Become a Premium member for

only $180 (AUD).

Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Subscribe by 31 May 2003.

The Daily Trading Diary will only be available to Premium members.

We have extended the cut-off until mid-May - to fit in with the introduction of US charts.

Trading Diary

April 28, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow continues the bullish ascending

triangle, rising 2% to close at 8471, but on lower volume.

The intermediate trend is down. A rise above 8587 will signal reversal to an up-trend; a fall below 8109 will signal continuation.

March 17th's follow through remains valid (as long as the index holds above 7763).

The primary trend is down; a rise above 9076 will signal a reversal.

The Nasdaq Composite rallied 28 points to close at 1462.

The intermediate trend is up.

The primary trend is up.

The S&P 500 gained 16 points to close at 914.

The intermediate trend is up.

The primary trend is down; a rise above 954 will signal a reversal.

The Chartcraft NYSE Bullish % Indicator is at 50.37% (April 25), after completing a Bull Correction buy signal.

The intermediate trend is down. A rise above 8587 will signal reversal to an up-trend; a fall below 8109 will signal continuation.

March 17th's follow through remains valid (as long as the index holds above 7763).

The primary trend is down; a rise above 9076 will signal a reversal.

The Nasdaq Composite rallied 28 points to close at 1462.

The intermediate trend is up.

The primary trend is up.

The S&P 500 gained 16 points to close at 914.

The intermediate trend is up.

The primary trend is down; a rise above 954 will signal a reversal.

The Chartcraft NYSE Bullish % Indicator is at 50.37% (April 25), after completing a Bull Correction buy signal.

Market Strategy

Short-term: Long if the S&P 500 is above

911; short if the intermediate trend reverses down.

Intermediate: Long if the Dow/S&P primary

trend reverses upwards; short if the intermediate trend (S&P)

reverses down.

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Long-term: There are already two bull signals: the March 17 follow through day and the NYSE Bullish % signal. Wait for confirmation from a Dow/S&P primary trend reversal.

Personal incomes and consumer spending

rise

Personal income and consumer spending both increased by 0.4% in March but the rise fell short of analysts' expectations. (more)

Personal income and consumer spending both increased by 0.4% in March but the rise fell short of analysts' expectations. (more)

Gold

New York (18.12): Spot gold is at $US 333.40.

New York (18.12): Spot gold is at $US 333.40.

ASX Australia

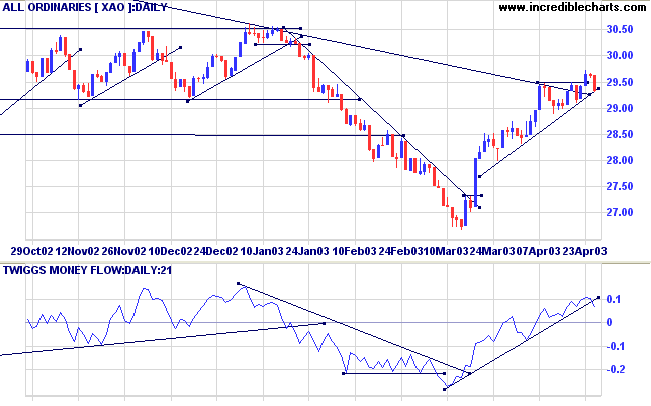

The ASX closed down 27 points at 2935 on lower volume, testing

the intermediate trendline.

The intermediate trend is up and we are unlikely to see a reversal while the US market is rallying strongly.

The primary trend is down; a rise above 3062 will signal a reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (21) has crossed below the upward trendline but still signals accumulation.

The intermediate trend is up and we are unlikely to see a reversal while the US market is rallying strongly.

The primary trend is down; a rise above 3062 will signal a reversal.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) is below; Twiggs Money Flow (21) has crossed below the upward trendline but still signals accumulation.

Market Strategy

Short-term: Long if the index rises above 2948; short if the

intermediate trend reverses (or XAO falls below 2888).

Intermediate: Long if the primary trend reverses up (XAO above

3062); short if the intermediate trend reverses.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

Long-term: There is already a bull signal: the March 18 follow through. Wait for confirmation from a primary trend reversal.

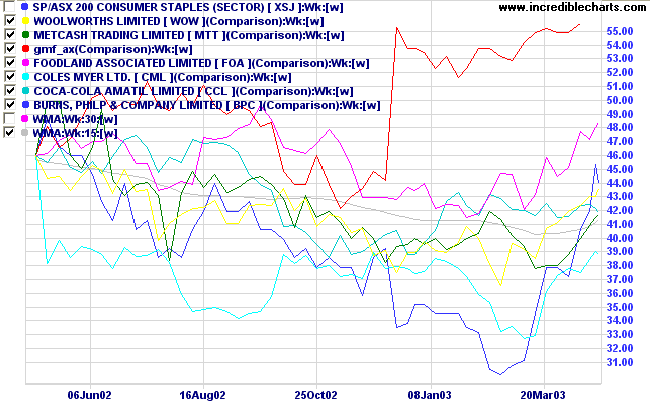

Consumer Staples

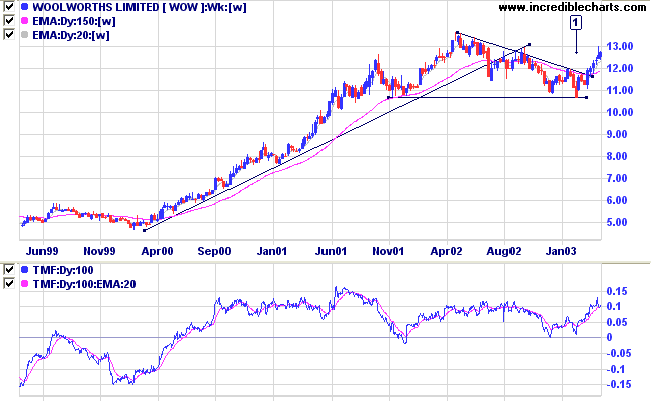

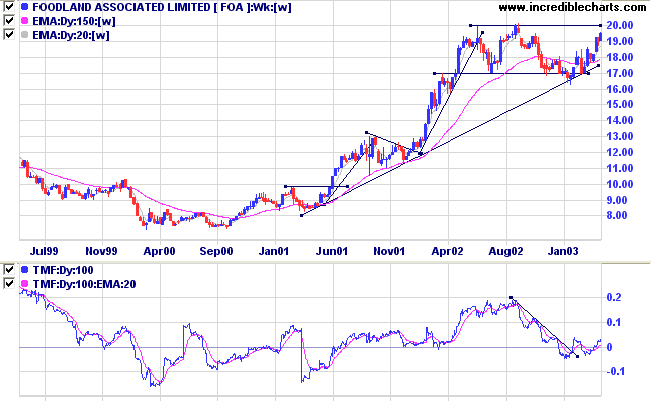

Consumer Staples are showing signs of recovery. Apart from BPC, the two leading stocks are

Woolworths and

Foodland.

Consumer Staples are showing signs of recovery. Apart from BPC, the two leading stocks are

Woolworths and

Foodland.

Both stocks show Stage 3 consolidations.

And, on both stocks, 100-day Twiggs Money Flow signals is

bullish.

But both face overhead resistance: WOW at 13.50 and FOA at 20.00.

This will have to be overcome before we can be sure that the two

have resumed a stage 2 up-trend.

Colin Twiggs

If you fail to plan,

you plan to fail.

- Philip Kotler

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.