Free Trial Period

If you activated your free trial when the Premium version was first introduced,

you may notice that your free trial has expired but that you still have access to Premium data.

We will shortly introduce US indexes and hourly updates for ASX stocks,

and the free trial period has been extended to fit in with this.

If you activated your free trial when the Premium version was first introduced,

you may notice that your free trial has expired but that you still have access to Premium data.

We will shortly introduce US indexes and hourly updates for ASX stocks,

and the free trial period has been extended to fit in with this.

Trading Diary

May 22, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow broke through resistance at 8523 on high

volume, up 0.9% at 8594 at the close.

The intermediate upward trendline has been broken. A rise above 8766 will signal continuation; a fall below 8394 will signal a reversal.

The primary trend is down; a rise above 9076 will signal a reversal.

The intermediate upward trendline has been broken. A rise above 8766 will signal continuation; a fall below 8394 will signal a reversal.

The primary trend is down; a rise above 9076 will signal a reversal.

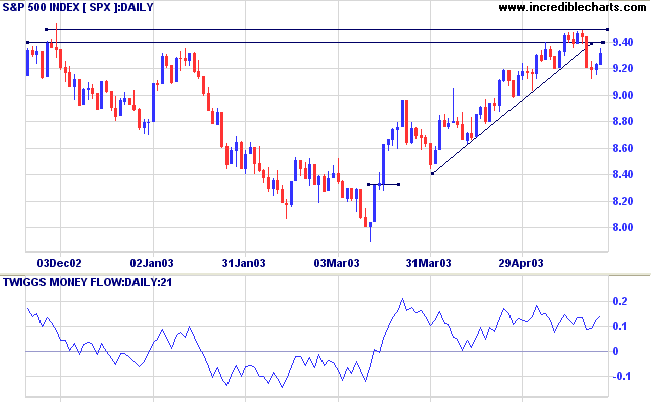

The S&P 500 gained 8 points to 931 at

closing.

The intermediate upward trend is weak. A fall below 912 will signal reversal; a rise above 948, continuation.

The primary trend is down; a rise above 954 will signal an up-trend.

The intermediate upward trend is weak. A fall below 912 will signal reversal; a rise above 948, continuation.

The primary trend is down; a rise above 954 will signal an up-trend.

The Nasdaq Composite rallied 1.2% to 1507 at the

close.

The intermediate trend is weak. A fall below 1478 will signal a down-trend; a rise above 1552 will signal continuation.

The index is in a primary up-trend.

The intermediate trend is weak. A fall below 1478 will signal a down-trend; a rise above 1552 will signal continuation.

The index is in a primary up-trend.

The Chartcraft NYSE

Bullish % Indicator recovered to 61.49% on May 21, following

a Bull

Correction buy signal on April 3.

Market Strategy

Short-term: Long if the S&P 500 rises above

954; short if the S&P intermediate trend falls below

912.

Intermediate: Long only when the Dow/S&P

primary trend turns upwards; short if the intermediate trend

(S&P) reverses down.

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Long-term: There are already two bull signals: the March 17 follow through day and the April 3 NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Final tax cut

The House of Representatives and Senate leaders reach agreement on a $US 350 billion tax cut. (more)

The House of Representatives and Senate leaders reach agreement on a $US 350 billion tax cut. (more)

TV advertising up

Advanced sales of TV advertising for the 2003-2004 season are up almost 10%. (more)

Advanced sales of TV advertising for the 2003-2004 season are up almost 10%. (more)

Gold

New York (16.04): Spot gold retreated to $US 367.60.

On the five-year chart gold has respected the long-term upward trendline.

New York (16.04): Spot gold retreated to $US 367.60.

On the five-year chart gold has respected the long-term upward trendline.

ASX Australia

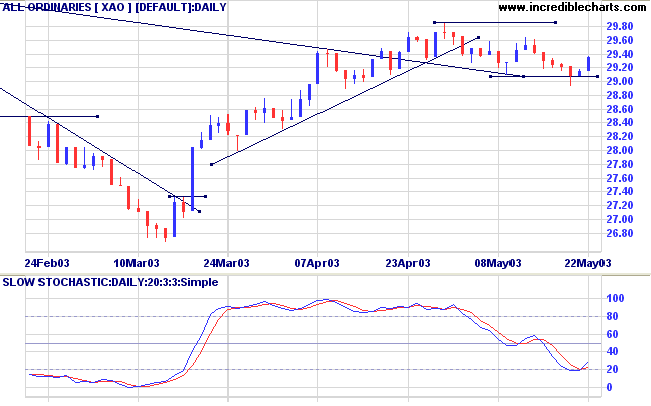

The All Ordinaries rallied off the false break

on big volume, closing up 21 points at 2936.

