Trading Diary: Back Issues

An archive of all past newsletters can be found at Trading Diary Archives.

Trading Diary

November 29, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow formed an inside day, closing down 0.4%

at 8896 on very low volume, to be expected after the Thursday

holiday.

The Nasdaq Composite index closed down slightly at 1468.

The S&P 500 closed almost unchanged at 936.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 48% (November 27).

The Nasdaq Composite index closed down slightly at 1468.

The S&P 500 closed almost unchanged at 936.

The Chartcraft NYSE Bullish % Indicator signals a bull alert at 48% (November 27).

Gold

New York: Spot gold gained 110 cents to $US 318.70.

New York: Spot gold gained 110 cents to $US 318.70.

ASX Australia

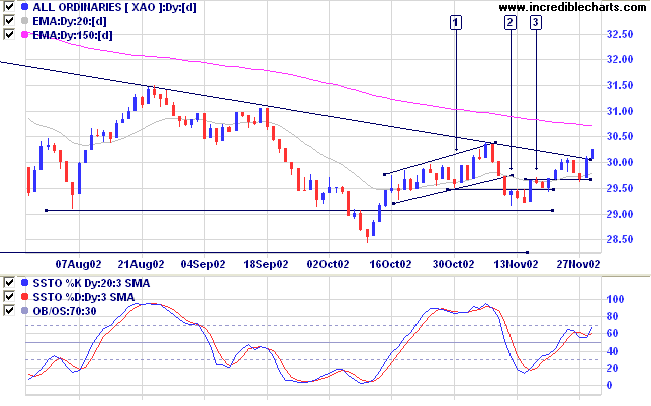

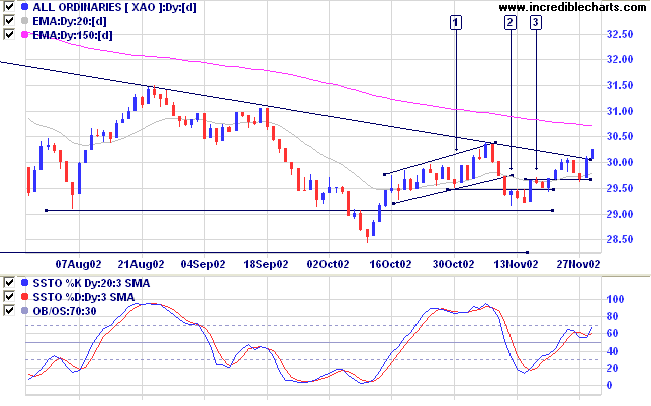

The All Ordinaries continues to rally strongly, closing up 18

points at 3025 on strong volume, and breaking through the upper

border of the symmetrical triangle.

The primary trend will reverse if the index rises above 3150.

The Slow Stochastic (20,3,3) has crossed back above its signal line; MACD (26,12,9) is above; Twiggs money flow has respected the zero line, a bullish signal.

The primary trend will reverse if the index rises above 3150.

The Slow Stochastic (20,3,3) has crossed back above its signal line; MACD (26,12,9) is above; Twiggs money flow has respected the zero line, a bullish signal.

