Sector

Analysis

Explains how to use the [Sectors ASX 200] project file

and how to set up Sector Comparison charts.

Explains how to use the [Sectors ASX 200] project file

and how to set up Sector Comparison charts.

Trading Diary

March 25, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow formed an

inside day, closing 0.8% up at 8280 on average volume. Monday

17th's

follow through signal remains valid so long as the index

holds above 7763.

The intermediate cycle is down, although the trendline has been broken.

The primary trend is down.

The Nasdaq Composite gained 1.5% to close at 1391.

The intermediate trend is down, despite the large correction.

The primary trend is up.

The S&P 500 formed an inside day, gaining 10 points to close at 874.

The intermediate trend is down, but the trendline has been broken.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator remains at 36% (March 24).

The intermediate cycle is down, although the trendline has been broken.

The primary trend is down.

The Nasdaq Composite gained 1.5% to close at 1391.

The intermediate trend is down, despite the large correction.

The primary trend is up.

The S&P 500 formed an inside day, gaining 10 points to close at 874.

The intermediate trend is down, but the trendline has been broken.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator remains at 36% (March 24).

Consumer confidence continues to fall

The Conference Board consumer confidence index fell to 62.5 from 64.8 in February; in line with expectations. (more)

Senate slashes tax cuts

Concerned about the growing budget deficit, the Senate votes to halve President Bush's $US 726 billion tax cut plan. (more)

The Conference Board consumer confidence index fell to 62.5 from 64.8 in February; in line with expectations. (more)

Senate slashes tax cuts

Concerned about the growing budget deficit, the Senate votes to halve President Bush's $US 726 billion tax cut plan. (more)

Gold

New York (16.30): Spot gold eased 100 cents to $US 328.10.

New York (16.30): Spot gold eased 100 cents to $US 328.10.

ASX Australia

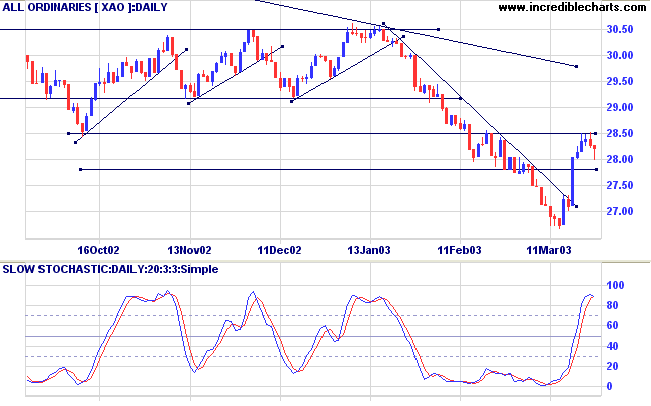

The All Ordinaries closed 7 points down at 2822 on lower volume.

The hammer

signals that the counter-trend is weak.

The intermediate trend is down, despite the break above the trendline.

The primary trend is down.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has crossed to below; Twiggs Money Flow (21) signals distribution.

The intermediate trend is down, despite the break above the trendline.

The primary trend is down.

MACD (26,12,9) is above its signal line; Slow Stochastic (20,3,3) has crossed to below; Twiggs Money Flow (21) signals distribution.

