Suggestions

If you have any suggestions as to how we can improve the charts, website or newsletter,

please post them at the Chart Forum: Suggestion Box.

Trading Diary

October 15, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow had a

follow-through day on strong volume, rising 4.8% to 8255.

This completes a

bottom reversal as defined by William O'Neil. The Dow Theory

measure of primary trend direction will only turn up if we have a

rally above 9130 of at least 3 weeks duration.

The Nasdaq Composite Index gapped up to close at 1282, an increase of more than 5%. The follow-through day completes a bottom reversal as defined by William O'Neil. The primary trend will reverse if the rally lasts 3 or more weeks and breaks above 1426.

The S&P 500 gained 40 points to close at 881, breaking through resistance at 855. The follow-through day completes a bottom reversal as defined by William O'Neil. The index will complete a double bottom if it rises above 965. The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 14).

The Nasdaq Composite Index gapped up to close at 1282, an increase of more than 5%. The follow-through day completes a bottom reversal as defined by William O'Neil. The primary trend will reverse if the rally lasts 3 or more weeks and breaks above 1426.

The S&P 500 gained 40 points to close at 881, breaking through resistance at 855. The follow-through day completes a bottom reversal as defined by William O'Neil. The index will complete a double bottom if it rises above 965. The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 14).

Wall Street rally

Better than expected results from Johnson&Johnson, Citigroup and General Motors boosted the market at the opening. (J&J)(Citi)(GM)

Intel later disappointed with third-quarter earnings of 11 cents per share compared to expectations of 13 cents. (Intel)

Back Issues

Better than expected results from Johnson&Johnson, Citigroup and General Motors boosted the market at the opening. (J&J)(Citi)(GM)

Intel later disappointed with third-quarter earnings of 11 cents per share compared to expectations of 13 cents. (Intel)

Gold

New York: Spot gold last traded at $US 313.50, falling 390 cents to the lowest close in more than a month.

New York: Spot gold last traded at $US 313.50, falling 390 cents to the lowest close in more than a month.

ASX Australia

The All Ordinaries completed a

follow-through day on higher volume, breaking above

resistance at 2940. The index closed up 30 points at

2946.

A break above 3150 will signal a primary trend reversal.

MACD (26,12,9) has joined Slow Stochastic (20,3,3) above its signal line. Twiggs money flow signals accumulation following a bullish divergence.

A break above 3150 will signal a primary trend reversal.

MACD (26,12,9) has joined Slow Stochastic (20,3,3) above its signal line. Twiggs money flow signals accumulation following a bullish divergence.

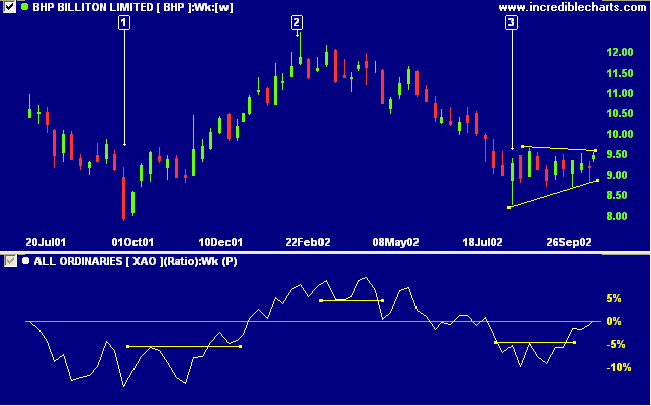

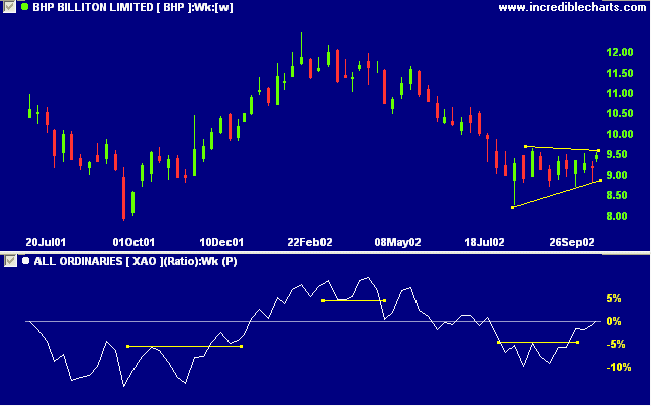

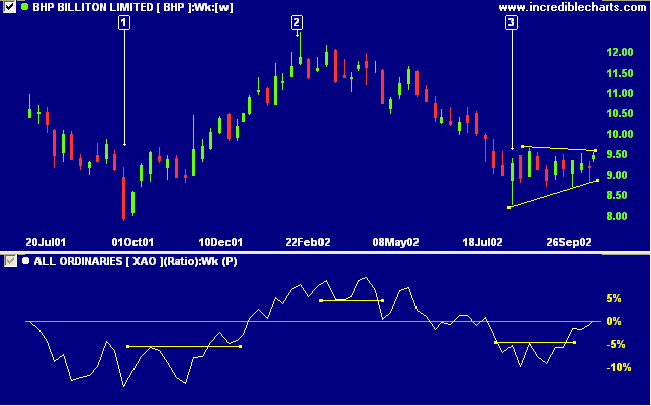

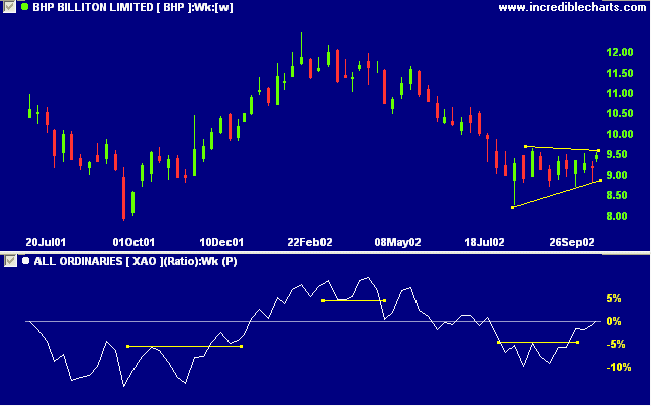

BHP Billiton [BHP]

Last covered on August 7.

