| Delayed Diary |

|

Apologies for the late diary. We

experienced an error on the server web pages and had to wait for all cache servers to clear. |

Trading Diary

August 4, 2003

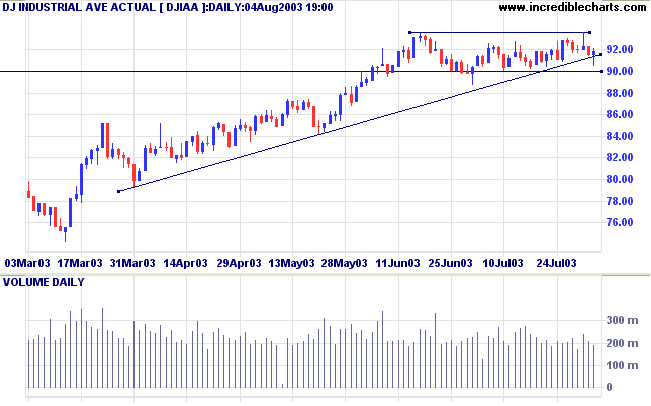

The intermediate trend is up. The index has formed a bullish ascending triangle with resistance at 9360. Support is at 9000.

The primary trend is up.

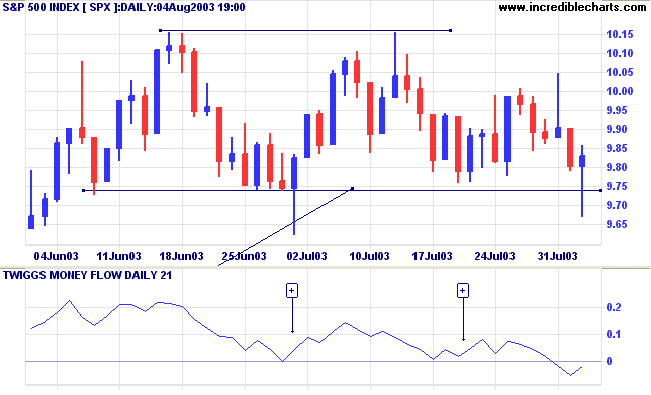

The intermediate trend is up. The index appears to be ranging between 1015 and 974. A fall below 974 will signal an intermediate down-trend.

Twiggs Money Flow (21) has crossed below zero, signaling distribution.

The primary trend is up.

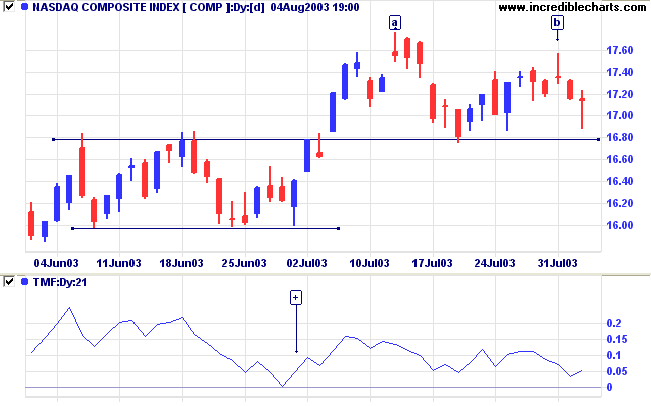

The intermediate trend is up. The index has formed a bearish lower high at [b]; a break below 1679 will signal a down-trend.

The primary trend is up.

Short-term: Long if the S&P500 is above 986. Short if below 974.

Intermediate: Long if S&P 500 is above 1015. Short if below 950.

Long-term: Long is the index is above 974.

August and September are, historically, the market's worst two months of the year. (more)

The yield on 10-year treasury notes eased a further 10 points to 4.32%.

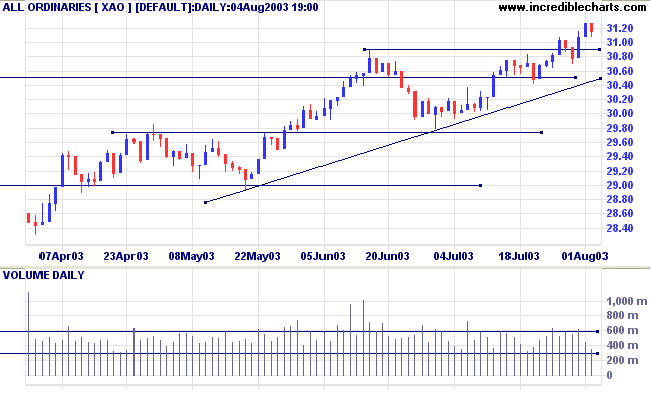

The intermediate and primary trends are both up.

New York (18.42): Spot gold has leveled off at $349.30.

The primary trend is still upwards.

The intermediate trend is up. A fall below 2978 would signal a reversal.

The primary trend is up.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is above; Twiggs Money Flow signals accumulation.

Short-term: Long if the All Ords is above 3127. Short if the index falls below 2978.

Intermediate: Long if the index is above 3127.

Long-term: Long if the index is above 2978 .