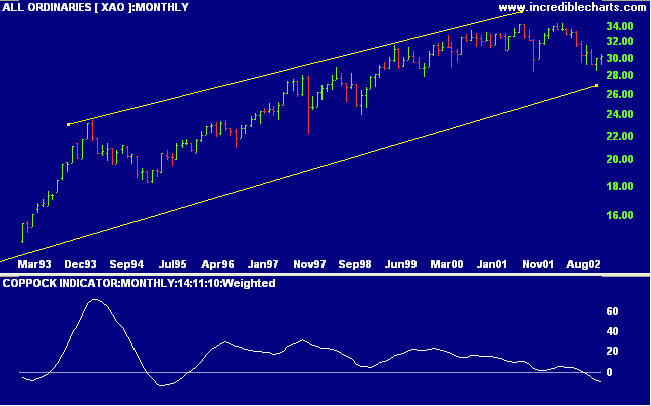

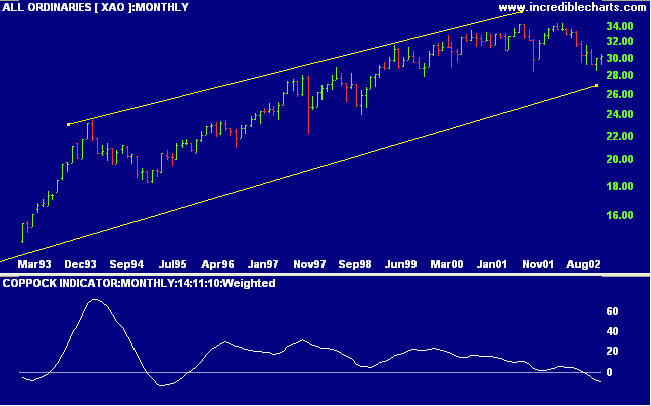

The long-term Coppock indicator is below zero and slopes

downward. An up-turn below zero will signal the start of a bull

market.

Woolworths [WOW]

Last covered on August 26.

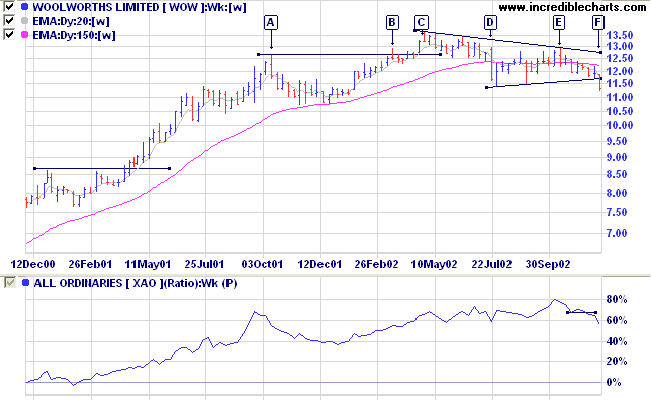

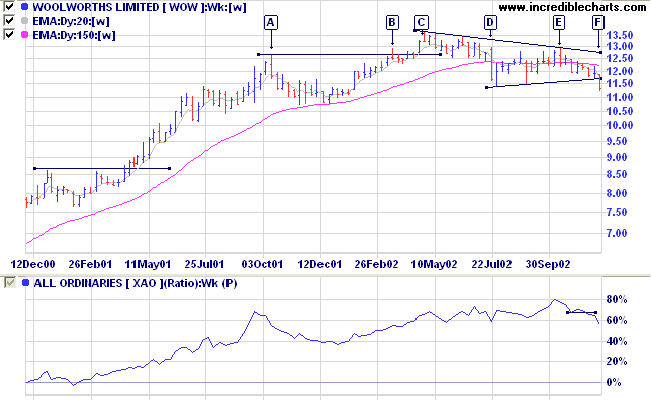

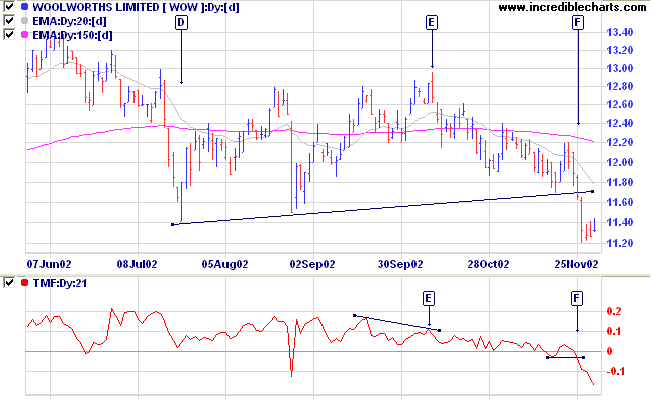

WOW formed a stage 3 top, in the shape of a a symmetrical triangle, after a long up-trend. Price has now broken out below the triangle at [F]. Relative strength (price ratio: xao) is falling.

Back Issues

Last covered on August 26.

WOW formed a stage 3 top, in the shape of a a symmetrical triangle, after a long up-trend. Price has now broken out below the triangle at [F]. Relative strength (price ratio: xao) is falling.

