Incredible Charts version 4.0.0.6

Use Help >>About to check that you have the latest update. The new version offers:

-

A Price

Ratio (relative strength) indicator that applies to all

securities in a project.

When installing on the Indicator Panel, select "Apply to Project".

-

New Stock Screens

- Directional Movement (+DI, -DI and ADX)

- MACD above or below zero

- Volume Filter

- Equivolume with closing prices

Trading Diary

October 07, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow lost a further 1.4% to close at 7423 on lower

volume.

The primary trend is down.

The Nasdaq Composite Index shed 1.8% to close at 1119.

The primary trend is down.

The S&P 500 has broken below support at 800 and is testing July lows, closing 15 points down at 785.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 30% (October 4).

The primary trend is down.

The Nasdaq Composite Index shed 1.8% to close at 1119.

The primary trend is down.

The S&P 500 has broken below support at 800 and is testing July lows, closing 15 points down at 785.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator reflects a bear confirmed signal at 30% (October 4).

JP Morgan cuts staff

The decision by JP Morgan to cut 4000 (20%) of its workforce may be the forerunner of staff cuts in an overweight US brokerage industry. (more)

Back Issues

The decision by JP Morgan to cut 4000 (20%) of its workforce may be the forerunner of staff cuts in an overweight US brokerage industry. (more)

Gold

New York: The spot gold price is unchanged at $US 322.10.

New York: The spot gold price is unchanged at $US 322.10.

ASX Australia

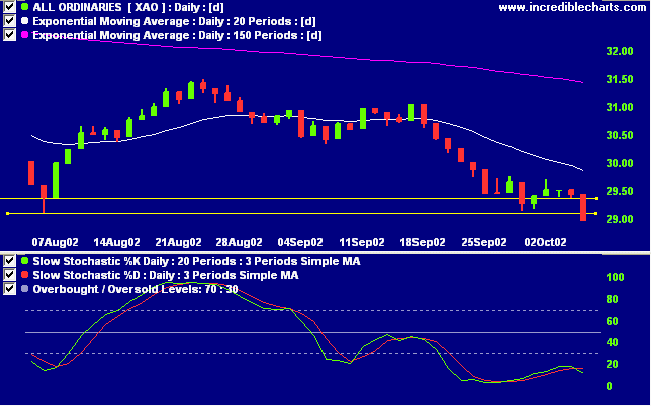

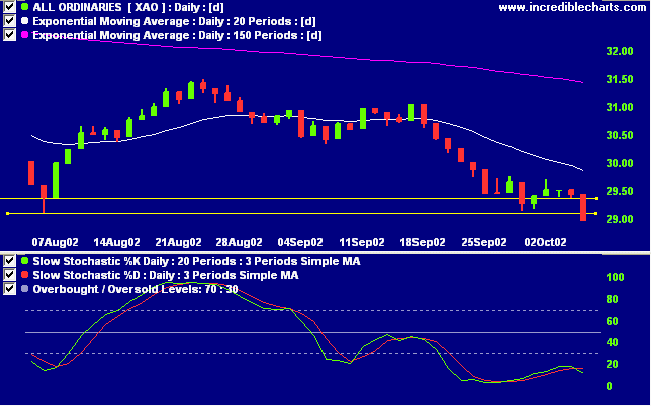

The All Ordinaries index has broken through support at 2940 to

2909, closing at 2896 on low volume. The next band of support

is at 2867 to 2828, from September 2001. The primary trend is

down.

Slow Stochastic (20,3,3) has crossed to below its signal line, to join MACD (26,12,9). Twiggs money flow signals distribution.

Slow Stochastic (20,3,3) has crossed to below its signal line, to join MACD (26,12,9). Twiggs money flow signals distribution.

QBE Insurance [QBE]

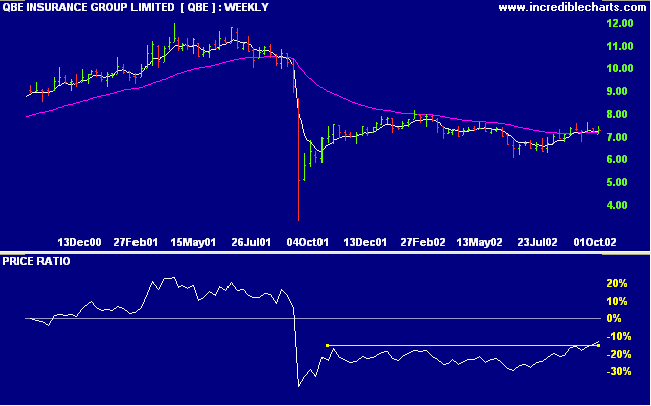

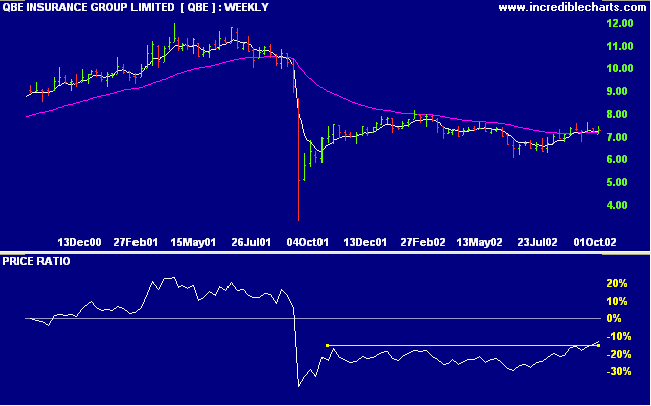

After a disastrous fall in September 2001, QBE has entered a stage 1 base, with relative strength (price ratio: xao) rising. The 150-day exponential moving average has leveled after a long decline.

