Incredible Charts version 4.0.0.4 is now available

See the What's New page for details.

Trading Diary

August 27, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow closed down 1% at 8824 on normal volume. There is a

secondary rally, while the primary cycle is in a

down-trend.

The Nasdaq Composite fell more than 3% to close at 1347. The primary cycle is in a down-trend, with a secondary rally.

The S&P 500 shed 14 points to close at 934. The primary trend is down, with a secondary correction.

The Chartcraft NYSE Bullish % Indicator bull alert signal is at 44% (August 26).

Hewlett-Packard meets estimates

H-P reported pro-forma third-quarter earnings in line with analysts estimates but missed revenue targets. (more)

H-P reported pro-forma third-quarter earnings in line with analysts estimates but missed revenue targets. (more)

Consumer confidence falls

The Conference Board consumer confidence index fell to 93.5 in August, down from 97.4 in July. (more)

The Conference Board consumer confidence index fell to 93.5 in August, down from 97.4 in July. (more)

Computer and retail stocks are down

Intel, Microsoft and Wal-Mart led the decline as the outlook for computer sales, and retail in general, softens. (more)

Intel, Microsoft and Wal-Mart led the decline as the outlook for computer sales, and retail in general, softens. (more)

ASX Australia

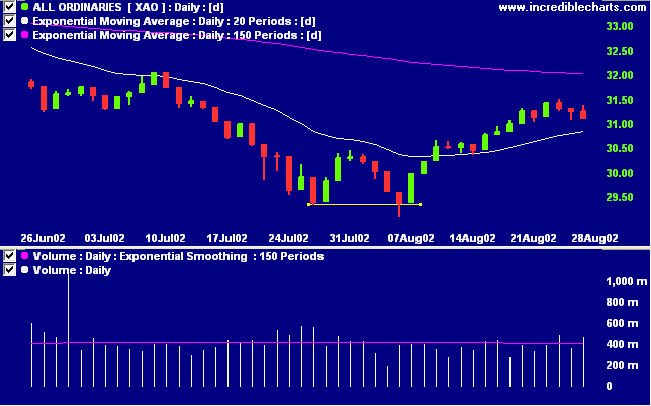

The All Ordinaries rallied in the morning but corrected sharply

in later trading to close 15 points down at 3111 on higher

volume. The primary trend is down.

The Stochastic (20,3,3) is below its signal line. Twiggs money

flow is declining.

The Reserve Bank's proposed credit card reforms

[RBA]

The RBA promises to:

The RBA promises to:

- change the formula for intercharge fees, charged between cardholders and retailers banks;

- allow retailers to pass on bank service fees to consumers; and

- end the restrictions on competition. (more)

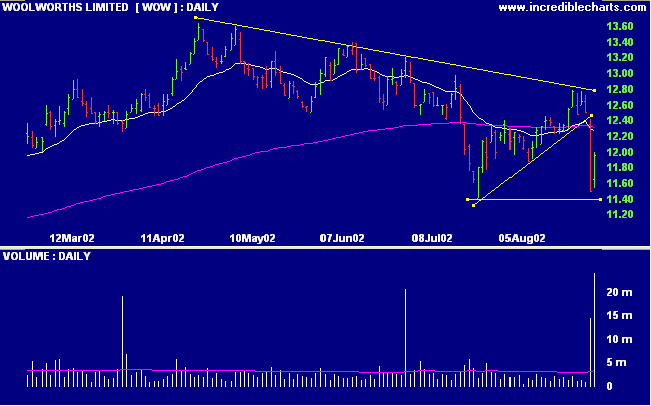

Woolworths [WOW]

Woolworths explain that the fall in supermarket margins is due to employee training costs for 72 new Franklins stores. (more)

Woolworths explain that the fall in supermarket margins is due to employee training costs for 72 new Franklins stores. (more)

The stock rebounded off the 11.40 support level to close at 11.96

on huge volume. Twiggs money flow swung back to accumulation

while MACD is still a bit weak.

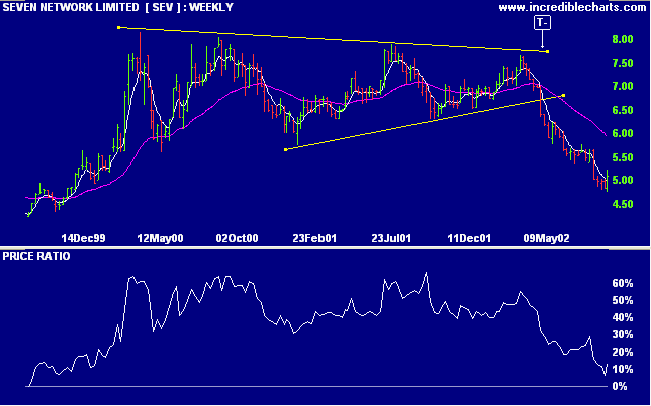

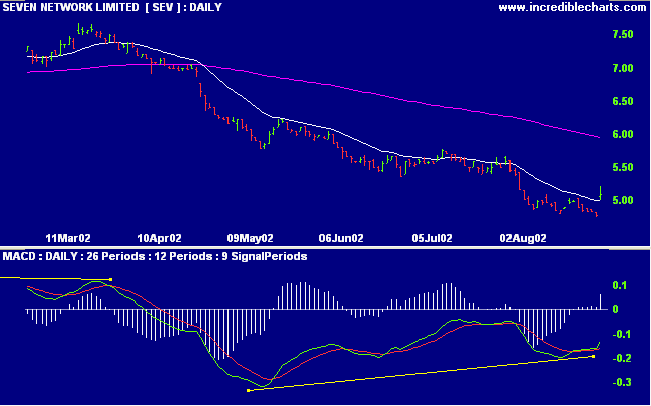

Seven Network [SEV]

Seven Network drastically cut costs to produce an annual profit of $65 million, at the high end of forecasts. (more)

On the weekly chart: SEV broke downwards from a symmetrical triangle and has yet to reach the target of 4.45. The 150-day moving average still slopes downward while relative strength (price ratio: xao) has been in a decline for the past 6 months.

Seven Network drastically cut costs to produce an annual profit of $65 million, at the high end of forecasts. (more)

On the weekly chart: SEV broke downwards from a symmetrical triangle and has yet to reach the target of 4.45. The 150-day moving average still slopes downward while relative strength (price ratio: xao) has been in a decline for the past 6 months.

MACD has completed a bullish divergence, while Twiggs money flow

signals distribution.

Conclusion

Short-term: Avoid new entries. Slow Stochastic and MACD are on

opposite sides of their respective signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

Your education earns you a living - your self-education earns you a fortune.

- Jim Rohn

Your education earns you a living - your self-education earns you a fortune.

- Jim Rohn

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.