December holidays

The newsletter over the holiday season will be shorter, with fewer stocks covered

as we take a break from the pressures of the market.

Trading Diary

December 11, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow formed another inside day, closing

almost unchanged at 8589 on average volume. The inside day

signals indecision about the future direction of the

market.

If the next rally fails to take out the high from December 2, we may face a re-test of the 7500 and 7200 support levels; equal highs (August 22 and December 2) in a down-trend are a bearish signal.

The primary trend is down. It will reverse up if the average rises above 9130.

The Nasdaq Composite gained 0.4% to close at 1396.

The primary trend is up.

The S&P 500 closed unchanged at 904. The index formed two equal highs (August 22 and December 2) and appears set to test the October low of 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 50% (December 10).

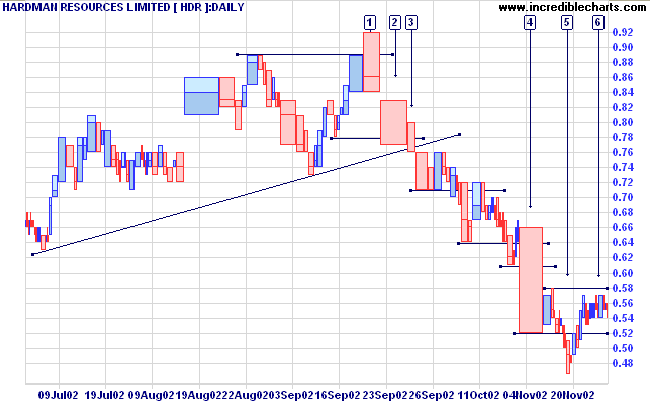

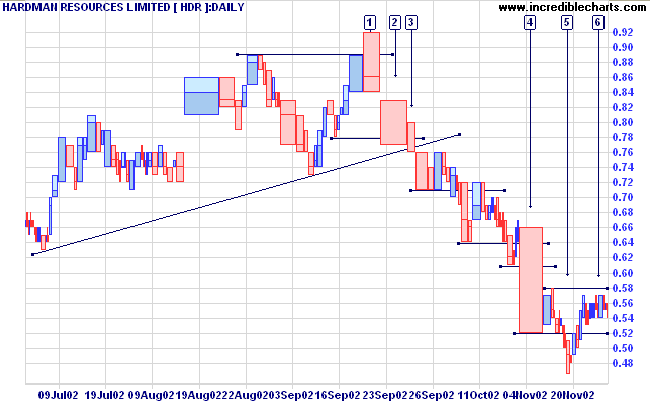

A false break of resistance at [1] is an early indication that the trend may reverse, reinforced by the gap at [2] on strong volume. The breakout from the trend channel occurred at [3] and was followed by a creeping down-trend before a fast break at [4] with strong volume. The trend continued down to [5] but on far lighter volume and the counter-trend has climbed back to re-test resistance at 0.58, the high of the previous up-swing. The resistance level appears to be holding, with price fluctuating in a narrow band.

A break below 0.52 will be a strong bear signal. A break above 0.58 would be mildly bullish.

Back Issues

If the next rally fails to take out the high from December 2, we may face a re-test of the 7500 and 7200 support levels; equal highs (August 22 and December 2) in a down-trend are a bearish signal.

The primary trend is down. It will reverse up if the average rises above 9130.

The Nasdaq Composite gained 0.4% to close at 1396.

The primary trend is up.

The S&P 500 closed unchanged at 904. The index formed two equal highs (August 22 and December 2) and appears set to test the October low of 768.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 50% (December 10).

Procter & Gamble

The consumer products manufacturer raised its earnings forecast for the quarter, citing strong sales in its health care business and in overseas markets. (more)

Gold

New York: Spot gold gained 170 cents to $US 324.90.

The consumer products manufacturer raised its earnings forecast for the quarter, citing strong sales in its health care business and in overseas markets. (more)

Gold

New York: Spot gold gained 170 cents to $US 324.90.

