Become a Premium member for

only $180 (AUD).

Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Trading Diary

May 5, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow formed an inside day, retreating 0.6% to

close at 8531 on lower volume.

The intermediate trend is down. The index has broken above the upper border of the ascending triangle but immediately retreated. I prefer to wait for a break above Friday's high (8612) to signal the start of an up-trend. A fall below 8109 will signal continuation.

The primary trend is down; a rise above 9076 will signal a reversal.

The S&P 500 closed 4 points down at 926.

The intermediate up-trend continues.

The primary trend is down; a rise above 954 will signal a reversal.

The Nasdaq Composite tested resistance at 1521 then closed back at 1504; 2 points up.

The intermediate trend is up.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator continues to climb after a Bull Correction buy signal, reaching 54.23% (May 2).

The intermediate trend is down. The index has broken above the upper border of the ascending triangle but immediately retreated. I prefer to wait for a break above Friday's high (8612) to signal the start of an up-trend. A fall below 8109 will signal continuation.

The primary trend is down; a rise above 9076 will signal a reversal.

The S&P 500 closed 4 points down at 926.

The intermediate up-trend continues.

The primary trend is down; a rise above 954 will signal a reversal.

The Nasdaq Composite tested resistance at 1521 then closed back at 1504; 2 points up.

The intermediate trend is up.

The primary trend is up.

The Chartcraft NYSE Bullish % Indicator continues to climb after a Bull Correction buy signal, reaching 54.23% (May 2).

Market Strategy

Short-term: Long if the S&P 500 remains

above 924; short if the intermediate trend reverses down (or

falls below 862).

Intermediate: Long only when the Dow/S&P

primary trend reverses upwards; short if the intermediate trend

(S&P) reverses down.

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

No rate cuts

The Federal Reserve is not expected to announce further rate cuts on Tuesday, despite rising unemployment and a manufacturing slow-down. (more)

The Federal Reserve is not expected to announce further rate cuts on Tuesday, despite rising unemployment and a manufacturing slow-down. (more)

Gold

New York (18.58): Spot gold is up slightly at $US 341.60.

New York (18.58): Spot gold is up slightly at $US 341.60.

ASX Australia

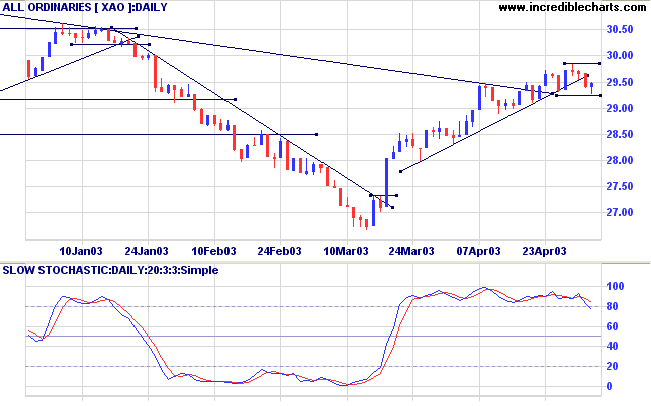

The All Ordinaries tested support at 2931 before rallying to

close up 7 points at 2948 on higher volume.

The intermediate up-trend continues but the indicators signal that it is weakening; a break below Monday's low of 2926 will be bearish.

The primary trend is down, although the trendline has been broken; a rise above 3062 will signal a reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines; Twiggs Money Flow (21) is below its upward trendline but continues to signal accumulation.

The intermediate up-trend continues but the indicators signal that it is weakening; a break below Monday's low of 2926 will be bearish.

The primary trend is down, although the trendline has been broken; a rise above 3062 will signal a reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines; Twiggs Money Flow (21) is below its upward trendline but continues to signal accumulation.

Market Strategy

Short-term: Long only if the index rises above 2950; short if the

intermediate trend reverses down (or XAO falls below 2926).

