2003 Membership

The reduced subscription to existing members

will run for at least 4 weeks

after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

after all the data is in place and the free trial commences.

Subscription/Registration forms will be available from the start of the free trial period.

We will keep you informed of progress.

Trading Diary

January 20, 2003

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

US markets are closed Monday for Martin Luther

King Day.

The Chartcraft NYSE Bullish % Indicator increased to 54% (January 17).

Back Issues

The Chartcraft NYSE Bullish % Indicator increased to 54% (January 17).

US Dollar weakens

The euro rose to a three-year high against the dollar, reaching $1.068 in thin trading.

Gold

New York: Spot gold eased 50 cents to $US 355.80

The euro rose to a three-year high against the dollar, reaching $1.068 in thin trading.

Gold

New York: Spot gold eased 50 cents to $US 355.80

ASX Australia

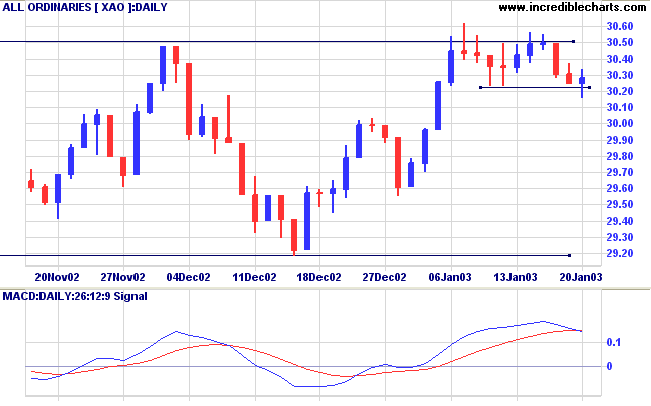

The All Ordinaries completed a short-term double top, breaking

below 3023 before rallying back to close at 3028 on average

volume.

The index ranges between 2915 and 3050, forming a base.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) has crossed below its signal line; Twiggs Money Flow is neutral.

The index ranges between 2915 and 3050, forming a base.

Slow Stochastic (20,3,3) is below its signal line; MACD (26,12,9) has crossed below its signal line; Twiggs Money Flow is neutral.

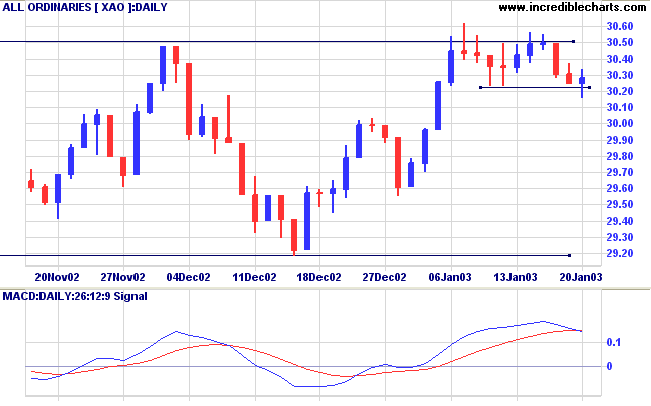

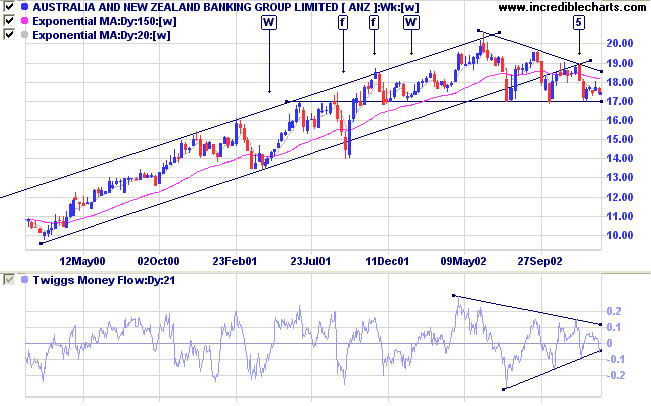

Australia & NZ Bank [ANZ]

Last covered on November 08, 2002.

After a long stage 2 up-trend ANZ formed a stage 3 top in the form of a descending triangle (Note the double bottoms [W] - strong bull signals in an up-trend - and the false breaks of the trend channel at [f]). The bearish triangle pattern was confirmed when price respected the lower trendline at 5.

The stock has, so far, held above support at 17.00. If Twiggs Money Flow breaks below the triangle on the indicator slot, this will signal weakness and that a break below 17.00 may be imminent.

Relative Strength (price ratio: xao) and MACD are both weakening.