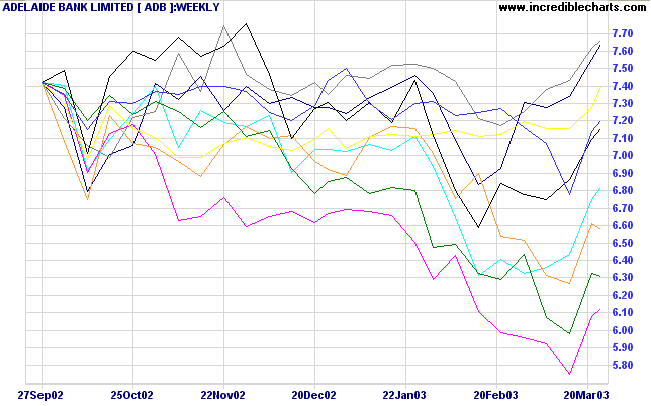

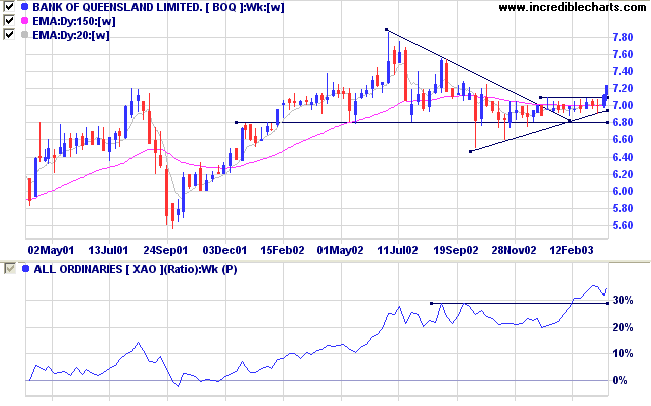

Banks

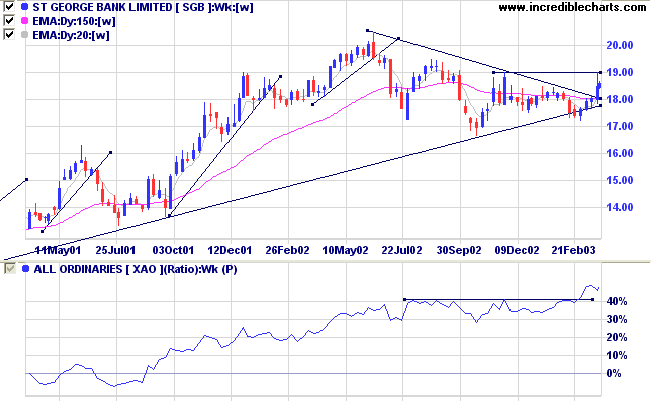

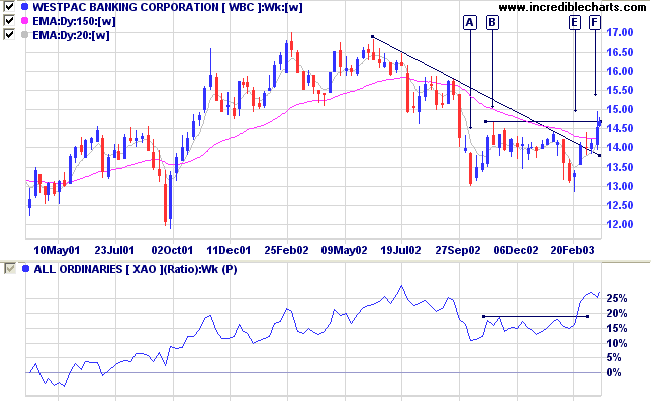

The Financial Sector is recovering faster than the other sector indices.

The 6-month price comparison chart reveals that

SGB,

WBC and

BOQ are the strongest performers in the sector. Also of interest are

ANZ and

NAB, while

CBA,

ADB,

BEN and

BWA still show weakness.

The Financial Sector is recovering faster than the other sector indices.

The 6-month price comparison chart reveals that

SGB,

WBC and

BOQ are the strongest performers in the sector. Also of interest are

ANZ and

NAB, while

CBA,

ADB,

BEN and

BWA still show weakness.

St George Bank [SGB] has rallied above the long-term trendline

and threatens a break above 19.00.

Westp[ac [WBC] is testing resistance at 14.67 after a double

bottom at [A] and [E].

Bank of Queensland [BOQ] has broken above resistance at 7.10

after completing a symmetrical triangle.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Long if the All Ords rises above 2829.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

In any moment of decision, the best thing you can do is the

right thing.

The worst thing you can do is nothing.

- Theodore Roosevelt.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.