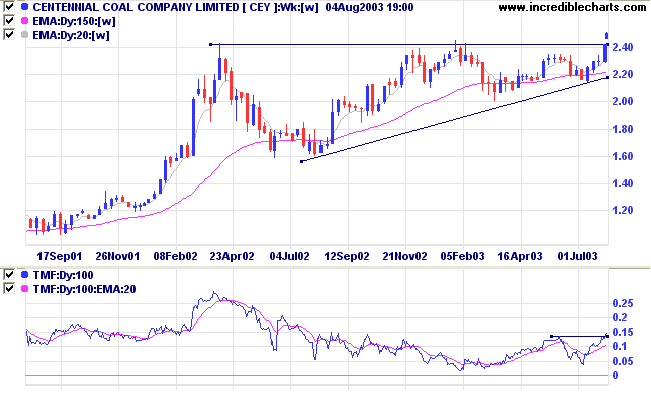

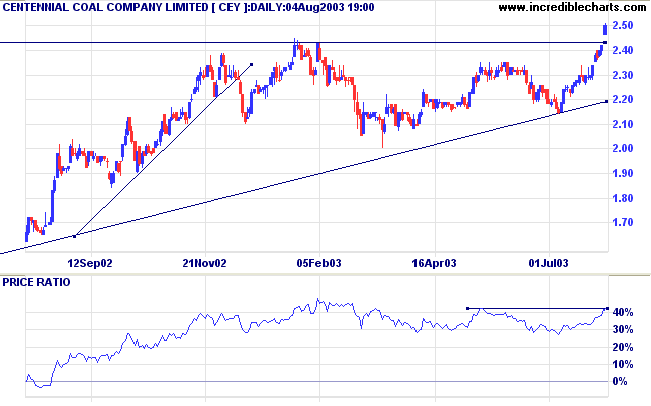

CEY has formed a long-term ascending triangle, completed with a breakout above resistance at 2.43.

Twiggs Money Flow (100) signals strong accumulation. MACD is bullish.

Last covered on June 16, 2003.

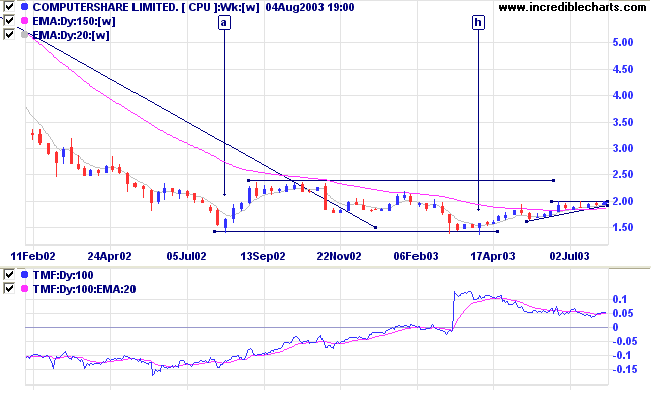

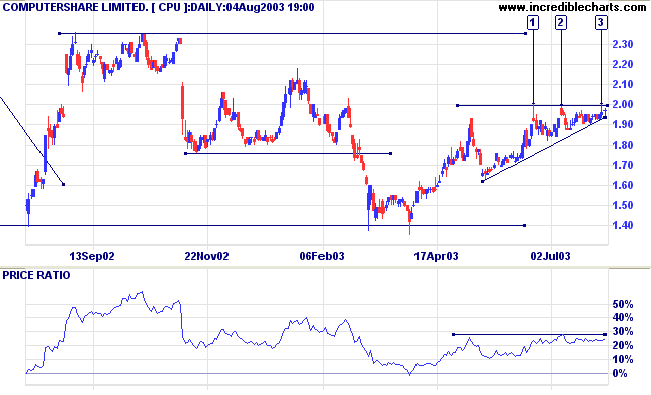

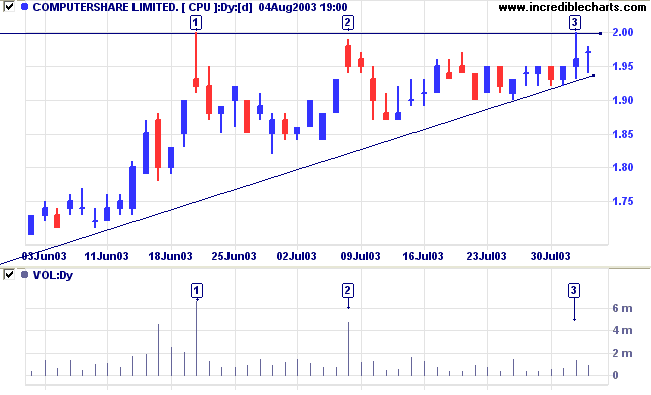

After forming a broad base, with a double bottom at [a] and [h], CPU has formed an ascending triangle over the last 2 months.

Twiggs Money Flow (100) is above zero but shows a bearish divergence, declining while price rises. MACD is bullish.

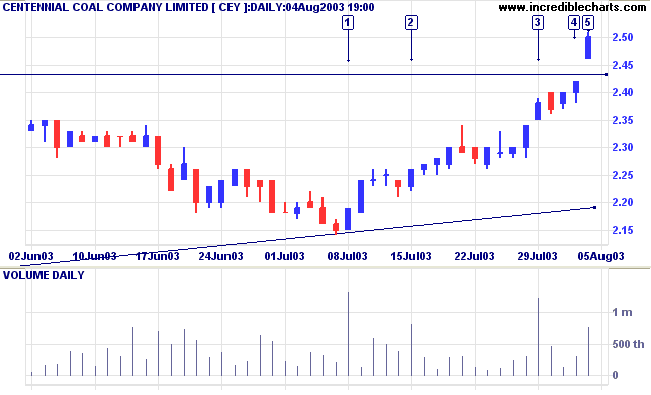

The close at [3] was still weak but lower volume signals that resistance may be diminishing.

The target for a breakout would be the 2.35 resistance level.

Rules Conditional # 2

To "buy down" requires a long purse and a strong nerve,

and ruin often overtakes those who have both nerve and

money.

The stronger the nerve the more probability of staying too

long.

~ SA Nelson: The ABC of Stock Speculation (1903).

| Stock Screens: % Of High |

|

We have adjusted the stock screen

filter to compare closing price to the previous highest

closing price. Previously, closing price was compared

to the previous highest price. |

You can now view back issues at the Daily Trading Diary Archives.

Back Issues