Trading Diary

August 12, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow again showed consolidation, closing down

0.7% at 8688 on low volume.

The primary cycle trend is downwards but a rally above 8806 will signal a reversal.

The primary cycle trend is downwards but a rally above 8806 will signal a reversal.

The Chartcraft NYSE Bullish % Indicator has given a bull alert signal, with a reading of 30% (August 9).

The Nasdaq Composite opened sharply lower but then rallied to

close unchanged at 1306.

The primary cycle is in a down-trend. Failure to reach the 1355

resistance level will be a bearish sign.

The S&P 500 declined 0.5% to 903.

The primary cycle trends downwards. A break above 912 will

signal a reversal.

Fed likely to disappoint

The Federal Reserve meeting on Tuesday is unlikely to deliver the hoped-for rate cut. (more)

The Federal Reserve meeting on Tuesday is unlikely to deliver the hoped-for rate cut. (more)

Treasury yields edge lower

The yield on 10-year treasury notes closed at 4.22%, close to levels last seen in the 1960's. (more)

The yield on 10-year treasury notes closed at 4.22%, close to levels last seen in the 1960's. (more)

ASX Australia

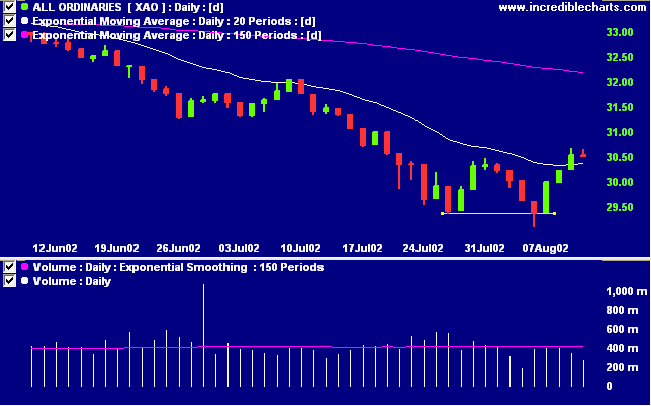

The All Ordinaries showed further hesitation, closing down 1

point at 3052 on low volume. The primary cycle trends down.

The Stochastic (20,3,3) and MACD (26,12,9) are above their signal

lines. Twiggs money flow shows uncertainty, crossing back below

zero.

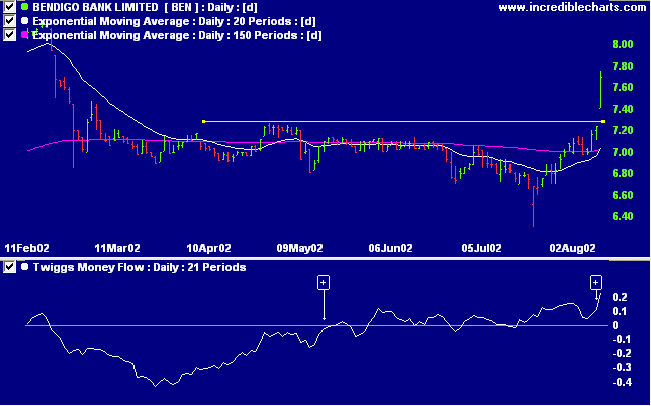

Bendigo Bank [BEN]

Bendigo announce a 47% increase in net profits to $48.8 million, with growth in all departments. (more)

Bendigo announce a 47% increase in net profits to $48.8 million, with growth in all departments. (more)

BEN has gapped up to a new 5-month high on strong volume.

Relative strength (price ratio: xao) and MACD are positive, while

Twiggs money flow has completed a trough while above zero - a

bullish signal.

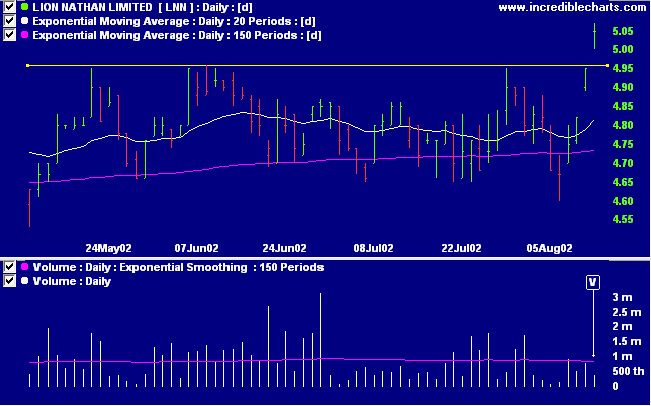

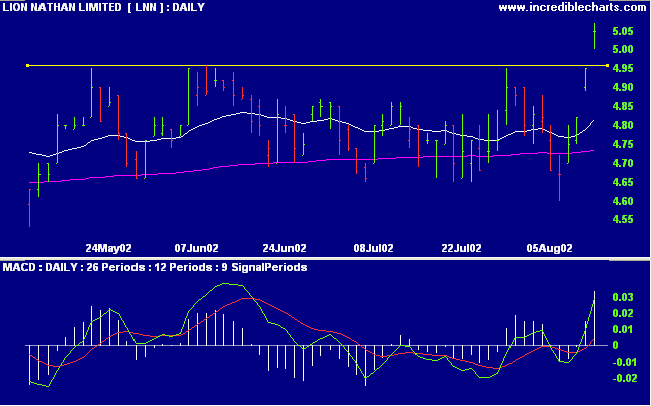

Lion Nathan [LNN]

LNN has gapped up above recent highs but on disappointing volume [V]. Relative strength (price ratio: xao) and Twiggs money flow are positive, while MACD looks promising.

LNN has gapped up above recent highs but on disappointing volume [V]. Relative strength (price ratio: xao) and Twiggs money flow are positive, while MACD looks promising.

Conclusion

Short-term: Long. Slow Stochastic and MACD are above their

respective signal lines.

Medium-term: Wait for the All Ords to signal a reversal.

Long-term: Wait for a bull-trend on the Nasdaq or S&P 500

(primary cycle).

Colin Twiggs

Thought for the Day:

There is a tide in the affairs of men, which, taken at the flood leads on to fortune.

- William Shakespeare, on market timing.

There is a tide in the affairs of men, which, taken at the flood leads on to fortune.

- William Shakespeare, on market timing.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.