Suggestions

Thank you for the many useful suggestions. They help us to plan further development.

If you have suggestions as to how we can

improve the charts, website or newsletter,

please post them at the Chart

Forum: Suggestion Box.

Trading Diary

October 17, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow held above the 8000 level, closing up almost 3% at 8275

on strong volume. The Dow Theory will signal a primary trend

reversal if the index rises above 9130.

The Nasdaq Composite Index gained more than 3% to close at 1272. The primary trend will reverse if there is a break above 1426.

The S&P 500 gained 19 points to close at 879. The index will complete a double bottom if it rises above 965. The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 16).

The Nasdaq Composite Index gained more than 3% to close at 1272. The primary trend will reverse if there is a break above 1426.

The S&P 500 gained 19 points to close at 879. The index will complete a double bottom if it rises above 965. The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 16).

Microsoft up

Microsoft reports first-quarter earnings of 50 cents per share, beating analysts estimates, but lowers forecasts for the next quarter. (more)

Back Issues

Microsoft reports first-quarter earnings of 50 cents per share, beating analysts estimates, but lowers forecasts for the next quarter. (more)

Gold

New York: Spot gold last traded at $US 311.60, down 270 cents.

New York: Spot gold last traded at $US 311.60, down 270 cents.

ASX Australia

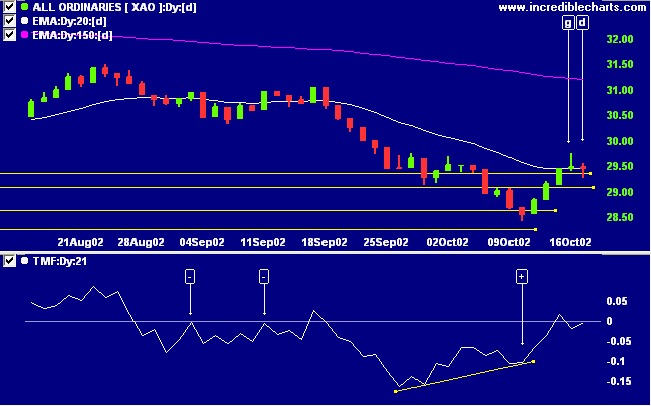

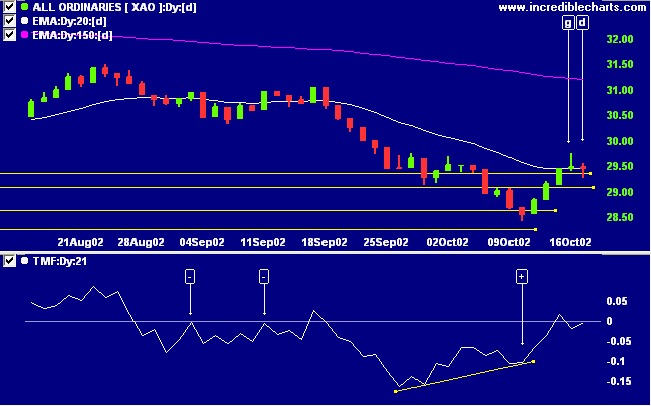

The All Ordinaries formed a dragonfly doji candlestick

[d], signaling that buyers are back in control. The index

closed 2 points down on above-average volume, holding above

support at 2910. A break above 3150 will signal a primary trend

reversal.

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. Twiggs money flow is rising, after a bullish divergence [+].

MACD (26,12,9) and Slow Stochastic (20,3,3) are above their signal lines. Twiggs money flow is rising, after a bullish divergence [+].

Adelaide Brighton Cement [ABC]

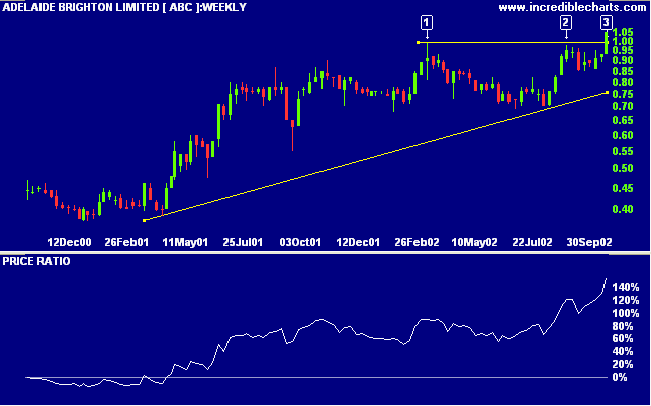

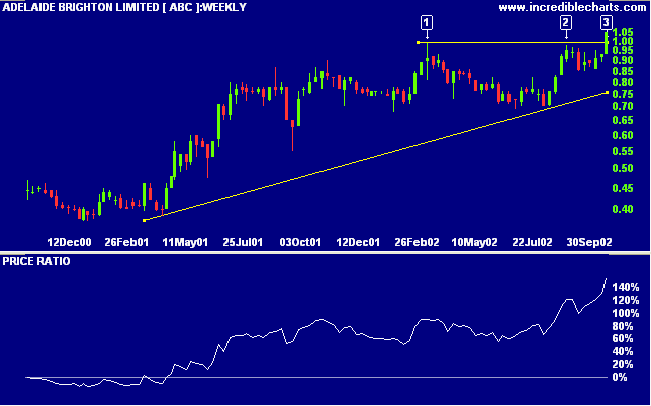

ABC entered a period of consolidation, below 1.00, after starting a stage 2 up-trend. Relative strength (price ratio: xao) is rising. A bullish cup and handle pattern can be seen, with the cup from [1] to [2] and the handle at [2] to [3].