Last covered on November 08, 2002.

After a long stage 2 up-trend ANZ formed a stage 3 top in the form of a descending triangle (Note the double bottoms [W] - strong bull signals in an up-trend - and the false breaks of the trend channel at [f]). The bearish triangle pattern was confirmed when price respected the lower trendline at 5.

The stock has, so far, held above support at 17.00. If Twiggs Money Flow breaks below the triangle on the indicator slot, this will signal weakness and that a break below 17.00 may be imminent.

Relative Strength (price ratio: xao) and MACD are both weakening.

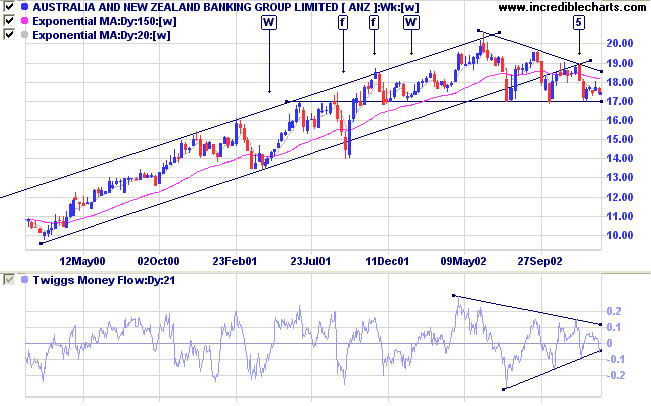

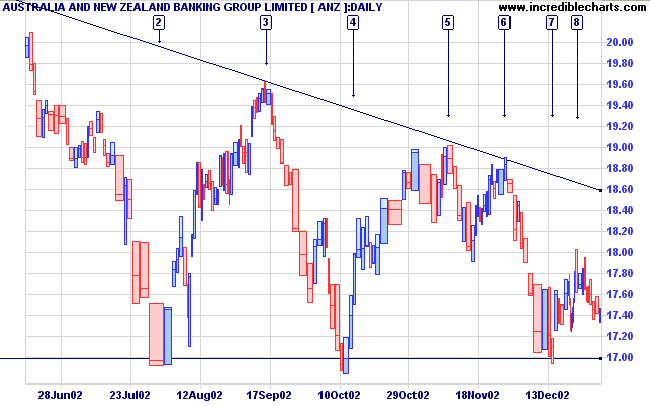

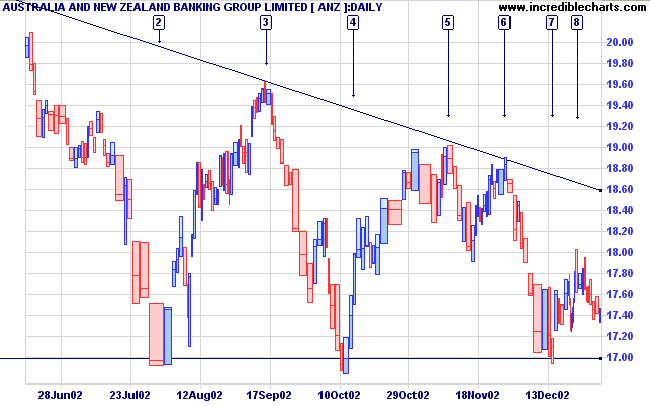

The Equivolume chart shows stronger volume when price is

falling than on the rallies.

Apart from false breaks at [2], [4] and [7], price has respected the 17.00 support level (Note that the double bottoms are not as reliable in a top or in a down-trend).

Apart from false breaks at [2], [4] and [7], price has respected the 17.00 support level (Note that the double bottoms are not as reliable in a top or in a down-trend).

Because of the false breaks it will be safer to wait, if ANZ

again breaks below 17.00, and enter short when price respects

the level from below.

Watch for a dry-up of volume, and daily range, on a short duration counter-rally.

Watch for a dry-up of volume, and daily range, on a short duration counter-rally.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Short if the All Ords is below 3023. The Slow

Stochastic and MACD are below their respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Man is man because he is free to operate

within the framework of his destiny. He is free to

deliberate,

to make decisions, and tochoose between alternatives. He is distinguished from animals by his freedom

to do evil or to do good and to walk the high road of beauty or tread the low road of ugly degeneracy.

- Martin Luther King Jr. : The Measures of Man, 1959.

to make decisions, and tochoose between alternatives. He is distinguished from animals by his freedom

to do evil or to do good and to walk the high road of beauty or tread the low road of ugly degeneracy.

- Martin Luther King Jr. : The Measures of Man, 1959.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.