|

|

|

WineOrb, Australia's premium fine wine

broker, are offering a free Masterclass for you and your

partner, to show you what to look for when making an

investment in wine. Complete the form on our site and tell us in less than 25 words why you would like to attend. The best entries will be invited to join us at the Masterclass on the 16th May 2003. Click here to enter. |

Trading Diary

March 6, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow formed an inside day, losing 1.3% to close at 7673 on

average volume. The intermediate cycle is down; the next support

level is at 7500.

The primary trend is down.

The Nasdaq Composite closed 8 points lower at 1302. The intermediate trend is down, with the next support level at 1200.

The primary trend is up.

The S&P 500 formed an inside day, down 7 points at 822. The intermediate trend is down.

The primary trend is down; the next support level is at 768.

The Chartcraft NYSE Bullish % Indicator is at 40% (March 5).

The primary trend is down.

The Nasdaq Composite closed 8 points lower at 1302. The intermediate trend is down, with the next support level at 1200.

The primary trend is up.

The S&P 500 formed an inside day, down 7 points at 822. The intermediate trend is down.

The primary trend is down; the next support level is at 768.

The Chartcraft NYSE Bullish % Indicator is at 40% (March 5).

Intel

The chip-maker narrowed its sales forecasts, cutting the high end off its previous guidance. (more)

The chip-maker narrowed its sales forecasts, cutting the high end off its previous guidance. (more)

Gold

New York (18.14): Spot gold climbed 350 cents to $US 356.10.

New York (18.14): Spot gold climbed 350 cents to $US 356.10.

ASX Australia

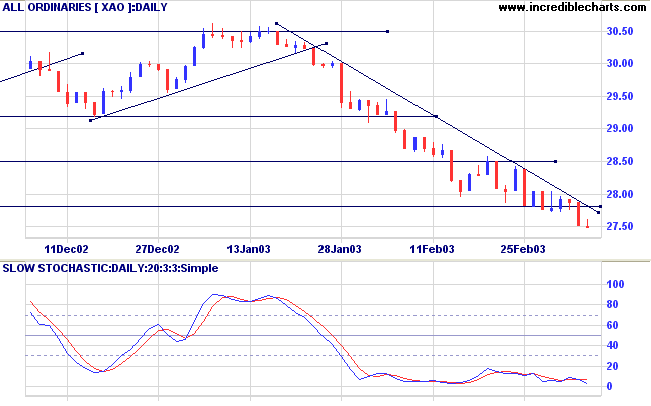

The All Ordinaries closed down 3 points at 2747 on lower volume.

The index has broken below the 2850 to 2779 support band. Unless

there is an immediate reversal, it is likely to weaken further.

The next support level is just below 2400, and the target for the

double top pattern is 2200.

Slow Stochastic (20,3,3) has crossed below its signal line; MACD (26,12,9) is below. The small divergence on Twiggs Money Flow has ended; the indicator signals distribution.

Slow Stochastic (20,3,3) has crossed below its signal line; MACD (26,12,9) is below. The small divergence on Twiggs Money Flow has ended; the indicator signals distribution.

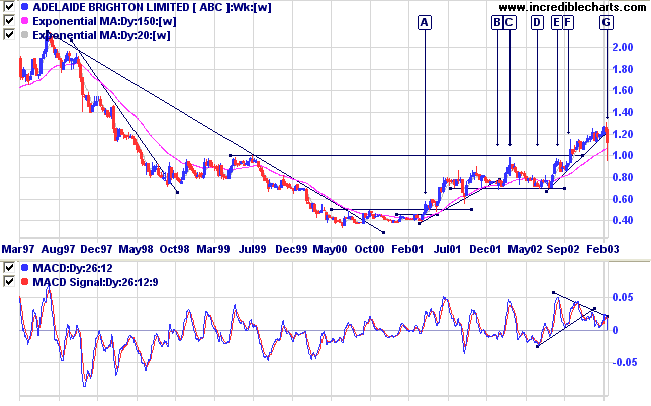

Adelaide Brighton [ABC]

Last covered on December 14, 2002.

After forming a broad base in 2000/2001, ABC commenced an up-trend at [A]. This was followed by a period of consolidation which included a cup and handle at [C] - [E] - [F]. The up-trend resumed, but now we have a break below the supporting trendline at [G].

Relative Strength (price ratio: xao) is rising, but 21-day Twiggs Money Flow and MACD show bearish divergences.

Last covered on December 14, 2002.

After forming a broad base in 2000/2001, ABC commenced an up-trend at [A]. This was followed by a period of consolidation which included a cup and handle at [C] - [E] - [F]. The up-trend resumed, but now we have a break below the supporting trendline at [G].

Relative Strength (price ratio: xao) is rising, but 21-day Twiggs Money Flow and MACD show bearish divergences.

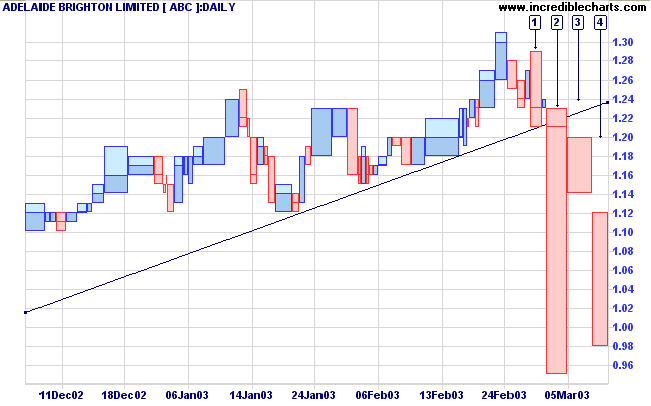

On the equivolume chart, ABC formed a hammer reversal after

breaking below the trendline at [2], closing back at the

trendline. According to Portmacquarie on the Chart Forum,

the tail was caused by two trades at 11.00 a.m. totaling 60,000

shares.

That was sufficient to spook the market and day [3] saw an inside day on strong volume, closing well below the supporting trendline.

Price gapped down on day [4] on fairly strong volume but the weak close signals short-term exhaustion and is likely to be followed by a test of resistance levels.

That was sufficient to spook the market and day [3] saw an inside day on strong volume, closing well below the supporting trendline.

Price gapped down on day [4] on fairly strong volume but the weak close signals short-term exhaustion and is likely to be followed by a test of resistance levels.

A break below 0.98 will confirm that ABC is in a strong

down-trend.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Short. Slow Stochastic and MACD are below their

respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Things should be made as simple as possible,

but not any simpler.

- Albert Einstein

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.