| Incredible Charts version 4.0.2.300 |

| The new version will be released this week. Changes include a revised watchlist and securities menu, enabling the addition of ETOs, warrants and US stocks, and a new printer module, with greater printer compatibility and functionality. |

Trading Diary

August 11, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

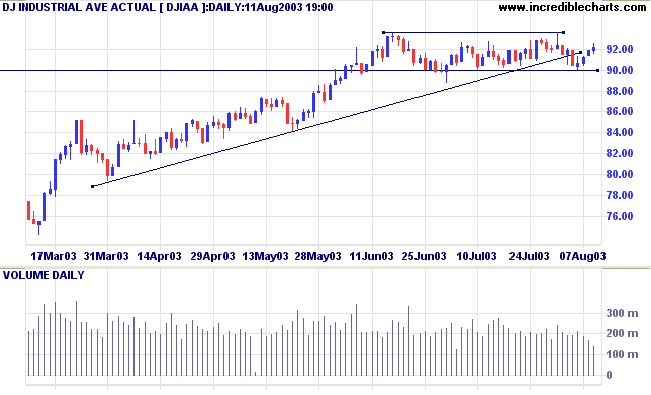

The Dow continues to consolidate above the 9000 support level,

closing up 0.3% at 9217 on lower volume.

The intermediate trend is up.

The primary trend is up.

The intermediate trend is up.

The primary trend is up.

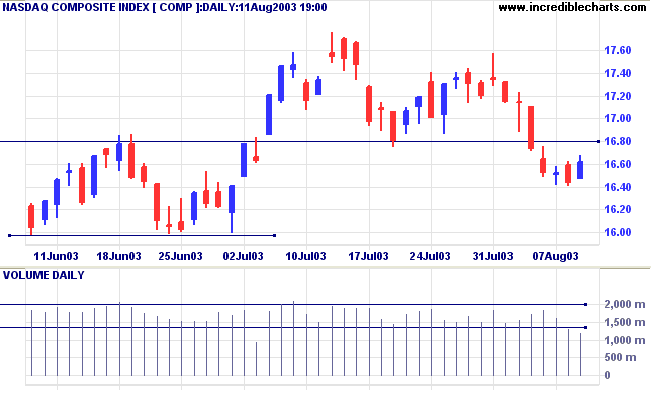

The Nasdaq Composite rallied to 1662 but on low volume. Unless

volume increases the index is unlikely to break above resistance

at 1680.

The intermediate trend is down.

The primary trend is up.

The intermediate trend is down.

The primary trend is up.

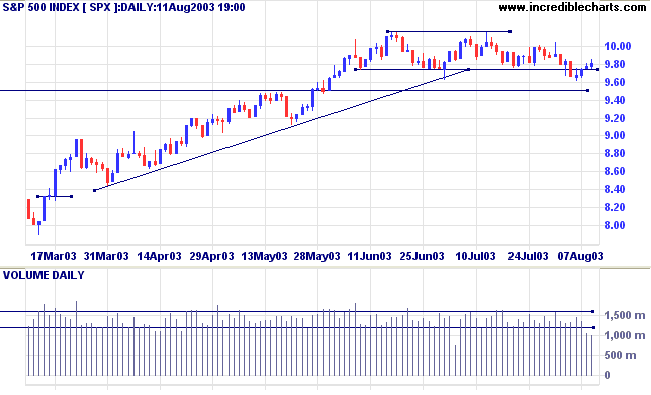

The S&P 500 gained 3 points to close at 981. Low volume

signals weakness.

The intermediate trend is down.

The primary trend is up.

The intermediate trend is down.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator is up

slightly at 74.35% (August 8).

Market Strategy

Short-term: Long if the S&P500 is above 1000. Short if below 974.

Intermediate: Long if S&P 500 is above 1015. Short if below 974.

Long-term: Long is the index is above 950.

Short-term: Long if the S&P500 is above 1000. Short if below 974.

Intermediate: Long if S&P 500 is above 1015. Short if below 974.