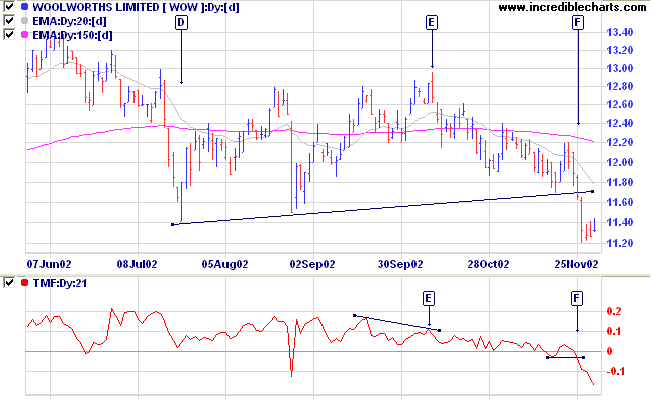

Twiggs money flow completed a bearish divergence at [E]

before the breakout at [F]. MACD completed a head and

shoulders pattern and is falling.

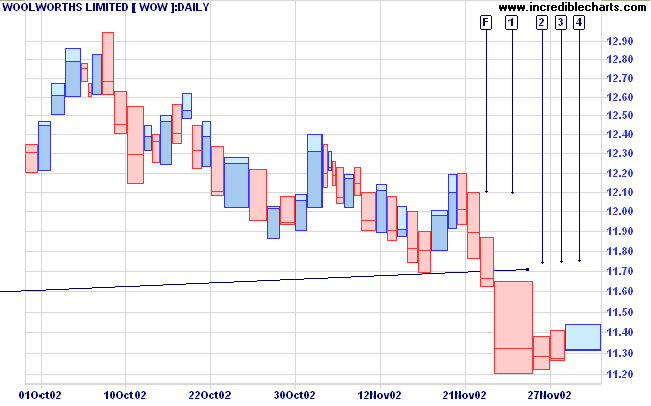

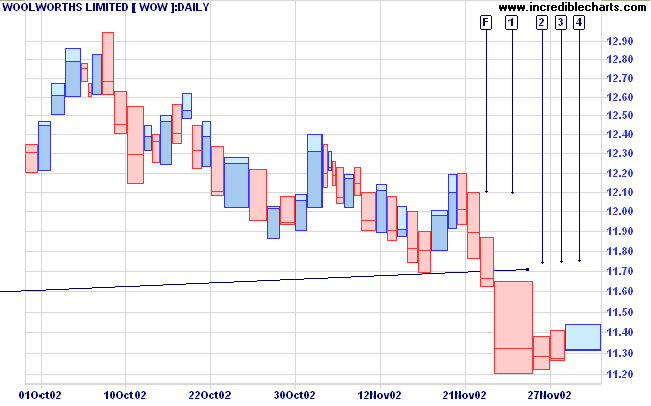

The breakout at [F] was on normal volume but was followed by

a large volume spike at [1]. Volume declined on the pull-back

at [2] and [3], before the long shadow and high volume at [4]

signal a reversal.

If price reverses downwards after [4], below the last low at

11.70, this will be a strong bear signal.

Sector Analysis

Changes are highlighted in bold.

Changes are highlighted in bold.

- Energy [XEJ] - stage 4 (RS is falling)

- Materials [XMJ] - stage 2 (RS is rising)

- Industrials [XNJ] - stage 4 (RS is falling)

- Consumer Discretionary [XDJ] - stage 2 (RS is rising)

- Consumer Staples [XSJ] - stage 4 (RS is falling)

- Health Care [XHJ] - stage 1 (RS is level)

- Property Trusts [XPJ] - stage 3 (RS is level)

- Financial excl. Property Trusts [XXJ] - stage 4 (RS is falling)

- Information Technology [XIJ] - stage 4 (RS is falling)

- Telecom Services [XTJ] - stage 4 (RS is falling)

- Utilities [XUJ] - stage 2 (RS is falling)

Sectors: Relative Strength

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 36 stocks (compared to 99, August 23rd and 10 on October 4th). Notable sectors are:

A stock screen of the ASX 200 using % Price Move (1 month: +5%) returned 36 stocks (compared to 99, August 23rd and 10 on October 4th). Notable sectors are:

- Diversified Metals & Mining

- Pharmaceuticals

- REITs

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Long. The Slow Stochastic and MACD are above

their respective signal lines.

Medium-term: Long.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

It is what we think we know already

that prevents us from learning.

- Claude Bernard (1813 - 1878), founder of experimental medicine.

that prevents us from learning.

- Claude Bernard (1813 - 1878), founder of experimental medicine.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.