Suggestions

If you have any suggestions as to how we can improve the charts, website or newsletter,

please post them at the Chart Forum: Suggestion Box.

Trading Diary

October 14, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow closed up slightly at 7877 on low volume. Buying pressure

appears to be waning - the true test this week will be whether

the index can carry above the 8000 resistance level. The primary

trend is down.

The Nasdaq Composite Index gained 10 points to close at 1220. The primary trend is down.

The S&P 500 gained 6 points to close at 841. Immediate resistance is at 855 and the index will complete a double bottom if it rises above 965. The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 11).

The Nasdaq Composite Index gained 10 points to close at 1220. The primary trend is down.

The S&P 500 gained 6 points to close at 841. Immediate resistance is at 855 and the index will complete a double bottom if it rises above 965. The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 26% (October 11).

A quiet day on Wall Street

The absence of a sell-off, after two strong up days. Some see this as a good sign for the next few weeks. (more)

Back Issues

The absence of a sell-off, after two strong up days. Some see this as a good sign for the next few weeks. (more)

Gold

New York: Spot gold last traded at $US 317.40, up 130 cents.

New York: Spot gold last traded at $US 317.40, up 130 cents.

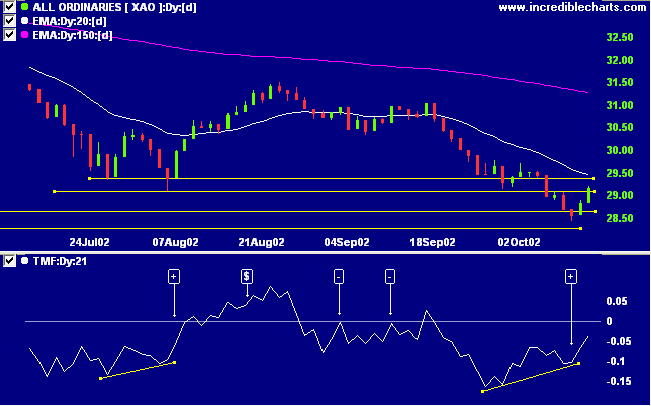

ASX Australia

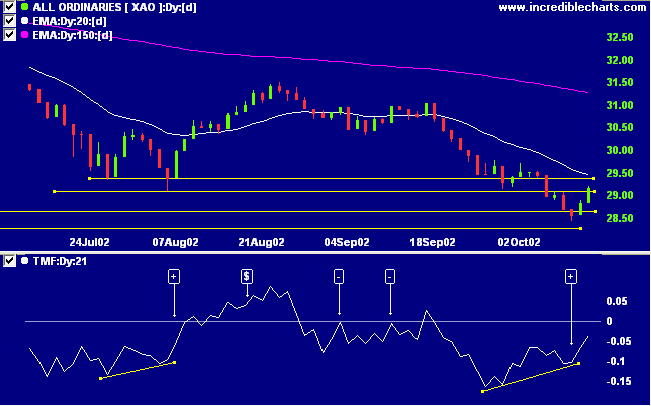

The All Ordinaries broke through initial resistance at 2909,

closing up 33 points on light volume. The primary trend is

still down.

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below. Twiggs money flow signals a bullish divergence [+].

Slow Stochastic (20,3,3) is above its signal line; MACD (26,12,9) is below. Twiggs money flow signals a bullish divergence [+].

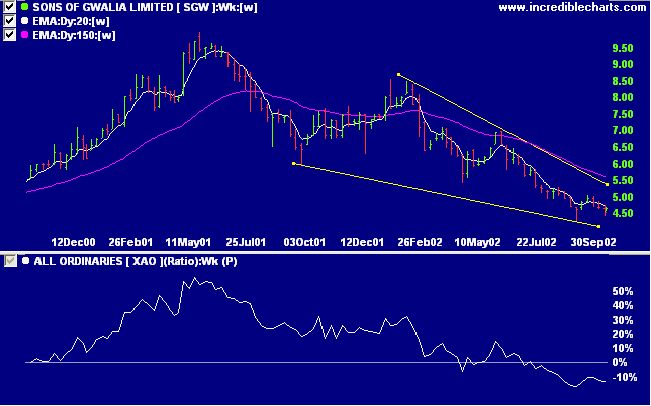

Sons of Gwalia [SGW]

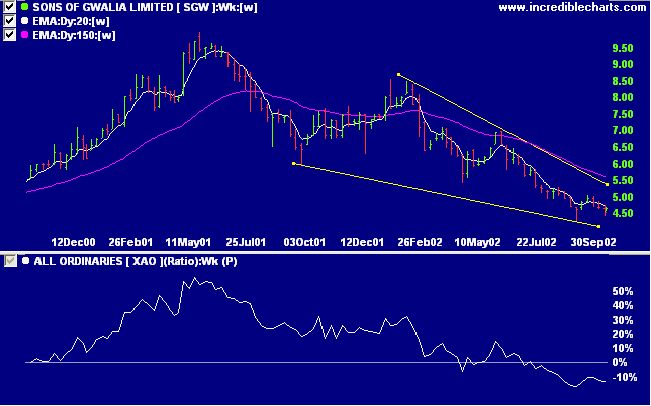

A lot has happened since September 2 when SGW was last covered.