Long-term: Long is the index is above 950.

No rate cuts expected

The Fed is expected to leave interest rates unchanged at its Tuesday meeting. (more)

The Fed is expected to leave interest rates unchanged at its Tuesday meeting. (more)

Treasury yields

The yield on 10-year treasury notes rallied to 4.37%.

The intermediate and primary trends are both up.

The yield on 10-year treasury notes rallied to 4.37%.

The intermediate and primary trends are both up.

Gold

New York (17.16): Spot gold rallied to $361.20.

The primary trend is still upwards.

New York (17.16): Spot gold rallied to $361.20.

The primary trend is still upwards.

ASX Australia

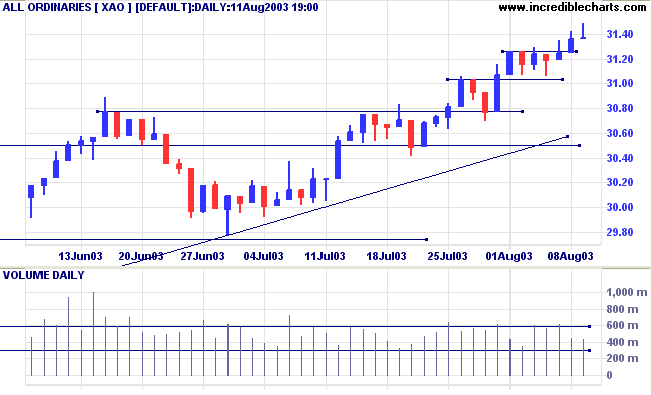

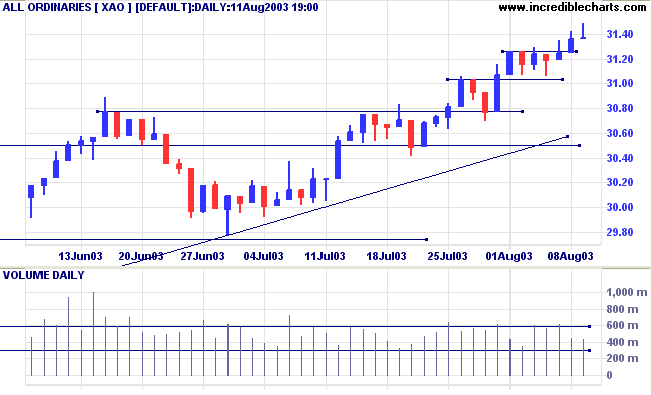

The All Ordinaries rallied in early trading but later retreated

to form a gravestone reversal signal, closing up 1 point at

3137 on lower volume.

The intermediate trend is up. A fall below 2978 would signal a reversal.

The primary trend is up.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

The intermediate trend is up. A fall below 2978 would signal a reversal.

The primary trend is up.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Market Strategy

Short-term: Long if the All Ords is above 3149. Short if the index falls below 2978.

Intermediate: Long if the index is above 3149.

Long-term: Long positions if the index is above 2978 .

Short-term: Long if the All Ords is above 3149. Short if the index falls below 2978.

Intermediate: Long if the index is above 3149.

Long-term: Long positions if the index is above 2978 .

RBA: Housing boom unsustainable

The Reserve Bank warns that the current rise in housing prices is unsustainable and financial institutions are vulnerable to a collapse in prices. (more)

The Reserve Bank warns that the current rise in housing prices is unsustainable and financial institutions are vulnerable to a collapse in prices. (more)

Diversified Metals & Mining

Several stocks from this sub-industry have shown strong growth over the last 3 months:

Several stocks from this sub-industry have shown strong growth over the last 3 months:

