| Incredible Charts version 4.0.2.300 |

| The new version will be released in the next few days. Changes include a revised watchlist and securities menu, enabling the addition of ETOs, warrants and US stocks, and a new printer module, with greater printer compatibility and functionality. |

Trading Diary

August 15, 2003

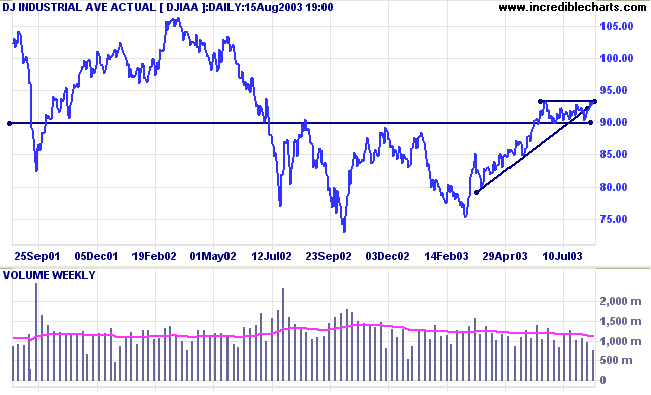

The intermediate trend is up.

The primary trend is up.

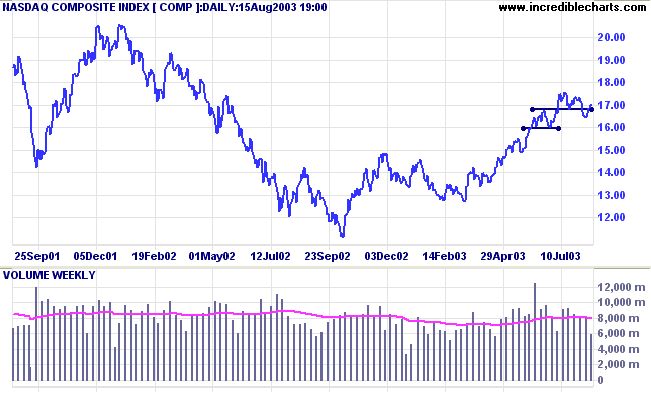

The intermediate trend is down.

The primary trend is up.

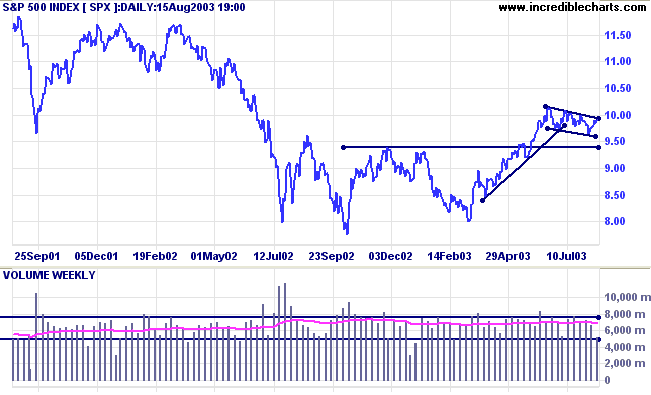

The intermediate trend is down.

The primary trend is up.

Short-term: Long if the S&P500 is above 1000. Short if below 986.

Intermediate: Long if S&P 500 is above 1015. Short if below 960.

Long-term: Long is the index is above 950.

The blackout resulted in low volumes but indexes mostly end the week flat. (more)

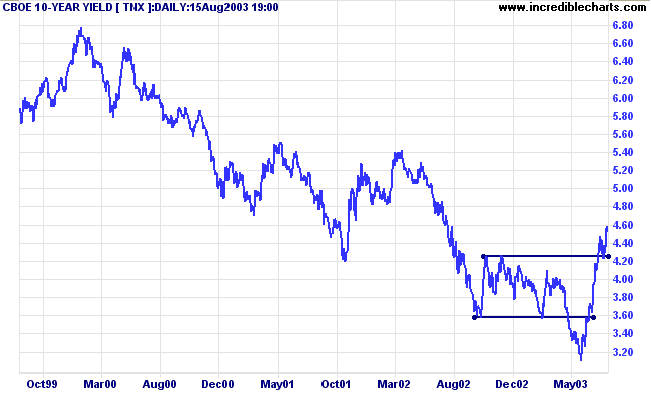

The yield on 10-year treasury notes closed at 4.53%, up 0.24% on last week.

The intermediate and primary trends are both up.

New York (13.30): Spot gold continues to climb, up 690 cents for the week, at $363.10.

The primary trend is still upwards.