The intermediate trend is down but on a weak signal.

The primary trend is down. A rise above 3062 will signal an up-trend.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above; Twiggs Money Flow (21) is rising.

The intermediate trend is down but on a weak signal.

The primary trend is down. A rise above 3062 will signal an up-trend.

MACD (26,12,9) is below its signal line; Slow Stochastic (20,3,3) has crossed to above; Twiggs Money Flow (21) is rising.

Market Strategy

Short-term: Long if the All Ords rises above

2964; short if the XAO falls below 2908.

Intermediate: Long if the primary trend reverses up (XAO above 3062); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Intermediate: Long if the primary trend reverses up (XAO above 3062); short if the XAO is below 2908.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

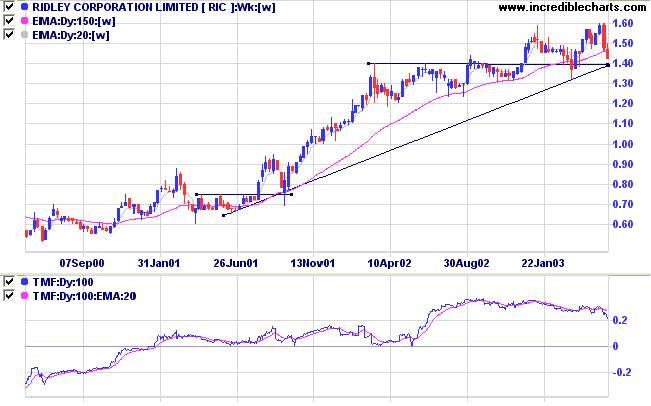

Ridley Corporation [RIC]

Last covered on December 19, 2002.

Ridley has been in a stage 2 up-trend for the past 2 years. It has now started a correction after a marginal new high.

Twiggs Money Flow (100) shows a slight bearish divergence after a lengthy period of strong accumulation.

Last covered on December 19, 2002.

Ridley has been in a stage 2 up-trend for the past 2 years. It has now started a correction after a marginal new high.

Twiggs Money Flow (100) shows a slight bearish divergence after a lengthy period of strong accumulation.

Relative Strength (price ratio: xao) appears to

be turning downwards; MACD and Twiggs Money Flow (21-day) show

bearish divergences.

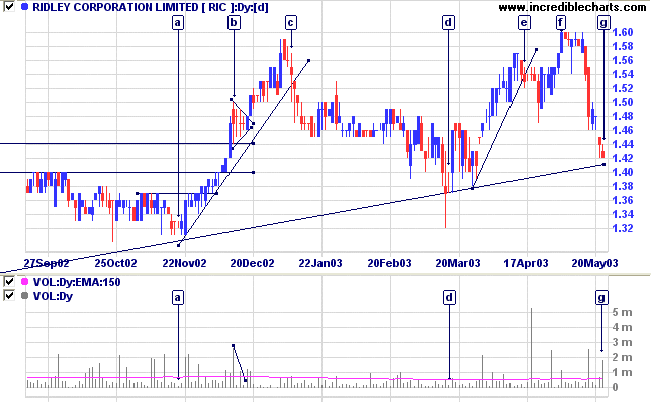

Note the entry points at [a] and [d] on the daily chart: both volume and daily range dried up above the long-term supporting trendline.

The pennant at [b] signaled continuation.

Exits could be taken at [c] and [e] when price penetrated the intermediate trendline.

The marginal high at [f] made a gain of only 1 cent before retreating.

RIC has now reached the supporting trendline; the daily range has narrowed but volume is still high. This is a pivotal point: if price rallies above the long-term trendline we could see another intermediate up-swing.

Note the entry points at [a] and [d] on the daily chart: both volume and daily range dried up above the long-term supporting trendline.

The pennant at [b] signaled continuation.

Exits could be taken at [c] and [e] when price penetrated the intermediate trendline.

The marginal high at [f] made a gain of only 1 cent before retreating.

RIC has now reached the supporting trendline; the daily range has narrowed but volume is still high. This is a pivotal point: if price rallies above the long-term trendline we could see another intermediate up-swing.

However, a fall below support at 1.40 would be

bearish.

And a fall below 1.32, completing the double top pattern, from [c] to [f], would be a strong bear signal.

And a fall below 1.32, completing the double top pattern, from [c] to [f], would be a strong bear signal.

New! Understanding

the Trading Diary has been expanded to offer further

assistance to readers.

Colin Twiggs

It does not do to leave a dragon out

of

your calculations, if you live near him.

- J.R.R. Tolkien, The Hobbit

Back Issues

Click here to access the Trading Diary Archives.

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.