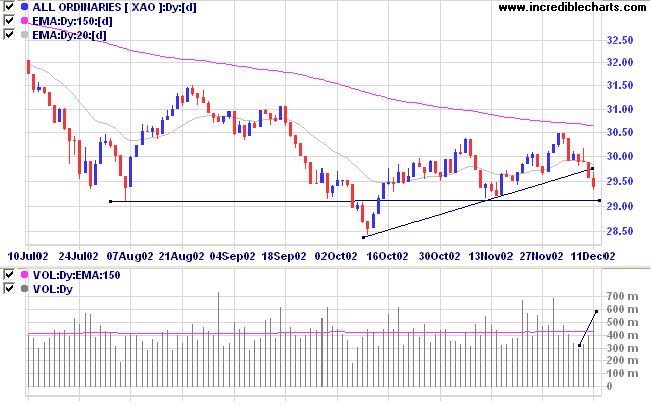

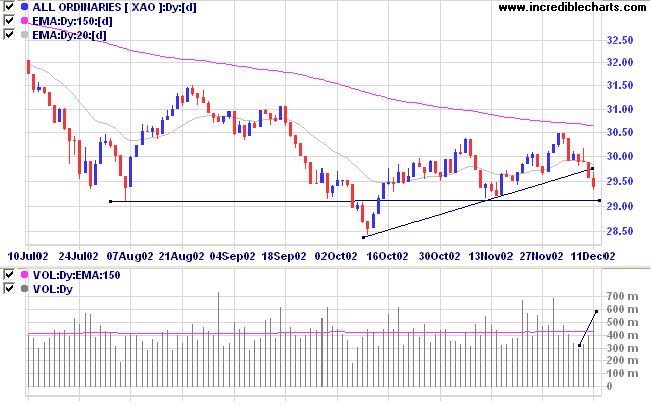

ASX Australia

The All Ordinaries closed down a further 17 points at 2939 on

rising volume. The index appears set to test support at 2915 in

the next few days

MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines; Twiggs money flow signals distribution.

MACD (26,12,9) and Slow Stochastic (20,3,3) are below their signal lines; Twiggs money flow signals distribution.

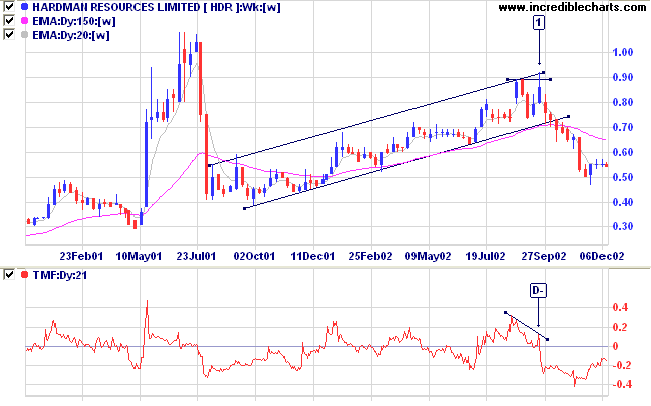

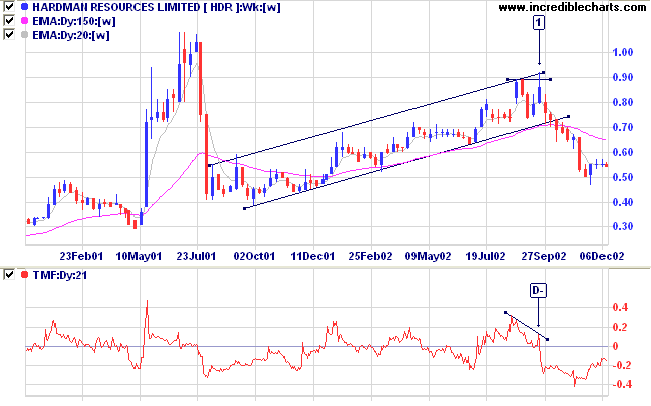

Hardman Resources [HDR]

Last covered on September 3.

After a huge spike in 2001, HDR continued in an upward trend until a false break above the previous high at [1], accompanied by a bearish divergence on Twiggs money flow and MACD and falling Relative Strength (price ratio: xao). The stock started a strong down-trend after breaking below the trend channel but is now forming a sideways congestion pattern.

Last covered on September 3.

After a huge spike in 2001, HDR continued in an upward trend until a false break above the previous high at [1], accompanied by a bearish divergence on Twiggs money flow and MACD and falling Relative Strength (price ratio: xao). The stock started a strong down-trend after breaking below the trend channel but is now forming a sideways congestion pattern.

A false break of resistance at [1] is an early indication that the trend may reverse, reinforced by the gap at [2] on strong volume. The breakout from the trend channel occurred at [3] and was followed by a creeping down-trend before a fast break at [4] with strong volume. The trend continued down to [5] but on far lighter volume and the counter-trend has climbed back to re-test resistance at 0.58, the high of the previous up-swing. The resistance level appears to be holding, with price fluctuating in a narrow band.

A break below 0.52 will be a strong bear signal. A break above 0.58 would be mildly bullish.

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Short. The Slow Stochastic and MACD are below their

respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

It is not given to any man to know it all.

When he thinks he's the smartest man in the world,

he puts himself in a class we call fools.

- Roy Longstreet: Viewpoints of a Commodity Trader.

When he thinks he's the smartest man in the world,

he puts himself in a class we call fools.

- Roy Longstreet: Viewpoints of a Commodity Trader.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.