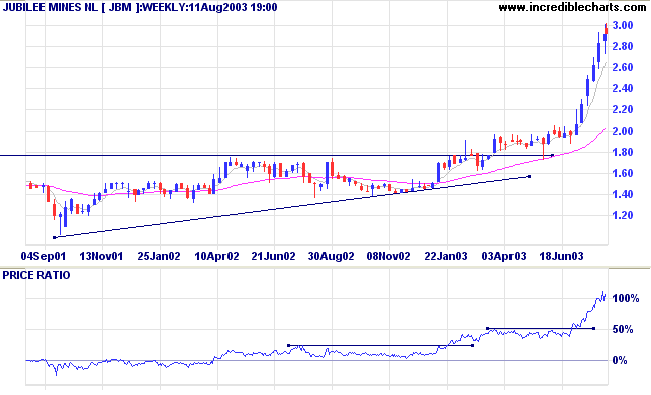

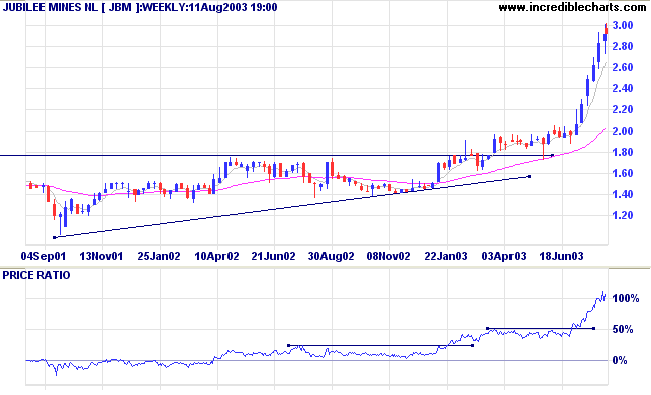

Jubilee Mines [JBM]

Last covered on July 31, 2003.

JBM is the top performer, having gained 54% in the last 3 months. Relative strength is rising strongly.

The rally is extended and appears due for a correction.

Last covered on July 31, 2003.

JBM is the top performer, having gained 54% in the last 3 months. Relative strength is rising strongly.

The rally is extended and appears due for a correction.

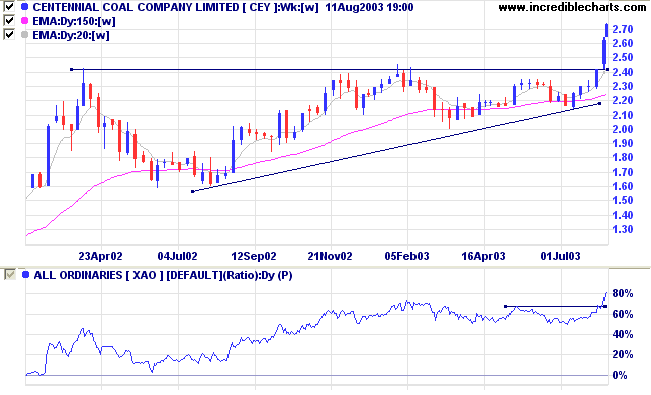

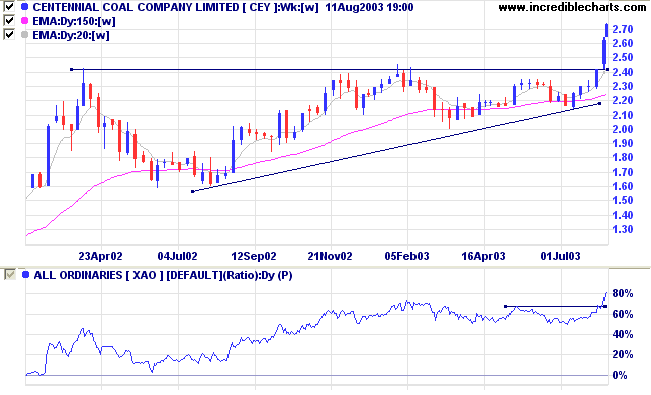

Cenennial [CEY]

Last covered on August 4, 2003.

CEY has broken out of an ascending triangle and made new 3-month highs on the Relative Strength and Twiggs Money Flow (100) indicators.

Last covered on August 4, 2003.