After a disastrous fall in September 2001, QBE has entered a stage 1 base, with relative strength (price ratio: xao) rising. The 150-day exponential moving average has leveled after a long decline.

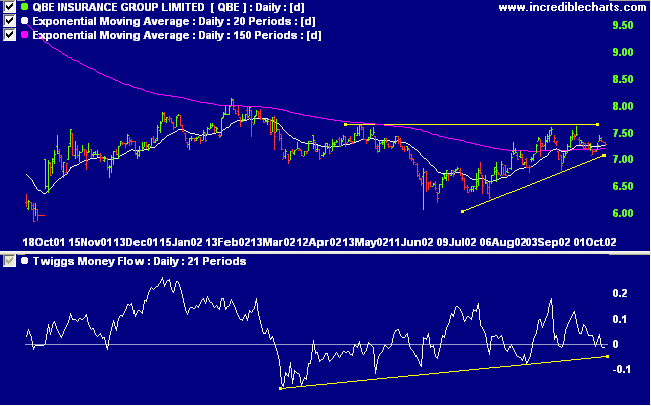

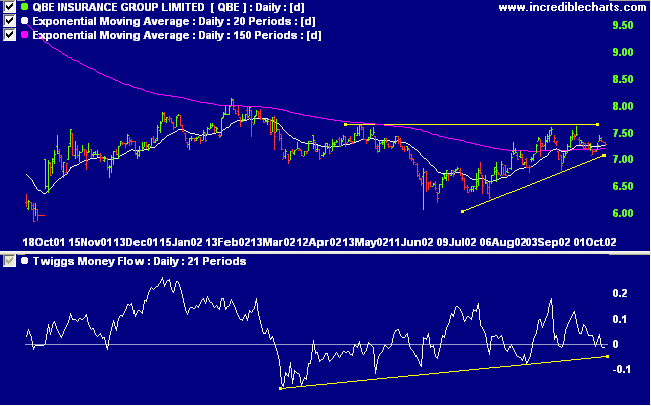

The daily chart shows a bullish ascending triangle pattern and

a bullish divergence on Twiggs money flow.

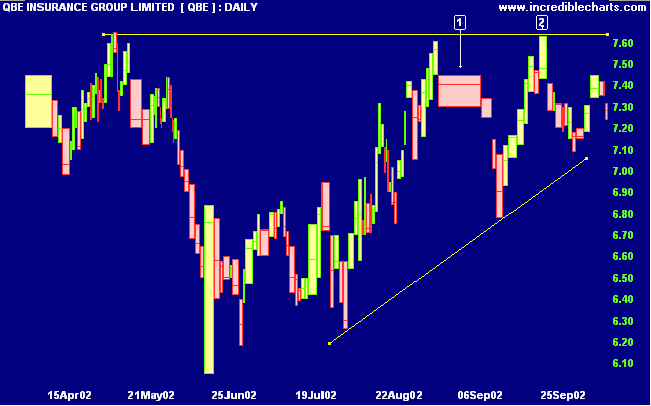

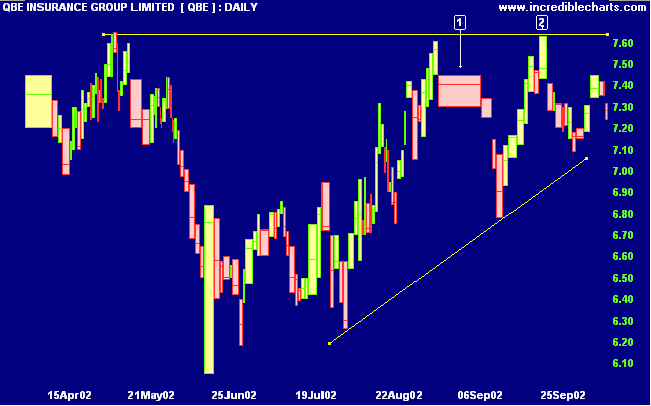

Last covered on

September 10, after a strong selloff [1], QBE rallied to

re-test resistance at 7.64 [2]. The test was weak, as can be

seen from the low close, and it may take several more tests

before a rally breaks above the resistance level.

The shaded areas on the equivolume chart depict closing prices: the lighter shade is above the close in an up-trend, and below the close in a down-trend.

The shaded areas on the equivolume chart depict closing prices: the lighter shade is above the close in an up-trend, and below the close in a down-trend.

Short-term: Short. The Slow Stochastic and MACD are below their

respective signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

To be a successful trader, you have to be able to admit mistakes .... the person who can easily admit to being wrong is the one who walks away a winner.

Victor Sperandeo - The New Market Wizards by Jack Schwager

To be a successful trader, you have to be able to admit mistakes .... the person who can easily admit to being wrong is the one who walks away a winner.

Victor Sperandeo - The New Market Wizards by Jack Schwager

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.