|

|

|

WineOrb, Australia's premium fine wine

broker, are offering a free Masterclass for you and your

partner, to show you what to look for when making an

investment in wine. Complete the form on our site and tell us in less than 25 words why you would like to attend. The best entries will be invited to join us at the Masterclass on the 16th May 2003. Click here to enter. |

Trading Diary

March 3, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow eased 0.7% to close at 7837 on lower volume, showing

uncertainty. The next support level is 7500.

The primary trend is down.

The Nasdaq Composite formed a key reversal, closing down 1.3% at 1320. The equal highs (on 21/2 and 3/3) signal that the index is likely to weaken. The next support level is at 1200.

The primary trend is up.

The S&P 500 lost 7 points to close at 834. The index also displays equal highs, signaling weakness. The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 40% (February 28).

The primary trend is down.

The Nasdaq Composite formed a key reversal, closing down 1.3% at 1320. The equal highs (on 21/2 and 3/3) signal that the index is likely to weaken. The next support level is at 1200.

The primary trend is up.

The S&P 500 lost 7 points to close at 834. The index also displays equal highs, signaling weakness. The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 40% (February 28).

Manufacturing weaker

The Institute of Supply Management's manufacturing index fell to a lower than expected 50.5, from 53.9 in January. (more)

The Institute of Supply Management's manufacturing index fell to a lower than expected 50.5, from 53.9 in January. (more)

Gold

New York (17.15): After early weakness, spot gold rallied to an unchanged $US 349.70.

New York (17.15): After early weakness, spot gold rallied to an unchanged $US 349.70.

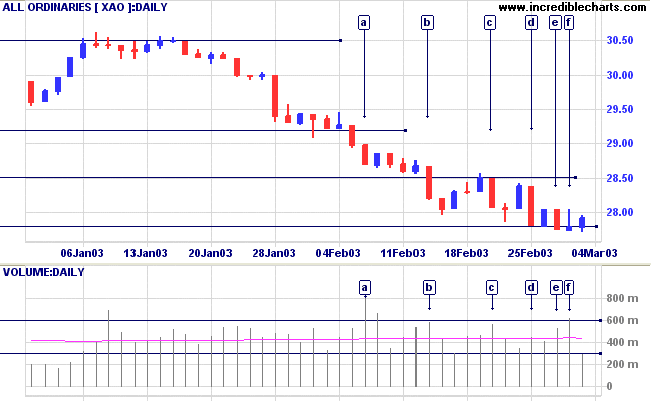

ASX Australia

The All Ordinaries rallied to close up 14 points at 2792. Very

low volume confirms that selling pressure is strong - the index

threatens to break below support and continue the

down-trend.

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines, but both are threatening to cross. Twiggs Money Flow still shows a small bullish divergence.

Slow Stochastic (20,3,3) and MACD (26,12,9) are below their signal lines, but both are threatening to cross. Twiggs Money Flow still shows a small bullish divergence.

Gradipore [GDP]

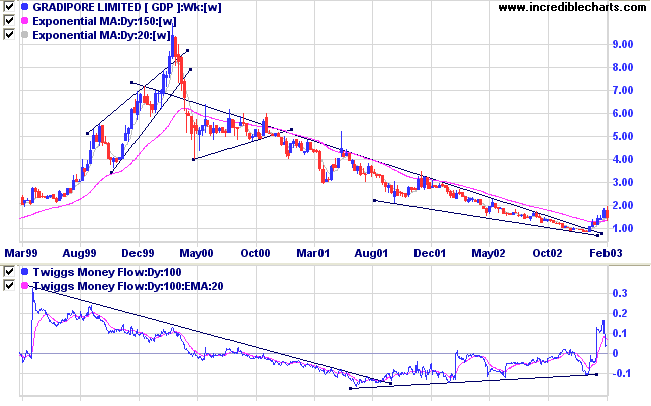

This biotech stock was the subject of recent discussion on the Chart Forum.

After the up-trend accelerated into a spike in early 2000, GDP formed a congestion pattern in the form of a triangle before commencing a stage 4 down-trend. The 100-day Twiggs Money Flow had shown bullish divergences for some time, before price broke above the downward trend line in January 2003 and rose above the 150-day exponential moving average.

This biotech stock was the subject of recent discussion on the Chart Forum.

After the up-trend accelerated into a spike in early 2000, GDP formed a congestion pattern in the form of a triangle before commencing a stage 4 down-trend. The 100-day Twiggs Money Flow had shown bullish divergences for some time, before price broke above the downward trend line in January 2003 and rose above the 150-day exponential moving average.

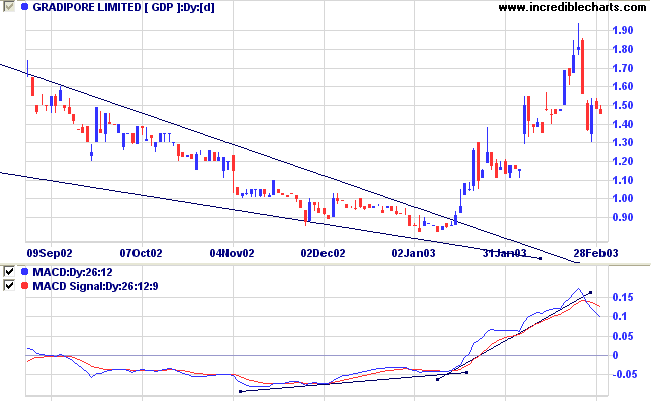

GDP had formed a descending wedge before the January breakout.

MACD and 21-day Twiggs Money Flow showed bullish divergences and

Relative Strength (price ratio: xao) started to rise. This is a

classic V-bottom and, as mentioned a few days ago, they often

fail: the base isn't broad enough to support the rally.

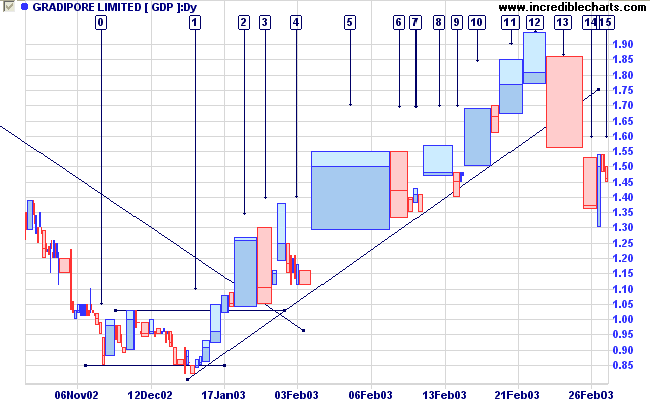

Equivolume shows the double bottom reversal at [0] and [1], with

a false break at [1].

This was followed by a power box at [2], breaking above resistance.

But a sharp retreat at [3] signaled nervousness.

Volume dried up markedly at [4], signaling a short-term buying opportunity.

GDP then gapped up at [5]. Gaps often exhaust short-term momentum, especially when accompanied by heavy volume, and lead to a consolidation as at [6].

The pattern repeats itself, with volume drying up on the correction, followed by a gap up on heavy volume, at [8] and again at [10].

The trend then rolls over after a surge in volume, with weaker closes at [11] and [12] followed by a sell-off on heavy volume at [13].

Price gaps down at [14], which exhausts the downward momentum, but volume dries up on the counter-trend.

This was followed by a power box at [2], breaking above resistance.

But a sharp retreat at [3] signaled nervousness.

Volume dried up markedly at [4], signaling a short-term buying opportunity.

GDP then gapped up at [5]. Gaps often exhaust short-term momentum, especially when accompanied by heavy volume, and lead to a consolidation as at [6].

The pattern repeats itself, with volume drying up on the correction, followed by a gap up on heavy volume, at [8] and again at [10].

The trend then rolls over after a surge in volume, with weaker closes at [11] and [12] followed by a sell-off on heavy volume at [13].

Price gaps down at [14], which exhausts the downward momentum, but volume dries up on the counter-trend.

GDP has lost upward momentum and strong selling pressure makes it

likely that the stock will re-test support at the December lows.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Short if the All Ords falls below 2780. Slow

Stochastic and MACD are below their respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Do you have the patience to wait

till the mud settles and the water is clear?

Can you remain unmoving

till the right action arises by itself?

- Lao Tse.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.