CEY has broken out of an ascending triangle and made new 3-month highs on the Relative Strength and Twiggs Money Flow (100) indicators.

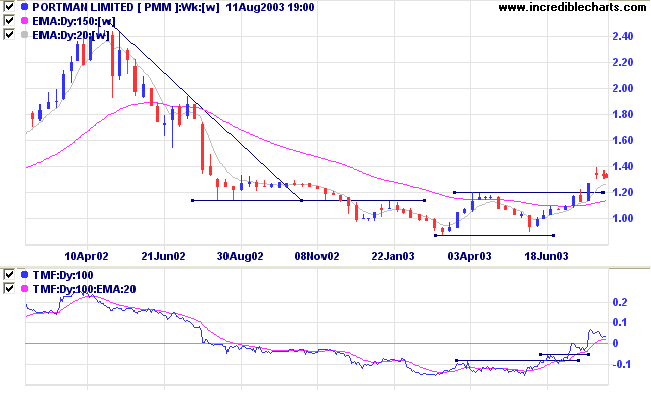

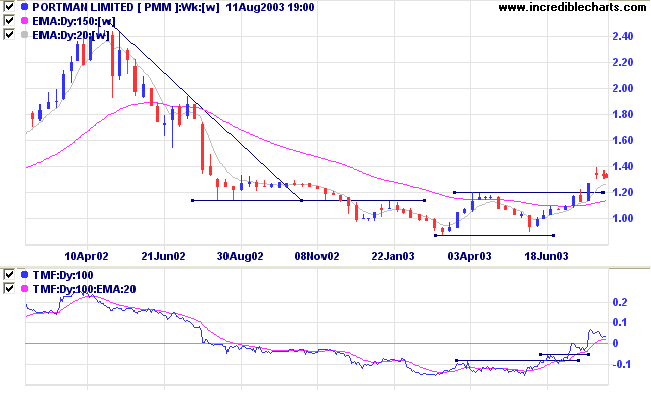

Portman [PMM]

Last covered on July 9, 2002.

PMM broke out of a broad stage 1 base, accompanied by strong volume.

Relative Strength and Twiggs Money Flow (100) are rising.

Last covered on July 9, 2002.

PMM broke out of a broad stage 1 base, accompanied by strong volume.

Relative Strength and Twiggs Money Flow (100) are rising.

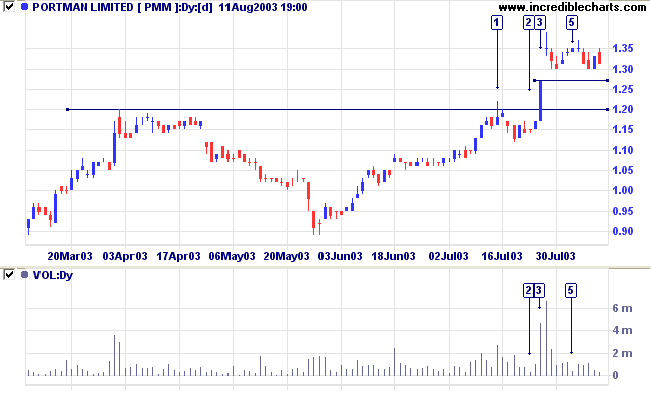

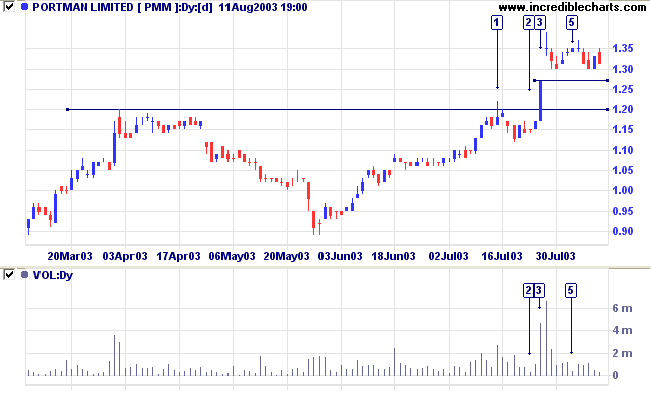

The daily volume chart shows hesitancy following the breakout

and we may see a pull-back to the 1.20 support level.