BHP has formed two fairly equal lows about 12 months apart, after a stage 4 down-trend. A rise to 12.50 would complete a double bottom reversal. Relative strength (price ratio: xao) is rising and the stock appears to be forming a bullish ascending triangle.

Last covered on August 7.

BHP has formed two fairly equal lows about 12 months apart, after a stage 4 down-trend. A rise to 12.50 would complete a double bottom reversal. Relative strength (price ratio: xao) is rising and the stock appears to be forming a bullish ascending triangle.

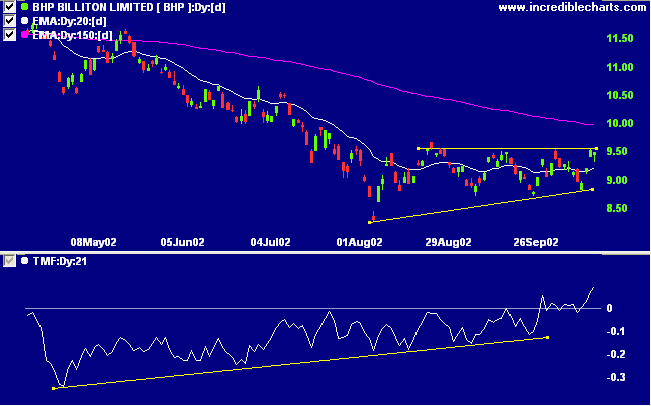

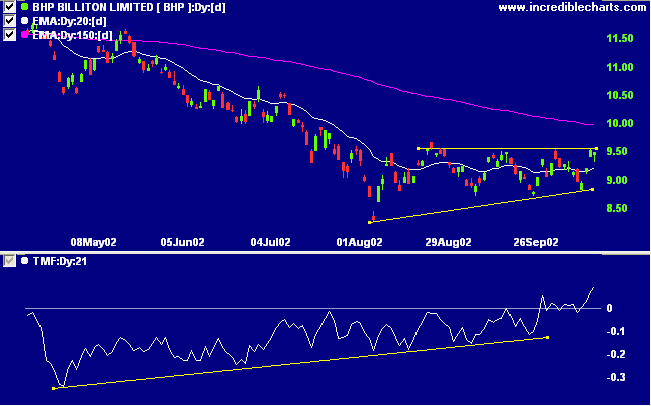

Twiggs money flow reflects a series of bullish divergences and

is now signaling accumulation, above zero.

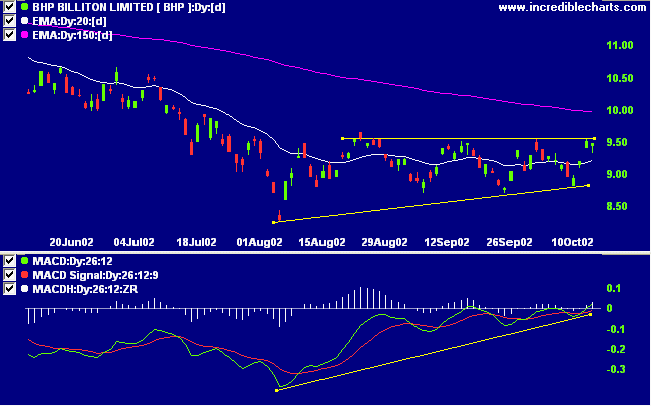

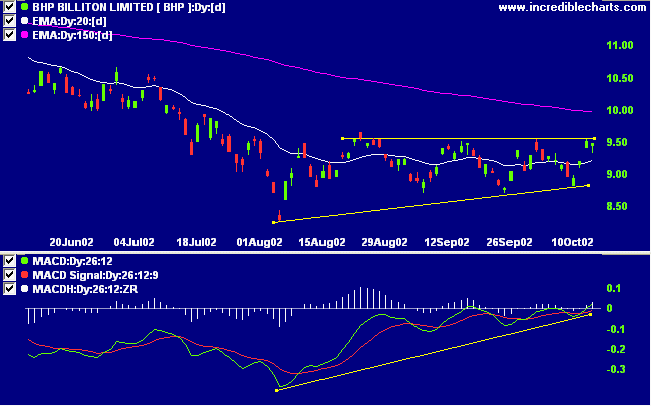

MACD also shows a bullish divergence. Resistance has formed at

9.55 to 9.66. Volume on the latest rallies is a bit thin.

A break above 9.55 will be a bear signal, confirmed if volume

rises and price penetrates above 9.66. A break below 8.71 will

be bearish.

Short-term: Long. The Slow Stochastic

and MACD are above their respective signal lines.

Medium-term: Long. I have seen

bottom reversals fail before, within 3 or 4 days of the

follow-through, but never one with this significant an

increase in volume, and across all three averages.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

Thought for the Day:

At times like this it is important to ignore all the speculation and conflicting opinions in the press

and to just concentrate on the message from the charts:

You do not need to know what the market is going to do!

All you need to know is what the market has actually done! This is the key!

- William J O'Neil, How to Make Money in Stocks

At times like this it is important to ignore all the speculation and conflicting opinions in the press

and to just concentrate on the message from the charts:

You do not need to know what the market is going to do!

All you need to know is what the market has actually done! This is the key!

- William J O'Neil, How to Make Money in Stocks

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.