ABC entered a period of consolidation, below 1.00, after starting a stage 2 up-trend. Relative strength (price ratio: xao) is rising. A bullish cup and handle pattern can be seen, with the cup from [1] to [2] and the handle at [2] to [3].

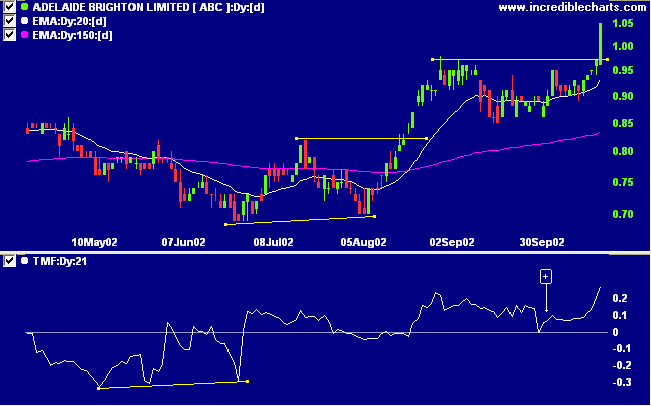

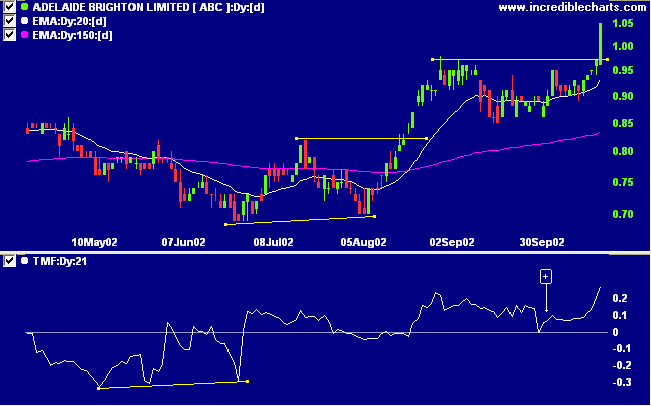

Twiggs money flow and MACD show bullish divergences, with TMF

respecting the zero line at [+], signaling strong accumulation.

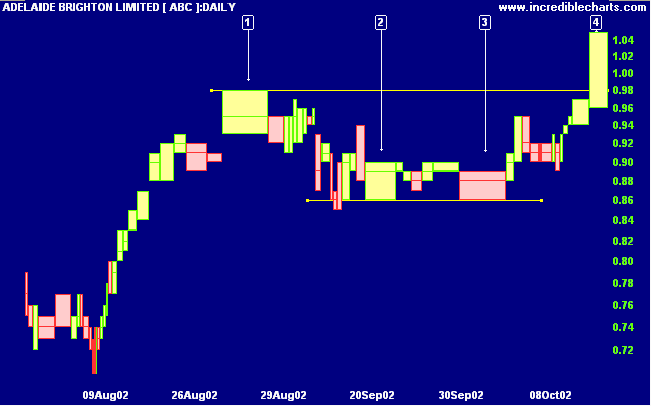

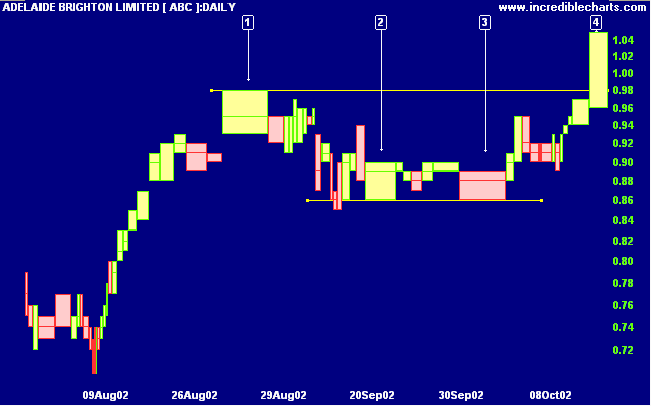

The equivolume chart reflects the handle from the cup

and handle pattern. At [1] higher prices were rejected with

the broad bar showing increased volume and the long upper

shadow signaling that sellers had wrested control away from

buyers. [2] and [3] reflect strong buying support at 0.86. The

breakout at [4] is confirmed by strong volume. The ideal entry

point would have been a buy-stop at 1.01 or 1.02 (avoid round

numbers) with a stop-loss either at: (1) 0.88 below the recent

low; (2) 0.92 below the 20-day MA; or (3) 0.97 below the

support/resistance line; depending on the trading objective and

time frame.

Hopefully ABC will pull back to test the 0.98 support level,

giving a second bull signal when it rallies off its lows.

Short-term: Long. The Slow Stochastic

and MACD are above their respective signal lines.

Medium-term: Long. Use stop losses to

protect yourself against a sudden reversal.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Thought for the Day:

And therefore the cautious man, when it is time to act impetuously, does not know how to do so, and he is ruined;

but if he had changed his conduct with the times, Fortune would not have changed.

- Niccolo Machiavelli, The Prince (1532)

And therefore the cautious man, when it is time to act impetuously, does not know how to do so, and he is ruined;

but if he had changed his conduct with the times, Fortune would not have changed.

- Niccolo Machiavelli, The Prince (1532)

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.