|

|

|

WineOrb, Australia's premium fine wine

broker, are offering a free Masterclass for you and your

partner, to show you what to look for when making an

investment in wine. Complete the form on our site and tell us in less than 25 words why you would like to attend. The best entries will be invited to join us at the Masterclass on the 16th May 2003. Click here to enter. |

Trading Diary

March 7, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

After falling to 7562 at the opening, the Dow rallied to close up

0.8% at 7740 on very strong volume.

The intermediate cycle is down; the next support level is at 7500.

The primary trend is down.

The Nasdaq Composite formed a strong closing price reversal, closing 3 points higher at 1305.

The intermediate trend is down, with the next support level at 1200.

The primary trend is up.

The S&P 500 gained 6 points to close at 828.

The intermediate trend is down.

The primary trend is down; the next support level is at 768.

The Chartcraft NYSE Bullish % Indicator is at 40% (March 6).

The intermediate cycle is down; the next support level is at 7500.

The primary trend is down.

The Nasdaq Composite formed a strong closing price reversal, closing 3 points higher at 1305.

The intermediate trend is down, with the next support level at 1200.

The primary trend is up.

The S&P 500 gained 6 points to close at 828.

The intermediate trend is down.

The primary trend is down; the next support level is at 768.

The Chartcraft NYSE Bullish % Indicator is at 40% (March 6).

Unemployment rise

Unemployment rose to 5.8% from 5.7% in January, raising expectations of further interest rate cuts. (more)

Unemployment rose to 5.8% from 5.7% in January, raising expectations of further interest rate cuts. (more)

Gold

New York (16.00): Spot gold lost 590 cents to close at $US 350.10.

New York (16.00): Spot gold lost 590 cents to close at $US 350.10.

ASX Australia

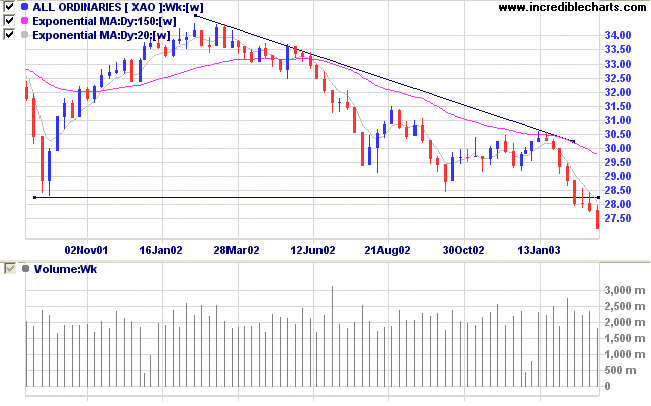

On the weekly chart the All Ordinaries has broken below the 2850

to 2779 support band and is likely to weaken further. The next

support level is just below 2400, and the target for the double

top pattern is 2200.

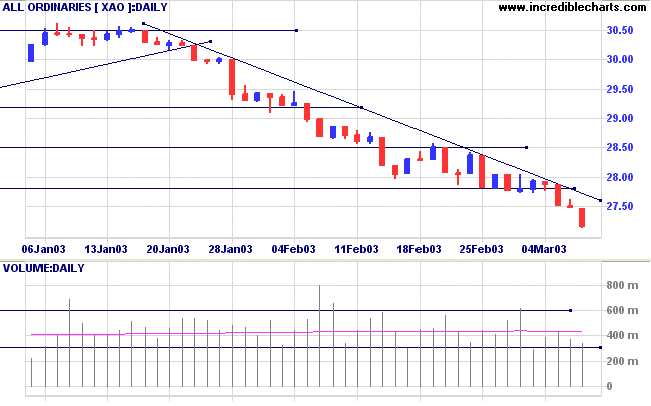

On the daily chart the index lost a further 32 points to close at

2715 on lower volume.

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines. The small divergence on Twiggs Money Flow has ended and the indicator signals distribution.

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines. The small divergence on Twiggs Money Flow has ended and the indicator signals distribution.

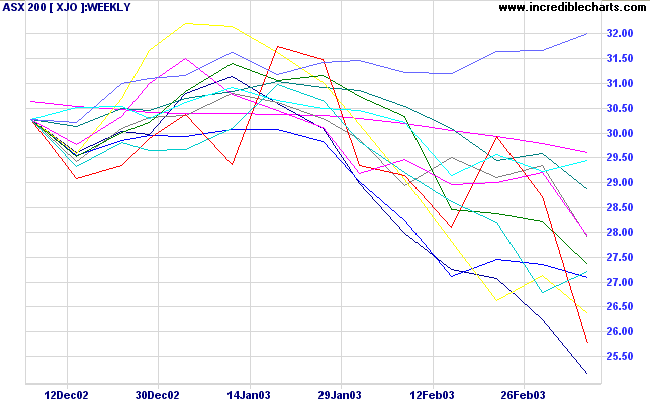

Sector Analysis

Changes are highlighted in bold.

On the 3-month sectors chart below,

Utilities is the only sector that is still positive.Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is rising)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 1 (RS is falling)

- Consumer Staples [XSJ] - stage 4 (RS is rising)

- Health Care [XHJ] - stage 4 (RS is falling)

- Property Trusts [XPJ] - stage 2 (RS is rising)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is rising)

Sectors: Relative Strength

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 15 stocks (compared to 99 on August 23, 2002; and 10 on October 4, 2002).

Two of the stocks were from Construction Materials.

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 15 stocks (compared to 99 on August 23, 2002; and 10 on October 4, 2002).

Two of the stocks were from Construction Materials.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Short. Slow Stochastic and MACD are below their

respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Man is a Religious Animal. He is the only Religious

Animal.

He is the only animal that has the True Religion - several of

them.

He is the only animal that loves his neighbor as

himself

and cuts his throat if his theology isn't straight.

- Samuel Clemens ("Mark Twain")

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.