Incredible Charts version 4.0.0.4 is now available

See the What's New page for details.

Trading Diary

August 29, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow closed down slightly at 8670 on normal volume. The

secondary rally is still intact, while the primary cycle is in a

down-trend.

The Nasdaq Composite came close to forming a key reversal, rising 1.6% to close at 1335, on an outside day. The secondary rally is still intact. The primary cycle is in a down-trend.

The S&P 500 closed unchanged at 917. The primary trend is down. The doji signals uncertainty.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 46% (August 28).

Sun spots

Sun Microsystems warn that technology spending is weakening and first-quarter revenues will be at the low end of the previous guidance. (more)

Sun Microsystems warn that technology spending is weakening and first-quarter revenues will be at the low end of the previous guidance. (more)

Phillips-Conoco merger

Phillips Petroleum appears likely to win FTC approval for its $US 24.5 billion merger with Conoco. (more)

Phillips Petroleum appears likely to win FTC approval for its $US 24.5 billion merger with Conoco. (more)

Dow 5000?

Technician Bernie Schaeffer believes that the Dow is inflated and will fall further. (more)

Technician Bernie Schaeffer believes that the Dow is inflated and will fall further. (more)

ASX Australia

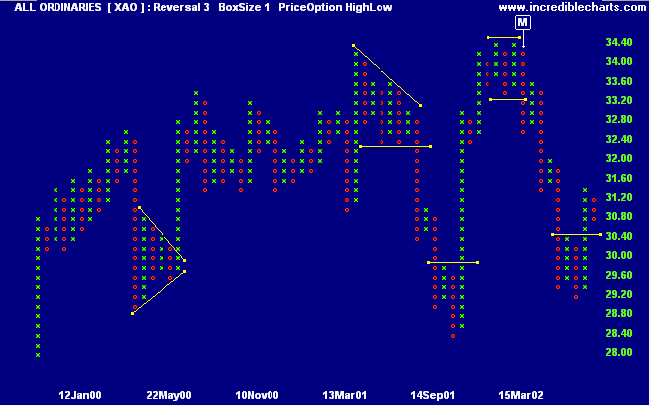

The All Ordinaries fell sharply at the opening before climbing

steadily through the day to close down 7 points at 3083 on normal

volume. The primary trend is down. The point and figure chart

below shows support at 3040 (the actual peak was 3047).

The Stochastic (20,3,3) is below its signal line. Twiggs money

flow signals distribution.

Suncorp-Metway [SUN]

The allfinanz group reported a 21% drop in earnings despite strong operating performance. (more)

The allfinanz group reported a 21% drop in earnings despite strong operating performance. (more)

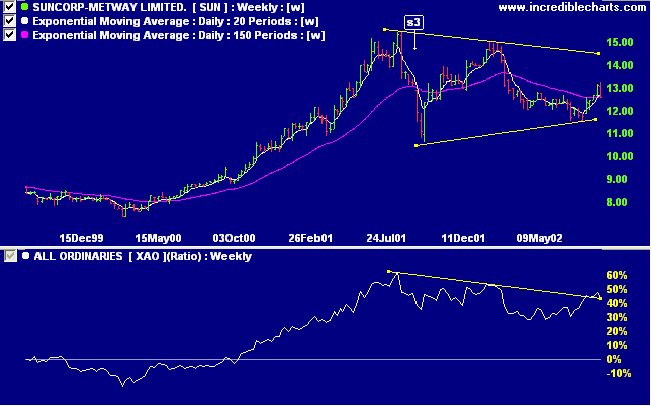

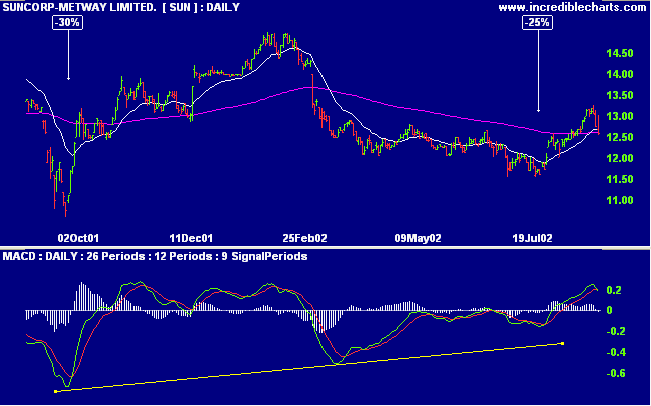

SUN is forming a stage 3 top in the form of a symmetrical

triangle, while relative strength (price ratio: xao) declines.

MACD and Twiggs money flow are positive.

Lion Nathan [LNN]

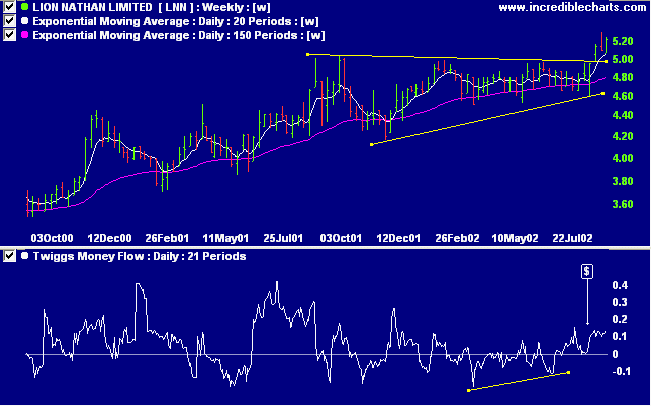

The brewer is in a stage 2 up-trend and recently broke out above an ascending triangle. Twiggs money flow and MACD show bullish divergences.

The brewer is in a stage 2 up-trend and recently broke out above an ascending triangle. Twiggs money flow and MACD show bullish divergences.

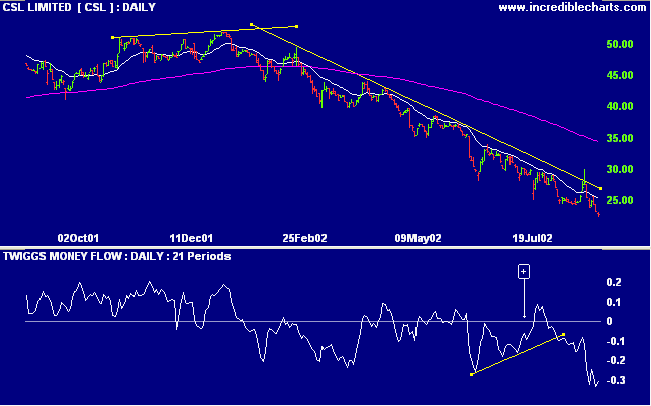

CSL [CSL]

CSL is in a steep stage 4 down-trend, depicted by the 150-day moving average. Relative strength (price ratio: xao) is falling, while MACD is negative and Twiggs money flow signals distribution.

CSL is in a steep stage 4 down-trend, depicted by the 150-day moving average. Relative strength (price ratio: xao) is falling, while MACD is negative and Twiggs money flow signals distribution.

Conclusion

Short-term: Avoid new entries. Slow Stochastic and MACD are on

opposite sides of their respective signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

Reading Market Wizards by Jack Schwager, there is a recurring theme:

almost every successful trader fails dramatically before they accumulate the wisdom necessary to succeed.

Reading Market Wizards by Jack Schwager, there is a recurring theme:

almost every successful trader fails dramatically before they accumulate the wisdom necessary to succeed.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.