Chart Forum Troubleshooting

Those readers who have had difficulty registering for the Chart Forum,

or uploading chart images to their posts:

Please refer to Forum Troubleshooting for assistance.

Trading Diary

February 18, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow rallied 1.6% to close at 8041 but on

light volume.

If the rally carries above the first resistance level at 8189, this will signal that the down-trend (secondary/intermediate cycle) is weak.

The primary trend is down.

The Nasdaq Composite gapped up 2.8% to close at 1346.

The primary trend is up.

The S&P 500 gained 16 points to close at 851.

The first resistance level is 868.

The Chartcraft NYSE Bullish % Indicator is at 42% (February 14).

If the rally carries above the first resistance level at 8189, this will signal that the down-trend (secondary/intermediate cycle) is weak.

The primary trend is down.

The Nasdaq Composite gapped up 2.8% to close at 1346.

The primary trend is up.

The S&P 500 gained 16 points to close at 851.

The first resistance level is 868.

The Chartcraft NYSE Bullish % Indicator is at 42% (February 14).

Gold

New York (16.45): Spot gold is down 310 cents at $US 343.60.

New York (16.45): Spot gold is down 310 cents at $US 343.60.

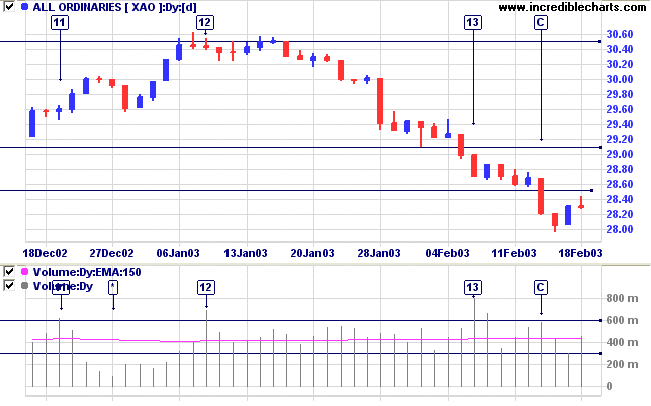

ASX Australia

The All Ordinaries failed to hold on to further gains, closing

back down at 2829 on average volume.

If the index moves lower on Wednesday, this will signal that the down-trend is still strong and threaten the 2779 support level.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

If the index moves lower on Wednesday, this will signal that the down-trend is still strong and threaten the 2779 support level.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below; Twiggs Money Flow signals distribution.

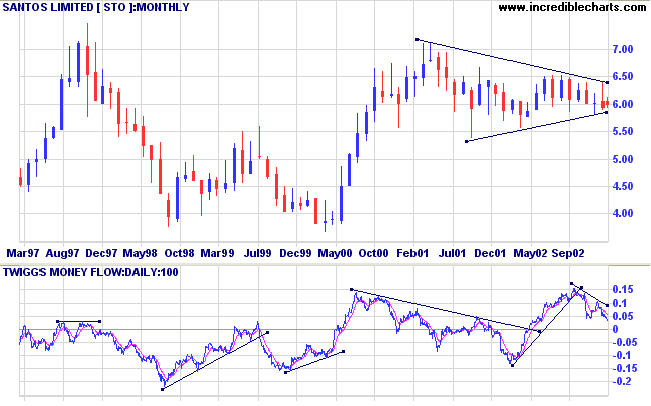

Santos [STO]

The Energy Index is in a stage 4 down-trend while Santos has been forming a stage 3 top over the past 2 years, in the form of a symmetrical triangle.

I have plotted a longer 100-day Twiggs Money Flow to highlight the long-term cycle of accumulation/distribution. This highlights several useful divergences at reversals in the primary trend. The indicator now signals weakness.

Relative Strength (price ratio:xao) is moving sideways; while MACD is bearish; and 20-day Twiggs Money Flow signals distribution.

The Energy Index is in a stage 4 down-trend while Santos has been forming a stage 3 top over the past 2 years, in the form of a symmetrical triangle.

I have plotted a longer 100-day Twiggs Money Flow to highlight the long-term cycle of accumulation/distribution. This highlights several useful divergences at reversals in the primary trend. The indicator now signals weakness.

Relative Strength (price ratio:xao) is moving sideways; while MACD is bearish; and 20-day Twiggs Money Flow signals distribution.

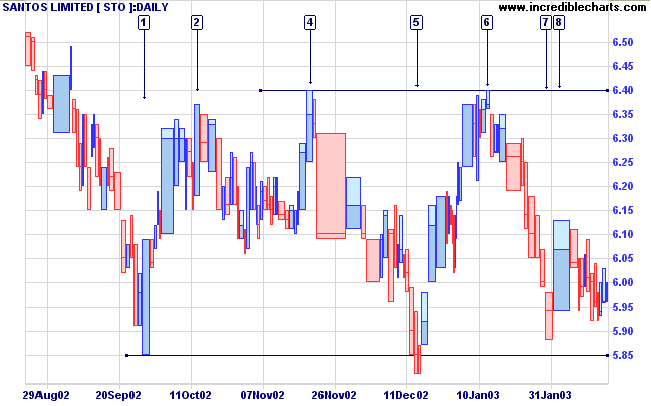

Within the triangle STO is ranging between 6.40 and 5.85. The

false break at [5] was on low volume and failed to close below

the support level. There was a strong decline down to [7] but

volume on the counter-trend at [8] is high and has dried up on

the following decline. This makes it likely that we will see

another rally up to the resistance level at 6.40.

In the longer-term, a break below 5.85 that then respects the new

resistance level, will be a strong bear signal.

A break above 6.40 would be bullish. Again, it would be prudent

to wait for price to respect the support level before taking new

entries.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Avoid new entries. Slow Stochastic and MACD are on

opposite sides of their respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

I have found that the greatest traders are the

ones who are most afraid of the markets.

My fear of the markets has forced me to hone my timing with

great precision.

- Mark Weinstein explains his high percentage of winning

trades;

from Market Wizards by Jack Schwager.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.