The stock has formed a bullish falling wedge while in a stage 4 down-trend. Relative strength (price ratio: xao) has been falling for the last 16 months but may be showing early signs of a reversal, forming a higher low.

A lot has happened since September 2 when SGW was last covered.

The stock has formed a bullish falling wedge while in a stage 4 down-trend. Relative strength (price ratio: xao) has been falling for the last 16 months but may be showing early signs of a reversal, forming a higher low.

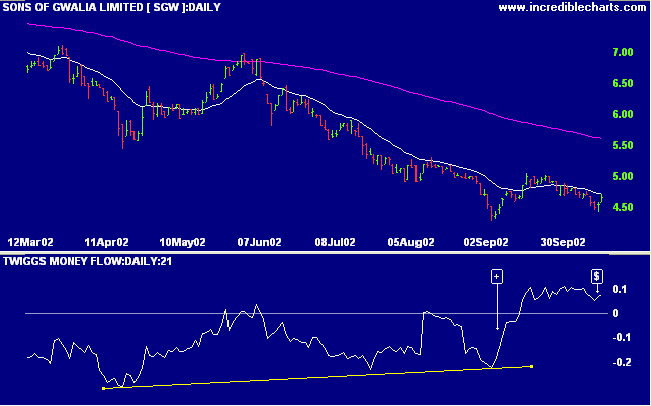

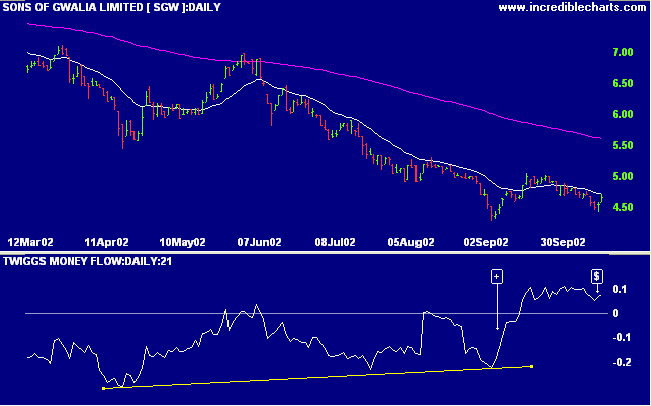

MACD shows a bullish divergence. Twiggs money flow shows a

bullish divergence [+] followed by strong accumulation [$] with

TMF holding above zero.

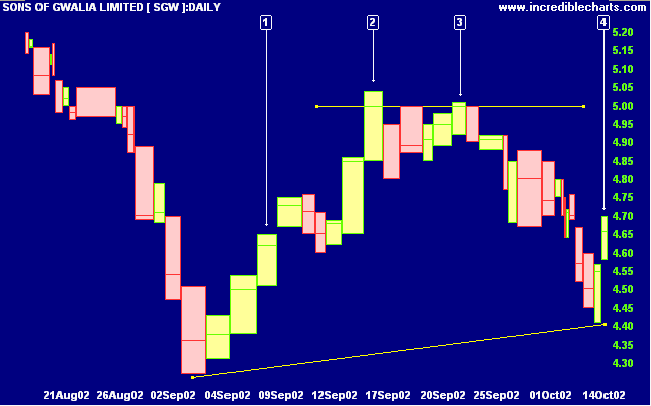

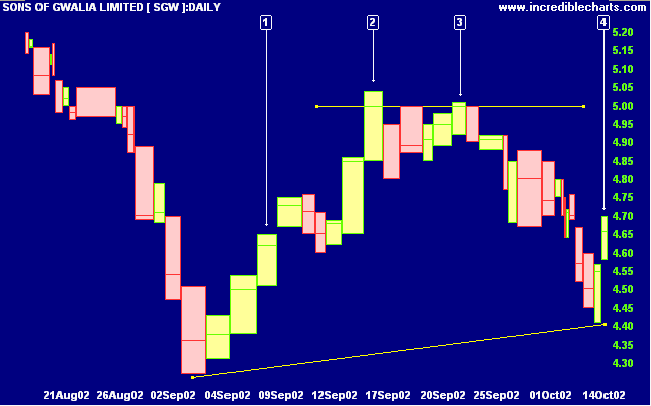

On the equivolume chart SGW appears to be forming an

ascending triangle with resistance at 5.00 after equal

highs at [2] and [3]. Volume on the latest rally [4] is a bit

thin and some heavier volume, as in the previous rally [1],

would be reassuring.

A break above 5.00 on strong volume will be a bull signal,

while a break below 4.35 will be a bearish continuation signal.

Short-term: Avoid new entries. The Slow Stochastic and MACD are

on opposite sides of their respective signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

Ordinary mortals know what's happening now,

the gods know what the future holds

because they are totally enlightened.

Wise men are aware of future things

just about to happen.

- C.P. Cavafy, a poem based on lines by Philostratos

Ordinary mortals know what's happening now,

the gods know what the future holds

because they are totally enlightened.

Wise men are aware of future things

just about to happen.

- C.P. Cavafy, a poem based on lines by Philostratos

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.