Incredible Charts 4.0.0.7

The new version provides an option to abbreviate the chart legend, on the Format Charts menu.

Incredible Charts should automatically update when you login.

Use Help >>About to check that you have the latest version.

Trading Diary

October 21, 2002

These extracts from my daily trading diary are intended to

illustrate the techniques used in short-term trading and should

not be interpreted as investment advice. Full terms and

conditions can be found at Terms

of Use .

USA

The Dow rose 2.6%, forming a continuation

flag, and closed at 8538 on average volume. A primary trend

reversal will be signaled if the index rises above 9130.

The Nasdaq Composite Index climbed 1.7% to close at 1309. The primary trend will reverse if there is a break above 1426.

The S&P 500 is also forming a continuation flag, closing up 1.7% at 899. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 18).

The Nasdaq Composite Index climbed 1.7% to close at 1309. The primary trend will reverse if there is a break above 1426.

The S&P 500 is also forming a continuation flag, closing up 1.7% at 899. The primary trend is down. The index will complete a double bottom reversal if it rises above 965.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 18).

Mixed results

Texas Instruments reported third-quarter earnings of 11 cents per share, compared to a loss of 3 cents a year ago, but warns that fourth-quarter sales and earnings will fall below estimates. (TI)

Dow component 3M Co. increased earnings by 38%, compared to the third quarter last year, and raised its guidance for the fourth quarter. (3M)

Back Issues

Texas Instruments reported third-quarter earnings of 11 cents per share, compared to a loss of 3 cents a year ago, but warns that fourth-quarter sales and earnings will fall below estimates. (TI)

Dow component 3M Co. increased earnings by 38%, compared to the third quarter last year, and raised its guidance for the fourth quarter. (3M)

Gold

New York: Spot gold was down 190 cents at $US 310.60.

New York: Spot gold was down 190 cents at $US 310.60.

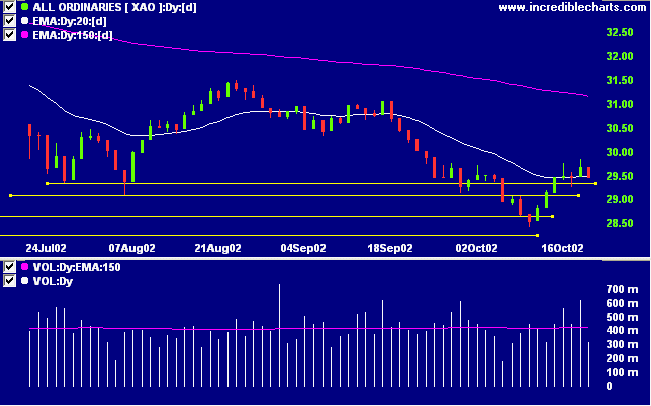

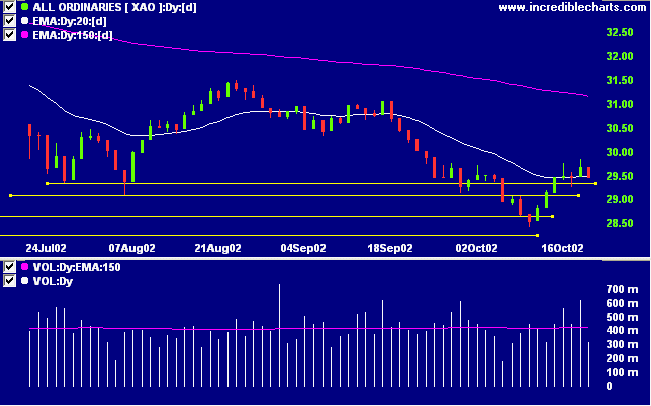

ASX Australia

The All Ordinaries closed down 19 points at 2948 on

reassuringly low volume. A break above 3150 will signal a

primary trend reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. Twiggs money is whipsawing around the zero line after a bullish divergence.

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. Twiggs money is whipsawing around the zero line after a bullish divergence.

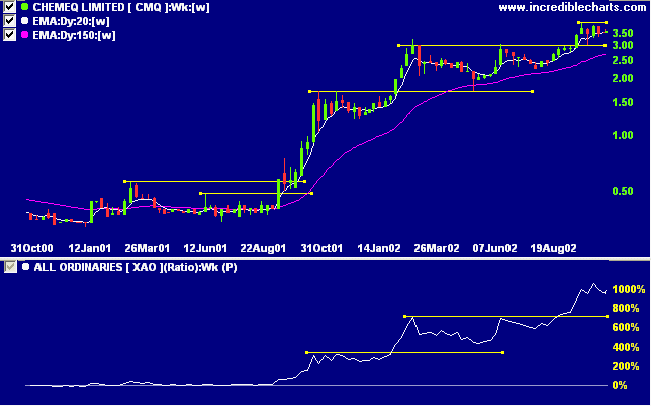

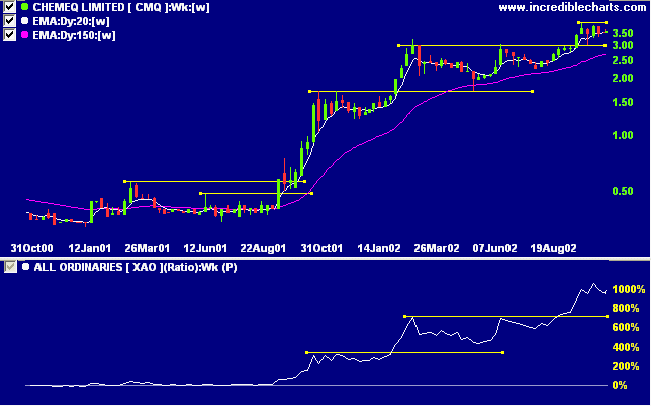

Chemeq [CMQ]

After a stage 2 up-trend CMQ broke through resistance at 3.00 and is now forming a pennant/symmetrical triangle between 3.00 and 4.00. Relative strength (price ratio: xao) continues to rise.

