Trading Diary

August 20, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

9000 is shaping as another resistance level,

with the Dow retreating 1.3% to close at 8872 on average

volume.

Primary cycle is in a down-trend.

Primary cycle is in a down-trend.

The Chartcraft NYSE Bullish % Indicator bull alert signal has risen to 40% (August 19).

The Nasdaq Composite formed an inside day, closing down by a

similar % at 1376.

The primary cycle is in a down-trend.

The S&P 500 corrected 13 points to close at 937. The primary cycle is in a down-trend.

Qwest sells phone books

The troubled telecom has sold its yellow pages directory publishing unit for $US 7 billion. (more)

The troubled telecom has sold its yellow pages directory publishing unit for $US 7 billion. (more)

Phone stocks down

Telecom stocks traded lower after a string of analyst downgrades. (more)

Telecom stocks traded lower after a string of analyst downgrades. (more)

ASX Australia

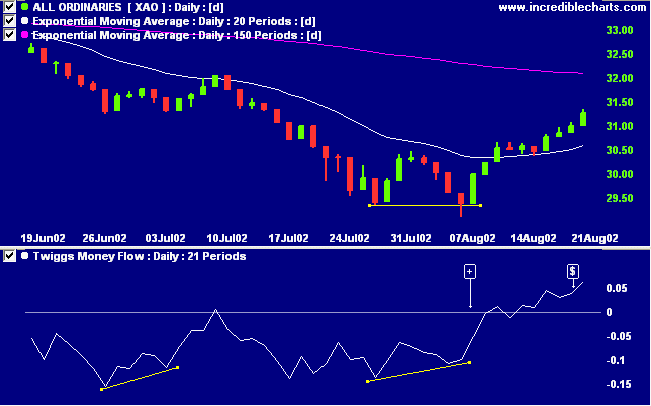

The All Ordinaries rose steeply in the morning and then held

those levels until the close, closing up 27 points at 3126 on

average volume.

The primary cycle trends down.

The primary cycle trends down.

The Stochastic (20,3,3) and MACD (26,12,9) are above their signal

lines. Twiggs money flow has

respected the zero line.

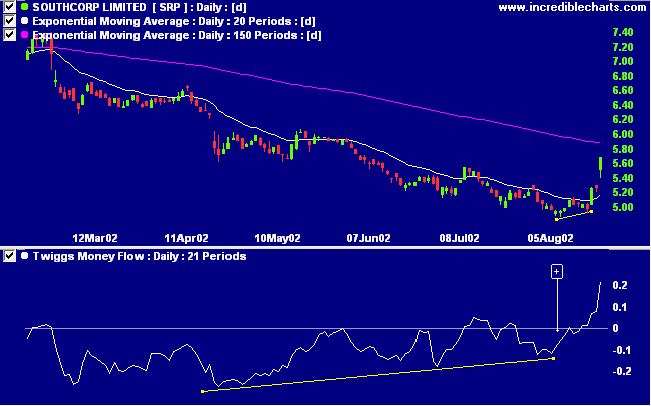

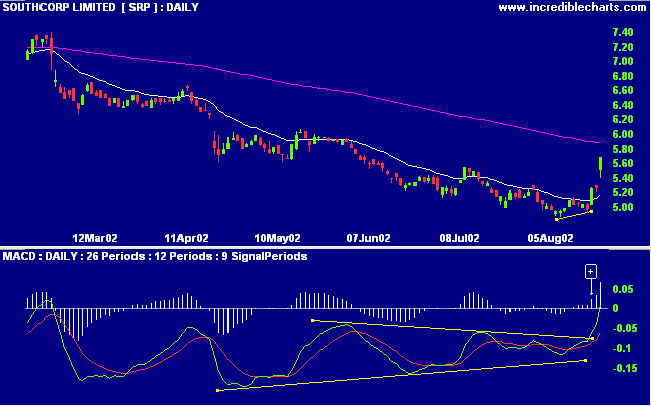

Southcorp - a good vintage

[SRP]

SRP posted a stronger-than-expected 13.4% increase in earnings per share (before amortization and profit on sale of business units). (more)

SRP posted a stronger-than-expected 13.4% increase in earnings per share (before amortization and profit on sale of business units). (more)

SRP has been in a stage 4 decline for the past year. Relative

strength (price ratio: xao) is weak but MACD and Twiggs money

flow show bullish divergences, with TMF rising strongly above

zero.

