The trend is

weakening with a far shorter rally from [D] to [E], compared to

the earlier [B] to [C]. The acid-test will be the resistance

level at the high of [E]. Failure to breach this level will be a

strong bear signal and is likely to result in a fall below

29.00.

Twiggs Money Flow and Relative Strength appear to contradict this, making new 3-month highs, while MACD formed a bullish trough above zero; so we shall have to adopt a wait-and-see attitude until price reaches 35.00.

Twiggs Money Flow and Relative Strength appear to contradict this, making new 3-month highs, while MACD formed a bullish trough above zero; so we shall have to adopt a wait-and-see attitude until price reaches 35.00.

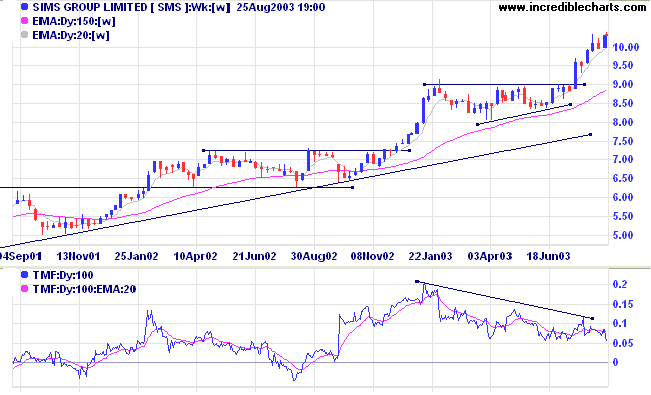

Sims Metal [SMS] is in a strong stage 2 up-trend.

Relative Strength has made a new 3-month high while MACD is bullish.

Twiggs Money Flow, however, shows a bearish divergence; so we need to be on the alert for a secondary correction.

Relative Strength has made a new 3-month high while MACD is bullish.

Twiggs Money Flow, however, shows a bearish divergence; so we need to be on the alert for a secondary correction.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers.

Colin Twiggs

Every organism has one and only one central

need in life, to fulfill its own potentialities.

~ Rollo May: Man's Search For Himself.

To set a default security that will load whenever Incredible

Charts opens:

(1) Open your Default Project (using File >> Open Project);

(2) Open the security that you want as a default;

(3) Select Securities >> Make the Current Security the Project Default.

Separate default securities can be set for each project. There is also an option to clear the project default.

(1) Open your Default Project (using File >> Open Project);

(2) Open the security that you want as a default;

(3) Select Securities >> Make the Current Security the Project Default.

Separate default securities can be set for each project. There is also an option to clear the project default.

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.