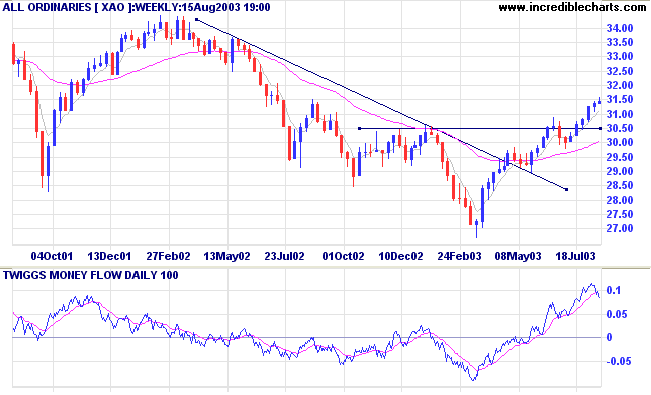

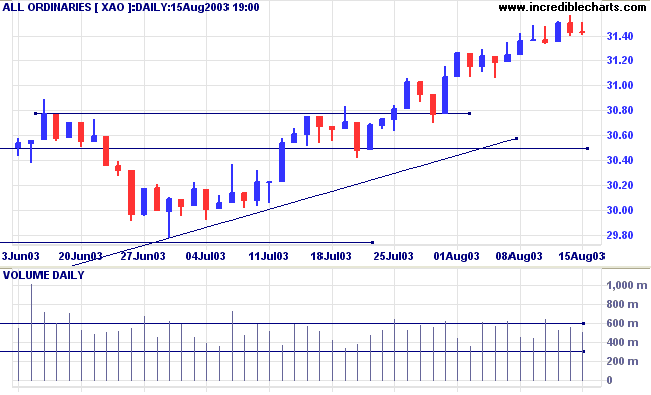

The intermediate trend is up. A fall below 2978 would signal a reversal.

The primary trend is up.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

MACD and Twiggs Money Flow (21) display bearish divergences.

Short-term: Long if the All Ords is above 3151. Short if the intermediate trend reverses.

Intermediate: Long if the index is above 3151.

Long-term: Long if the index is above 2978 .

Changes are highlighted in bold.

- Energy [XEJ] - stage 2 (RS is rising) This is an unstable V-bottom.

- Materials [XMJ] - stage 2 (RS is level)

- Industrials [XNJ] - stage 1 (RS is falling)

- Consumer Discretionary [XDJ] - stage 2 (RS is level)

- Consumer Staples [XSJ] - stage 1 (RS is falling)

- Health Care [XHJ] - stage 2 (RS is level)

- Property Trusts [XPJ] - stage 2 (RS is falling)

- Financial excl. Property Trusts [XXJ] - stage 2 (RS is falling)

- Information Technology [XIJ] - stage 1 (RS is rising)

- Telecom Services [XTJ] - stage 2 (RS is rising) Another V-bottom.

- Utilities [XUJ] - stage 2 (RS is falling)

A stock screen of the ASX 200 using % Price Move (1 month: +5%) declined to 65 stocks (compared to 131 on April 11, 2003; and 8 on March 14, 2003).

- Gold (7)

- Diversified Metals & Mining (5)

- Oil & Gas Exploration & Production (5)

- Health Care Facilities (3)

- Health Care Equipment (3)

- Construction Materials (3)

- Auto Parts & Equipment (3)

Stocks analyzed during the week were:

- Jubilee Mining - JBM

- Centennial Coal - CEY

- Portman Mining - PMM

- BHP Billiton - BHP

- Oxiana Resources - OXR

- Newcrest - NCM

- Croesus - CRS

- Infomedia - IFM

- Publishing & Broadcasting - PBL

- News Corporation - NCP

- Tabcorp Holdings - TAH

- Ansell - ANN

A healthy skepticism is seldom out of place in

Wall Street, so far as speculation is concerned. Money is

seldom lost thereby.

People who have had experience covering one or two panics know

very well that the first lesson that has to be learned by the

successful speculator is the avoidance of the disaster always

caused by a panic.

.....The successful speculator must be content at times to

ignore probably two out of every three apparent opportunities

to make money,

and must know how to sell and take his profits when the "bull"

chorus is loudest.

When he has learned that much, he has learned a great

deal.

~ SA Nelson: The ABC of Stock Speculation (1903).

| Backup |

|

Watchlist (.viz) and project (.ini) files

are stored in a folder on your computer. It is advisable to

back them up on a regular basis. If you do not regularly do backup, use the Import and Export Files commands to make a convenient copy. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues