Full Member Version

We are making good progress

and will announce a start date shortly.

One area that is likely to be delayed is dividend data

- we have to find another data supplier due to reliability issues.

Trading Diary

February 25, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

After breaking below the congestion zone at the

opening, the Dow rallied after lunch to close up 0.6% at 7909 on

higher volume. The next support level is 7500.

The primary trend is down.

The Nasdaq Composite mirrored the Dow, closing up 0.5% at 1328.

The primary trend is up.

The S&P 500 repeated the story, breaking below congestion and then rallying back up to close at 838. The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 42% (February 24).

The primary trend is down.

The Nasdaq Composite mirrored the Dow, closing up 0.5% at 1328.

The primary trend is up.

The S&P 500 repeated the story, breaking below congestion and then rallying back up to close at 838. The next support level is at 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator is at 42% (February 24).

Consumer confidence at 9-year low

The Conference Board index of consumer confidence dropped to 64 from 78.8 in January. (more)

The Conference Board index of consumer confidence dropped to 64 from 78.8 in January. (more)

Gold

New York (16.45): Spot gold is back down 540 cents at $US 351.70.

New York (16.45): Spot gold is back down 540 cents at $US 351.70.

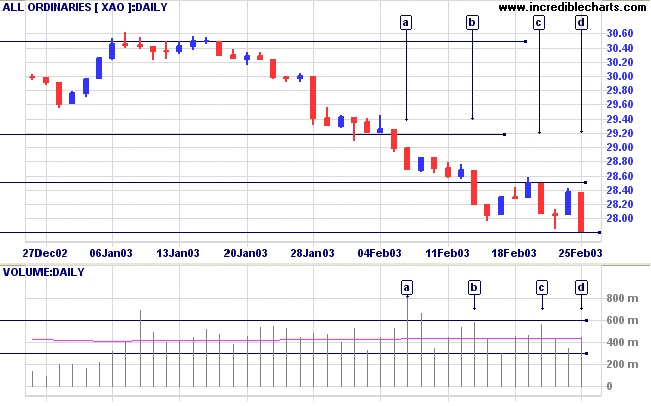

ASX Australia

The All Ordinaries closed 2% down at 2780, testing support from

October 1999. Higher volume on the declines, [a] to [d], signal

trend strength. The support level will be severely tested over

the next few days.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is below. Twiggs Money Flow still shows a small bullish divergence.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) is below. Twiggs Money Flow still shows a small bullish divergence.

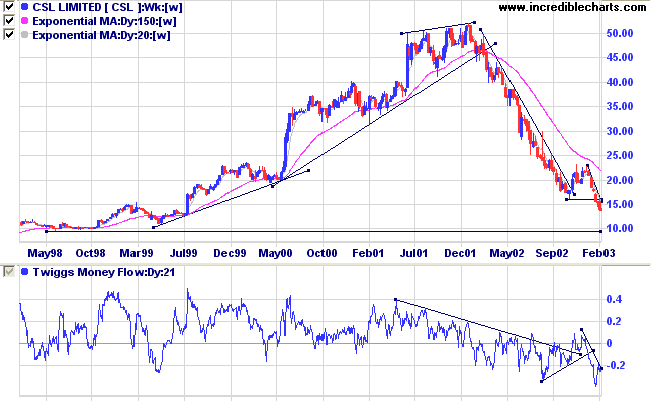

CSL Limited [CSL]

Last covered on December 2, 2002.

Another stock from the weak Health Care sector, CSL formed a stage 3 top in 2001 after a strong up-trend. The ensuing down-trend was even faster, falling to 16.00 at the end of November before a brief rally to 23.00. The stock then formed a double top, a strong continuation signal in a down trend, before resuming the stage 4 decline.

Relative Strength (price ratio: xao) is weakening, Twiggs Money Flow signals strong distribution and MACD is bearish.

Last covered on December 2, 2002.

Another stock from the weak Health Care sector, CSL formed a stage 3 top in 2001 after a strong up-trend. The ensuing down-trend was even faster, falling to 16.00 at the end of November before a brief rally to 23.00. The stock then formed a double top, a strong continuation signal in a down trend, before resuming the stage 4 decline.

Relative Strength (price ratio: xao) is weakening, Twiggs Money Flow signals strong distribution and MACD is bearish.

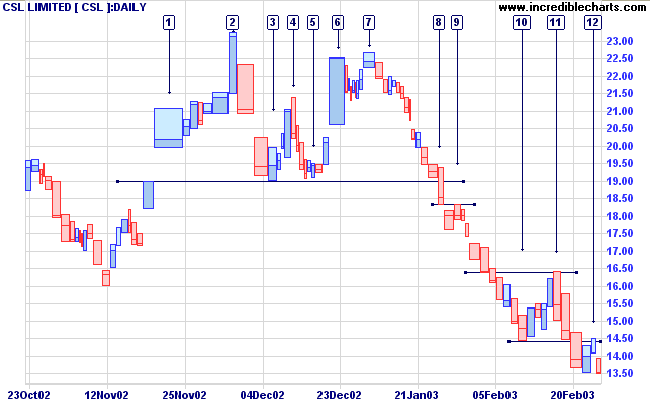

Equivolume shows completion of the recent double top at [8]. This

also closed the gap at [1], reinforcing the signal. The short

pull-back at [9] signaled strong selling pressure. The next

counter-trend at [11] was stronger, but failed to test resistance

at 17.60. The counter-trend at [12] only lasted one day, briefly

testing resistance at the low of [10], but on low volume with a

weak close, signaling trend strength.

The down-trend is strong and the next major support level is at 10.00 (on the weekly chart).

The down-trend is strong and the next major support level is at 10.00 (on the weekly chart).

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Short. Slow Stochastic and MACD are below their

respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Whatever failures I have known, whatever errors I have

committed,

whatever follies I have witnessed in private and public

life

have been the consequence of action without

thought.

- Bernard Baruch

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.