Intermediate: Long if the primary trend reverses up (XAO above

3062); short if the intermediate trend reverses down.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

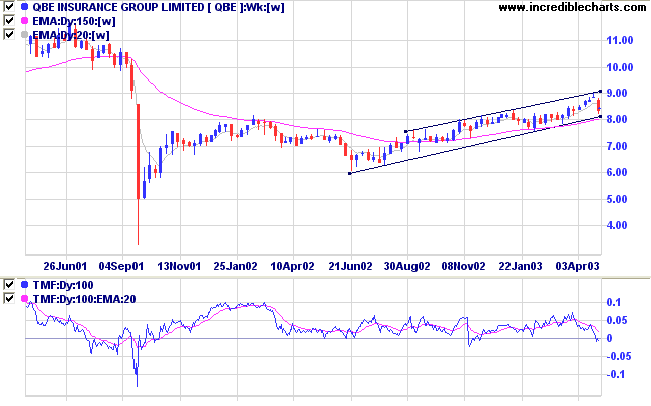

QBE Insurance [QBE]

Last covered on December 3, 2002.

QBE has formed a stage 2 upward trend after a broad base consolidation.

Twiggs Money Flow shows steady accumulation since the disastrous fall in September 2001.

Last covered on December 3, 2002.

QBE has formed a stage 2 upward trend after a broad base consolidation.

Twiggs Money Flow shows steady accumulation since the disastrous fall in September 2001.

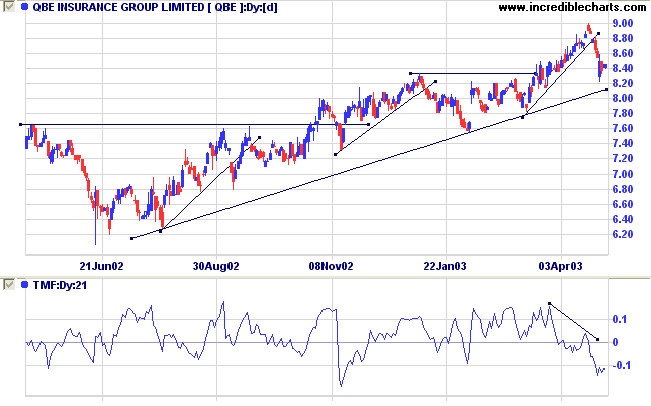

On the daily chart there is a break of the fast, intermediate

up-trend; followed by a sharp correction back to the primary

trendline.

The 21-day Twiggs Money Flow shows a strong bullish divergence.

The 21-day Twiggs Money Flow shows a strong bullish divergence.

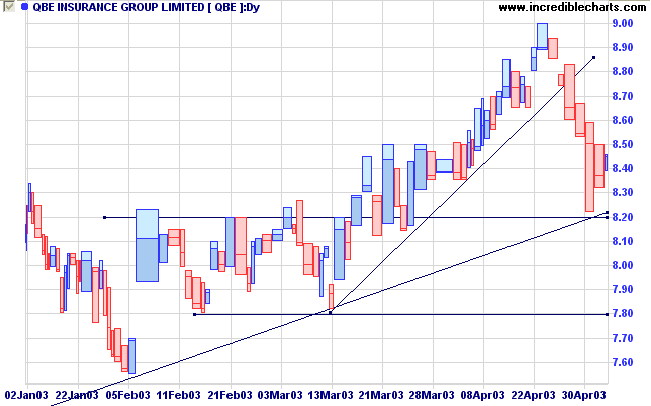

The equivolume chart highlights the dry-up of volume in the

second half of the intermediate up-trend and the increase in

volume on the correction. The stock should find support at the

8.20 level; a break below 7.80 would be a strong bear

signal.

Swing traders will normally seek long entries at an up-turn at the primary trendline. Caution should be exercised because of the strong volume on the last correction: wait for a further test of the supporting trendline and a dry up of volume and volatility at the bottom of the correction.

Swing traders will normally seek long entries at an up-turn at the primary trendline. Caution should be exercised because of the strong volume on the last correction: wait for a further test of the supporting trendline and a dry up of volume and volatility at the bottom of the correction.

New! Understanding

the Trading Diary has been expanded to offer further

assistance to readers.

Colin Twiggs

Don't gamble.

Take all your savings and buy some good stock

and hold it 'til it goes up then sell it.

If it don't go up, don't buy it.

- Will Rogers.

Back Issues

Click here to access the Trading Diary Archives.

Click here to access the Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.