The first break at [1] proved to be a false break and was followed by a short-term entry point at [2], with a dry up of volume and volatility at the end of the correction. The break at [3] was followed by an upward gap on strong volume, exhausting short-term buying pressure. The subsequent rally to [5] displayed weak volume and failed to make new highs. Support levels are at 1.27, the high of [3], and at 1.20.

The first break at [1] proved to be a false break and was followed by a short-term entry point at [2], with a dry up of volume and volatility at the end of the correction. The break at [3] was followed by an upward gap on strong volume, exhausting short-term buying pressure. The subsequent rally to [5] displayed weak volume and failed to make new highs. Support levels are at 1.27, the high of [3], and at 1.20.

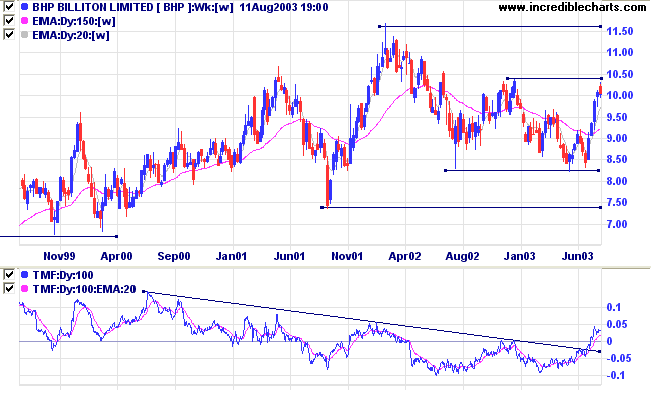

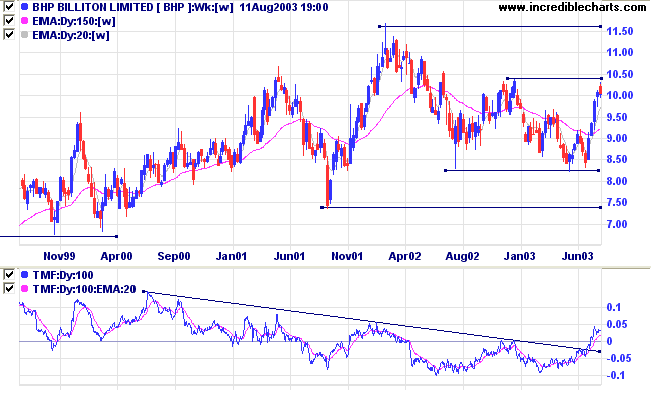

BHP Billiton [BHP]

Last covered on October 15, 2002.

BHP is approaching resistance at 10.30 after completing a double bottom, May to July 2003.

Twiggs Money Flow is rising while Relative Strength is neutral. Not exciting.

Last covered on October 15, 2002.

BHP is approaching resistance at 10.30 after completing a double bottom, May to July 2003.

Twiggs Money Flow is rising while Relative Strength is neutral. Not exciting.

Understanding

the Trading Diary has been expanded to offer further

assistance to readers.

Colin Twiggs

Laws Conditional # 6.

........It is better to act on general than on special

information (it is not so misleading), viz.: the state of the

country, the condition of the crops, manufactures, etc.

Statistics are valuable, but they must be kept subordinate to

a comprehensive view of the whole situation.........."When in

doubt do nothing." Don't enter the market on half conviction;

wait till the convictions are fully matured.

~ SA Nelson: The ABC of Stock Speculation (1903).

| Tip: Multiple Moving Averages |

|

Pre-set files are available with Daryl

Guppy's Multiple Moving Averages: Select File>>Open Project>>[Multiple Moving Averages - 12]. |

Back Issues

You can now view back issues at the Daily Trading Diary Archives.

You can now view back issues at the Daily Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.