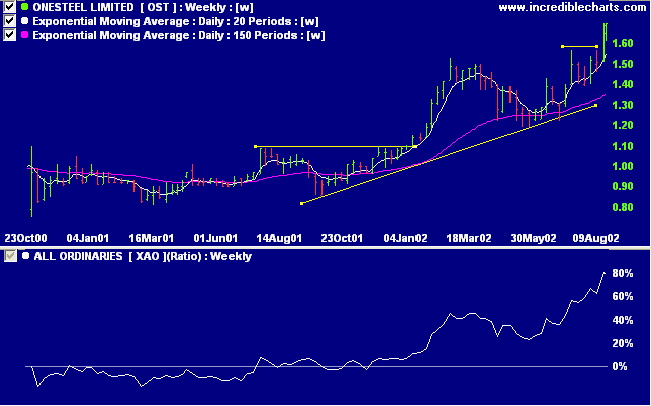

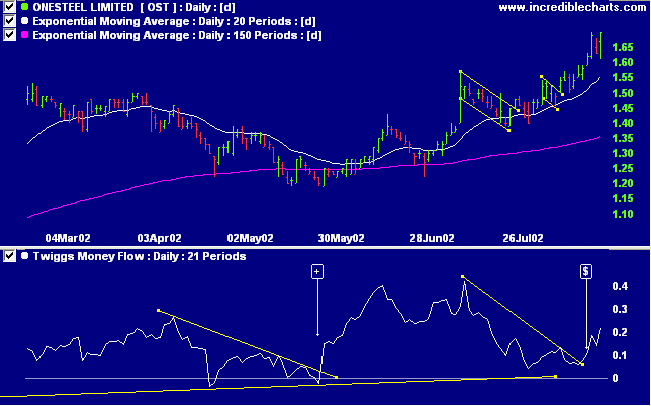

OST reached a record high of $1.70 with relative

strength (price ratio: xao) rising.

MACD and Twiggs money flow have completed

bullish signals [$], with troughs respecting the zero

line.

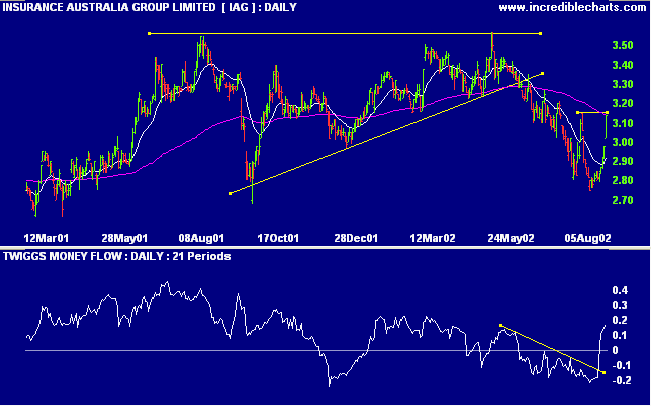

Insurance Australia Group [IAG]

After breaking down from a large ascending

triangle IAG has rallied to test resistance at 3.15. (more)

Relative strength (price ratio: xao) is neutral,

while MACD shows a bullish divergence and Twiggs money flow

signals accumulation.

Conclusion

Short-term: Wait for the market to digest the

poor US performance before taking any long. Slow Stochastic and MACD are above their respective

signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

Even if you're on the right track, you'll get run over if you just sit there.

- Will Rogers.

Even if you're on the right track, you'll get run over if you just sit there.

- Will Rogers.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.