After a stage 2 up-trend CMQ broke through resistance at 3.00 and is now forming a pennant/symmetrical triangle between 3.00 and 4.00. Relative strength (price ratio: xao) continues to rise.

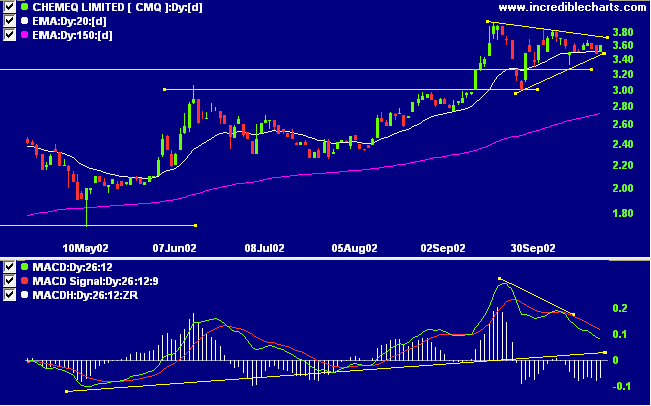

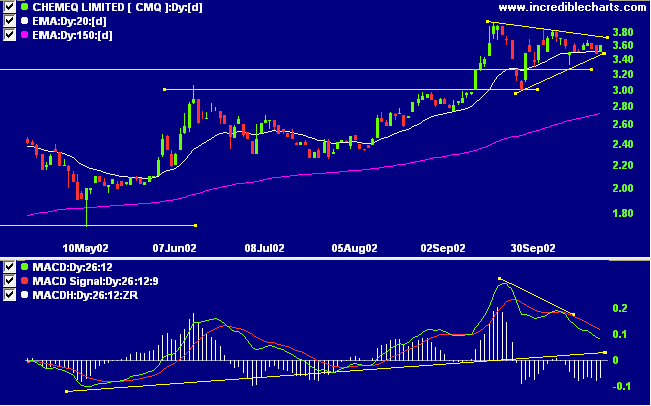

Congestion just below or above a resistance

level is normally a bullish sign. But, after being bullish for

some time, MACD and Twiggs money flow show bearish declines in

the last month.

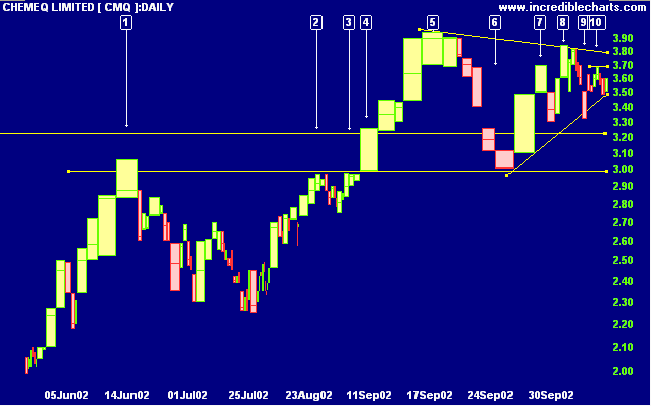

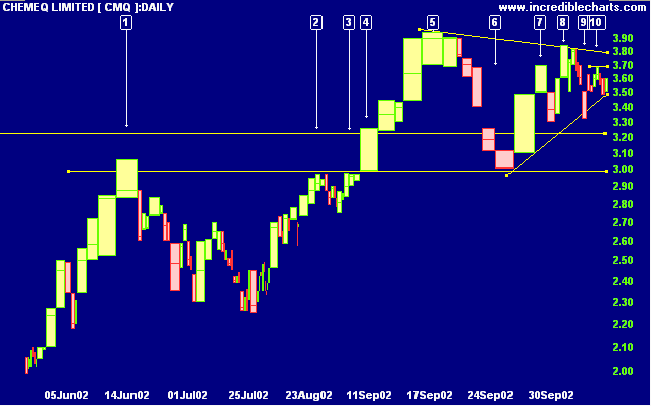

The equivolume chart shows strong support at

3.00. Notice how support formed at the round number and not at

the high of day [1]. The small correction between [2] and [3],

on light volume, was a good time to increase ones position.

Alternatively, accumulate on day [4] at the breakout. Rallies

to [5] and [7] were on strong volume but this has faded on the

next two rallies at [8] and [10]. I will only increase the

position if MACD and TMF hold above zero and price breaks above

3.80 on strong volume.

A break below 3.30 would be bearish.

Short-term: Long. The

Slow Stochastic and MACD are above their respective signal

lines.

Medium-term: Long.

Use stop losses to protect yourself against a sudden

reversal.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Thought for

the Day:

Many people watch, but few see.

- Monty Roberts, Horse Sense for People.

Many people watch, but few see.

- Monty Roberts, Horse Sense for People.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.